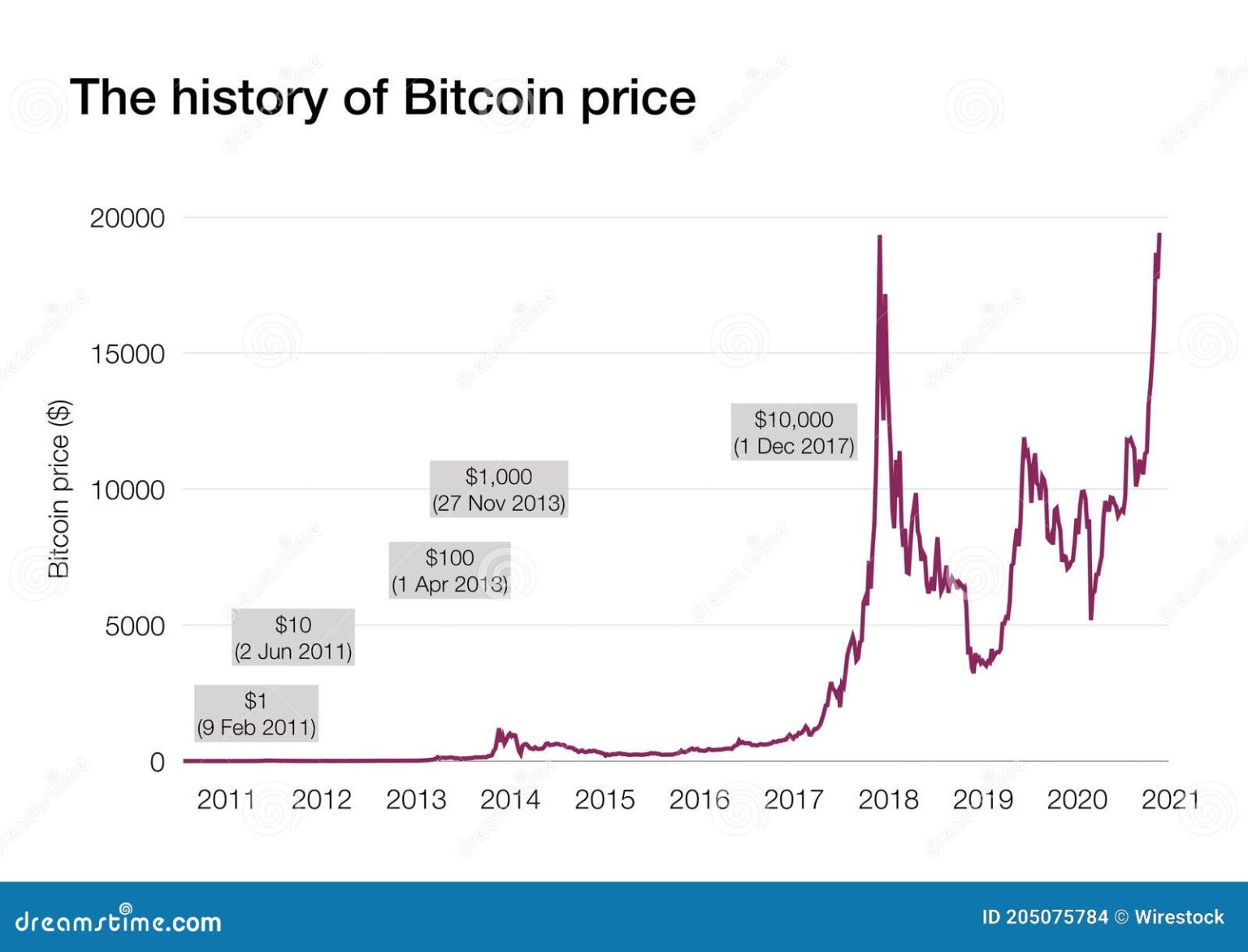

In the ever-evolving world of cryptocurrency, Bitcoin price analysis remains a crucial aspect for investors and enthusiasts alike. Recently, BTC experienced a slight drop, falling briefly below 68,000 USDT before stabilizing at 67,986 USDT. This downturn highlights the current Bitcoin value and its fluctuating nature, as the 24-hour increase narrowed to 4.53%. As we dive into the latest Bitcoin news today, understanding the factors behind the BTC price drop will be essential for navigating the markets. Additionally, insights from the OKX BTC market can provide valuable context for current cryptocurrency trends.

