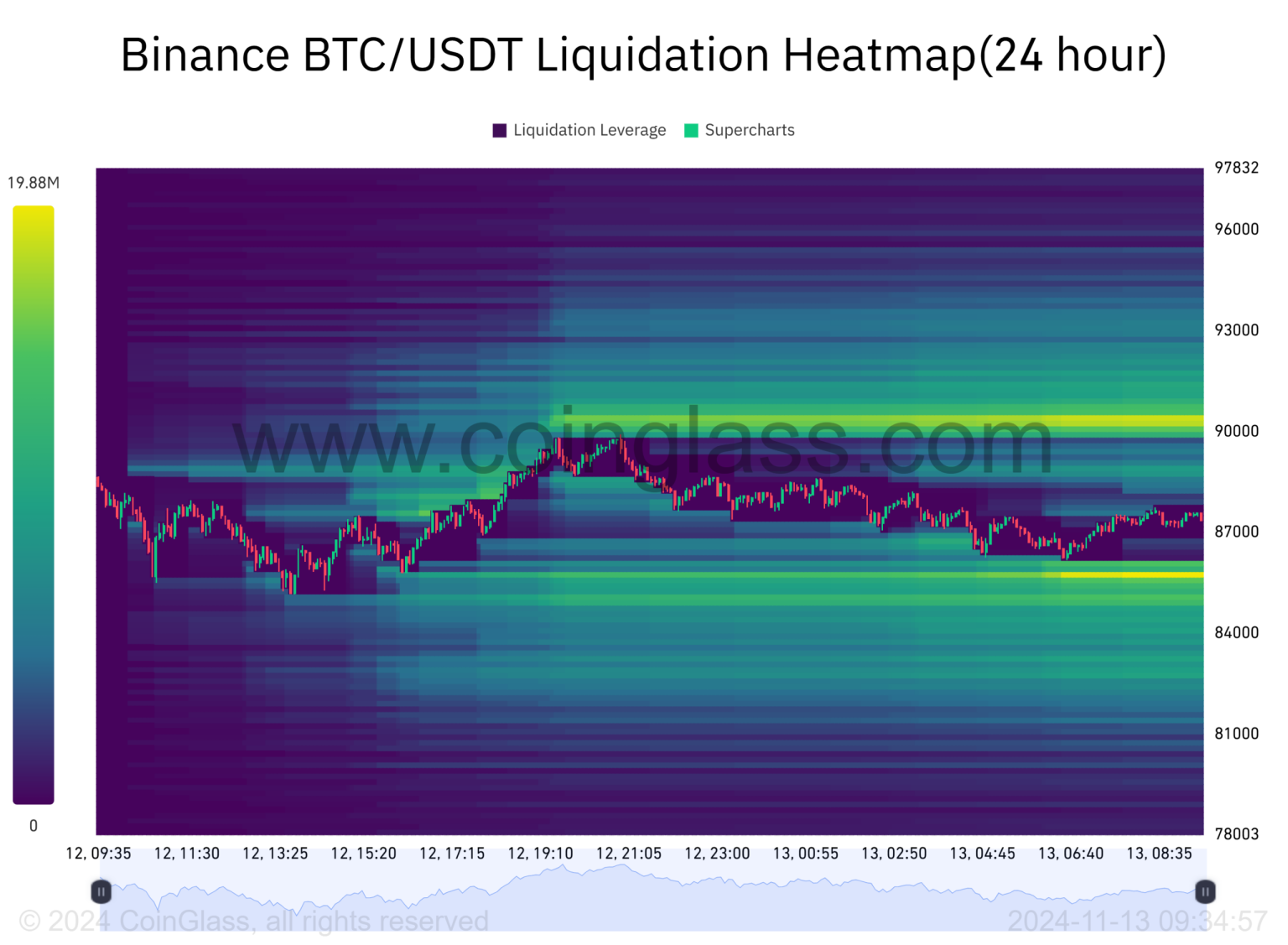

In a dramatic turn of events in the Bitcoin market analysis, BTC liquidations soared to an astonishing 79.85 million dollars within just four hours. This surge contributes to a staggering total of 167 million dollars in crypto liquidations across the network. Such high levels of liquidation raise questions about the current cryptocurrency trading trends and investor sentiment in the volatile digital asset space. Data from Coinglass highlights the significant impact of short positions, which accounted for 142 million dollars of the total liquidations. As traders react to fluctuations in prices, continuous updates, including insights on the Ethereum liquidation update, become vital for navigating this unpredictable market.

