The recent anticipation surrounding an interest rate cut has captured the attention of traders, with over 23% expecting a shift at the upcoming FOMC meeting. This surge in expectations is fueled by market reactions to Kevin Warsh’s nomination as the next Federal Reserve Chair, a prospect that has raised concerns about the future trajectory of Federal Reserve policy. Traders who favored a rate cut have increased their bets by almost 5% from last week, driven by fears of a hawkish approach to monetary policy. If realized, a 25 basis point decrease could signal a loosening of liquidity conditions, which historically tends to support rising crypto asset prices. As financial markets navigate this evolving landscape, the implications of such a cut could reverberate across various sectors, making it a critical topic for investors and analysts alike.

Market speculation about potential reductions in interest rates has gained traction, especially with key developments such as the upcoming FOMC meeting where decisions on monetary policy will be made. The appointment of individuals like Kevin Warsh as a potential Fed Chair has sparked debate among economists and traders regarding the future direction of interest rates. This situation raises critical questions about liquidity conditions in the market, particularly how they might influence investment strategies and asset valuations. As the expectations for a shift in interest rates grow, understanding the intricacies of Federal Reserve operations becomes essential for stakeholders involved in both traditional and digital asset markets. The potential impact on sectors like cryptocurrency is particularly noteworthy, as changes in liquidity could drive significant fluctuations in prices.

| Key Point | Details |

|---|---|

| Traders Expecting Rate Cut | Over 23% of traders now expect an interest rate cut at the next FOMC meeting. |

| Previous Expectations | Only 18.4% were expecting a rate cut last Friday, showing nearly a 5% increase. |

| Anticipated Cut | Those expecting the March cut anticipate a 25 basis point decrease; no cuts of 50 BPS or more are forecasted. |

| Warsh’s Nomination Impact | Warsh’s nomination as Fed Chair has unsettled the markets, being viewed as hawkish. |

| Effect on Crypto and Liquidity | Higher rates are expected to negatively impact asset prices, while a cut is seen as positive. |

| Analysts’ Views | Mixed signals from Warsh’s nomination on liquidity and credit stability in the US. |

Summary

An interest rate cut is increasingly expected by traders, with over 23% predicting a reduction at the upcoming FOMC meeting. This growing anticipation is primarily driven by concerns over the hawkish stance of Kevin Warsh, President Trump’s nominee for Fed Chair. The market’s reaction illustrates the significance of interest rates in influencing economic conditions, especially for crypto assets. Traders and investors are monitoring these developments closely as they have profound implications for liquidity and asset prices.

Rising Expectations for an Interest Rate Cut

As more traders turn their attention to the upcoming FOMC meeting, expectations for an interest rate cut have seen a sharp rise. Recent data indicates that over 23% of traders anticipate that the Federal Reserve will lower rates, a notable increase from 18.4% just a few days prior. This shift in sentiment is fueled by market concerns surrounding the hawkish outlook tied to Kevin Warsh’s nomination as the new chair of the Federal Reserve. Investors and analysts are navigating a rapidly changing landscape, attempting to decipher the implications of this potential rate cut for investment strategies and market behavior.

The possible reduction of interest rates, even by a modest 25 basis points, can significantly impact liquidity conditions and investor confidence. A cut could stimulate borrowing and spending, which in turn might bolster economic growth. However, the market’s reaction is complex; stakeholders are balancing hopes for a supportive monetary policy against fears that Warsh’s hawkish stance could continue to hold rates higher for longer. As traders adjust their positions, the possibility of a rate cut adds a critical dynamic to market expectations leading up to the FOMC meeting.

Impact of Federal Reserve Policy on Crypto Asset Prices

The Federal Reserve’s policies, particularly regarding interest rates, have profound implications for various asset classes, including cryptocurrencies. As interest rates impact liquidity conditions, any indications of an interest rate cut could posit a favorable environment for crypto asset prices. Lower interest rates generally lead to easier access to capital and a more vibrant investment landscape, encouraging capital flow into riskier assets like cryptocurrencies.

