In recent news, the BTC price drop has captured the attention of investors and analysts alike as Bitcoin falls below the key threshold of 70,000 USDT. This decline has led to speculation regarding the future of cryptocurrency trends, particularly as the current price sits at 69,990.8 USDT, displaying a modest 24-hour increase of just 7.53%. The latest Bitcoin price analysis reveals significant shifts within the market, prompting discussions about the implications for BTC price prediction and future values, especially looking ahead to 2026. With the volatility in the digital currency realm, OKX market news continues to provide vital insights for those tracking Bitcoin’s performance. As we delve deeper into this price fluctuation, understanding the driving factors behind the BTC price drop is essential for making informed investment decisions.

The recent decline in Bitcoin’s valuation, often referred to as a cryptocurrency slump, has stirred considerable interest among market participants. The price dip beneath 70,000 USDT not only highlights immediate market challenges but also sets the stage for broader discussions on the potential trajectories of digital currencies. As we navigate this landscape, terms like Bitcoin market analysis and cryptocurrency downturns take center stage, influencing both short-term trading strategies and long-term market sentiment. Observers are eager to uncover insights from platforms like OKX, where significant price movements provide a clearer picture of Bitcoin’s future. Moving forward, the focus will likely shift to forecasts surrounding BTC’s recovery and the factors shaping its value in the coming years.

| Key Point | Details |

|---|---|

| BTC Price Drop | BTC has dropped below 70,000 USDT, currently priced at 69,990.8 USDT. |

| Percentage Increase | The 24-hour increase in BTC price has narrowed down to 7.53%. |

| Source | Odaily Planet Daily report, AI-assisted news. |

Summary

The recent BTC price drop marks a significant event as it has fallen below 70,000 USDT, with its current valuation at 69,990.8 USDT. This decline is noteworthy as it also coincides with a narrowing of the 24-hour increase to 7.53%. Investors should monitor these changes closely as they indicate potential shifts in market dynamics.

Understanding the Recent BTC Price Drop

Recently, Bitcoin (BTC) experienced a significant drop, falling below the 70,000 USDT mark to a current valuation of 69,990.8 USDT. This decline has raised eyebrows among investors and analysts alike. The drop in price could be attributed to a variety of factors affecting the overall cryptocurrency market, including regulatory news, shifts in investor sentiment, and fluctuations in demand. The current 24-hour increase has dwindled to 7.53%, which indicates a slowdown in bullish momentum that many had expected to continue.

