Bitcoin market analysis remains crucial as the cryptocurrency continues to experience fluctuations in value, with recent events highlighting significant volatility. Following a notable Bitcoin price drop to $60,000, market observers are closely examining the underlying factors contributing to this decline. There’s much to unpack regarding the recent sell-off, as multiple variables such as leveraged liquidation and miners being compelled to sell play a role in shaping current trends. Understanding these elements not only aids in deciphering a Bitcoin recovery but also sheds light on broader cryptocurrency market trends that investors should be aware of. As highlighted by experts like Matthew Sigel from VanEck, analyzing the complexities of this situation allows for better positioning ahead of potential future rebounds.

In a world where digital currencies fluctuate wildly, a comprehensive analysis of Bitcoin and the factors influencing its market dynamics is essential. The recent downturn has prompted discussions around various explanations for the current sell-off, where factors such as liquidation pressures from high-leverage positions and external influences like the waning enthusiasm for AI technologies come into play. Understanding these intricacies helps to frame the conversation around Bitcoin recovery indicators and broader trends within the cryptocurrency ecosystem. With insights from figures like Matthew Sigel of VanEck, stakeholders can better navigate the unpredictable waters of Bitcoin investing and anticipate where the market might head next.

| Key Points | |||||

|---|---|---|---|---|---|

| Matthew Sigel, head of digital asset research at VanEck, remarks that the recent Bitcoin sell-off lacks a clear trigger. | Challenges arise in identifying the market bottom due to the absence of a single catalyst. | Recovery conditions may become clearer despite the challenges. | Factors contributing to Bitcoin’s drop to $60,000 include leveraged liquidation and miners selling off. | Retreat from AI hype and threats from quantum computing also played roles. | Investors are reacting to the typical four-year bull-bear cycle in the Bitcoin market. |

| Overall, the market sentiment is cautious but could lead to potential recovery if conditions stabilize. |

Summary

Bitcoin market analysis reveals that the recent downturn in Bitcoin’s price, currently at $60,000, is distinct due to the absence of a clear, singular cause. Matthew Sigel’s insights help illuminate the complex factors at play, including forced sell-offs from miners and shifting market sentiments away from artificial intelligence hype. This situation illustrates the market’s volatility, especially as it navigates the cyclical patterns typically observed in Bitcoin’s history. Understanding these dynamics is crucial for investors looking to make informed decisions in the ongoing Bitcoin market.

Bitcoin Market Analysis: Understanding Recent Trends

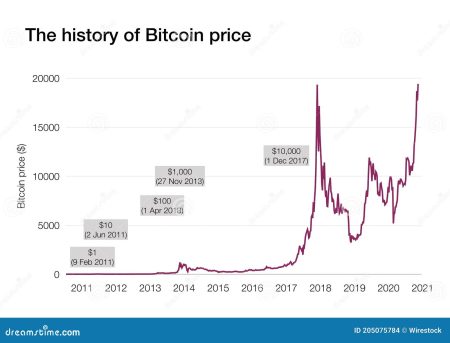

The recent fluctuations in Bitcoin’s market value have prompted analysts, such as Matthew Sigel from VanEck, to dive deeper into Bitcoin market analysis. Unlike historical crashes that could be attributed to a specific triggering event, the current Bitcoin price drop appears to be influenced by a variety of complex factors. This makes predicting the market bottom increasingly difficult for investors and analysts alike. Economic cycles, particularly the anticipated four-year bull-bear cycle, coupled with external pressures, are shaping the Bitcoin landscape, demanding a nuanced analysis.

In recent weeks, Bitcoin has seen a significant sell-off, dropping to roughly $60,000. Factors contributing to this decline include leveraged liquidation, a phenomenon where highly leveraged positions are forcibly liquidated, resulting in dramatic price drops. Additionally, factors such as miners being compelled to sell their assets, a decline in the artificial intelligence hype that previously boosted cryptocurrency interest, and looming threats from quantum computing have all played crucial roles in the downturn. These elements indicate that the cryptocurrency market trends are dynamic and require continuous monitoring for accurate market analysis.

