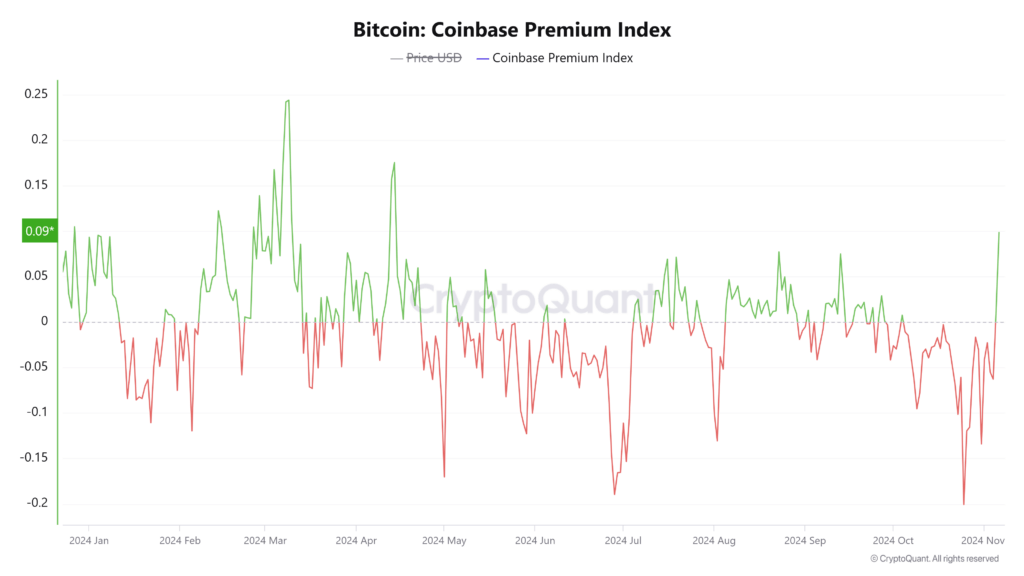

The Coinbase Bitcoin Premium Index has recently garnered attention as it enters its 23rd consecutive day in negative premium, currently recorded at -0.0878%. This notable drop indicates fluctuating Bitcoin prices and highlights a significant shift in market sentiment affecting crypto trading dynamics. Such a prolonged period of negative premium points to rising selling pressure within the U.S. market, revealing a potential decrease in investors’ risk appetite amidst heightened market risks. Understanding the Coinbase Bitcoin Premium Index can provide crucial insights into the 2026 Bitcoin trends and overall crypto market behavior. As traders monitor these shifts, they can better assess strategies to navigate the current landscape of Bitcoin and its impact on investments.

The recent developments surrounding the Coinbase Bitcoin Premium Index have sparked discussions among cryptocurrency enthusiasts and traders alike. By tracking the variations in Bitcoin’s pricing on the Coinbase exchange compared to its global market price average, investors gain valuable insights into the current trading climate. When the index remains in negative territory, it often suggests that traders are facing significant selling pressure and may exhibit lower confidence levels in the market. This phenomenon can lead to shifts in investor behavior, particularly affecting how people approach their crypto investments in 2026. By analyzing such indices, stakeholders can forecast market trends and adjust their strategies accordingly.

| Key Points |

|---|

| Coinbase Bitcoin Premium Index has been negative for 23 days straight, currently at -0.0878%. |

| The index has only seen two days of positive premium in 2026: January 6 at 0.011% and January 15 at 0.0023%. |

| A negative premium indicates significant selling pressure in the U.S. market and decreasing investor risk appetite. |

| It reflects market risk aversion and potential capital outflows from the U.S. Bitcoin market. |

Summary

The Coinbase Bitcoin Premium Index has been a focal point in recent Bitcoin market analysis, showing a continued negative premium for an extended period. This trend indicates a notable shift in market sentiment among U.S. investors, marked by increased selling pressure and a reduced appetite for risk.

Understanding the Coinbase Bitcoin Premium Index

The Coinbase Bitcoin Premium Index provides crucial insights into the performance of Bitcoin against its global market prices. Currently sitting in a negative premium of -0.0878% for an extended period indicates a shift in market sentiment, reflecting a lack of confidence among investors. With the Index recorded in negative territory for 23 consecutive days in 2026, it exemplifies significant selling pressure specifically in the U.S. crypto trading environment. A prolonged period of negative premium not only affects investor enthusiasm but can also alert traders to impending market trends.

