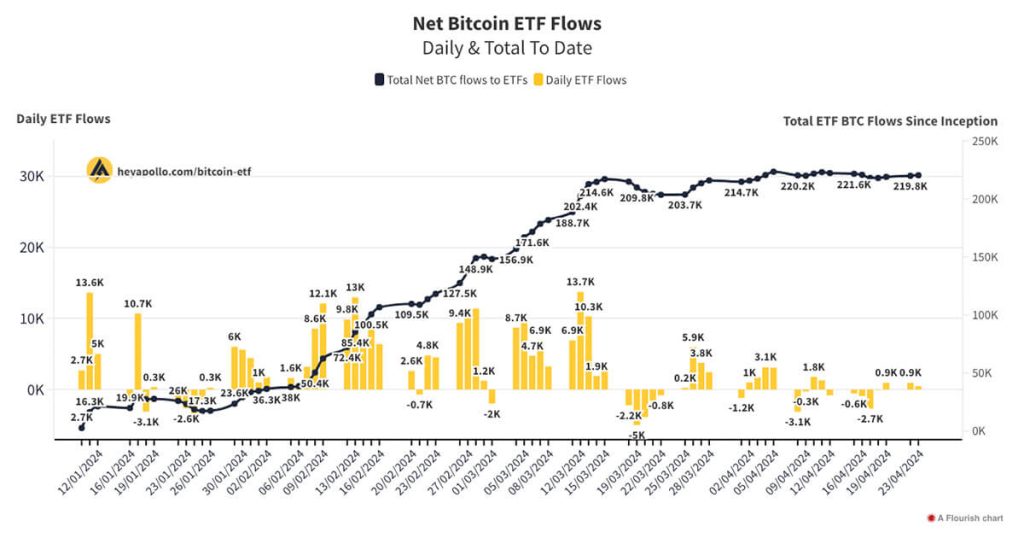

Bitcoin ETF inflows made headlines on Friday as BlackRock’s spot Bitcoin exchange-traded fund (ETF) attracted a remarkable $231.6 million, despite a turbulent week for Bitcoin. This influx marks only the 11th day of net inflows for the fund this year, highlighting a significant deviation from the recent trend of substantial outflows. With the crypto market sentiment wavering sharply, the pressure on Bitcoin’s price has seen it drop to as low as $60,000. However, preliminary Farside data shows that U.S.-based spot Bitcoin ETF products collectively garnered $330.7 million in inflows, signifying renewed interest among investors amid volatile market conditions. Analyzing Bitcoin investment reports reveals that market players are keenly watching Bitcoin ETF performance indicators, including the iShares Bitcoin Trust ETF (IBIT), which could dictate Bitcoin price trends moving forward.

The recent activity surrounding Bitcoin exchange-traded funds (ETFs) has sparked intrigue among investors and analysts alike. Flows into these financial products, particularly those like the BlackRock Bitcoin ETF, have become essential barometers of market demand and overall crypto ecosystem vitality. As investor appetite fluctuates, understanding Bitcoin ETF dynamics can significantly aid in investment decisions and crypto market analysis. The consistent monitoring of inflows and outflows provides valuable insights into how Bitcoin’s trading patterns might evolve, particularly during periods of heightened volatility. Terms like Bitcoin investment analysis and crypto market sentiment are becoming increasingly relevant as the landscape shifts, reflecting a complex interplay between investor behavior and Bitcoin valuations.

| Key Point | Details |

|---|---|

| BlackRock’s Bitcoin ETF Inflows | $231.6 million in inflows on Friday after two days of significant outflows. |

| Overall Market Sentiment | Sentiment plummeted, with Bitcoin’s price briefly hitting $60,000, leading to outflows of $548.7 million in two days. |

| 2026 Year-to-Date Inflows | IBIT has recorded only 11 days of net inflows in 2026 amid market volatility. |

| Inflows vs. Outflows | Recent inflows totaled $330.7 million across nine U.S. spot Bitcoin ETFs, following $1.25 billion in outflows over three days. |

| IBIT Trading Activity | IBIT saw its shares worth $10 billion traded on a day of significant price drop and rebound. |

| Bitcoin Price Movement | Bitcoin was trading at $69,820, down 24.30% over the past 30 days and saw a price drop of 13% on one day. |

| Market Losses | Crypto holders faced paper losses around 42% as Bitcoin dropped below $73,000. |

| Historical Context | Before the downturn in October, net inflows were around $62.11 billion, now at approximately $55 billion. |