Factors Behind Bitcoin’s Recovery: What to Watch

As we look towards possible recovery scenarios for Bitcoin, it’s essential to identify the factors that could influence a rebound in its price. Analysts like Sigel point out that, despite the current sell-off, there are conditions that may facilitate Bitcoin’s resurgence. Understanding these recovery factors involves examining market sentiment, regulatory developments, and shifts in investor behavior as they respond to macroeconomic changes. For instance, the growing institutional interest in Bitcoin can play a significant role in supporting its market recovery.

To effectively gauge Bitcoin’s recovery potential, investors should also consider the impact of technological advancements, particularly in blockchain applications, which could strengthen investor confidence. Additionally, ongoing analyses—similar to those conducted by VanEck—will provide valuable insights into how the cryptocurrency market reacts to global financial trends and uncertainties. Should market participants begin to expect a consolidation period before the next growth cycle, the conditions for recovery could tighten, setting the stage for a rebound in Bitcoin prices.

Understanding the Bitcoin Sell-off: An In-Depth Explanation

The recent Bitcoin sell-off has left many investors bewildered, as its causes are not as straightforward as they have been in the past. While typical reasons such as regulatory news or market panics have previously driven prices down, this current situation exemplifies a more convoluted array of factors. As Matthew Sigel of VanEck stated, the sell-off’s complexity is what makes understanding its roots vital for investors hoping to navigate the turbulent waters of cryptocurrency trading.

Among the key explanations for this downturn is the phenomenon of leveraged liquidation, which occurs when traders holding margined positions are forced to close their trades as prices fall. This time-honored practice often exacerbates price declines, leading to more volatility in Bitcoin’s market. Additionally, the speculation surrounding artificial intelligence’s influence on cryptocurrency markets has waned, leading to a diminished interest among potential investors. This combination of internal market dynamics and external pressures has contributed significantly to the sell-off, raising numerous questions about the future trajectory of Bitcoin.

Impact of the Four-Year Bull-Bear Cycle on Bitcoin

One of the intriguing aspects of Bitcoin’s market behavior is its adherence to a predictable four-year cycle of bull and bear markets. This cyclical nature greatly influences investor psychology and trading strategies. During the bullish periods, enthusiasm and prices surge, driven by positive market sentiment and increased risk tolerance among traders. However, after reaching peak prices, many investors anticipate a pullback, leading to sell-offs that reset the market. Understanding this cycle is critical for Reacting to Bitcoin’s price behavior over time.

As the market enters a bear phase, many investors begin to prepare for the next potential upswing, often resulting in a mixed bag of reactions. The anticipation of this cyclical transition affects how long-term holders perceive selling pressures and when they decide to divest their holdings. The intricacies of this bull-bear dynamic lay the groundwork for potential recovery factors, and, with informed analysis, savvy investors can position themselves strategically to benefit from inevitable market reversals.

Leveraged Liquidation: A Driving Force of Market Volatility

Leveraged liquidation has emerged as a pivotal force in Bitcoin’s market movements, particularly during periods of heightened volatility. This occurs when traders take on leverage to amplify their positions, but when the market takes a downturn, these positions can be forcefully liquidated to mitigate risks. As more traders find themselves unable to maintain their leveraged positions, a domino effect is triggered, resulting in accelerated selling pressure. Understanding this process is crucial for any investor looking to navigate the tumultuous waters of Bitcoin trading.

What distinguishes the current sell-off from past events is the lack of a clear singular trigger. Instead, multiple parties have engaged in leveraged trading, which has led to cascading losses that spiral outwards. Market analysts like Sigel emphasize the need for investors to consider how leveraged positions contribute to market dynamics and overall volatility. Recognizing the implications of leverage on market trends not only provides clarity on past price actions but also helps investors prepare for potential rebounds as the market stabilizes.

