The recent crypto market crash has shaken the foundations of what was once considered a flourishing digital asset landscape, erasing nearly $2 trillion in value within months. Triggered by macroeconomic pressures and investor speculation, this dramatic decline has left many wondering about the future of cryptocurrencies like Bitcoin and Ethereum, which have both faced significant price declines during this tumultuous period. Furthermore, the implications of Trump’s crypto policies and shifts in crypto trading sentiment have only added to the market’s volatility, making it challenging for traders to navigate through the chaos. As the industry reeled from this downturn, conversations surrounding stablecoin regulations became increasingly urgent, emphasizing the need for a robust regulatory framework. The ongoing market turmoil not only reflects immediate economic concerns but also raises critical questions about the long-term sustainability of the crypto market in a rapidly evolving financial landscape.

In the wake of the recent downturn in digital currencies, often labeled as a crypto upheaval, investors find themselves grappling with the harsh realities of a market in decline. This tremor, which has stripped away trillions in value, hints at broader economic repercussions and the fragility of crypto assets amid external pressures. As the trading environment shifts, the fallout from governmental decisions, including those under Trump’s administration, has intensified discussions about appropriate regulations for stablecoins and the overall trading landscape. The drastic fluctuation in Bitcoin and Ethereum prices has not only impacted individual investors but has also altered the sentiment around the crypto ecosystem at large. As stakeholders reassess their positions, the underlying mechanics of the market reveal critical insights into the relationship between policy, regulation, and price movements.

| Key Point | Description |

|---|---|

| Market Surge and Fall | The crypto market surged to around $4.379 trillion, growing by $2 trillion but has since retraced to approximately $2.37 trillion. |

| Policy and Regulatory Changes | Trump’s administration established a friendlier crypto regulatory environment, including the GENIUS Act for stablecoins and efforts to expand banking involvement with crypto. |

| Market Mechanisms | Investors were impacted by a cycle of selling, influenced by concerns from a historical pattern this led to a selloff, including a significant $20 billion liquidation. |

| Winners and Losers | In the boom, exchanges and stablecoin issuers thrived; in the downturn, retail investors and companies like Strategy faced heavy losses. |

Summary

The recent crypto market crash has seen vast amounts of capital evaporate, with nearly $2 trillion in value erased since its peak. The transition from a friendly regulatory environment under Trump to current economic realities has left many investors reevaluating their positions. With technological and market pressures creating turbulence, the resilience of the crypto assets continues to be tested as the sector adapts to changing financial landscapes.

The Aftermath of the Crypto Market Crash

The recent downturn in the crypto market has highlighted the extreme volatility of digital assets, resulting in severe financial losses for many investors. The collapse, often referred to as a market crash, can be attributed to a convergence of factors including shifting regulatory landscapes and changes in investor sentiment. Instead of a steady climb, what once appeared to be a golden age of crypto under Trump’s policies has quickly spiraled downward, erasing nearly $2 trillion in market value within months. Many investors are left grappled by the sudden revert of Bitcoin from an all-time high of over $126,000 to a significant decline, showcasing the inherent risks involved in crypto trading.

This decline also echoes the fears surrounding broader economic impacts, as many investors adopt a defensive posture against the backdrop of macroeconomic pressures. As traders pull back, the liquidity within the crypto space has diminished, contributing to the declines across various tokens like Ethereum and stablecoins. The lessons learned from this episode point to the importance of regulatory clarity, which could help stabilize the tumultuous crypto environment.

In responding to the aftermath of the crash, investors are now reassessing their portfolios and exit strategies. For many, the volatility experienced highlights the essential need for strategic financial planning. The crash has forced traders to reconsider their positions, with many retreating from the crypto market altogether until a clearer strategy emerges. Simultaneously, some see this period as a buying opportunity, betting on a rebound as historical market cycles suggest potential recoveries after downturns. Ultimately, the disparity in responses to the market crash illustrates the divide in investor confidence and strategy.

Impact of Trump’s Policies on Cryptocurrency Regulations

Donald Trump’s approach to cryptocurrency has garnered significant attention, particularly in the context of recent policies that aimed to foster a favorable environment for digital assets. Trump’s administration took decisive steps to establish a regulatory framework around cryptocurrencies, aimed at promoting innovation while addressing inherent risks. Under his leadership, legislation such as the GENIUS Act laid the groundwork for stablecoin regulation and provided a clearer path for crypto trading activities. However, the perception of such policies shifted dramatically with the onset of the recent crypto market crash, calling into question their effectiveness in sustaining market growth.

