As the cryptocurrency landscape evolves, the significance of Bitcoin prediction becomes increasingly crucial for investors and enthusiasts alike. With Bitcoin’s price forecast indicating potential shifts, understanding the finer points of BTC market analysis can provide clarity in turbulent times. Recent fluctuations have led many to scrutinize current cryptocurrency trends, especially as the market navigates through a Bitcoin bear market. Identifying Bitcoin’s support levels is essential for gauging the asset’s resilience against further downturns. Therefore, in this article, we will explore the patterns and predictions that may shape Bitcoin’s journey in the coming months.

In the ever-changing world of digital currencies, the importance of forecasting Bitcoin’s future cannot be overstated. As traders and investors keenly observe BTC’s potential trajectories, insights into price trends and market behavior become valuable tools. This discussion delves into the implications of recent market movements, taking a closer look at how historical data informs our understanding of Bitcoin’s next steps. With the cryptocurrency ecosystem constantly shifting, recognizing key support levels, and adapting strategies to current market dynamics is essential for navigating the challenges that lie ahead. Prepare to discover the overarching patterns that define Bitcoin’s path as we analyze various scenarios for its impending performance.

| Key Point | Description |

|---|---|

| Bitcoin’s Market Cycle | Bitcoin often experiences cyclical movements characterized by distinct phases: peak, correction, and recovery. |