Summary

Bitcoin ETF inflows witnessed a remarkable resurgence on Friday, signaling potential recovery amidst a turbulent market. Despite substantial outflows earlier in the week, BlackRock’s Bitcoin ETF managed to attract significant funds, indicating a renewed interest from investors. The ebbs and flows of Bitcoin ETF inflows provide crucial insight into market sentiment, highlighting both the challenges and opportunities within the cryptocurrency landscape.

Understanding Bitcoin ETF Inflows Amid Market Turbulence

In recent weeks, the fluctuations of Bitcoin’s price have been a cause for concern amongst investors, especially reflected in the latest inflows and outflows from Bitcoin ETFs. The BlackRock Bitcoin ETF, a key player in this space, saw significant inflows of $231.6 million on Friday despite turbulent market conditions. This marked a stark contrast to the previous days when the iShares Bitcoin Trust ETF (IBIT) faced substantial outflows of $548.7 million, highlighting the volatility present in the crypto market. Such fluctuations illustrate how investor sentiment can shift dramatically in response to Bitcoin price trends.

Understanding these inflows is crucial for anyone involved in Bitcoin investment analysis. Since the beginning of 2026, IBIT has captured just 11 days of net inflows, suggesting that investors are cautious about entering the market. The sharp drops in Bitcoin’s price—with a notable decrease of 24.30% over the past month—serve as a backdrop for these inflows and outflows, indicating that sentiment in the crypto market is decidedly bearish, but the recent inflows may signal the potential for a resurgence in confidence.

The Impact of Bitcoin Market Sentiment on IBIT

Market sentiment plays a pivotal role in the performance of Bitcoin ETFs like IBIT. During episodes of high volatility, such as the recent week when Bitcoin’s price dropped dramatically to $60,000, investors often react swiftly, leading to substantial outflows. ETF analysts have noted that the current downturn has resulted in paper losses of approximately 42% for Bitcoin ETF holders since prices fell below $73,000. Understanding how these sentiments influence trading behavior can provide insights into IBIT’s performance and its future trajectory.

Moreover, Bitcoin’s price movements are not just isolated events but are often influenced by broader market factors and investor psychology. As sentiments evolve, so does the interaction between Bitcoin and its ETF counterparts. With the Bitcoin ETF experience demonstrating unique correlations to crypto market sentiment and investor confidence, it becomes essential for analysts to monitor these dynamics continuously. This allows for more informed predictions regarding the asset’s price direction amid potential recoveries or further declines.

Analyzing Recent Trends in Bitcoin Prices and ETF Flows

Recent trends indicate that Bitcoin prices are experiencing significant volatility, which directly correlates to ETF flows in the market. The recent Friday inflow of $231.6 million into BlackRock’s Bitcoin ETF stands out against the backdrop of a larger trend, where investors have been more hesitant due to previous sharp declines. With Bitcoin trading at approximately $69,820 following a steep drop, it’s evident that market conditions are precarious. Observations like that from Bloomberg’s ETF analyst Eric Balchunas underscore how fluctuations in the market can lead to record-setting trading volumes, hinting at traders acting swiftly based on price movements.

This ongoing analysis of Bitcoin price trends alongside ETF performance is critical for investors looking to navigate this dynamic market. While historical inflows prior to October were around $62.11 billion, the sharp decline has led to a drastic decrease in total inflows to around $55 billion. This reflects a cautious investor mentality and highlights the necessity of closely analyzing price movements and trading volumes to cultivate strategies for future investment.

