ETH dormant addresses are making headlines as two long-inactive wallets recently emerged in the cryptocurrency market. On February 6, 2026, it was reported that these addresses, which had been dormant for up to two years, took advantage of a price dip by withdrawing significant amounts of Ethereum from Binance. Specifically, one address, 0x55C1, withdrew 10,000 ETH valued at approximately $19.24 million, while the other, 0x1342, pulled out 1,892 ETH worth about $3.75 million. These movements not only highlight the resurgence of dormant ETH wallets but also reflect broader trends in ETH market movements, sparking interest across cryptocurrency news channels. As the attention focuses on these withdrawals, traders and investors are keenly observing how such dormant addresses can influence future ETH price dynamics.

Recently, the awakening of inactive Ethereum wallets has captured the attention of the crypto community. These previously dormant Ethereum addresses have started making transactions, particularly following significant fluctuations in the ETH price. This phenomenon includes substantial withdrawals from major exchanges like Binance, indicating a potential shift in market sentiment. With these developments, analysts are now analyzing how such resurgent wallets could affect market stability and trading behaviors amongst Ethereum enthusiasts. As we delve into the implications of these recent activities, it becomes clear that dormant wallets can sometimes play a crucial role in the ever-evolving landscape of cryptocurrencies.

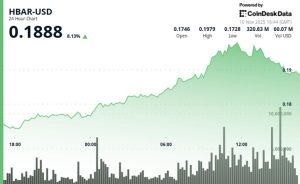

| Aspect | Details |

|---|---|

| Date of Report | February 6, 2026, 16:56 |

| Source | Odaily Planet Daily |

| Monitoring Tool | Lookonchain |

| Dormant Address 1 | Address 0x55C1 (Dormant for 2 years, withdrew 10,000 ETH worth $19.24 million) |

| Dormant Address 2 | Address 0x1342 (Dormant for 1 year, withdrew 1,892 ETH worth $3.75 million) |

Summary

ETH dormant addresses have recently come into focus as two significant transactions have been noted. On February 6, 2026, two long-dormant Ethereum addresses, one inactive for 2 years and another for a year, were found to have withdrawn large amounts of ETH from Binance. These developments indicate a potential shift in dormant address activity, impacting the overall market sentiment.