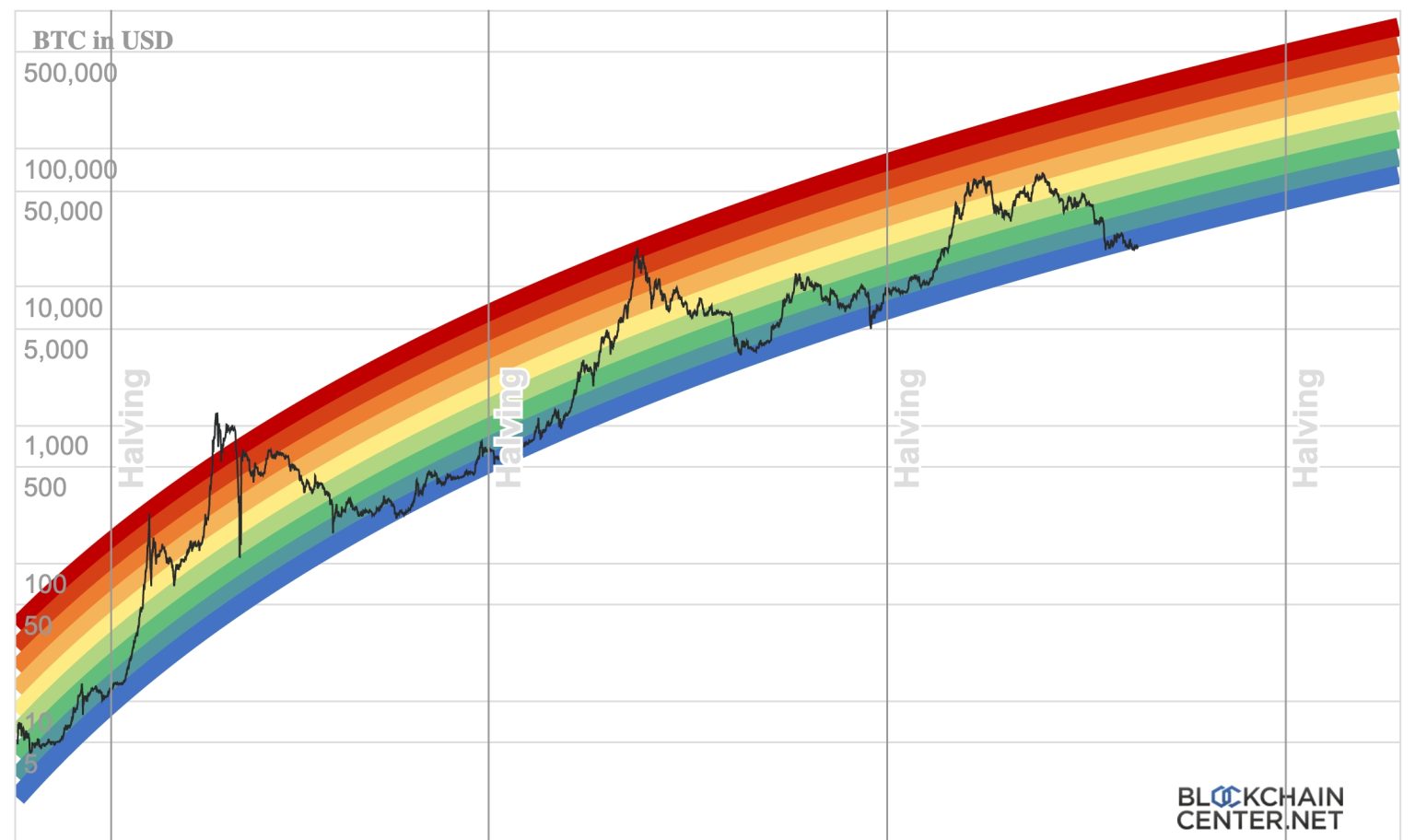

| Historical Analysis | Analysis of past cycles shows significant price drops after reaching all-time highs – an average first-leg decline of approximately 50%. |

| Current Market Situation | Bitcoin has currently dropped around 51% from its recent peak of $126k as it enters a bear market. |

| Price Levels to Watch | Key price points include $85k as a correction indicator, $49k as critical support, and sub-$40k levels indicating deeper declines. |

| Predictions | Potential price scenarios range from a soft landing around $56k to $60k, a base target of $49k, and a deeper cut between $36k to $42k. |

Summary

Bitcoin prediction is an essential topic as we navigate through the current fluctuations in the cryptocurrency market. The repeated patterns observed in Bitcoin’s historical cycles indicate that while the current downturn may seem severe, it is part of a familiar pattern of recovery following significant dips. Observing key price levels of $49k and $73k will be crucial for evaluating market sentiment and potential rebounds. Therefore, while uncertainty remains, the predictions based on historical trends are hopeful for a turnaround, particularly if Bitcoin can stabilize and regain lost momentum.

Analyzing Current Bitcoin Market Trends

As Bitcoin continues to fluctuate around significant price points, understanding the current market trends is crucial for potential investors and crypto enthusiasts. Bitcoin, often viewed through the lens of its price forecast, has recently shown signs of both volatility and potential stabilization. Factors such as institutional interest, regulatory developments, and macroeconomic influences shape the cryptocurrency trends influencing BTC prices. This current phase mirrors previous market behavior, where the price experiences parabolic rises followed by substantial corrections, making it essential to monitor these movements closely.

Additionally, historical analysis of BTC market fluctuations can provide meaningful insights into where Bitcoin might head next. Examining past cycles of Bitcoin price drops helps pattern recognition and forecasting future movements. The dynamics of recent dips, observed during the transitional phases in the 2021-2022 bear market, clearly indicate how market sentiment can shift dramatically based on external pressures and internal dynamics. Investors are urged to familiarize themselves with these downturns, as they often reveal critical support levels that indicate where a resurgence might occur.

Understanding Bitcoin Price Predictions

When embarking on Bitcoin price predictions, several analytical methods can assist in developing a reliable forecast. Understanding the underpinning support levels is vital, particularly as Bitcoin approaches significant thresholds, such as the anticipated $49k mark, which has been previously identified as a pivotal level in bear market scenarios. Historical data demonstrates that frequent contact with these support levels often influences trading behavior, thereby framing expectations for future price movement. Using tools such as technical analysis, alongside sentiment analysis from market participants, can refine these predictions even further.

Moreover, the sentiment surrounding Bitcoin price predictions often oscillates, influenced by market news, social media chatter, and expert commentary. These elements contribute to a collective mood that can either drive prices up or lead to further declines. As observers remain keenly aware of market conditions, understanding how to interpret signals surrounding BTC trends becomes essential for navigating the complexities of cryptocurrency investments.

