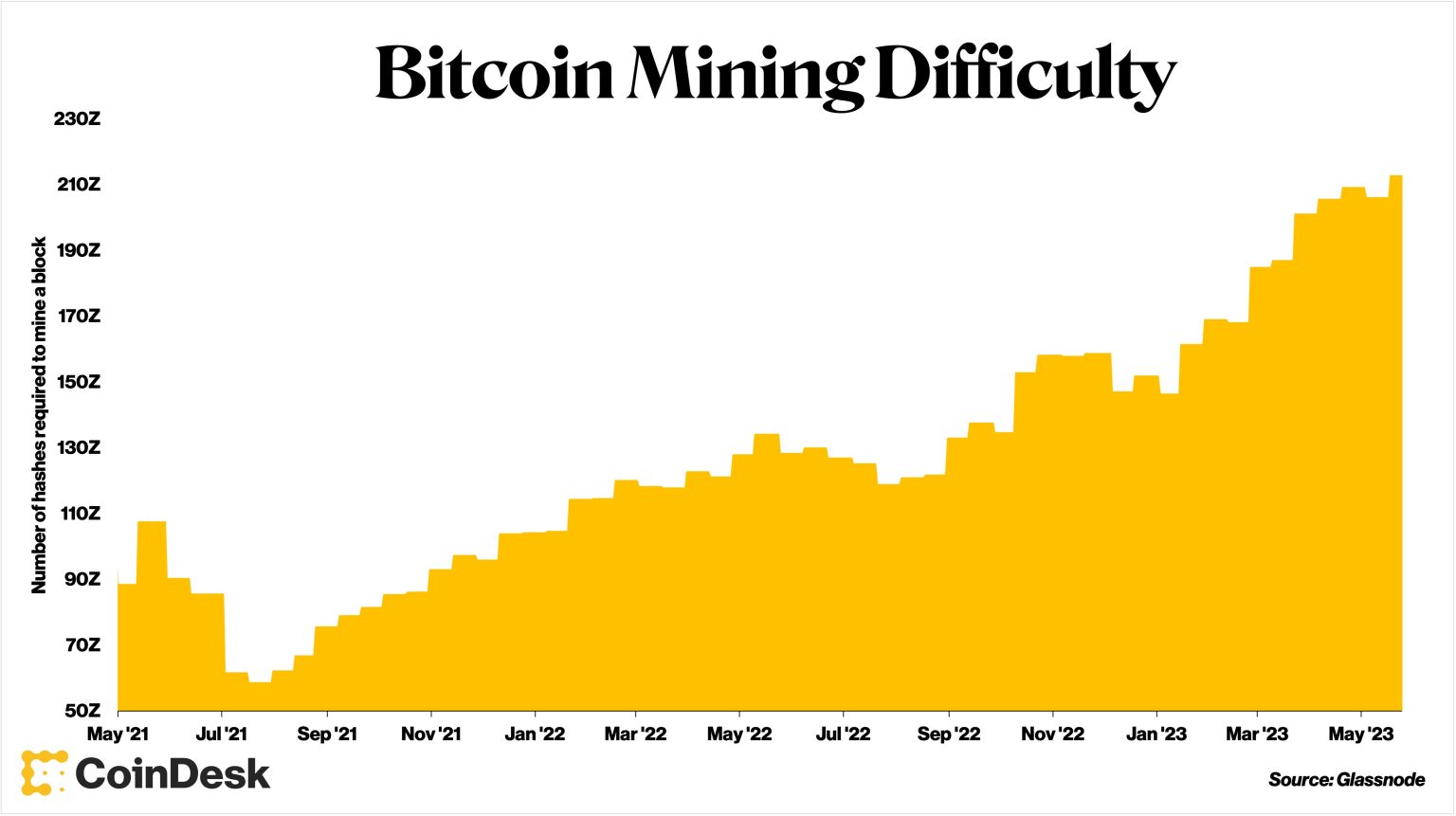

Bitcoin mining difficulty has recently undergone a significant transformation, marking the largest single drop since the summer of 2021. On February 8th, a mining difficulty adjustment at block height 935424 resulted in a decrease of 11.16%, lowering the overall mining difficulty to 125.86 trillion hashes. This adjustment is noted as the tenth-largest in Bitcoin’s history, coinciding with a seven-day average hashrate of 990.08 exahashes per second (EH/s). The recent Bitcoin difficulty adjustment represents a crucial change in the cryptocurrency landscape, influencing not only mining operations but also having potential implications for Bitcoin price impact and miner profitability. Staying informed through the latest Bitcoin mining news is essential for stakeholders as shifts in the network’s hashrate dynamics bring both challenges and opportunities.