The Role of Miners in Bitcoin Price Dynamics

Miners play an essential role in the Bitcoin ecosystem, not just in securing the network but also in influencing market prices. When miners are forced to sell their Bitcoin holdings due to operational costs or market pressures, it can create considerable selling pressure that impacts overall prices. This phenomenon is evident in the recent price drops observed, where miners’ need to liquidate portions of their holdings to cover costs has contributed to the ongoing downturn.

The relationship between miners and market pricing is multifaceted. Investors must consider how fluctuations in mining profitability directly affect their willingness to hold versus sell. As market sentiment sways, miners may respond strategically to capitalize on profitable periods or mitigate losses during bear phases. Understanding this relationship helps investors gauge potential recovery factors and formulate strategies that align with ongoing market conditions.

Artificial Intelligence Hype: Its Rising and Falling Influence

The surge in interest surrounding artificial intelligence (AI) has extensively influenced various sectors, including cryptocurrency markets. Initially, the interplay between AI advancements and Bitcoin created bullish momentum, attracting investors seeking to capitalize on technological advancements. However, as the fervor around AI gradually subsided, many investors reevaluated their interest in Bitcoin, leading to decreased buying activity and, ultimately, contributing to the recent price drop.

As the AI hype cools, analysts must assess how this shift impacts investor behavior within the cryptocurrency markets. While some may argue that AI and blockchain technologies are symbiotic, knowledge about this relationship can inform trading decisions. Investors focusing on Bitcoin must remain vigilant regarding external technological trends, as they can shape the investment landscape significantly, influencing everything from market confidence to regulatory approaches in the cryptocurrency sector.

Future Outlook for the Cryptocurrency Market: Key Considerations

As the cryptocurrency market grapples with recent challenges, investors are keen to understand what the future might hold. Key considerations for the outlook involve analyzing existing trends, regulatory landscapes, and technological advancements. With Bitcoin continuing to be a benchmark for the entire market, any fluctuations often have a cascading effect on altcoins and investors’ overall confidence in the sector.

Additionally, looking ahead, market analysts will be closely monitoring any signs of stabilization following the recent downturn. Factors such as institutional adoption, advancements in blockchain technologies, and the potential for emerging regulatory frameworks will play a significant role in defining the trajectory of Bitcoin and, by extension, the entire cryptocurrency market. A comprehensive understanding of these elements will equip investors to make informed decisions amidst potential market recoveries.

Frequently Asked Questions

What were the main factors contributing to the recent Bitcoin price drop?

The recent Bitcoin price drop can be attributed to several factors, including leveraged liquidation, forced selling by miners, the retreat of artificial intelligence hype, and the ongoing threats from quantum computing. Additionally, the traditional four-year bull-bear cycle pattern in the cryptocurrency market also influenced investor behavior and the sell-off.

How does VanEck analyze the future of Bitcoin amidst recovery factors?

VanEck’s analysis indicates that despite the recent Bitcoin sell-off, there are numerous recovery factors to consider. Matthew Sigel, head of digital asset research at VanEck, highlighted that the absence of a single catalyst for the sell-off makes predicting the market bottom more complex, yet it may also set the stage for a clearer path to recovery for Bitcoin.

What does the Bitcoin recovery process involve after a sell-off?

The Bitcoin recovery process involves analyzing cryptocurrency market trends, understanding market sentiment, and identifying triggers that typically lead to recovery. Factors such as institutional investment, regulatory clarity, and technological advancements are crucial in reversing the trend following a Bitcoin price drop.

How do cryptocurrency market trends affect Bitcoin’s price fluctuations?

Cryptocurrency market trends play a significant role in Bitcoin’s price fluctuations. External events, investor sentiment, and emerging technologies may lead to sudden changes in demand for Bitcoin, influencing both price drops and recoveries. Market trends can reflect broader economic conditions, making it essential for investors to stay informed.

Can you explain the recent Bitcoin sell-off based on expert analysis?

Expert analysis from Matthew Sigel at VanEck explains that the recent Bitcoin sell-off lacked a clear, identifiable catalyst unlike previous crashes. It involved complex factors, including the liquidation of leveraged positions, miner selling, and reactions to broader market conditions, ultimately creating a challenging environment for investors hoping to determine the market’s bottom.