Crypto liquidations have been a hot topic in the digital currency world as they represent the automatic closing of trading positions, often leading to substantial financial losses for investors. In the last hour alone, the total liquidations soared to over $45 million, with short positions taking the brunt of the hit. Notably, Bitcoin liquidations accounted for approximately $24.53 million, while Ethereum liquidations reached about $9.84 million, signaling shifting dynamics in the market. This ongoing trend in crypto market analysis showcases the volatility and risks inherent in trading, especially for those holding risky short positions. Understanding the nuances of these liquidations can help traders navigate the complex landscape of cryptocurrencies more adeptly.

In recent times, the phenomenon of forced closures in trading accounts has escalated, specifically referred to as liquidations in the cryptocurrency domain. With both Bitcoin and Ethereum experiencing significant market movements, traders are seeing their leveraged positions eliminated, resulting in massive amounts being wiped out. Recent data reveals that positions taken against the market, particularly those expecting declines, have faced harsh repercussions, leading to losses totaling millions. This situation serves as a stark reminder of the volatile nature of digital asset investments, where both upward and downward movements can trigger automated sell-offs. As experts delve deeper into crypto market behavior, understanding these liquidation events becomes increasingly essential for all traders.

| Category | Amount Liquidated (USD) | Details |

|---|---|---|

| Total Liquidations | 45,300,000 | Total amount liquidated across all positions in the last hour. |

| Short Positions | 38,790,000 | The majority of liquidations coming from short positions. |

| Long Positions | 6,510,000 | A smaller portion of liquidations affecting long positions. |

| Bitcoin Liquidations | 24,530,000 | Bitcoin experienced significant liquidation events. |

| Ethereum Liquidations | 9,840,000 | Ethereum’s liquidations contributed to the overall market liquidations. |

Summary

Crypto liquidations surged dramatically in the past hour, exceeding $45 million, predominantly impacting short positions. This recent spike can have significant implications for market volatility as traders align their positions based on liquidations. The majority of the liquidations came from short positions, highlighting a shift in market sentiment, while Bitcoin and Ethereum saw the highest amounts liquidated, indicating the volatility in these major cryptocurrencies. Monitoring these trends in crypto liquidations is essential for investors and traders alike.

Understanding Crypto Liquidations: A Detailed Look

Crypto liquidations represent a crucial phenomenon in the cryptocurrency market, where leveraged positions are forcibly closed due to insufficient collateral. In the last hour alone, over $45 million in liquidations occurred, primarily affecting traders with short positions. This sudden drop in market prices can trigger a cascade of liquidations, as margin calls push traders out of the market, leading to substantial losses. Understanding how these liquidations happen is essential for any trader looking to navigate the volatile crypto landscape.

The recent data highlights that approximately $38.79 million from short positions and $6.51 million from long positions were liquidated. This stark contrast indicates a market trend where bearish sentiment may have become overly inflated, leading to a large number of traders betting against the market. As Bitcoin and Ethereum liquidations make headlines, it becomes clear that market analysis and positioning play a pivotal role in the outcomes of these trades. Traders must remain vigilant, analyzing market conditions to avoid getting caught in the liquidation trap.

The Impact of Bitcoin and Ethereum Liquidations

Bitcoin and Ethereum are two of the most significant cryptocurrencies in the market, and their liquidations often act as indicators of broader market trends. In the last hour, Bitcoin liquidations reached a staggering $24.53 million, while Ethereum liquidations totaled $9.84 million. These figures are not just numbers; they reflect the sentiment and confidence of investors in these leading cryptocurrencies. When large-scale liquidations occur, it can lead to increased volatility, affecting the entire crypto market.

These liquidations also raise important questions about market behavior and the strategies employed by traders. For instance, when Bitcoin experiences a sharp decline, it often triggers panic selling, leading to more liquidations in both BTC and ETH. This is particularly relevant for those holding long positions, who may be forced out of trades due to margin calls. As the crypto market continues to evolve, investors must stay informed about liquidations, as they provide valuable insights into potential market movements and investor sentiment.