The recent alteration in Bitcoin mining parameters reflects an evolving digital currency ecosystem, where mining efficiency and network resilience are paramount. The adjustment to the mining parameters serves as a reminder of the challenges miners face amidst fluctuating market conditions, including the broader topic of Bitcoin hashrate updates. As the cryptocurrency network experiences these shifts, followers of Bitcoin network news must consider how these developments may impact their strategies and investments. Furthermore, the recent reductions in mining difficulty not only affect operational facets but also resonate through the market, potentially influencing Bitcoin’s value trajectory. Engaging with the latest trends and informative content regarding mining operations helps navigate the evolving landscape of this revolutionary digital asset.

| Key Point | Details |

|---|---|

| Current Adjustment | On February 8, Bitcoin saw an 11.16% decrease in mining difficulty, the largest drop since summer 2021. |

| New Difficulty Level | The new mining difficulty level is set at 125.86 T. |

| Network Hashrate | The seven-day average hashrate is currently 990.08 EH/s. |

| Recent Trends | The total hashrate of the network has decreased by about 20% over the past month. |

| Market Influence | Bitcoin price has retreated over 45% since the peak, impacting miners’ earnings. |

| External Factors | Winter storms in late January disrupted hashrate by approximately 200 EH/s. |

Summary

Bitcoin mining difficulty has recently experienced its largest decline since 2021, indicating significant shifts within the network. This adjustment reflects the challenges miners face, exacerbated by falling Bitcoin prices and external factors such as severe weather conditions. The drop in mining difficulty and hashrate not only highlights the volatility of the cryptocurrency market but also emphasizes miners’ need for adaptation in a fluctuating economic environment.

Understanding Bitcoin Mining Difficulty Adjustments

Bitcoin mining difficulty is a crucial aspect of the cryptocurrency’s ecosystem, specifically designed to maintain a consistent block generation time of approximately every ten minutes. Adjustments occur roughly every two weeks, depending on the total computational power of the network, also known as the hashrate. As the hashrate increases, the difficulty level raises, ensuring that no matter how many miners are participating, the rate of new Bitcoin creation remains steady. The recent 11.16% drop in mining difficulty, marking the largest adjustment since summer 2021, underscores how dynamic this sector can be, particularly in response to various market conditions.

The implications of such adjustments are significant for Bitcoin miners. When difficulty decreases, it becomes easier and less resource-intensive for miners to validate transactions and earn Bitcoin rewards. This adjustment can rejuvenate interest among miners who may have paused operations due to unfavorable conditions—such as decreased Bitcoin prices or increased competition. As reported in recent Bitcoin mining news, the current reduction brings the overall mining difficulty to 125.86 trillion hashes, creating a more favorable environment for miners looking to optimize their operations in an increasingly challenging market.

Impact of Bitcoin’s Hashrate on Mining Difficulty

Bitcoin’s hashrate directly influences the mining difficulty levels. A drop in hashrate, as seen in recent weeks, reflects a decreasing number of active miners or reduced mining power due to external factors such as energy shortages or unfavorable market conditions. The significant fall to a seven-day average hashrate of 990.08 EH/s indicates a more competitive environment for miners. With the hashrate declining by approximately 20% this last month, it is important for miners to adapt their strategies and technology to remain profitable in this evolving landscape.

Consequently, miners are closely monitoring the relationship between hashrate and mining difficulty to mitigate risks associated with profitability. As Bitcoin’s price has retreated over 45% from its all-time high, a correlation can be observed between price and mining engagement. Many miners may temporarily suspend operations during market downturns, contributing further to the decline in hashrate. Continuous tracking of the Bitcoin network news is essential for miners to make informed decisions on when to invest in hardware or scale back their operations based on the current economic conditions.