The recent turbulence in the cryptocurrency market has led to a wave of asset liquidations, particularly in Bitcoin. Many traders have faced significant challenges as their positions were unexpectedly liquidated in a cascading effect. With BTC liquidations making headlines, it’s essential to analyze how these dynamics impact the broader crypto landscape. Markets are responding rapidly to price movements, prompting a closer look at crypto liquidations and trading behaviors. Insights from platforms tracking liquidation data, like Coinglass, offer crucial perspectives on the ongoing shifts and trends in this ever-evolving sector.

| Category | Amount Liquidated ($) | Long Positions ($) | Short Positions ($) |

|---|---|---|---|

| Total Liquidations | 167,000,000 | 24,850,000 | 142,000,000 |

| BTC Liquidations | 79,850,000 | N/A | N/A |

| ETH Liquidations | 43,260,000 | N/A | N/A |

Summary

BTC liquidations surged significantly in the past four hours, highlighting the volatility in the crypto market. During this period, total liquidations across the entire network reached an alarming 167 million dollars, with short positions dominating the liquidations at 142 million dollars. The notable BTC liquidations of 79.85 million dollars contribute heavily to this overall figure, mirroring Ethereum’s liquidations of 43.26 million dollars. Such drastic figures depict the ongoing instability and risk associated with cryptocurrency trading, reminding traders of the need for careful risk management.

Understanding BTC Liquidations in the Current Market

The recent surge in BTC liquidations has garnered significant attention from analysts and traders alike. In the past four hours alone, liquidations involving Bitcoin reached a staggering 79.85 million dollars. This disproportionate share highlights the ongoing volatility in the cryptocurrency markets, where traders often grapple with rapid price fluctuations. As the market experiences such sharp movements, especially during critical trading hours, liquidations can serve as a reflection of broader trading trends. It’s essential for investors to monitor these figures closely as they can indicate potential future price movements in Bitcoin.

BTC liquidations are a critical metric that affects the overall health of the cryptocurrency ecosystem. A total liquidation of 167 million dollars showcases market apprehensions and potential shifts in trader sentiment. With an increased focus on crypto liquidations, particularly in BTC, many are keen on understanding how price volatility in Bitcoin influences other major currencies like Ethereum. By leveraging data sources such as Coinglass, traders can make informed decisions about their investments, adjusting their strategies according to real-time trends in the crypto market.

Crypto Liquidations: Analyzing Recent Trends

The recent data reflecting 167 million dollars in total liquidations signals a significant event for cryptocurrency traders. Among these liquidations, short positions dominated with 142 million dollars, which indicates that many traders were caught off guard by sudden market movements that went against their expectations. Understanding these liquidation trends is crucial for anyone involved in cryptocurrency trading, as it not only provides insights into trader behavior but also hints at the overall market sentiment. When such large volumes of liquidations occur, it can create a cascading effect on market prices, driving them either lower or causing abrupt recoveries.

Additionally, these crypto liquidations highlight the repercussions of leveraging strategies that traders might apply. Traders often utilize futures contracts and margin trading to amplify their positions, but this can backfire in volatile conditions. The recent figures give a clear view of how serious the impact can be, especially in moments like these when the market is unpredictable. Staying informed through platforms like Coinglass can help traders keep abreast of liquidations and adjust their trading strategies accordingly to mitigate risks effectively.

Ethereum Liquidation Update and Market Implications

Alongside Bitcoin, Ethereum’s performance remains under scrutiny with its recent liquidations totaling 43.26 million dollars. This figure, while lesser than BTC’s, still reflects a significant level of activity, suggesting that Ethereum is not immune to the same volatility affecting the broader crypto market. Understanding Ethereum liquidation trends is essential for investors who track key cryptocurrencies, as the interaction between Bitcoin and Ethereum often influences market movements in both directions. Elevated liquidation levels for Ethereum can lead traders to reconsider their positions, especially as they relate to BTC’s actions.

As Ethereum’s liquidation figures emerge alongside BTC data, it paints a portrait of the current trading landscape. Investors are increasingly looking at how fluctuations in one major cryptocurrency can affect the other. The interplay between Ethereum and Bitcoin is essential for comprehensive cryptocurrency market analysis. With Coinglass data providing crucial insights into these metrics, traders can develop strategies that account for potential correlations between BTC and ETH, ultimately informing their investment decisions during periods of volatility.

Cryptocurrency Trading Trends Amid Market Liquidations

In light of recent liquidations amounting to 167 million dollars, identifying prevailing cryptocurrency trading trends becomes pivotal. As traders respond to sudden market shifts, the likelihood of increased volatility tends to rise, resulting in a heightened risk for those in long or short positions. The trend toward liquidations often serves as a warning signal, indicating that many traders may have over-leveraged their positions, suggesting a broader pattern in behavior that can be predicted as more liquidations occur. Hence, understanding these patterns is vital for any trading strategy.

Furthermore, tracking trading trends can reveal insights into market psychology. For instance, the spike in BTC liquidations signals a potential overreaction from traders attempting to hedge against perceived risks. By analyzing trader sentiment through liquidation data, speculation can give way to more disciplined trading strategies. Awareness of these dynamics can be instrumental for traders aiming to make educated decisions while navigating the unpredictability of the crypto landscape.