The juxtaposition of regulations and market performance raises concerns for investors. Although many welcomed the pro-crypto stance initiated by Trump, the loss of value in the sector raises valid questions about the sustainability of such policies. Market participants are now more skeptical about how future regulatory decisions will influence both the price of Bitcoin and Ethereum, and the overall trading sentiment in the crypto landscape.

Additionally, a closer examination reveals that while Trump’s measures aimed to reduce regulatory burdens, they may not have been enough to prevent the market’s volatility. Regulatory challenges are further intertwined with economic factors, such as inflation and international trade tensions, which underscore how external elements can heavily influence the crypto market’s stability. As investors turn their gaze toward new regulations, there remains uncertainty regarding how they can mitigate the negative impacts borne from market mechanisms that were evidently under strain before the crash.

Bitcoin’s Price Decline and Its Causes

Bitcoin’s recent price decline has brought to light the intricate dynamics tied to market behavior and trading sentiment. With prices dropping sharply from their historic highs, many investors are left to question the underlying factors propelling this drop. Analysts attribute part of this decline to a mechanical unwinding of leveraged positions in the market—a situation exacerbated by the recent policies and trade tensions fostered under Trump’s presidency. As market momentum shifts, traders began to liquidate positions, leading to a cascading effect that dragged Bitcoin’s value lower and disrupted market stability.

Moreover, alongside the price drop, the cryptocurrency has faced stiff competition from alternative investment vehicles like stock assets and commodities. Many new investors are now gravitating toward these options, further shifting the crypto trading sentiment. This behavior underlines an evolving landscape in which Bitcoin’s dominance is increasingly challenged, posing risks to its long-term value retention.

The broader question remains: can Bitcoin recover from this significant price decline? While some market participants believe a rebound is possible, especially with institutional support and regulatory clarity, others remain cautious due to prevailing macroeconomic uncertainties. Observations suggest that any recovery may hinge on renewed investor confidence and a more stable trading environment. This signals the need for prospective crypto investors to remain vigilant and informed not only about Bitcoin’s trajectory but also about the influence of external factors, such as upcoming regulations and economic pressures.

Ethereum’s Market Impact in the Current Landscape

Ethereum, as one of the leading cryptocurrencies, has faced significant market impacts alongside Bitcoin’s decline. With Ethereum’s price dropping from recent highs, traders are assessing the interplay between the platform’s underlying technology, the DeFi boom, and the volatility inherent to digital assets. As Ethereum remains a crucial player within the decentralized finance ecosystem, its fluctuating value serves as a bellwether for the health of the broader cryptocurrency market. The recent downturn not only impacts prices but also brings to light the importance of gas fees, transaction speeds, and network upgrades which can sway investor sentiment significantly.

In the context of Trump’s regulatory decisions, Ethereum’s future growth stands to benefit or suffer from the policies set forth regarding stablecoins and digital asset trading. For instance, if stablecoin regulation comes into effect, Ethereum could see an increased use as a settlement layer, positively affecting its market cap. However, significant declines can create uncertainty about new developments, and many are waiting for regulatory clarity to determine their next steps regarding Ethereum and its potential integration into wider financial systems.

Furthermore, Ethereum’s challenges post-market crash underscore the complexities of transitioning from a speculative asset to a functional economic platform. With increased scrutiny from both investors and regulators, Ethereum must navigate the fine line between innovation and compliance. Investors are now more cautious, weighing the potential future value against the recent price fluctuations. As developers continue to pursue scalability and efficiency improvements, Ethereum’s performance will ultimately be reflective of its ability to adapt to the changing regulatory landscape while maintaining its position as a leading smart contract platform.

Stablecoin Regulations and Their Significance

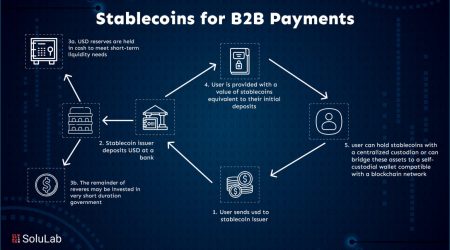

Stablecoins have emerged as crucial players in the cryptocurrency market, often serving as safe havens amid volatile fluctuations. Recent regulations initiated under the Trump administration, notably the GENIUS Act, have sought to appropriately manage the growth and issuance of stablecoins while ensuring consumer protection. As these regulations come into play, understanding their impact will become increasingly vital for market participants, particularly traders looking for stable trading rails during uncertain times.

The establishment of a regulatory framework for stablecoins is seen by many as a necessary step towards fostering trust in the cryptocurrency ecosystem. This is especially important given the recent market crash that has altered trader sentiment and the perception of digital assets. With clearer guidelines, stablecoins can play a significant role in enhancing market liquidity, providing investors with much-needed stability amidst price swings of major cryptocurrencies like Bitcoin and Ethereum.