Analyzing Short and Long Positions in Crypto

Trading in cryptocurrencies often involves taking short or long positions, which can significantly influence market dynamics. Short positions are typically placed when traders anticipate a decline in a cryptocurrency’s price. The recent data shows that a considerable amount of liquidations stemmed from these short positions, suggesting that many market participants were betting against the prevailing trend. When prices do not move as expected, these short positions can be heavily liquidated, causing a market spike that could thwart bearish expectations.

On the other hand, long positions reflect the optimism of traders regarding an upward price movement. The $6.51 million in liquidations from long positions indicates that even bullish sentiment can be vulnerable during spike events. In the crypto market, it’s imperative to have robust risk management strategies in place to mitigate potential liquidation risks. Traders must continually analyze market trends and adjust their positions accordingly to protect their investments amid the frequent fluctuations characteristic of the crypto landscape.

The Role of Market Sentiment in Liquidations

Market sentiment plays an integral role in the occurrence of liquidations within the crypto space. The overall mood of traders can drive prices up or down, and when negative sentiment prevails, it often leads to liquidations. The recent incident where over $45 million was liquidated is indicative of a significant shift in market sentiment, particularly influencing those who held short positions. As traders reacted to changing price dynamics, those overly confident in their short positions faced rapid liquidation due to falling prices.

In the dynamic world of cryptocurrencies, sentiment analysis is an essential tool for predicting potential liquidations. Monitoring news, regulatory updates, and market trends can provide insights into how market sentiment may evolve. With Bitcoin and Ethereum often at the forefront of these discussions, keeping abreast of market analysis reports is crucial. Understanding how sentiment translates into trading actions can help prevent participation in liquidations and foster smarter trading strategies.

Defensive Trading Strategies to Avoid Liquidation

Given the volatility of the crypto market and the risk of liquidation, employing defensive trading strategies is vital for success. Traders can utilize stop-loss orders to automatically close positions at predetermined price levels, mitigating potential losses and reducing the likelihood of margin calls. This practice is especially relevant for those engaging in leveraged trading, as it sets a safety net to protect against wild price swings. By implementing such strategies, traders can maintain greater control over their investments, regardless of market conditions.

Furthermore, diversification across various assets, including Bitcoin and Ethereum, can help buffer against market downturns. By not putting all capital into a single trade or cryptocurrency, traders can reduce their overall risk exposure. When liquidations occur, it often affects one asset class more than others; hence a diversified portfolio can weather market fluctuations more effectively. Ultimately, adopting a cautious and calculated approach is paramount for traders to navigate through the unpredictable waters of the crypto market.

Learning from Liquidation Trends in the Crypto Market

To effectively engage in the cryptocurrency market, it’s critical to analyze past liquidation trends. Studying historical data on liquidations can shed light on how volatile events tend to unfold and provide insights into future market behavior. The recent liquidation event, where approximately $45 million vanished in a matter of hours, demonstrates how sudden market shifts can impact even the most rooted positions. Understanding these patterns guides traders in making informed decisions and prepares them for future market fluctuations.

Additionally, exploring the correlation between Bitcoin and Ethereum liquidations helps traders identify broader trends that may signal potential opportunities or threats. Often, the liquidation of one major asset can create a ripple effect across the market, impacting other cryptocurrencies. For example, when Bitcoin liquidates significantly, Ethereum may also experience a downturn due to shared market sentiments. By staying attuned to these relationships, traders can strategically position themselves to capitalize on market shifts or protect their investments from sudden downturns.