The Significance of ETH Dormant Addresses in Market Trends

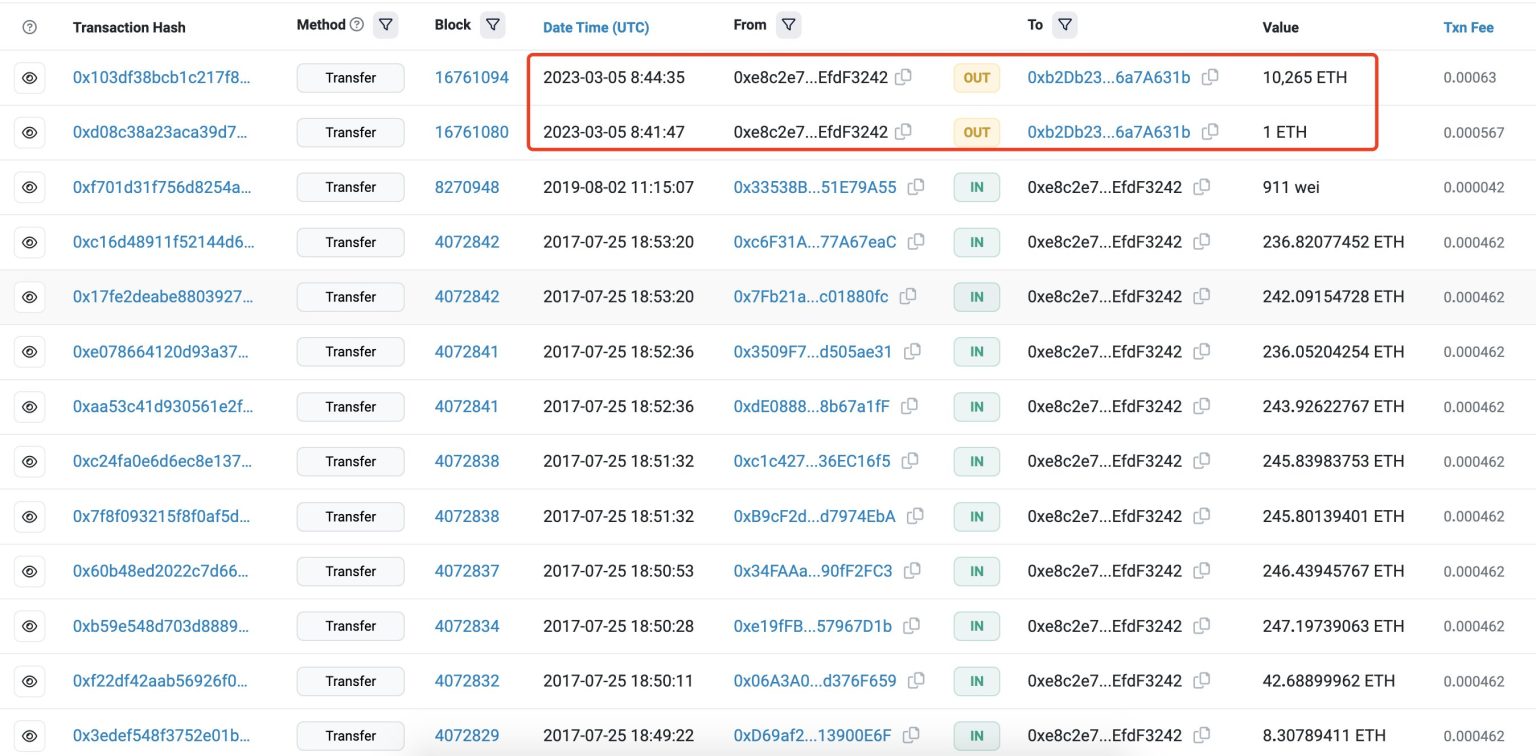

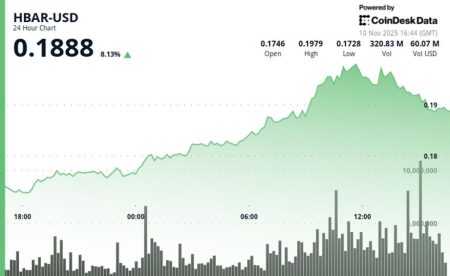

ETH dormant addresses often serve as crucial indicators of market activity and investor behavior. When previously dormant wallets spring into action, particularly during a price dip, it raises eyebrows among cryptocurrency analysts. In the case mentioned, two wallets that had lain inactive for over a year suddenly executed significant withdrawals from Binance during a reported ETH price dip. This movement can suggest that investors are re-evaluating their holdings and are potentially positioning themselves for upward price movements, thus reflecting a dynamic change in the market sentiment.

Monitoring dormant addresses has become an essential tool for investors looking to gauge potential shifts in the Ethereum ecosystem. The sudden activity from addresses that had been inactive for years can spark speculation about future ETH market movements. Analysts often critique such actions as signals that the sellers believe the market has hit a low point, thus opting to liquidate their assets. Therefore, tracking these dormant addresses becomes vital for anyone wanting to remain informed about the latest cryptocurrency news and trends.

Ethereum Wallet Activity and Market Movements

The activity within Ethereum wallets can significantly impact the perceived health of the ETH market. For instance, the reported withdrawals from previously dormant wallets indicate a possible shift in the behavior of large investors, often referred to as ‘whales.’ These whales can move substantial amounts of ETH without direct influence on public sentiment, yet their actions can trigger major waves of buy or sell activity. The recent withdrawals from Binance add to the ongoing conversation about how specific actions during ETH price dips can impact overall confidence in the crypto market.

