In this BTC price update, we delve into the latest fluctuations impacting Bitcoin’s value, as it has recently dropped below 69,000 USDT, trading at 68,995 USDT. This shift in the cryptocurrency market highlights a narrowing 24-hour increase of just 5.92%, prompting traders and investors to reassess their positions. As we observe these Bitcoin price news developments, it becomes essential to analyze how factors influence BTC market trends. With platforms like OKX reporting these changes, the current Bitcoin value is under the spotlight, drawing attention from market analysts. Stay tuned as we explore the implications of this price adjustment on the broader cryptocurrency landscape and potential future movements in BTC.

In today’s update regarding the Bitcoin market, we’re witnessing a significant downturn as BTC falls beneath the 69,000 USDT threshold, currently valued at 68,995 USDT. This latest shift introduces a reduced growth rate of 5.92% over the past 24 hours, raising eyebrows in cryptocurrency circles. The cryptocurrency market analysis reveals crucial insights into how this decline may be indicative of larger trends in digital asset trading. Analysts on platforms like OKX are keenly examining this situation to forecast future price fluctuations of Bitcoin. As investors digest this BTC price update, the dynamics of the cryptocurrency landscape continue to evolve rapidly.

| Key Point | Details |

|---|---|

| Current BTC Price | 68,995 USDT |

| Price Movement | Falls below 69,000 USDT |

| 24-hour Increase | Narrowed to 5.92% |

Summary

BTC price update shows that Bitcoin has recently fallen below the 69,000 USDT mark, now sitting at 68,995 USDT, with a gradual decrease in its 24-hour increase percentage to 5.92%. This shift in value indicates fluctuating market dynamics that investors should monitor closely.