The Impact of Bear Markets on Bitcoin

Bear markets can be particularly challenging for Bitcoin investors, especially given the asset’s historical volatility. The current bear market presents an opportunity for seasoned traders and newcomers to reevaluate their strategies amid the uncertainty. By analyzing Bitcoin’s performance during previous downturns, such as the significant declines noted in 2018 and 2022, investors can better prepare for similar trajectory patterns. Such analysis often reveals that bear markets can deepen before hitting significant lows, thereby emphasizing the importance of setting and monitoring support levels.

Despite the challenges presented by bear markets, they also provide opportunities for astute investors. Previous cycles demonstrate that downturns often lead to eventual price recoveries, making it crucial to identify potential buying zones. In the case of Bitcoin, levels around $49k could attract buyers who view the price as undervalued relative to long-term projections. Understanding the psychology of Bitcoin traders during bear markets remains integral to navigating these tough periods and potentially capitalizing on the lows.

Establishing Bitcoin Support Levels for Investment

Establishing robust support levels forms the backbone of successful Bitcoin investment strategies during bearish phases. Historical data indicates that significant price points often act as psychological barriers, influencing trader behavior and decision-making. Bitcoin’s established support near the $49k mark raises the question of how it has historically performed when approaching similar levels. Investors should closely observe market reactions at these critical thresholds to gauge sentiment and potential reversals.

Moreover, consistent monitoring of Bitcoin price action near established support levels can provide invaluable insights for timing market entries. Understanding how these levels function during price corrections empowers investors to make more informed decisions. Historical behavior shows that when Bitcoin approaches these pivotal points, an influx of buying interest can often emerge, pushing prices higher. Therefore, diligent study and real-time analysis remain critical tasks for those navigating the complex and often unpredictable Bitcoin market.

Future Scenarios: Bitcoin’s Path Ahead

Looking ahead, it’s essential to consider multiple scenarios regarding Bitcoin’s trajectory. While the current environment is marked by uncertainty, stakeholders must assess potential pathways based on prevailing market conditions and external factors. If Bitcoin manages to stabilize above recent support levels, we could witness a bullish trend emerge as institutions re-engage. Conversely, should Bitcoin drop further into the $36k to $42k range, a reevaluation of strategies would be necessary as investor sentiment deteriorates.

Scenario planning remains a powerful tool in the crypto realm, especially when attempting to navigate Bitcoin’s unpredictability. Traders could devise strategies based on these predicted scenarios, aligning their investments with broader market movements. Understanding that cryptocurrency trends can rapidly evolve necessitates a proactive mindset, where timely adjustments to forecasts and investments continuously occur.

Lessons from Historical Bitcoin Drawdowns

Historical drawdowns play a pivotal role in understanding the cyclical nature of Bitcoin. Observing previous downturns provides a lens through which investors can gauge potential future performance. The analysis shows a consistent pattern where Bitcoin experiences significant drops after hitting all-time highs, often exceeding 50%. Such insights draw attention to the psychological dynamics at play, as traders navigate their hopes and fears throughout the cycle.

Moreover, comprehending these historical drawdowns emphasizes the importance of resilience and preparedness among investors. Each cycle brings unique challenges yet also the opportunity for growth and learning. Historical perspective provides a context where informed decisions can be made, setting the stage for future investments. By embracing lessons from past cycles, traders can cultivate a mindset that values patience and strategic planning over reactive behaviors.

Key Indicators to Monitor for Bitcoin

Monitoring key indicators is paramount for evaluating Bitcoin’s market performance in real-time. Particularly during volatile periods, certain indicators can provide insights into potential price movements. Metrics such as trading volume, market sentiment, and changes in miner economics offer valuable contextual information that can heavily influence price predictions. When combined with levels of support and resistance, these signals can guide strategic decision-making.

In addition to technical analysis, staying informed about broader economic conditions is crucial. Factors such as inflation rates, regulatory changes, and technological advancements can substantially affect Bitcoin’s landscape. By remaining vigilant and adaptable, investors can better position themselves to respond to market shifts while recognizing opportunities and risks as they evolve.