The Recent Downturn in Bitcoin Prices and Its Effects on Mining

The Bitcoin market has recently experienced a significant retreat in prices, falling over 45% from its peak value of $126,000. This dramatic price drop has had a ripple effect across the entire mining sector. Miners are faced with increased operational costs while simultaneously earning less for their efforts, leading to tighter margins and heightened uncertainty. The interplay between Bitcoin prices and miner profitability cannot be understated; as Bitcoin faces downward pressure, miners must strategize to ensure their sustainability while navigating these challenges.

Amid these market fluctuations, other factors such as ETF fund outflows have also compounded challenges for miners. Continuous pressures to maintain profitability while managing costs effectively can result in a reevaluation of mining strategies. Miners could look toward consolidating operations, optimizing their equipment, or even scaling back their output during prolonged periods of low prices. Staying attuned to Bitcoin mining news can provide essential insights into market movements that affect their bottom line, thereby enabling smarter decision-making processes.

Seasonal Impacts on Bitcoin Mining Operations

Bitcoin mining is not just influenced by market dynamics; seasonal changes can significantly impact operations and hashrate stability. The recent winter storms across several regions in the U.S. forced many miners to reduce their hashrate to help support the local power grids during peak demand periods. Such external factors highlight the fragility of mining operations, particularly in areas that face extreme weather conditions. This led to a temporary disruption, showcasing how miners must adapt to these unforeseen challenges, which can ultimately affect their efficiency and output.

In regions prone to weather-related disruptions, miners often have to implement strategies that allow them to handle such operational stresses. Investing in backup power solutions, diversifying locations, and leveraging renewable energy sources are some of the adaptations that can mitigate risks associated with seasonal storms. As Bitcoin mining continues to evolve, the sector must pay attention not only to market fluctuations but also to environmental factors that could have a long-term impact on operational success.

Future Prospects for Bitcoin Mining Amidst Market Changes

Looking ahead, the Bitcoin mining industry faces a complex landscape shaped by mining difficulty adjustments, fluctuating hashrate, and market conditions. As the largest single drop in mining difficulty since 2021 suggests, there are often cycles in miner engagement correlated with market price movements. Miners who are proactive in adapting to these cycles and improving efficiency will likely thrive, while those who resist change may find themselves at a disadvantage. Understanding these dynamics is essential for anyone serious about remaining involved in Bitcoin mining.

With advancements in technology, future improvements in mining equipment will also play a critical role in how easily miners can respond to changes in difficulty and hashrate. Moreover, the growing trend towards environmentally friendly mining practices may become not only a preference but a necessity for compliance and sustainability reasons. As the Bitcoin network evolves, remaining informed through Bitcoin network news will empower miners to make educated decisions that can secure their positions in an ever-competitive market.

The Role of Hashrate Updates in Mining Efficiency

Regular hashrate updates are indispensable for miners who need timely information about current network status, especially when it comes to understanding changes in mining difficulty. These updates provide insights into the overall health and capacity of the Bitcoin network, allowing miners to adjust their strategies effectively. For example, when hashrate declines, it may signal times when mining becomes less competitive or profitable, prompting miners to reevaluate their operations.

Moreover, miners who are attuned to hashrate fluctuations can better strategize for long-term success. Tracking these metrics not only informs about daily operational decisions but can also help in prioritizing investments in new hardware or energy sources. This ongoing awareness contributes significantly to maintaining a competitive edge, especially during volatile periods that strain profitability. In summary, understanding and adapting to hashrate updates is crucial for maximizing mining efficiency in today’s turbulent market.

Analyzing Bitcoin Mining News for Strategic Decisions

Staying updated on Bitcoin mining news is essential for miners looking to maintain a sustainable and profitable operation. The rapidly changing landscape of cryptocurrency markets means that insight from news articles, analyst reports, and community discussion can provide valuable information for making educated decisions. With the latest adjustments and pricing changes impacting overall mining activities, miners must be proactive in gathering information to navigate these challenges effectively.

Furthermore, the insights gleaned from Bitcoin mining news can aid in identifying emerging trends such as regulatory developments, technological advancements, and shifts in investment patterns. Being informed allows miners to pivot strategies in response to external pressures or innovations, leading to enhanced operational effectiveness. As the mining environment becomes increasingly competitive, those who leverage current news and trends will likely outperform those who remain uninformed, thereby securing their place in the market.