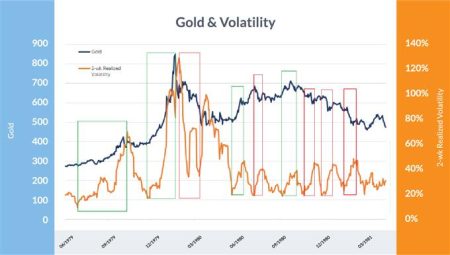

Conversely, tighter liquidity conditions associated with higher interest rates tend to dampen investor enthusiasm, as seen in the recent volatility of crypto assets. If Warsh adopts a path focusing on reducing the Federal Reserve’s balance sheet, as suggested by his comments, we may witness shifts in liquidity that influence crypto market dynamics. The ongoing discourse surrounding Federal Reserve policy will remain crucial for traders looking to leverage volatility in crypto asset prices.

Kevin Warsh’s Nomination and Market Reactions

Kevin Warsh’s nomination to lead the Federal Reserve has provoked a wide array of reactions from market participants. Many traders and investors are apprehensive about his more hawkish viewpoints, which emphasize a potential restraint on monetary policy easing. It has been observed that the nomination stirred significant market volatility, particularly regarding precious metals and cryptocurrencies, which are sensitive to changes in liquidity and interest rates.

As analysts assess Warsh’s implications for future Fed policy, the conversation continues to highlight how such leadership changes can ripple through the economic landscape. If his nomination indicates a sustained high-interest rate environment, we might expect a market recalibration, affecting everything from valuations of assets to the behavior of traders amidst evolving liquidity conditions. The ability of the markets to digest and react to these signals remains essential in formulating investment strategies moving forward.

Market Volatility in Response to Federal Reserve Announcements

Market volatility often escalates in anticipation of announcements from the Federal Reserve, especially regarding interest rate adjustments. Traders are keenly responsive to any cues, and with the FOMC meeting on the horizon, fluctuations in expectations are palpable. Increased uncertainty surrounding Kevin Warsh’s more hawkish potential policies has added layers to market dynamics, prompting some investors to hedge their positions.

Such volatility is characteristic of financial markets, where speculations about interest rates and liquidity conditions can lead to pronounced swings in the prices of both traditional and digital assets. The divergent expectations of an interest rate cut versus a potentially more restrictive policy under Warsh create a landscape ripe for speculation, further compounding uncertainty in several asset classes.

Understanding Liquidity Conditions and Their Importance

Liquidity conditions are integral to financial markets, affecting everything from day-to-day trading to long-term investment strategies. When liquidity is ample, assets can be bought and sold without significant price impacts, which generally benefits growth. In contrast, tighter liquidity—often a result of increased interest rates—can lead to market hesitation, affecting prices of assets including cryptocurrencies.

Under the impending scrutiny of Warsh’s nomination, liquidity conditions could undergo significant shifts. If the market interprets proposed policies as leaning toward a contraction of the money supply, it could cause ripples through the entire investment ecosystem, influencing decision-making among traders and investors. Thus, understanding how these liquidity elements play into the larger economic picture is crucial for safeguarding investments in a volatile environment.

Future Implications of Fed Policy Decisions

The implications of Federal Reserve policy decisions extend well beyond immediate market reactions; they shape the broader economic landscape for years. As traders speculate on future interest rate movements, they also consider how these policies will influence inflation, economic growth, and consumer spending. The potential interest rate cut, while viewed positively by some, could introduce an era of uncertainty if accompanied by conflicting signals from the Fed regarding overall economic health.

With Kevin Warsh’s nomination cast against this backdrop, stakeholders must weigh both short- and long-term consequences of any policy changes. As crypto investors especially remain vigilant, the potential for both growth and tightening presents a dual-edged sword. The evolution of Federal Reserve decisions will undoubtedly play a pivotal role in shaping market dynamics in the near future.

Speculative Trading Amidst Heightened Uncertainty

In a climate of heightened uncertainty surrounding Federal Reserve policy, speculative trading has surged among active market participants. Traders often engage in speculation as they anticipate interest rate movements and their potential impact on asset prices. With over 23% predicting a cut at the next FOMC meeting, proactive strategies are emerging as investors jockey to capitalize on perceived opportunities amidst volatility driven by Warsh’s nomination.