The Role of Coinglass in Tracking Liquidations

Coinglass has emerged as a leading resource for monitoring cryptocurrency liquidations, providing traders with timely and relevant market data. By reporting on metrics such as the 167 million dollars in total liquidations over four hours, Coinglass serves as a barometer for market health and trader behavior. With its intuitive interface, users can easily access real-time liquidation statistics, including the detailed breakdown of positions by coin, helping traders formulate more informed strategies for their investments.

Utilizing Coinglass data not only enhances market transparency but also supports proactive trading. By regularly referencing this source, traders can better gauge when to enter or exit positions, seeing firsthand when major liquidations occur. This can be particularly advantageous during peak trading hours when market sentiment shifts rapidly. Overall, incorporating tools like Coinglass into trading practices can play a significant role in optimizing outcomes during periods of high volatility.

Evaluating Risks: Liquidation Triggers in Cryptocurrency

Understanding the risks associated with cryptocurrency trading is critical, especially as the market faces widespread liquidations. Triggers for such liquidations often stem from abrupt changes in market conditions, influenced by external factors such as regulatory news, market sentiment shifts, or large-scale trades. With recent figures showing substantial BTC and ETH liquidations, traders are reminded of the inherent risks involved with over-leveraging and the subsequent vulnerability to rapid price movements.

Evaluating these triggers also helps traders establish personal risk management strategies. Awareness of liquidation thresholds can aid in setting realistic stop-loss orders, reducing the potential for devastating losses. By analyzing historical data alongside current trends, traders can make calculated decisions, employing protective measures that align with their risk appetite and market outlook.

Decoding Market Behavior: What Liquidations Reveal

Market behavior is often best understood through the lens of liquidation data, as it reveals what traders are facing during turbulent times. The recent liquidations involving BTC and ETH highlight a strong sentiment shift among traders, with mass exits amplifying price trends either downward or upward, depending on the prevailing conditions. Analyzing how traders respond to market signals provides valuable insight into their thought processes, which can be crucial for predicting future movements.

By decoding the implications of liquidations, especially given the significant figures reported by Coinglass, traders can identify patterns that enhance their market strategies. Recognizing how sentiment shifts lead to liquidations allows savvy traders to anticipate potential market corrections or rebounds, fostering informed decision-making that can capitalize on emerging trends.

The Future of Crypto Trading in Light of Liquidation Events

The recent surge in liquidations serves as a critical juncture in the evolution of cryptocurrency trading, necessitating a deep analysis of future trends. With BTC and ETH leading the discussions surrounding liquidation events, traders must remain agile and adaptable to ever-shifting market conditions. It is likely that ongoing market volatility will trigger further liquidation events, requiring traders to develop robust risk management practices to safeguard their investments.

Looking ahead, the emergence of advanced trading tools and analytics platforms like Coinglass will continue to shape the landscape of crypto trading. Future events may not only spotlight liquidations but also foster a more educated trader base that can navigate these complexities with enhanced insight. As the cryptocurrency market matures, understanding the implications of liquidations will be key to both short-term trading success and long-term investment strategy.

Frequently Asked Questions

What are the latest statistics on BTC liquidations in the context of cryptocurrency trading trends?

In the past 4 hours, BTC liquidations amounted to 79.85 million dollars, contributing significantly to the total network liquidations of 167 million dollars, according to recent data from Coinglass.

How do BTC liquidations impact the Bitcoin market analysis?

BTC liquidations can lead to increased volatility in the Bitcoin market. Recent figures show that 79.85 million dollars in BTC liquidations occurred, which can influence market sentiment and trading behavior.

What does the recent update on crypto liquidations tell us about market conditions?

The latest update indicates a staggering total of 167 million dollars liquidated across the network, with BTC liquidations specifically at 79.85 million dollars, highlighting ongoing fluctuating market conditions.

What is the significance of the short positions in the recent BTC liquidations data?

Short positions accounted for 142 million dollars in liquidations out of the total 167 million dollars. This indicates bearish sentiment in the market, as traders bet against BTC’s price increase.

How do ETH liquidations compare to BTC liquidations in the most recent market data?

In the latest market analysis, BTC liquidations totaled 79.85 million dollars while ETH liquidations reached 43.26 million dollars, showing a stronger bearish trend in Bitcoin relatively.

Where can I find detailed insights on BTC and ETH liquidations?

For detailed insights, the Coinglass data provides comprehensive analytics on BTC and ETH liquidations, illustrating the impact of liquidation trends on overall cryptocurrency pricing.

What should traders watch for during high BTC liquidations periods?

During high BTC liquidations, traders should monitor market trends and volatility, as significant liquidations (like the recent 79.85 million dollars) can lead to sharp price movements and trading opportunities.

How do recent cryptocurrency trading trends reflect on BTC liquidations?

Recent cryptocurrency trading trends indicate a heightened level of liquidation activity, with BTC liquidations reflecting market participants’ reactions to price fluctuations and potential market corrections.