Ondo ETF is making waves in the financial market as 21Shares has officially submitted its application to launch this innovative exchange-traded fund. As highlighted by Bloomberg’s senior ETF analyst, Eric Balchunas, the introduction of Ondo ETF is a significant development that investors should keep an eye on. This promising move comes amidst a dynamic landscape of investment news that underscores the growing interest in ETFs. The Ondo ETF is positioned to tap into the evolving trends in the ETF sector, offering potential for diverse investment strategies. With the rise of options like the Ondo ETF, it’s an exciting time for those seeking to stay informed on the latest ETF news.

The recent announcement about the Ondo ETF epitomizes a transformative shift in the exchange-traded fund marketplace, especially as international financial firms like 21Shares seek to innovate. Under the expert eyes of analysts such as Eric Balchunas from Bloomberg, this new venture highlights alternative avenues for investors looking to enhance their portfolios. With continuous coverage on investment news and shifts in market trends, funds like the Ondo ETF represent an adaptation to changing investor preferences. As the ETF landscape evolves, understanding these financial instruments becomes essential for anyone keen on navigating future investment opportunities. The forthcoming launch of the Ondo ETF speaks volumes about the growing strategic options available in the industry.

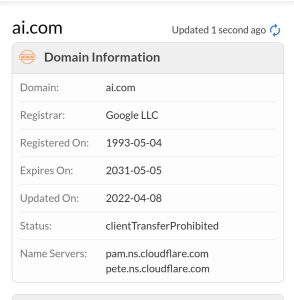

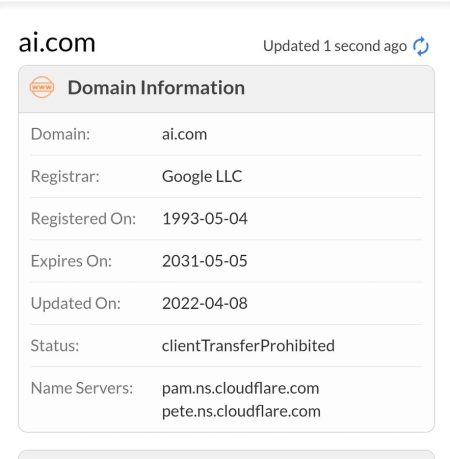

| Key Point | Detail |

|---|---|

| Analyst | Eric Balchunas, senior ETF analyst at Bloomberg |

| Company | 21Shares |

| ETF Launch | 21Shares is applying to launch the Ondo ETF |

| Source | Odaily Planet Daily News via X platform |

Summary

The Ondo ETF is an exciting new financial product as revealed by Bloomberg’s analyst Eric Balchunas. With 21Shares taking the initiative to launch it, the Ondo ETF could potentially reshape how investors approach exchange-traded funds. This development signifies growing interest in innovative investment options within the ETF market.

Understanding the Ondo ETF Launch

The Ondo ETF is a new offering set to be launched by 21Shares, a prominent player in the cryptocurrency investment space. As reported by Eric Balchunas, who serves as a senior ETF analyst at Bloomberg, this initiative marks a significant trend in the evolving landscape of exchange-traded funds. Aimed at diversifying investment portfolios, the Ondo ETF is expected to attract both seasoned and beginner investors looking to venture into the cryptocurrency market.

21Shares has been at the forefront of introducing innovative financial products, and the Ondo ETF is no exception. By leveraging blockchain technology and offering crypto-based exposure in a regulated environment, the Ondo ETF promises to provide investors with a unique investment vehicle. This move reflects the growing acceptance of digital assets in mainstream finance, highlighting how traditional investment strategies are adapting to embrace the future of money.

Latest ETF News: Impact on Investment Strategies

The news surrounding the Ondo ETF launch is poised to shake up the investment strategies of many institutional and retail investors alike. As the ETF landscape continues to evolve, staying updated with ETF news, including analyses from experts like Eric Balchunas, is essential. Investors not only need to consider the performance of traditional assets but also the emerging opportunities presented by cryptocurrency-based ETFs.

Platforms like Bloomberg actively provide in-depth analysis of new ETF launches, ensuring investors have access to pertinent information that could influence their trading decisions. The introduction of the Ondo ETF by 21Shares could serve as a catalyst, paving the way for a broader adoption of cryptocurrency investments within conventional portfolio management practices.

The Role of Eric Balchunas in ETF Analysis

Eric Balchunas, as a senior ETF analyst at Bloomberg, plays a crucial role in shaping investor perceptions regarding new financial products. His insights into the potential impacts of ETFs, such as the Ondo ETF, are invaluable for understanding market dynamics. By disseminating timely and accurate ETF news, Balchunas helps investors make informed decisions, crucial in an environment where cryptocurrency volatility is ever-present.

Furthermore, Balchunas’s analysis goes beyond just news reporting; it encompasses a comprehensive understanding of market trends and institutional behavior. His assessments can significantly influence how investors position themselves in the market, especially with new offerings like the Ondo ETF from 21Shares nearing launch.

Key Benefits of Investing in the Ondo ETF

Investing in the Ondo ETF presents a myriad of benefits, especially for those looking to diversify their portfolios with cryptocurrency assets. One of the primary advantages is the exposure it offers to a broad range of digital assets within a regulated framework, ensuring investor protection and compliance. Such guidelines are vital in fostering confidence among investors who may otherwise hesitate to dive into the crypto market due to ongoing regulatory uncertainties.

Moreover, the Ondo ETF, like other ETFs, provides liquidity and flexibility to investors. Unlike traditional assets that may require large initial capital outlay, ETFs allow investors to buy shares at market value. This aspect is particularly appealing as investors can gain exposure to a rising asset class without the complexities of managing individual cryptocurrency wallets or transactions.