Technological Innovations Shaping Bitcoin Mining

Technological advancements continue to shape the future of Bitcoin mining, enabling miners to operate more efficiently and effectively. Innovations such as ASIC miners have drastically improved hash rates, allowing for increased profitability even during challenging market conditions. Additionally, the integration of AI and machine learning technologies into mining operations offers unprecedented levels of optimization, helping miners to analyze data in real-time and make proactive adjustments to their operations.

Moreover, energy-efficient solutions are becoming increasingly relevant as miners seek sustainable practices in light of rising ecological concerns. The adoption of renewable energy sources not only reduces operating costs but also enhances miners’ reputations in a market that’s becoming more engaged with environmental issues. Keeping an eye on these technological developments will be vital for miners who wish to stay competitive and thrive through future market variances.

The Economic Ripple Effects of Bitcoin Mining Difficulty Changes

Changes in Bitcoin mining difficulty can create substantial economic ripple effects, influencing both individual miners and the broader crypto economy. As difficulty adjustments impact the profitability of mining, miner engagement can ebb and flow, affecting the distribution of Bitcoin across the network. When mining becomes less profitable due to increased difficulty, some miners exit the market, potentially driving prices down further. Conversely, a drop in difficulty can invigorate miner activity, thereby increasing Bitcoin supply and potentially stabilizing prices.

Additionally, fluctuations in mining difficulty can affect Bitcoin adoption rates and investor behavior. As miners respond to difficulty changes, their strategies may inadvertently influence market sentiment, which can attract or repel new investors. Understanding these interconnected dynamics is essential for stakeholders within the cryptocurrency ecosystem to navigate the evolving landscape and to plan for future trends in Bitcoin mining.

Frequently Asked Questions

What is Bitcoin mining difficulty and how does it affect miners?

Bitcoin mining difficulty is a measure of how challenging it is to find a new block in the Bitcoin network. It adjusts approximately every two weeks (or every 2016 blocks) based on the total hashrate of the network. When more miners join the network, the difficulty increases, making it harder for individual miners to earn rewards. Conversely, a decrease in mining difficulty, as seen in recent adjustment drops, can enhance the profitability for miners due to less competition.

How does the Bitcoin difficulty adjustment process work?

The Bitcoin difficulty adjustment process recalibrates the mining difficulty to ensure that blocks are mined approximately every 10 minutes. This adjustment is based on the total hashrate on the network—if blocks are added too quickly, difficulty increases, and if they are added too slowly, difficulty decreases. The recent adjustment saw an 11.16% drop, representing a significant shift amidst varying hashrate conditions.

What impact does the Bitcoin hashrate update have on mining difficulty?

The Bitcoin hashrate update directly influences mining difficulty by indicating how much computational power is being used in the mining process. A falling hashrate, like the recent drop to 990.08 EH/s, suggests fewer miners are active, prompting a difficulty decrease to incentivize mining activity. This update is crucial for maintaining a stable block time, and significant drops may lead to adjustments to support struggling miners.

What does recent Bitcoin mining news say about the current difficulty levels?

Recent Bitcoin mining news highlighted the largest single drop in mining difficulty since summer 2021, with an 11.16% decrease to 125.86 T. This adjustment reflects the ongoing changes in the Bitcoin hashrate, which has fallen significantly, impacting miners’ earnings and operational decisions in light of the overall market conditions.

How is Bitcoin mining difficulty affected by the price of Bitcoin?

Bitcoin mining difficulty is indirectly impacted by the price of Bitcoin. As prices decline, as seen with Bitcoin’s drop from $126,000, miners can face reduced revenues, which may lead to some exiting the market. The latest adjustments reflect how a 20% decline in the network hashrate correlates with the falling Bitcoin price, creating fluctuations in mining difficulty.

Why was there a significant drop in the Bitcoin network hashrate?

The recent significant drop in the Bitcoin network hashrate, which fell to about 863 EH/s, can be attributed to multiple factors, including extreme winter weather conditions in the U.S. that forced some miners to lower their output. Additionally, prolonged bearish conditions in the market and increased operational costs have pressured miners, leading to a decline in the overall hashrate and resulting in major mining difficulty adjustments.