This increased engagement in speculative trading, particularly in light of crypto asset prices, illustrates the complexities facing investors. The blend of expectation for a potential rate cut, mixed with the perceived permanence of Warsh’s hawkish stance, creates a fertile ground for trading strategies that hinge on short-term market movements and emotional responses.

The Role of the Federal Reserve in Economic Stability

The Federal Reserve plays a crucial role in maintaining economic stability through its interest rate policies. These decisions help to control inflation, regulate employment levels, and influence overall economic confidence. As the market reacts to the possibility of an interest rate cut, it underscores the essential balance the Fed must achieve in fostering economic growth while managing inflation risks.

In this context, new leadership—such as that potentially ushered in by Warsh’s nomination—could shift the balance of these objectives. Observers look to the Fed not just to implement policy changes but also to create a predictable environment that allows investors to make informed decisions. The dire implications of inconsistent Fed policies can lead to market disruptions, making clarity in communications key to nurturing economic stability.

Navigating the Future of Crypto Investments

For cryptocurrency investors, the intersection of Federal Reserve policy and market behavior is increasingly critical. With expected shifts due to a possible interest rate cut, investors must navigate a landscape fraught with both opportunities and challenges. The allure of crypto investing, coupled with the potential for increased liquidity should rates fall, presents a compelling case for market engagement.

However, the potential for a prolonged hawkish approach under Warsh must also be factored into long-term investment strategies. Those looking to capitalize on crypto asset price movements must remain vigilant and adaptable, staying informed about policy discussions and market reactions. This dual focus on both the macroeconomic landscape and specific market dynamics will be essential for success in the evolving crypto investment realm.

Frequently Asked Questions

What is the significance of the interest rate cut expected at the next FOMC meeting?

The anticipated interest rate cut at the upcoming Federal Open Market Committee (FOMC) meeting may indicate a shift towards accommodating monetary policy, which could stimulate economic growth. A rate cut usually enhances liquidity conditions, making borrowing cheaper, thereby impacting various asset prices, including crypto assets.

How does Kevin Warsh’s nomination influence expectations for an interest rate cut?

Kevin Warsh’s nomination as Fed Chair has created uncertainty around interest rate policy. While the market sees a 23% chance of an interest rate cut, Warsh is viewed as hawkish, and his stance might influence the FOMC’s decision to maintain higher rates, impacting liquidity conditions.

What impact do interest rate cuts have on crypto asset prices?

Interest rate cuts generally lead to improved liquidity conditions, which can positively affect crypto asset prices. Lower rates decrease borrowing costs, potentially increasing investment and spending in the crypto market.

Why has the anticipation for an interest rate cut increased among traders?

The anticipation for an interest rate cut among traders has risen due to heightened concerns regarding Kevin Warsh’s hawkish stance, combined with broader economic signals that suggest a potential policy shift at the FOMC meeting.

What role does the Federal Reserve’s policy play in shaping liquidity conditions?

The Federal Reserve’s policy directly impacts liquidity conditions. An interest rate cut typically enhances liquidity by lowering borrowing costs, while a hawkish approach may tighten liquidity, affecting economic growth and financial markets, including crypto.

How might a 25 basis point interest rate cut affect the markets?

A 25 basis point interest rate cut, if confirmed, could lead to increased market liquidity and potentially boost asset prices across various sectors. Investors may react positively, believing that more favorable borrowing conditions will support economic activity.

What should investors consider with the current speculation around the interest rate cut?

Investors need to consider how the potential interest rate cut could affect liquidity and credit conditions. They should also monitor the implications of Kevin Warsh’s policies, as his hawkish tendencies may counteract the anticipated benefits of a rate cut.

What does the rise to 23% expectation for an interest rate cut indicate about trader sentiment?

The rise to a 23% expectation for an interest rate cut suggests that traders are becoming increasingly concerned about economic conditions and are looking for signals from the Fed that may indicate a shift towards a more dovish stance.