Market Dynamics: The Role of Bitcoin ETF in Investment Strategies

The advent of Bitcoin ETFs like the one launched by BlackRock has transformed how investors interact with cryptocurrencies. These products offer a structured investment channel for traditional investors looking to gain exposure to Bitcoin without the complexities of owning the digital asset directly. As observed recently, inflows in Bitcoin ETFs can provide a clearer insight into market dynamics and investor sentiment. With Thursday’s significant outflows and Friday’s recovery, such patterns underscore the ETF’s role as a barometer for Bitcoin investment analysis.

Investors adapting their strategies based on ETF flows can capitalize on shifts in market conditions. Historically, significant inflows tend to coincide with bullish trends, while outflows often signal market pessimism. As Bitcoin’s recent price trends suggest potential recovery phases amidst turbulent movements, monitoring the flow of investor capital into Bitcoin ETFs can yield valuable insights for investment strategies. Managing exposure through this medium allows investors to optimize their portfolios to align with evolving market sentiment.

Insights on IBIT Performance and Market Reactions

The performance of the iShares Bitcoin Trust ETF (IBIT) provides critical insights into the overall health of the cryptocurrency market. After experiencing its second-worst daily price drop, the ETF rebounded impressively by 9.92% on Friday. This volatility illustrates how market sentiment impacts investor reactions and trading decisions. Observers noted that while losses have been steep recently, the fluctuating nature of IBIT’s performance reflects broader trends in Bitcoin’s price, indicating that investor behavior remains highly responsive to market conditions.

Furthermore, Bitcoin’s price movements serve as an indicator of investor appetite for risk in relation to Bitcoin ETFs. As the price dipped below $60,000 and then hovered around the current levels, it’s crucial for analysts to understand these price reactions alongside performance metrics from IBIT. This allows for a nuanced Bitcoin investment analysis, as assessing inflows and corresponding price movements can provide predictive insights into how the market may react in the future, particularly in times of uncertainty.

Bitcoin ETF Flows and Their Future Outlook

The future outlook for Bitcoin ETF flows, particularly in products like the BlackRock Bitcoin ETF, remains uncertain yet intriguing. With the dual nature of inflows during volatile times—where spikes can be seen even amid negative market sentiment—investors must remain vigilant about underlying market trends. The substantial $231.6 million inflow amidst a challenging market signifies that savvy investors are positioning themselves for potential recoveries, hinting at future optimism surrounding Bitcoin’s price trajectory.

Looking forward, it is essential for investors to stay updated on market conditions and ETF performance metrics. Historical data indicates that prior to downturns, Bitcoin ETFs enjoyed surging inflows, suggesting that shifts in sentiment can lead to renewed confidence. As analysts monitor Bitcoin price trends and investor behavior, future fluctuations in ETF inflows will be indicative of broader acceptance and interest in cryptocurrencies, culminating in market stabilization or further upheavals.

Evaluating Investor Behavior During Market Fluctuations

Investor behavior is a crucial component of understanding market dynamics in the Bitcoin space, particularly during periods of price instability. The recent price dip to around $60,000 triggered significant outflows from ETFs, yet the speedy recovery highlighted investors’ strategic responses during downturns. This mixed behavior emphasizes the complexity of market sentiment; while fear drives immediate sell-offs, opportunistic buying arises as prices stabilize. Investors are not merely reacting to price changes, but also recalibrating their strategies based on perceived value during these fluctuations.

As analysis evolves, incorporating psychological factors that influence investor decisions can yield deeper insights into trading patterns. Observations suggest that during extreme market sentiment shifts, such as those seen in the last week, investors often default to a more defensive posture, preferring to liquidate assets rather than endure further losses. Consequently, understanding these behavioral trends can guide more predictive approaches in both cryptocurrency and broader financial market analyses.

The Relationship Between Bitcoin and Traditional Investment Vehicles

The relationship between Bitcoin and traditional investment vehicles is increasingly evident through the performance of Bitcoin ETFs. As institutional interest grows, evidenced by BlackRock’s substantial ETF inflows, the integration of Bitcoin into mainstream investment strategies is becoming more pronounced. This evolution reflects a shift where Bitcoin is no longer seen merely as a speculative asset but increasingly as a legitimate component in diversified portfolios, akin to stocks and bonds.

