BTC withdrawal is a hot topic in the crypto community, especially following the recent surge in Bitcoin wallet activity. A report from Odaily Planet Daily highlights that a newly created wallet executed a significant BTC withdrawal, pulling out 1,550 BTC from Binance, equating to about 106.62 million USD. Such large-scale transactions often have substantial BTC price implications, attracting the attention of investors and market analysts alike. Consequently, staying updated with Binance news and onchain monitoring tools is crucial for anyone looking to navigate the crypto market effectively. Understanding the dynamics behind these withdrawals can provide insights into market trends and investor behavior.

When discussing the movement of cryptocurrency assets, withdrawal activities are a key indicator of market sentiment and trading strategies. Recently, a notable transaction involved a new Bitcoin wallet facilitating a considerable withdrawal, emphasizing shifts in liquidity and investor interest. Monitoring these transactions not only aids in crypto market analysis but also raises questions about potential price movements of Bitcoin. Alternative terms such as Bitcoin asset transfer and cryptocurrency withdrawal could also be explored to broaden the understanding of this critical process. Insights gained from observing these activities can be indispensable for enthusiasts aiming to decode the intricacies of the digital currency ecosystem.

| Details |

|---|

| A newly created wallet withdrew 1,550 BTC from Binance, valued at approximately $106.62 million. |

Summary

BTC withdrawal from exchanges raises several implications for the market. Recently, a newly established wallet executed a significant BTC withdrawal of 1,550 BTC from Binance, totaling around 106.62 million USD. This transaction underlines the increasing movement of Bitcoin towards private wallets, which can be interpreted as a bullish signal by traders and investors. Understanding these market dynamics is vital for anyone interested in cryptocurrency.

Significant BTC Withdrawal from Binance

In a noteworthy transaction reported by Odaily Planet Daily, over 1,550 BTC was withdrawn from Binance, amounting to approximately 106.62 million USD. This significant BTC withdrawal has raised eyebrows within the crypto community, particularly regarding its implications on market dynamics. Such large withdrawals are often analyzed to gauge investor sentiment and capital flow within the crypto market, influencing price movements and trading strategies.

The recent withdrawal highlights a vital aspect of Bitcoin wallet activity; it indicates that some investors might be looking to safeguard their assets outside of exchanges amidst varying market conditions. Monitoring such activity through on-chain analysis provides insights into the behavior of large holders—typically known as ‘whales’—whose choices can have pronounced effects on BTC price implications. It remains crucial for traders to stay abreast of these developments to better inform their investment decisions.

The Importance of Onchain Monitoring in Understanding Crypto Trends

Onchain monitoring has become an essential tool for crypto enthusiasts and analysts alike, allowing the observation of intricate Bitcoin wallet activity that could affect overall market conditions. As seen with the recent withdrawal from Binance, on-chain data provides transparency and insight into the motivations behind significant transactions. From tracking large withdrawals to analyzing transaction patterns, this form of monitoring enables stakeholders to gauge the mood of the market accurately.

Utilizing platforms that focus on onchain metrics can lead to more informed decisions and enhanced market analysis. By understanding the behaviors of Bitcoin holders, particularly in relation to substantial transfers like large Binance withdrawals, traders can estimate potential price movements. This analytical approach can reveal emerging trends, ensuring investors are better positioned to navigate the volatile crypto landscape.

Analyzing the Implications of Recent Binance Activities

The recent activity surrounding Binance not only signifies a considerable divorce of assets from the exchange but also signifies potential shifts in the crypto market landscape. Analysts track such events to understand broader market implications and assess investors’ confidence trends. Significant withdrawals, like the 1,550 BTC pulled from Binance, can indicate uncertainty or strategic repositioning among large stakeholders.

Furthermore, understanding these activities through thorough crypto market analysis can empower investors to respond proactively. When large volumes of Bitcoin leave exchanges, it may hint toward bullish sentiments and an accumulation phase, potentially paving the way for upward price movements. Staying updated on Binance news and other major exchanges can provide valuable insights necessary for anticipating BTC price implications.

Cryptocurrency Market Analysis Post-Binance Withdrawal

In the aftermath of the substantial BTC withdrawal from Binance, market analysts are keenly focused on the implications for cryptocurrency prices. Historical data often shows a correlation between large withdrawals and subsequent price adjustments. With over 1,550 BTC now removed from an exchange, questions arise about how this will influence market liquidity and investor psychology moving forward.

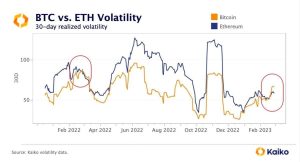

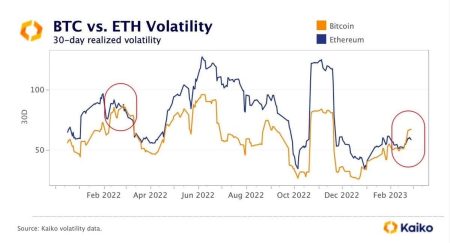

Additionally, a comprehensive analysis of market indicators, coupled with this significant Binance event, allows traders to prepare for potential price volatility. High volatility in crypto markets can either create opportunities or present risks, underscoring the importance of real-time data monitoring and analysis. Investors should consider integrating on-chain insights with traditional market indicators to develop a robust strategy.