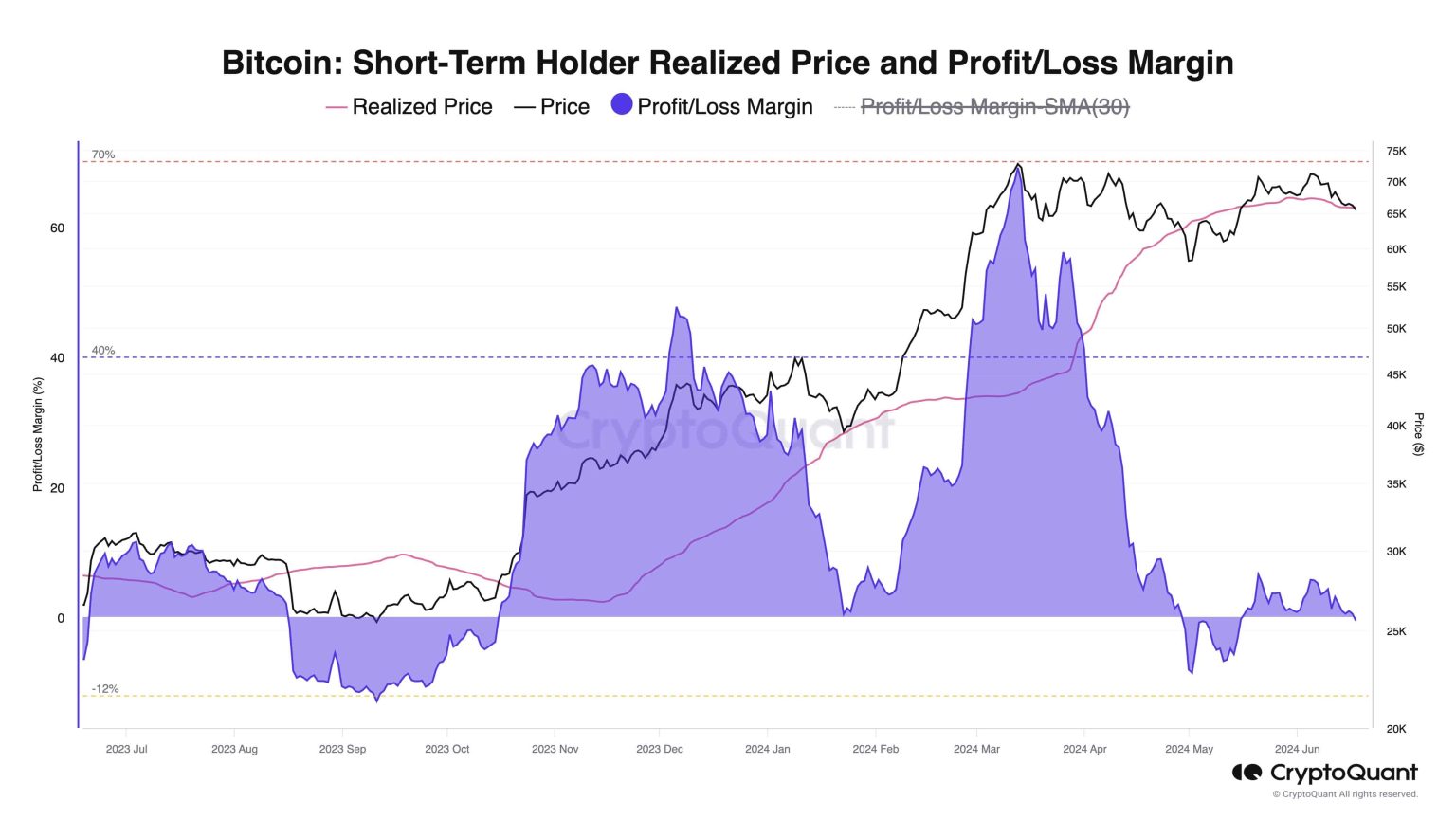

Analyzing the reasons behind this BTC price drop is crucial for investors looking to strategize their next moves. Factors such as volatility in the altcoin market, investor profit-taking, and changes in overall market sentiment can significantly influence Bitcoin’s price trajectory. By keeping a pulse on these dynamics, investors can better anticipate potential price movements and adjust their investment strategies accordingly.

Bitcoin Price Analysis: Insights from OKX Market News

The OKX market news highlights essential information regarding the current state of Bitcoin prices and offers valuable insights for traders and investors. Detailed Bitcoin price analysis suggests that although a recent correction has occurred, the overall upward trend for BTC remains intact in the long term. Analysts believe the ongoing interest from institutional investors, coupled with increasing mainstream adoption, could lead to a resurgence in Bitcoin value even after a brief setback.

Moreover, staying informed about market indicators and trends is crucial for making educated investment decisions. The OKX market provides traders with real-time updates that can inform their entry and exit strategies. It’s essential to consider other factors such as global economic conditions and potential regulatory changes that could impact the cryptocurrency landscape as a whole, which ultimately feeds back into Bitcoin’s price action.

Bitcoin Price Prediction for 2026: What to Expect

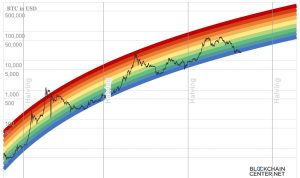

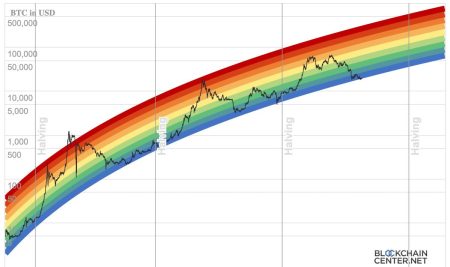

Looking ahead to 2026, many experts are speculating about the future of Bitcoin’s price and potential trends that could dominate the market. Given its historic upward trajectory, predictions for the BTC price in 2026 often suggest that Bitcoin could substantially increase its value, particularly if broader adoption continues and technological advancements enhance its usability. Analysts predict that Bitcoin will not only gain traction but could also reach new all-time highs, with various estimates suggesting values beyond the current market levels.

Factors influencing Bitcoin’s performance leading up to 2026 are multifaceted, involving both macroeconomic trends and internal developments within the cryptocurrency community. Innovations like the implementation of Bitcoin scaling solutions, enhanced security measures, and mainstream financial institutions integrating blockchain technology can contribute to heightened investor confidence and ultimately lift BTC prices. Hence, keeping an eye on these developments will be crucial for anyone involved in Bitcoin investments.

Navigating Cryptocurrency Trends Amidst Market Fluctuations

As cryptocurrency continues to evolve, understanding the trends shaping the market is vital for both new and experienced traders. The current fluctuations, including the recent BTC price drop, highlight the volatility that characterizes the crypto space. These variances often lead to short-term profit opportunities for traders who can quickly adapt to the changing narratives and market sentiments. Following established trends while being aware of the potential for sudden shifts can help investors remain competitive.

Moreover, analyzing cryptocurrency trends involves looking beyond Bitcoin and considering altcoins and DeFi projects which may also indirectly affect BTC prices. For instance, the performance of leading altcoins can impact investor perceptions of Bitcoin, potentially drawing capital away during downturns or inspiring confidence in cryptocurrencies as a whole during bullish phases. Keeping abreast of such trends will enable traders to make informed decisions and capitalize on market movements.