With Bitcoin’s interactions with traditional assets, the role of ETFs becomes crucial for bridging the gap between these two realms. Fluctuations in crypto market sentiment directly affect ETF flows and subsequently influence traditional market perceptions. When Bitcoin performances stabilize or show signs of recovery, traditional investors may feel more confident, potentially leading to increased institutional investments in Bitcoin ETFs. As this relationship continues to grow, monitoring these interactions will be key for predicting future market trends.

Future Predictions for Bitcoin Investment and ETF Trends

Looking ahead, future predictions for Bitcoin investment are closely tied to movements within the ETF landscape. With the recent turmoil in Bitcoin prices and the corresponding effects on ETFS like IBIT, predictions will largely focus on how Bitcoin can recover its lost ground. If the recent inflow of $231.6 million into BlackRock’s Bitcoin ETF signals a turning point, we could see renewed interest from institutional investors leading to a bullish sentiment in the crypto market.

Additionally, investors should closely watch patterns of inflows and outflows as potential indicators of broader investment trends. The correlation between Bitcoin’s price volatility, market sentiment, and ETF trends will remain critical as investors navigate this landscape. Analysts may forecast further inflows should Bitcoin stabilize above significant price points, indicating a possible resurgence of interest in cryptocurrency investments.

Frequently Asked Questions

What are the recent Bitcoin ETF inflows reported for BlackRock’s fund?

On Friday, BlackRock’s spot Bitcoin ETF recorded notable inflows of $231.6 million, reversing a trend of outflows earlier in the week as the crypto market sentiment fluctuated.

How do Bitcoin ETF inflows impact Bitcoin price trends?

Bitcoin ETF inflows can significantly influence Bitcoin price trends, as they reflect investor interest. The recent inflows, coupled with Bitcoin trading at $69,820, suggest a potential shift in market sentiment after earlier declines.

What does the performance of BlackRock’s IBIT indicate about Bitcoin investment analysis?

The performance of BlackRock’s IBIT, which recently experienced both major inflows and drops in value, offers critical insights for Bitcoin investment analysis. The ETF’s volatility highlights the sensitivity of Bitcoin investment to market sentiment and external factors.

What has been the trend of Bitcoin ETF inflows in 2026?

In 2026, Bitcoin ETF inflows have been sporadic, with IBIT experiencing only 11 days of net inflows. This trend indicates a cautious approach from investors amid fluctuating crypto market sentiment and significant price changes.

Why are Bitcoin ETF inflows important for understanding crypto market sentiment?

Bitcoin ETF inflows are vital for gauging crypto market sentiment because they represent the collective confidence of investors. Increased inflows, like the recent $330.7 million across various U.S.-based ETFs, can signal renewed interest in Bitcoin despite previous downturns.

How do recent Bitcoin ETF inflows correlate with Bitcoin price fluctuations?

Recent Bitcoin ETF inflows correlate closely with Bitcoin’s price fluctuations, as seen when inflows surged after a week of declining prices. This relationship suggests that investor behavior, reflected in ETF activity, impacts Bitcoin price stability.

What impact did recent outflows have on Bitcoin ETF performance like IBIT?

The recent outflows, totaling $1.25 billion before the inflows, had a marked impact on Bitcoin ETF performance. IBIT saw significant losses but rebounded slightly afterward, showcasing the volatility inherent in Bitcoin investments and broader market conditions.

How do analysts view Bitcoin ETF inflows amidst declining market conditions?

Analysts view Bitcoin ETF inflows as a positive sign of resilience, despite overall declining market conditions. For example, while recent outflows indicate investor anxiety, the inflows suggest that some investors are seizing opportunities amidst the turmoil.

What were the overall net inflows for Bitcoin ETFs prior to October’s downturn?

Before the downturn in October 2026, net inflows into spot Bitcoin ETFs were approximately $62.11 billion, highlighting the potential for recovery despite current issues in the crypto market.

How is the performance of blackrock’s Bitcoin ETF influencing investor behavior?

The performance of BlackRock’s Bitcoin ETF is influencing investor behavior by reshaping expectations around Bitcoin price trends. As IBIT reacts to market fluctuations, it draws attention from both bullish investors and those hedging against volatility.