Investment Trends: The Rise of Cryptocurrency ETFs

As investment trends shift towards digital assets, cryptocurrency ETFs, including the Ondo ETF, are gaining prominence among retail and institutional investors. Recent reports suggest that the adoption of these financial products is likely to accelerate, driven by increasing interest in alternative investments. This trend reflects a broader acceptance of cryptocurrencies, which were once considered speculative and risky.

Market analysts recognize the Ondo ETF as a benchmark for future cryptocurrency ETFs, setting the stage for continued innovation in the investment landscape. As investors become more educated about digital currencies and seek new avenues for growth, cryptocurrency ETFs could revolutionize standard investing practices, similar to how tech stocks transformed market dynamics in the past.

Bloomberg ETF Analysis: Insights and Predictions

Bloomberg ETF analysis provides critical insights that can guide investors through the complexities of emerging products such as the Ondo ETF. The platform employs sophisticated tools and expert opinions to evaluate the potential risks and rewards of investing in new ETFs. This rigorous analysis equips investors with the knowledge necessary to make sound financial decisions in a rapidly evolving marketplace.

Furthermore, by monitoring ongoing ETF news, Bloomberg analyses can predict investment trends and market movements. As the Ondo ETF prepares to launch, features highlighted in these analyses will enable investors to understand its implications for their portfolios and the crypto market at large. Such information is crucial for anyone considering adding cryptocurrencies to their investment strategy.

21Shares: A Leader in Cryptocurrency ETF Innovation

21Shares has established itself as a frontrunner in the innovation of cryptocurrency ETFs, emphasizing the importance of utilizing blockchain technology within traditional financial frameworks. By offering products such as the Ondo ETF, 21Shares not only democratizes access to digital assets but also enhances investor confidence through increased transparency and regulatory compliance. This approach is essential for growing the cryptocurrency investment ecosystem.

The strategic initiatives taken by 21Shares to launch the Ondo ETF indicate a growing recognition of the need for accessible investment options within the crypto sphere. This has significant implications for both individual and institutional investors who are looking to diversify their holdings and manage risk more effectively. 21Shares continues to push boundaries, paving the way for a new wave of ETF innovation that could define the next era of investing.

Navigating the Challenges of Cryptocurrency Investments

While the launch of the Ondo ETF signifies a major step forward for cryptocurrency investments, potential investors must remain aware of the inherent challenges associated with this asset class. These challenges include market volatility, regulatory changes, and the evolving nature of blockchain technology. Thoroughly understanding these factors is crucial for anyone looking to engage with the Ondo ETF and other similar products.

Additionally, investors are urged to stay updated with the latest investment news and expert analyses, like those provided by Eric Balchunas on platforms like Bloomberg. This knowledge aids in navigating the often treacherous waters of cryptocurrency investment while making informed decisions that align with their financial goals.

Future Outlook for the Ondo ETF and Cryptocurrency ETFs

The future outlook for the Ondo ETF and cryptocurrency ETFs in general appears optimistic, fueled by increasing institutional interest and a growing acceptance of digital currencies by the mainstream investment community. Analysts predict that as more investors become familiar with the advantages these investment vehicles offer, the demand for such products will surge. This could lead to further innovations in the space, with 21Shares at the forefront.

Moreover, as the regulatory environment for cryptocurrencies stabilizes and matures, ETFs like the Ondo ETF will likely find themselves in a favorable position, aligning with investor interests. Continued analysis of ETF performance and market trends will be essential in shaping the future of cryptocurrency investments, and platforms like Bloomberg will play a critical role in providing these insights to a wider audience.

Frequently Asked Questions

What is the Ondo ETF and its purpose in the market?

The Ondo ETF is a proposed exchange-traded fund designed to provide investors with exposure to innovative financial products. Recently highlighted by Bloomberg’s senior ETF analyst Eric Balchunas, the Ondo ETF aims to enhance investment opportunities by incorporating unique assets into its portfolio.

Who is behind the launch of the Ondo ETF?

The Ondo ETF is being launched by 21Shares, a prominent player in the cryptocurrency investment space. Eric Balchunas from Bloomberg has discussed how this ETF will cater to new investment trends, making it an exciting addition to the market.

What impact could the Ondo ETF have on the ETF news landscape?

The Ondo ETF could significantly influence the ETF news landscape by introducing new investment strategies and asset classes. Analysts like Eric Balchunas are closely monitoring its development, as it may attract a diverse range of investors looking for innovative products.

What insights does Eric Balchunas provide about the Ondo ETF?

Eric Balchunas, a leading analyst at Bloomberg, has shared insights about the Ondo ETF, emphasizing its potential to reshape the investment market. He highlights how this ETF could meet the increasing demand for unique and diversified investment options.

How does the Ondo ETF fit within the broader investment news context?

In the broader investment news context, the Ondo ETF represents a trend toward innovative financial vehicles that appeal to modern investors. As detailed by sources like Bloomberg, it signifies a shift in the ETF market, led by initiatives from firms like 21Shares.

What are the expected advantages of investing in the Ondo ETF?

Investing in the Ondo ETF is expected to offer advantages such as diversified exposure to unique assets, potential growth in emerging markets, and alignment with current investment trends as highlighted by analysts like Eric Balchunas in ETF news.

Where can I find more information about the Ondo ETF’s application process?

For in-depth information regarding the Ondo ETF’s application process, you may refer to financial news platforms, including Bloomberg’s analysis, where analysts like Eric Balchunas provide updates and insights on its progress in the ETF market.