Navigating Bitcoin’s Emotional Landscape

The emotional aspect of investing in Bitcoin cannot be overstated, particularly in an environment filled with uncertainty and volatility. Market sentiment often swings from extreme optimism to stark pessimism, reflecting investor behavior during bear and bull markets. Understanding how these emotions operate can enhance decision-making and retain a long-term view despite short-term fluctuations. In particular, recognizing moments of fear or greed can significantly impact reactions to market changes.

Furthermore, fostering a disciplined approach to investing in Bitcoin, especially during bear markets, can help manage emotional responses. A focus on evidence-based strategies and historical patterns provides clarity amid chaos. By mapping out potential scenarios and response strategies ahead of time, investors can navigate the emotional landscape more effectively, ensuring that their decisions align with rationale rather than panic.

Conclusion: Preparing for Bitcoin’s Future

In conclusion, preparing for Bitcoin’s logistical and emotional journey involves analyzing historical data and current market conditions. As the cryptocurrency landscape continues to evolve, investors must maintain an adaptable approach based on empirical studies and behavioral patterns. This foresight is particularly vital amid uncertain economic environments that can amplify the impact of Bitcoin’s price volatility.

Investors and traders alike are urged to leverage robust frameworks that accommodate changing conditions, ensuring sound strategies that withstand market fluctuations. By employing thorough research and remaining attentive to the psychological dynamics at play, stakeholders can navigate the complexities of Bitcoin trading more confidently, positioning themselves favorably for anticipated trends and potential price recoveries ahead.

Frequently Asked Questions

What is the latest Bitcoin price forecast and what factors influence it?

The current Bitcoin price forecast suggests potential target levels around $49k as a critical support point. Factors influencing this prediction include historical drawdown patterns, BTC market analysis, and the examination of previous cycles, which often showcase a familiar pattern of declines following significant peaks.

How does BTC market analysis help predict future price movements for Bitcoin?

BTC market analysis utilizes historical price patterns, current market sentiment, and support levels to provide insights into potential future price movements. By examining trends and behaviors from past cycles, analysts can identify possible outcomes and forecast scenarios, such as the commonly referenced $49k support level during a bear market.

What are cryptocurrency trends indicating about Bitcoin’s future performance?

Cryptocurrency trends highlight a cautious outlook for Bitcoin, especially as it approaches key support levels like $49k. Market dynamics suggest that while some indicators point to potential stabilization, there is still a risk of further declines, particularly if previous patterns of behavior repeat, as seen in past bear markets.

How should investors prepare for a potential Bitcoin bear market?

Investors should prepare for a potential Bitcoin bear market by identifying key support levels such as $49k, monitoring market signals, and staying informed on BTC market analysis. Understanding previous bear market behaviors can guide investment strategies and help in decision-making during price corrections.

Could Bitcoin’s price dip below $49k and what historical data supports this?

Yes, Bitcoin’s price could dip below $49k based on historical data, which shows that after a significant peak, Bitcoin often experiences severe drops. The patterns observed in previous cycles indicate that after a 50% drop, further declines can occur, potentially bringing prices down to the $36k to $42k range under certain market conditions.

What should be watched for when predicting Bitcoin price movements?

When predicting Bitcoin price movements, key indicators include market sentiment, BTC support levels, ETF flow behavior, mining efficiency, and overall cryptocurrency trends. These factors can signal market shifts and help determine whether Bitcoin is likely to experience a soft landing or a deeper cut.

Why is the $73k level significant in Bitcoin’s price prediction?

The $73k level is significant because it marks a psychological battle point for Bitcoin; it is where dip buyers are likely to enter, and it indicates whether the market is poised for recovery or further decline. If Bitcoin surpasses this level amidst improving market conditions, it could signal stronger bullish momentum.

What historical patterns can be observed in Bitcoin’s bear markets?

Historical patterns in Bitcoin’s bear markets reveal a tendency for significant declines following their peaks, often around 50% initially, followed by varying degrees of further drops. These repetitive behaviors provide invaluable insights for predicting potential price actions during current and future bear cycles.