Understanding Bitcoin Wallet Activity Trends

Bitcoin wallet activity plays a pivotal role in understanding the market movements and investor behavior. Transactions, such as the recent withdrawal from Binance, reflect strategic decisions made by holders. Tracking wallet performance and activities can offer invaluable insights into potential market trends and forthcoming price changes.

Moreover, analyzing Bitcoin wallet balances can indicate whether investors are accumulating or distributing their holdings. A surge in withdrawals often reflects an intention to hold long-term rather than trade, pointing to bullish market sentiment. By paying attention to these wallet activity trends, investors can align their strategies with prevailing market conditions and enhance potential returns.

The Role of Crypto Market News in Investment Decisions

Staying updated with crypto market news is crucial for making informed investment decisions. From monitoring major exchanges like Binance to following news on regulatory changes, the information available can significantly impact investor sentiment and market behavior. Recent news involving significant BTC withdrawals draws immediate attention and demands analysis to interpret its potential consequences.

Incorporating current events into trading strategies can provide a competitive edge. Investors who leverage timely information and market insights can navigate the complexities of the cryptocurrency landscape more effectively. Enhancing the decision-making process with up-to-date news ensures that strategies are both proactive and reactive to market fluctuations.

BTC Price Implications of Large Withdrawals

Large withdrawals, such as the recent one from Binance, can have profound consequences on BTC’s price trajectory. Historically, significant outflows from exchanges have been associated with a surge in spot prices, as they often suggest that investors are withdrawing their assets for holding purposes rather than selling. Understanding these implications is essential for traders aiming to capitalize on potential market movements.

Further implications of large BTC withdrawals can lead to increased scarcity in the available supply, which might drive prices up should demand remain consistent or rise. Such scenarios highlight the importance of responsive trading strategies that consider both on-chain data and market sentiment when predicting the future price of Bitcoin.

Leveraging Onchain Data for Better Investment Outcomes

Investors increasingly recognize the value of leveraging onchain data to enhance their investment outcomes. By analyzing transaction volumes and Bitcoin wallet activity, investors can better navigate market conditions and make data-driven decisions. Recent transactions, like the notable BTC withdrawal from Binance, serve as key indicators of market sentiment and trigger strategic responses.

Ultimately, the integration of onchain analytics into trading strategies can yield more profitable outcomes. This data not only informs investors about current trends but also anticipates future market movements based on historical patterns. The ability to react quickly to onchain insights will distinguish successful investors from their peers in the fluid cryptocurrency market.

Strategies for Responding to Binance News and Market Movements

Given the dynamic nature of the crypto market and rapid news cycles, developing effective strategies in response to Binance news and market movements is essential for success. Investors should consider diversifying their portfolios and employing risk management techniques to cushion against possible volatility stemming from significant withdrawals, like the recent 1,550 BTC event.

In addition to portfolio diversification, having clear entry and exit strategies based on real-time market analysis can optimize investment outcomes. By acknowledging market shifts influenced by news and monitoring Bitcoin wallet activity, traders can position themselves advantageously ahead of potential price fluctuations.

Frequently Asked Questions

What does the recent BTC withdrawal from Binance indicate about Bitcoin wallet activity?

The recent withdrawal of 1,550 BTC from Binance, as reported by Odaily Planet Daily, indicates significant activity in Bitcoin wallets. Such large transactions can sometimes suggest movements by institutional investors or large holders, potentially impacting the crypto market analysis and BTC price implications.

How can I monitor Bitcoin wallet activity related to BTC withdrawals?

To monitor Bitcoin wallet activity, including BTC withdrawals, utilize tools like Onchain monitoring platforms that provide real-time data. These tools can show transaction volumes and wallet interactions that may impact the broader crypto market analysis.

What are the implications of large BTC withdrawals on the crypto market?

Large BTC withdrawals, such as the recent 1,550 BTC withdrawal from Binance, can influence the crypto market by affecting supply dynamics and investor sentiment. Such actions may signal confidence or caution among major holders, leading to fluctuations in BTC price.

Why are BTC withdrawals from exchanges like Binance significant?

BTC withdrawals from exchanges such as Binance are significant as they often indicate a shift in market dynamics. Withdrawals can suggest that investors are moving their assets to private wallets, possibly to secure them against market volatility, which can lead to changes in Bitcoin wallet activity and overall market sentiment.

What should investors consider regarding the implications of BTC withdrawal trends?

Investors should analyze BTC withdrawal trends along with other market metrics. Sudden increases in withdrawals can hint at potential price volatility or shifts in market sentiment. Regularly checking reports on Bitcoin wallet activity and using Onchain monitoring can provide insights important for crypto market analysis.