Market movements are often mirrored by wallet activities, with considerable implications for future trends. If more dormant addresses begin to withdraw ETH during price dips as witnessed with addresses 0x55C1 and 0x1342, it may suggest a wider trend of investors beginning to trust the market again. Therefore, tracking such behaviors not only helps in understanding immediate effects on ETH price but can also offer predictive insights into the future of the Ethereum blockchain and investment strategies.

Binance and Its Role in ETH Withdrawals

Binance has been a cornerstone for numerous ETH transactions, with its significant role in withdrawals directly influencing Ethereum liquidity. In recent weeks, prominent withdrawals from dormant addresses, especially during notable price dips, indicate that large holders of ETH are using platforms like Binance to offload large amounts efficiently. The swift transactions from wallets that have not been active for years highlight the importance of the platform in facilitating capital movement, especially during crucial market moments.

Moreover, Binance’s liquidity may tempt dormant investors to engage as they see favorable market conditions with favorable rates for withdrawals. The two notable transactions, withdrawing significant ETH amounts from Binance, illustrate a broader strategy employed by investors looking to capitalize on the current ETH market sentiments. As more investors look to Binance for transactions, it underlines the platform’s reliance and connection to the movements we see within the cryptocurrency news cycle regarding Ethereum.

Current Trends in Cryptocurrency News Around ETH

The cryptocurrency landscape is ever-evolving, with ETH often taking center stage in the latest market reports and news. Recent activity surrounding dormant addresses is just one of many trends making headlines. With the news of substantial withdrawals tied to significant dollar amounts, it showcases the volatility and investor behavior intrinsic to Ethereum and its overall investment philosophy. Regular updates and news cycles provide investors with vital insights regarding not just ETH price fluctuations but also the behavioral trends of large stakeholders.

One of the key narratives in current cryptocurrency news is how macroeconomic influences can affect ETH dynamically. Global events, emerging regulations, and technological advancements within Ethereum itself can lead to shifts in market behavior. Staying informed is crucial for any investor, particularly with the possibility of price dips or spikes brought about by individual decisions from significant dormant addresses, thus reflecting both individual and collective investor sentiments in the ETH market.

Understanding ETH Price Dips and Buying Opportunities

Price dips in the Ethereum market present unique buying opportunities for savvy investors. With dormant addresses now becoming active during these dips, it poses questions about the future trajectory of ETH price. The recent withdrawals during such a market phase may indicate a strategic approach by significant holders who believe that the value of ETH can rebound sharply. As prices slip, market sentiment can lead to panic or prevention, but these dormant addresses adopting a bullish stance provide a counter-narrative that can inspire other investors to consider purchasing.

For potential buyers, assessing market movements alongside the activity of dormant wallets could offer valuable insight into whether a dip is a momentary setback or a precursor to a substantial uptick. Understanding the intricacies of ETH price adjustments—especially in relation to mass market psychology—can enhance any investor’s strategy. As we’ve seen with the previously dormant addresses, the collective actions of ETH holders can significantly influence the market.

Analyzing Ethereum Wallets in a Digital Age

In the digital age, the analysis of Ethereum wallets serves a crucial function for understanding investor behavior and market dynamics. With a vast number of wallets existing on the Ethereum network, an individual’s decision to withdraw or hold ETH can send ripples across market sentiments. The activity from long-dormant wallets, such as those withdrawing vast amounts of Ethereum recently, represents a pivotal shift that requires careful scrutiny. This activity can bolster confidence in Ethereum’s price stability or alert the market to potential fluctuations.

Additionally, examining wallet behaviors enables investors to assess broader trends within the Ethereum ecosystem. The technological backbone of Ethereum markets hinges significantly on investor confidence, thus frequently analyzed through wallet activity and trends. Encouragingly, the recent patterns observed during price dips could help pinpoint strategic buying and selling opportunities, with dormant addresses adding important context to these ongoing discussions in the crypto community.