The Impact of Regulatory Changes on Bitcoin Prices

Regulatory changes have an undeniable impact on cryptocurrency prices, including Bitcoin. Recent news suggests that as authorities worldwide become increasingly involved in cryptocurrency market regulations, Bitcoin’s price may react significantly. Positive regulatory news can lead to price surges, while restrictive regulations can contribute to downturns like the recent BTC price drop seen in the OKX market report. Understanding the regulatory landscape becomes crucial in predicting price movements.

Investors need to stay informed about legislation as it unfolds within key markets. The implications of laws regarding crypto exchanges, taxation, and trading of cryptocurrencies will undoubtedly influence market confidence. Ultimately, an investor’s ability to navigate these regulatory waters can determine success in anticipating and capitalizing on Bitcoin’s price changes.

Market Sentiment: Analyzing the Emotional Landscape of Cryptocurrency Trading

Market sentiment plays a pivotal role in the cryptocurrency trading ecosystem. Emotions such as fear and greed significantly influence traders’ decisions, leading to price fluctuations like the recent BTC price drop. By gauging market sentiment through tools such as fear and greed indices or social media sentiment analysis, traders can better assess the market’s potential direction. For example, fear can lead to panic selling, while greed can catalyze buying frenzies.

Understanding the emotional landscape can also provide context to Bitcoin’s historical price movements. Market cycles often correlate with shifting sentiments, where periods of exuberance follow respective periods of pessimism. Traders who can interpret these emotional cues may capitalize on the fluctuating market sentiment, leading to more strategic investment choices in the volatile world of cryptocurrencies.

The Role of Institutional Investors in Bitcoin Valuation

Institutional investors have rapidly become a dominant force in the cryptocurrency market, especially concerning Bitcoin’s valuation. Their interest and investments can significantly affect BTC prices, often leading to spikes in price trends. The recent BTC price drop demonstrates how the market can quickly shift, and institutional activity can either bolster confidence or instigate sell-offs based on broader market conditions.

Moreover, the influx of institutional capital creates waves of legitimacy for Bitcoin, establishing it as a viable asset class among traditional investors. Understanding what drives these institutional players can provide valuable insights into Bitcoin’s price predictions and potential market behaviors. Factors such as economic indicators, portfolio diversification strategies, and macroeconomic conditions will continue to influence how these large players interact with Bitcoin markets.

Analyzing Historical Trends to Forecast Bitcoin’s Future

Traditionally, investors looking to forecast Bitcoin’s future prices often turn to historical data and charts for guidance. By examining past trends and cycles, analysts can identify recurring patterns that may indicate potential future movements. For instance, historical analysis demonstrates that Bitcoin frequently experiences rapid price surges after corrections, suggesting that the current BTC price drop may be a precursor to future gains.

Utilizing technical analysis tools can aid traders in making educated predictions about Bitcoin’s price trajectory. Trends observed during previous market cycles, combined with current market conditions, help to form a comprehensive outlook on Bitcoin’s potential performance going forward. Keeping track of this historical framework alongside emerging trends allows investors to maintain a strategic edge in a constantly evolving market.

The Future of Bitcoin: Long-Term Market Predictions

As the cryptocurrency landscape continues to develop, long-term predictions for Bitcoin become increasingly relevant. Many analysts are optimistic about BTC’s potential to reach unprecedented valuation, particularly as adoption rates soar and market infrastructures improve. Throughout the years, Bitcoin has demonstrated remarkable resilience, often bouncing back stronger from dips such as the recent drop below 70,000 USDT.

Regular forecasting involves a range of variables from technological advancements to macroeconomic trends. Therefore, investors should monitor developments carefully, as they can significantly influence Bitcoin’s future path. By remaining vigilant and astute in their analysis, investors can position themselves to capitalize on Bitcoin’s potential growth in the forthcoming years.

Frequently Asked Questions

What caused the recent BTC price drop below 70,000 USDT?

The recent BTC price drop below 70,000 USDT can be attributed to various market factors, including investor sentiment shifts, potential profit-taking, and overall cryptocurrency trends impacting Bitcoin’s valuation.

How does the BTC price drop affect future Bitcoin price predictions for 2026?

The current BTC price drop could influence Bitcoin price predictions for 2026 by introducing volatility in the market, which analysts take into account when estimating future trends and potential growth.

What are the implications of BTC’s price drop for traders on platforms like OKX?

For traders on OKX, the BTC price drop may prompt reevaluation of trading strategies, particularly in a volatile market, as the 24-hour increase narrows to 7.53%, indicating a shift in short-term trading opportunities.

What should investors know about Bitcoin price analysis in light of the current BTC price drop?

Investors should closely monitor Bitcoin price analysis following the BTC price drop, as it provides insight into market health and investor behavior, which is essential for making informed decisions amid fluctuating prices.

How can the BTC price drop affect overall cryptocurrency trends?

The BTC price drop can significantly impact overall cryptocurrency trends, as Bitcoin often serves as a market leader. A decline in BTC’s price may lead to reduced confidence in other cryptocurrencies, influencing market dynamics.