When examining the dynamics of Bitcoin’s market performance, a thorough review of its price movements is essential for any trader or investor. Recent fluctuations saw Bitcoin briefly dip below the significant threshold of 68,000 USDT, now showing a current valuation of 67,986 USDT, with a modest increase observed over the last 24 hours. Keeping abreast of the latest cryptocurrency developments, including Bitcoin news today, can enhance your market insights and trading strategies. Analyzing the shifts in Bitcoin’s worth against various market conditions offers a window into potential future trends. Furthermore, exploring the data from platforms such as OKX can enrich our understanding of price variations and investor sentiment.

| Date | Price (USDT) | 24-Hour Increase (%) | Market Update Source |

|---|---|---|---|

| 2026-02-07 07:15 | 67,986 | 4.53 | Odaily Planet Daily |

Summary

Bitcoin price analysis indicates a recent downturn, as BTC fell briefly below 68,000 USDT, settling at 67,986 USDT. The price has experienced a modest increase of 4.53% over the past 24 hours. This fluctuation in Bitcoin’s price highlights the market’s volatility and emphasizes the importance of continual monitoring.

Current Bitcoin Value Fluctuations

As of today, the current Bitcoin value has experienced a slight dip, falling briefly below the 68,000 USDT mark. This fluctuation in the BTC price is indicative of the volatility that often characterizes the cryptocurrency market. Investors and traders need to monitor these changes closely as they can impact investment decisions significantly. The current Bitcoin price of approximately 67,986 USDT reflects a narrowing of recent gains, which were once at 4.53% over the last 24 hours.

Such fluctuations can be attributed to various factors including market sentiment, regulatory updates, and macroeconomic indicators. For instance, the recent BTC price drop may have been influenced by shifting investor behaviors in the OKX BTC market, which is known for its liquidity and trading volumes. Keeping an eye on these trends is essential for anyone looking to navigate the crypto space effectively.

Bitcoin Price Analysis: Understanding Today’s Trends

Analyzing the current state of Bitcoin is crucial for investors who are keen on making informed decisions. The recent price analysis reveals that Bitcoin dipped to 67,986 USDT after briefly surpassing the 68,000 USDT threshold. This situation raises questions about the sustainability of the cryptocurrency’s trajectory, especially given that the 24-hour increase has cooled off to just 4.53%. Such price movements can signal potential buying or selling opportunities in the market.

Moreover, the Bitcoin news today is flooded with discussions about these shifts in value, where analysts are focusing on how current trends might align with historical data patterns. It’s important to look at broader cryptocurrency trends in the market, as these can provide valuable context for understanding the future performance of Bitcoin. In conclusion, potential investors should carefully consider both the immediate price movements and broader trends when engaging with Bitcoin.

Impact of BTC Price Drop on Investors

The recent BTC price drop has significant implications for investors who are either holding positions or looking to enter the market. A decline below the 68,000 USDT level can invoke emotional responses among traders, potentially leading to panic selling or hasty investments. Recognizing how such fluctuations affect market sentiment is critical for devising a robust investment strategy in cryptocurrencies like Bitcoin.

Furthermore, experienced investors often take these drops as a buying opportunity, leveraging the lower price points to accumulate more BTC. However, it’s crucial to remain cautious and conduct thorough analysis, particularly in understanding the factors driving the current Bitcoin value. Engaging with reliable Bitcoin news today can offer insights into market dynamics, helping investors make sound choices in a volatile environment.

Analyzing Cryptocurrency Trends Post-BTC Decline

The recent decline in Bitcoin’s price brings to light the importance of analyzing cryptocurrency trends. Such fluctuations are not unique to Bitcoin; they tend to ripple through the crypto market, often affecting altcoins and leading to broader market corrections or rallies. After the BTC price drop, many investors turn to indicators and analytics tools to interpret market behavior and predict future movements.

Moreover, the current trends in the cryptocurrency space suggest a complex interplay of factors influencing prices, including regulatory news and technological advancements. Keeping an eye on the cryptocurrency landscape post-BTC decline can provide insights into future price directions. Investors should consider subscribing to reliable news sources to stay updated on these critical movements and trends.

OKX BTC Market Dynamics

Understanding the dynamics of the OKX BTC market is essential for grasping why Bitcoin prices fluctuate as they do. The OKX exchange, known for its high trading volumes and liquidity, plays a crucial role in determining Bitcoin’s value based on real-time supply and demand. This exchange often sets the tone for price movements, making it a point of focus for many investors.

Given the recent drop in BTC prices, analysts are deciphering how the actions occurring within the OKX market might foreshadow future trends. Whether through institutional investments or changing retail participation, these trends can provide insights into market strength. For anyone involved in Bitcoin trading or investing, understanding the specific dynamics of exchanges like OKX is fundamental to making informed decisions.