BTC Price Update: Current Trends and Analysis

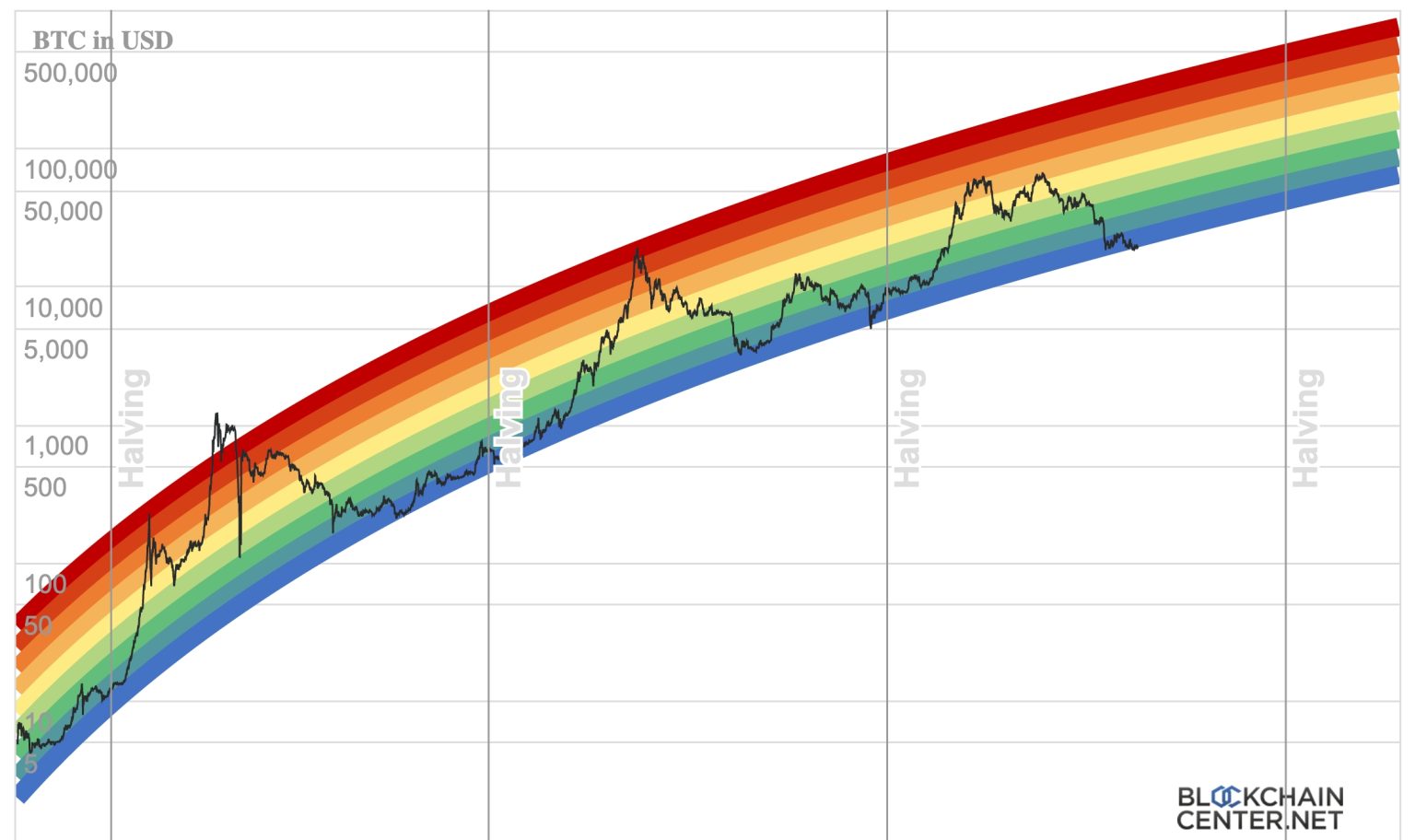

As of the latest reports, BTC has reached a price point of 68,995 USDT, marking a notable decline below the 69,000 USDT threshold. This shift in the Bitcoin value emphasizes the volatility of the cryptocurrency market, where fluctuations can often lead to shifts in investor sentiment and market dynamics. The recent 24-hour increase has narrowed to 5.92%, suggesting that while there has been some upward momentum, the current pace is losing strength. Traders and investors are carefully monitoring these changes as they could signal broader trends across the cryptocurrency sector.

The current state of the BTC price indicates a potential consolidation period, where investors may be evaluating market conditions before making significant moves. Analysts emphasize the importance of understanding both macroeconomic factors and technical indicators that influence the cryptocurrency market. The narrowing increase could imply that traders are becoming more cautious, reflecting on past performances and other critical metrics such as volume and market cap to place their bets. Keeping an eye on price updates like this is crucial for anyone involved in Bitcoin trading.

Understanding Cryptocurrency Market Trends

The cryptocurrency market is characterized by rapid changes and unpredictable trends. Recent Bitcoin price news highlights how various factors, ranging from regulatory news to adoption rates, can affect price movements. When BTC falls below key levels such as 69,000 USDT, it often triggers a chain reaction in market sentiment, compelling both retail and institutional investors to reassess their positions and strategies. This is particularly relevant in the context of BTC market analysis which utilizes existing data to forecast future price actions.

Market trends not only impact Bitcoin but also have a cascading effect on the broader cryptocurrency ecosystem. With altcoins often mirroring BTC’s movements, a decline in Bitcoin’s price can lead to a pullback in other digital assets, leading to a collective adjustment in investment strategies. Understanding these market trends is essential for traders looking to capitalize on price fluctuations and make informed decisions during times of volatility.

Delving into the intricacies of BTC market analysis enables investors to identify patterns and potential breakout scenarios. For instance, by examining historical data concerning BTC’s performance during similar price points, traders can deduce probable future behavior. This involves looking at previous recoveries, market sentiment analysis, and key indicators that signal a change. As the cryptocurrency market continually evolves, those who pay close attention to these analyses are likely to find more success in their trading endeavors.

OKX BTC Price Insights and Market Implications

The OKX exchange has provided a pivotal platform for tracking BTC’s price movements in real time, and the current report shows BTC at 68,995 USDT. This figure is not just a number but a reflection of how market dynamics play out on trading platforms. OKX’s role in the cryptocurrency market is significant; it allows users to engage with Bitcoin in a manner that can influence both short-term trading and long-term investment strategies.

With Bitcoin’s recent drop below the 69,000 USDT mark, analysts are closely observing trading volumes on OKX to understand how they impact market sentiment. A decrease in trading activity may suggest a lack of confidence among investors, potentially leading to further price declines. Conversely, increased activity could signal a strong buying interest at current levels, indicating that traders are looking to capitalize on perceived value. Understanding the nuances of market behavior in response to price updates is essential for successful trading.

Current Bitcoin Value: What It Means for Investors

The current Bitcoin value of 68,995 USDT brings to light significant considerations for both novice and experienced investors. With the dynamics of the cryptocurrency market constantly in flux, this price point may act as a critical touchstone for future trading strategies. Investors often assess their entry and exit points based on current valuations, as they attempt to navigate the complex environment of digital asset trading.

Moreover, the current state of Bitcoin pricing reflects broader themes in the economic landscape, including inflation trends, regulatory changes, and adopter sentiment toward cryptocurrencies. As more individuals and institutions adopt Bitcoin, fluctuations in its value can have immense implications for market stability. Staying informed about the Bitcoin price amid changing conditions allows investors to make strategic decisions that could lead to profitable outcomes.

Frequently Asked Questions

What is the current Bitcoin price update as of February 7, 2026?

As of February 7, 2026, the current Bitcoin price is 68,995 USDT. This represents a recent drop below 69,000 USDT and reflects a 24-hour increase of 5.92%.

How do cryptocurrency market trends affect the BTC price update?

Cryptocurrency market trends play a crucial role in BTC price updates. For instance, fluctuations in market sentiment, regulatory news, and macroeconomic factors can lead to significant changes in Bitcoin’s value, similar to the recent drop below 69,000 USDT.

Where can I find OKX BTC price updates?

You can find OKX BTC price updates directly on the OKX exchange’s website or app, where they provide real-time data on Bitcoin’s value, currently at 68,995 USDT as of the latest update.

What does the latest BTC market analysis indicate about Bitcoin’s value?

The latest BTC market analysis indicates a slight dip in Bitcoin’s performance, with the price falling to 68,995 USDT. While the 24-hour increase has narrowed to 5.92%, indicating potential market consolidation.

Why is the current Bitcoin value significant for investors?

The current Bitcoin value, which is 68,995 USDT, is significant for investors as it reflects market dynamics and sentiment. Monitoring such price updates assists in making informed investment decisions within the volatile cryptocurrency market.