Moreover, the regulations surrounding stablecoins could also redefine the competitive dynamics within the cryptocurrency market. By setting clear eligibility and operational requirements, regulators can encourage responsible innovation which enhances market confidence. As adoption increases, stablecoins are expected to serve a pivotal role in how traders execute transactions, thereby influencing overall trading volumes and price movements in the broader cryptocurrency space. Nevertheless, how effectively these regulations can balance innovation with oversight remains to be seen in the aftermath of the recent crypto market crash.

The Role of Crypto Trading Sentiment

Crypto trading sentiment plays an undeniably vital role in shaping market movements. As seen during the recent crash, investor psychology can rapidly shift from extreme bullishness to overwhelming bearishness, often triggered by external factors like regulatory changes or macroeconomic events. The sentiment-driven cycles in digital asset trading underline a unique aspect of the cryptocurrency market where emotions often drive buying and selling decisions more than fundamental analyses.

Post-market crash, many investors are taking a step back to reassess their trading strategies and mindset. Some are adopting a wait-and-see approach, while others are opportunistically looking for entry points as they gauge potential rebounds. The volatile nature of trading sentiment has implications for both short-term traders and long-term investors who must constantly navigate the psychological elements that influence trading behavior and market confidence.

Additionally, the interconnectedness of crypto trading sentiment with traditional financial assets further complicates market dynamics. As cryptocurrencies become more correlated with other asset classes, sentiment driven by developments in stock markets, commodities, and economic indicators becomes increasingly relevant. This interplay indicates that crypto trading sentiment cannot be isolated from the broader financial landscape, making it vital for traders to consider macroeconomic conditions when engaging in the digital asset markets.

Identifying the Winners of the Crypto Boom and Bust

In the immediate aftermath of the crypto boom, certain players emerged as winners during the surge in asset values. Exchanges and derivatives platforms which thrive on trading volumes have seen their revenue soar when prices were high and volatile. The heightened activity in the crypto market translated into increased trading fees, allowing these businesses to capitalize on the liquid environment created by bullish sentiment. Additionally, stablecoin issuers also benefited significantly, as their dollar-pegged tokens provided essential liquidity during periods of uncertainty, proving their utility within the trading ecosystem.

However, as we shift focus towards the bust phase of the market, those who positioned themselves heavily with cryptocurrencies are now bearing the brunt of losses. Public companies and institutional investors, particularly those with concentrated stakes in Bitcoin, are grappling with stock price declines and valuations that have become significantly impaired. The rise and subsequent tumble of the market spotlight how rapidly fortunes can change in the volatile realm of digital assets, turning once-venerated market participants into cautionary tales.

Amid this environment, it’s crucial for investors to recognize the importance of diversification and risk management strategies. The crypto boom has illuminated the need for a more cautious approach to investing, particularly for new entrants who may be lured by high returns. As market dynamics evolve, understanding who benefits and who suffers during both bullish and bearish trends will dictate future investment strategies necessary to navigate the tumultuous nature of cryptocurrencies.

Frequently Asked Questions

What caused the recent crypto market crash following Trump’s crypto policies?

The recent crypto market crash can be attributed to a combination of external policies, including Donald Trump’s surprise announcement of tariffs, macroeconomic conditions, and cyclical market behavior. As traders anticipated tighter regulations and political shifts, the market saw a mechanical unwind, resulting in a significant decline in asset values.

How did Bitcoin price decline during the crypto market crash?

Bitcoin experienced a drastic price decline during the crypto market crash, dropping to around $60,000 before recovering slightly to approximately $65,894. This was part of a broader market sell-off that led to significant losses across various cryptocurrencies.

What impact did the Ethereum market have on the crypto market crash?

During the crypto market crash, Ethereum also faced significant losses, with its price dipping to around $1,752 at one point. The decline in Ethereum’s value reflects the overall bearish sentiment in the crypto market, amplifying concerns over regulatory changes and trading behaviors.

What are the implications of stablecoin regulations on the crypto market crash?

Stablecoin regulations have become a critical focus as they manage liquidity in the crypto market during downturns. The recent crash highlighted the importance of stablecoins as traders utilize them to navigate volatile conditions and settle trades, showcasing their role in mitigating further market declines.

How did trading sentiment influence the crypto market crash?

Crypto trading sentiment shifted dramatically leading up to and during the market crash. As investor confidence wavered with political uncertainties, such as those stemming from Trump’s policies, many long-term holders executed sell-offs to secure profits, exacerbating the decline in prices.