This premium index serves as a barometer for assessing U.S. investor behavior in contrast to global trends. During times of heightened uncertainty or bearish momentum, a negative premium can emerge as investors may be more inclined to sell off their holdings rather than engaging in new acquisitions. As seen on January 6 and January 15, when the premium briefly turned positive, it highlighted moments where market sentiment shifted favorably. Keeping an eye on these fluctuations can provide valuable foresight into potential market reversals or continued trends in Bitcoin trading.

Impact of Negative Premium on Bitcoin Prices

A sustained negative premium on the Coinbase Bitcoin Premium Index is indicative of bearish market conditions which can significantly influence Bitcoin prices. When the index remains in negative territory, it often correlates with broader market sentiment signaling reduced demand for Bitcoin, potentially resulting in decreased pricing across exchanges. This trading behavior can be particularly observed when investors exhibit a cautious approach to Bitcoin accumulation, leading to an oversupply that drives prices down.

In the context of 2026, negative premiums might foreshadow trends that could persist throughout the year. Market analysts frequently scrutinize the relationship between the Coinbase Bitcoin Premium Index and market sentiment to predict Bitcoin price trajectories. Should the negative premium continue, it could indicate a prevailing risk aversion among traders, who may opt to hold off on purchases until more favorable conditions arise. Consequently, this dynamic could shape the overall landscape of Bitcoin trading, as investor behavior adapts to ongoing market signals.

Analyzing Market Sentiment and Crypto Trading Strategies

Market sentiment plays a pivotal role in shaping the trading strategies adopted by both individual and institutional investors in the cryptocurrency landscape. With the Coinbase Bitcoin Premium Index consistently reflecting negative premiums, it suggests a bearish sentiment lingering in the market, compelling traders to reassess their strategies. In this climate, traders might prioritize short selling or hedging their positions against potential downturns rather than seeking long-term inventory builds.

Moreover, understanding market sentiment is crucial for forecasting future trends in Bitcoin prices. For instance, as negative premiums persist, savvy traders may begin to look for opportunities to buy at lower prices, foreseeing a rebound in Bitcoin’s value. Implementing strategies that factor in the current sentiment allows investors to navigate market complexities with greater confidence while aligning their trading decisions with real-time market conditions, ultimately optimizing their potential returns in an unpredictable sector.

2026 Bitcoin Trends: Navigating Uncertainty

The year 2026 has introduced a myriad of uncertainties regarding Bitcoin trends, highlighted by the indication of a negative premium on the Coinbase Bitcoin Premium Index. As traders and investors grapple with fluctuating demands and external economic factors, the negative outlook calls for a careful examination of market dynamics. Amidst these challenges, understanding historical performance and price volatility can offer strategic insights for trading decisions.

Despite the current negative premium, the potential for market recovery remains viable. The cryptocurrency market is notorious for its volatility, and history has shown that it can rebound rapidly. Traders should remain vigilant and ready to capitalize on shifts in market sentiment, especially as price anomalies can lead to profitable trading opportunities. The trends noted so far may set foundational markers that influence future market phases throughout 2026, encouraging both analyses of prevailing conditions and proactive strategies.

The Role of Capital Outflows in Bitcoin Market Dynamics

Capital outflows often serve as a red flag for investors, particularly in the context of a persistently negative premium as indicated by the Coinbase Bitcoin Premium Index. The observed trend of significant capital leaving the U.S. market suggests that investors might be seeking refuge in alternative assets or markets due to concerns over Bitcoin’s stability. This outflow trend is critical to understanding how market confidence can shift and how Bitcoin prices react to such economic behaviors.

Investors must analyze the implications of these capital movements, which may indicate waning confidence in BTC’s potential for growth. A negative premium not only signals a downturn but may also prompt discussions around the resilience of Bitcoin amidst broader market challenges. Armed with insights from market analytics, investors can adapt their strategies to mitigate risks associated with capital outflows and align their positions with emerging trends.

Indicators of Market Risk Aversion

Market risk aversion is often reflected in the performance of the Coinbase Bitcoin Premium Index, particularly when it remains negative for extended periods. When market participants exhibit heightened caution, it can lead to significant shifts in trading volumes and price dynamics. This underlying sentiment often emerges during periods of economic instability or extensive uncertainty regarding Bitcoin’s regulatory landscape, prompting investors to reevaluate their positions.

Recognizing these indicators, traders can better navigate the complexities of crypto trading. By understanding the signs of market risk aversion, they can develop more informed trading strategies that either capitalize on declining prices or protect their investments against adverse market conditions. Such astute analysis enables investors to not only shield their portfolios but also anticipate recovery opportunities when market sentiment gradually shifts favorably.