Factors Influencing Bitcoin’s Price Today

Today’s Bitcoin price is influenced by a variety of factors that range from macroeconomic conditions to technical analyses. Current shifts in the market dynamics, including investor sentiment and trading volumes, may contribute to the fluctuations observed recently. Understanding these factors can help traders anticipate potential price movements and make better decisions.

Additionally, news surrounding Bitcoin—such as regulatory pronouncements or high-profile investments—often plays a significant role in shaping public perception and, consequently, market prices. Keeping abreast of Bitcoin news today is vital for anyone interested in the cryptocurrency space, as it can provide critical context for understanding and predicting price changes.

Investment Strategies Amidst BTC Price Changes

As Bitcoin’s price undergoes fluctuations like the latest drop below 68,000 USDT, it’s essential for investors to reevaluate their investment strategies. Investors should consider employing methodologies tailored to capitalize on volatility—such as dollar-cost averaging or stop-loss orders—which can mitigate risks associated with sudden price changes. Such strategies can enhance long-term viability in the often unpredictable cryptocurrency market.

Additionally, assessing the performance of Bitcoin relative to other cryptocurrencies can provide a holistic view of the market landscape. By comparing Bitcoin’s trends with altcoins and examining respective price movements, investors can identify potential diversification opportunities that might cushion against adverse shifts in Bitcoin’s value. Continuous learning and adaptation to market conditions are fundamental to navigating these strategies successfully.

The Role of Market Sentiment in Bitcoin Pricing

Market sentiment invariably impacts Bitcoin pricing; recent evidence shows that bullish or bearish sentiments can significantly influence BTC’s market performance. For instance, the recent price dip was influenced by a general sense of caution among investors, who may have reacted to market news and trends and decided to sell. Understanding these sentiments provides clarity and assists investors in making informed decisions.

Moreover, sentiment analysis tools can be useful in gauging market emotions and predicting future movements in Bitcoin. By closely monitoring social media, trading volume, and market commentary, investors can develop a sense for how sentiment is shifting and adjust their strategies accordingly. Fostering an awareness of market psychology can enhance an investor’s ability to navigate price fluctuations effectively.

Future Predictions for Bitcoin Prices

Forecasting future Bitcoin prices is inherently complex, particularly in light of recent price movements that seen the currency hover around 67,986 USDT. Many analysts predict that Bitcoin’s future performance will be closely linked to how it responds to current market sentiment and broader economic conditions. Factors such as regulatory changes, technological advancements within blockchain, and public adoption rates of cryptocurrencies will likely influence its value moving forward.

Investors looking for long-term gains must analyze not just current trends but also the macroeconomic environment. For example, expectations surrounding interest rates and inflation can directly affect investment flows into cryptocurrencies. Understanding these dynamics is crucial not just for predicting Bitcoin’s price but for devising strategies that align with potential future market conditions.

Frequently Asked Questions

What caused the recent BTC price drop below 68,000 USDT?

The recent BTC price drop below 68,000 USDT can be attributed to market fluctuations and investor sentiment, as reported by Odaily Planet Daily. The current Bitcoin value stands at approximately 67,986 USDT, showing a narrowing 24-hour increase of 4.53%. Such shifts are not uncommon in cryptocurrency trends.

How is the current Bitcoin value affecting the OKX BTC market?

The current Bitcoin value at 67,986 USDT is impacting the OKX BTC market by reflecting a slight decrease from earlier highs. This price movement, characterized by a 4.53% increase over the last 24 hours, indicates ongoing volatility that traders on the OKX platform should monitor closely.

What are the latest cryptocurrency trends affecting Bitcoin’s price?

Current cryptocurrency trends influencing Bitcoin’s price include market reactions to economic news, shifts in investor behavior, and overall market sentiment. Recently, Bitcoin’s value fluctuated with a notable price drop below 68,000 USDT, but it has seen a slight recovery of 4.53% in the last 24 hours.

Where can I find Bitcoin news today regarding its price analysis?

For the latest Bitcoin news today, particularly regarding price analysis, you can refer to credible financial news websites and cryptocurrency exchanges like OKX. Recent reports indicate Bitcoin briefly fell below 68,000 USDT, currently stabilizing at around 67,986 USDT, with a daily increase of 4.53%.

What does the recent BTC price drop mean for investors?

The recent BTC price drop below 68,000 USDT signifies increased volatility, which could present both risks and opportunities for investors. Understanding these fluctuations is crucial, as the current Bitcoin value reflects short-term trends that may impact investment strategies moving forward.