The Resurgence of ETH: Historical Context and Future Potential

The resurgence of ETH, particularly in light of recent dormant address activities, underscores a historical context that is rich and complex. Ethereum has undergone various phases of growth, decline, and resurgence, which are mirrored in the behavior of its investors. Dormant addresses becoming active during significant market movements is not just anecdotal; it reflects a longer trend of investor behavior responding to market stimuli, suggesting that confidence in Ethereum may once again be on the upswing.

Future potential for ETH remains promising as investors begin to re-engage with their dormant assets. As Ethereum continues to evolve—through technological improvements and market adaptations—investors are likely to react proactively. Moves like those observed in the past week could mark the beginning of a broader trend where previously dormant investors start participating more actively, further stimulating the market. Accordingly, keeping an eye on these emerging trends can offer insight into the potential road ahead for Ethereum and its ecosystem.

Investment Strategies During ETH Price Fluctuations

Investment strategies during times of ETH price fluctuations can vary significantly, especially with the insights gleaned from dormant wallet activities. The recent withdrawals from long-inactive addresses indicate a confidence shift within a realm that is typically marked by volatility. Investors can take cues from such movements to adjust their strategies; for instance, seeing these withdrawals as bullish sentiment might encourage new capital investments during a price dip.

Furthermore, educating oneself on the impact of wallet activity plays a crucial role in refining investment strategies. When analyzing key events such as ETH price dips, strategies may need to pivot quickly, considering how larger players act in the market. Investors can benefit from adopting a long-term view while being mindful of immediate opportunities that arise from unusual wallet activities, enabling a balanced approach to hedge against potential losses.

Staying Ahead in the Ethereum Market: Key Takeaways

As we analyze the activities surrounding ETH dormant addresses, there are essential takeaways for those vested in Ethereum’s future. The recent actions serve as a critical reminder of the unpredictable yet fascinating dynamics within the cryptocurrency market. Understanding patterns and market sentiments driven by these movements can provide a significant edge for both sentimental traders and seasoned investors alike, especially during price dips.

To stay ahead in the Ethereum market, constant vigilance of not just price but also investor actions is paramount. Not only does monitoring will empower investors to respond thoughtfully to market trends, but it also aids in crafting strategies that can navigate through the volatile nature of cryptocurrency investments. The narrative surrounding dormant addresses and their impact on market movements reminds us that Ethereum’s ecosystem is lively, with opportunities around every corner.

Frequently Asked Questions

What are ETH dormant addresses and how do they affect the ETH price dip?

ETH dormant addresses refer to Ethereum wallets that have not been active for a significant period, often resulting in a sudden surge of ETH transactions during market movements, such as an ETH price dip. When previously dormant addresses begin transacting, it can lead to increased market activity, potentially influencing ETH price fluctuations.

Why are dormant addresses significant in the context of Ethereum wallets?

Dormant addresses are important in the context of Ethereum wallets because they can indicate investor sentiment. When a dormant address awakens, as seen during recent ETH price dips, it may suggest that investors see an opportunity to buy or sell, impacting overall market dynamics and potentially drawing attention from cryptocurrency news outlets.

How do ETH market movements correlate with dormant addresses?

ETH market movements can correlate with dormant addresses when long-inactive wallets suddenly reactivate during significant price events, like an ETH price dip. This activity can signal potential buying pressure or market confidence among holders, prompting others to monitor these addresses closely for insights into market trends.

What recent events highlight the activity of ETH dormant addresses?

Recent reports, like the one from Odaily Planet Daily, highlight the activity of ETH dormant addresses, such as Address 0x55C1, which withdrew 10,000 ETH after being dormant for 2 years during an ETH price dip. This indicates a notable re-engagement with the market, drawing interest from traders and cryptocurrency news platforms.

Is there any impact from Binance ETH withdrawal on dormant addresses?

Yes, Binance ETH withdrawal can have a significant impact on dormant addresses. For instance, when addresses like 0x1342, dormant for a year, suddenly withdraw ETH, it raises questions about market confidence and may influence broader ETH market movements, especially during price dips.