Investor Behavior in Response to Market Signals

Investor behavior is heavily influenced by prevailing market signals, particularly when assessing the negative premium reflected in the Coinbase Bitcoin Premium Index. This behavior is characterized by actions such as selling off holdings, awaiting better entry points, or adjusting long-term investment strategies in light of negative sentiment. Traders acting on these signals anticipate potential downturns, often leading to larger fluctuations in Bitcoin prices.

Understanding how these behaviors manifest can aid investors in crafting better strategies for participating in the crypto market. For example, those noticing a trend of negative premiums might choose to establish strategic stop-loss orders or diversify their portfolios by investing in other cryptocurrencies, rather than solely focusing on Bitcoin. As these market signals evolve, continuous analysis of investor behavior will be key to identifying profitable opportunities amidst shifting trends.

Shifts in Bitcoin Trading Volume and Its Implications

The trading volume of Bitcoin often fluctuates in tandem with the performance of the Coinbase Bitcoin Premium Index, especially during periods of negative premium. A decrease in trading volume often signals a lack of confidence among investors, as they may choose to await more favorable market conditions before entering new positions. Conversely, an upturn in trading volume might suggest a resurgence of interest in Bitcoin amid changing market dynamics.

Analyzing these volume shifts allows traders to gauge market interest and momentum. For instance, if increased trading volume occurs alongside a narrowing of the negative premium, it may indicate an impending shift in market sentiment that could support a price rebound. Traders well-versed in reading these patterns can better position themselves to take advantage of volatility, ultimately enhancing their investment outcomes in the competitive landscape of cryptocurrency trading.

Long-Term Outlook for Bitcoin Amidst Current Trends

Despite the current negative premium presented by the Coinbase Bitcoin Premium Index, it is essential to adopt a long-term perspective on Bitcoin’s potential trajectory. The cryptocurrency market has faced numerous challenges in the past, often emerging stronger in the aftermath of corrective phases. The patterns observed in 2026 may eventually pave the way for substantial growth, particularly if investors rekindle their confidence in Bitcoin as a viable asset class.

Market analysts emphasize the importance of looking beyond short-term price actions and focusing on foundational developments within the Bitcoin ecosystem. Improvements in scalability, regulatory clarity, and increased acceptance among institutional investors are critical factors that can significantly influence Bitcoin’s long-term outlook. By considering these elements, investors can position themselves advantageously to maximize their returns when the market ultimately shifts towards recovery.

Frequently Asked Questions

What does the Coinbase Bitcoin Premium Index indicate about Bitcoin prices?

The Coinbase Bitcoin Premium Index measures the price disparity between Bitcoin on Coinbase and the global average market price. A negative reading, such as the current -0.0878% reported, suggests selling pressure and indicates a bearish sentiment in Bitcoin prices.

Why has the Coinbase Bitcoin Premium Index been in negative premium recently?

The Coinbase Bitcoin Premium Index has been in a negative premium for 23 days due to several factors, including reduced risk appetite among investors, increased market volatility, and potential capital outflows from the U.S. market, leading to bearish market sentiment surrounding Bitcoin.

How can the Coinbase Bitcoin Premium Index affect crypto trading strategies?

Traders can use the Coinbase Bitcoin Premium Index as an indicator of market sentiment. A prolonged negative premium may signal a good time for short selling or caution in buying positions, while potential recoveries into positive territory could signify a bullish reversal in crypto trading strategies.

What does a negative premium on the Coinbase Bitcoin Premium Index mean for 2026 Bitcoin trends?

Currently, the negative premium on the Coinbase Bitcoin Premium Index may reflect ongoing bearish trends in Bitcoin for 2026. With only two days in positive territory since the start of the year, market participants may need to adapt their strategies to navigate these conditions.

How does the Coinbase Bitcoin Premium Index relate to market sentiment?

The Coinbase Bitcoin Premium Index is directly linked to market sentiment; a negative premium often indicates waning confidence in Bitcoin’s price stability and influences investor behavior, reflecting broader market risk aversion and selling pressures.

What historical performance of the Coinbase Bitcoin Premium Index can guide future Bitcoin price predictions?

Examining the historical performance of the Coinbase Bitcoin Premium Index, including its current negative streak, can help analysts project future Bitcoin price movements. Trends observed can aid in predicting shifts in market sentiment and potential trading opportunities.

What should investors consider about the Coinbase Bitcoin Premium Index before trading Bitcoin?

Investors should closely monitor the Coinbase Bitcoin Premium Index, particularly its negative readings, as they can signify shifts in market sentiment and risk appetite. Understanding these trends is crucial for making informed trading decisions in the dynamic landscape of Bitcoin.