Technological Tools for Monitoring Crypto Liquidations

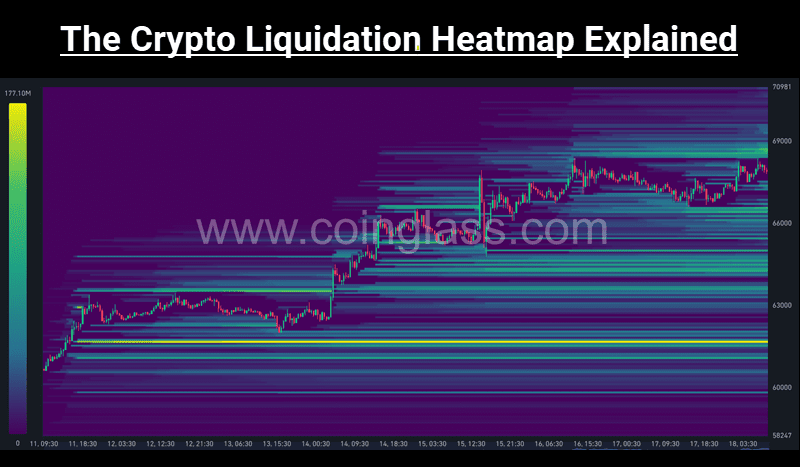

In the rapidly evolving world of cryptocurrencies, utilizing technological tools to monitor liquidations can be immensely beneficial. Advanced trading platforms and applications, like Coinglass, provide real-time data on liquidations across various platforms, allowing traders to gauge market sentiment quickly. Access to timely information on the extent of Bitcoin and Ethereum liquidations can help traders adjust their strategies proactively, ensuring they remain on the right side of market movements.

Furthermore, integrating technical analysis tools can enhance decision-making processes. By analyzing price charts, volume trends, and other technical indicators, traders can identify potential liquidation zones and adjust their trades accordingly. Understanding these technical elements against the backdrop of market news and sentiment can lead to more accurate predictions about future price movements and minimize the risk of unexpected liquidations. Harnessing technology effectively will play a key role in navigating the complex landscape of cryptocurrency trading.

Market Analysis: What Liquidations Reveal About Trading Behavior

Analyzing liquidations provides valuable insights into trading behavior and market strategies employed by participants in the cryptocurrency market. The recent $45 million liquidation event primarily affecting short positions suggests that many traders may have underestimated the market’s potential for recovery. As prices fluctuated, traders betting against the market faced rapid liquidations, indicating a collective misjudgment of the market trend. These patterns can serve as cautionary tales for future trading as the crypto arena remains volatile and unpredictable.

Moreover, liquidations can also reflect the overall health of the crypto market. High liquidation volumes may indicate panic selling or an overleveraged market, which can signify an impending downturn. Conversely, low liquidation rates during price fluctuations may suggest stability and investor confidence. By regularly engaging in market analysis, traders can learn to interpret liquidation data and adjust their trading strategies to mitigate risks effectively.

Preparing for Future Liquidation Events in Crypto Trading

Preparation is key in the unpredictable landscape of cryptocurrency trading, especially regarding liquidations. Understanding the factors that lead to high liquidation volumes can help traders anticipate potential market shifts. For instance, significant announcements around regulation or technology can often trigger rapid price movements, leading to liquidations. As such, staying informed about market developments is crucial for risk management and strategic trading.

Traders can also prepare by developing a robust risk management plan that includes setting clear entry and exit strategies. By outlining risk tolerance levels and potential liquidation points ahead of time, traders can navigate the market more effectively. As history has shown, volatility in cryptocurrencies like Bitcoin and Ethereum can lead to quick liquidation events that, if unprepared for, can result in substantial losses. By proactively planning for such events, traders can mitigate risks and improve their trading outcomes.

Frequently Asked Questions

What are crypto liquidations and how do they occur?

Crypto liquidations refer to the forced closure of trading positions when a trader’s collateral falls below a certain threshold, often due to a rapid price decline. This occurs primarily in the context of margin trading, where traders leverage assets to increase their position size. For example, if a trader holds a short position and the market price of the cryptocurrency increases, their collateral may be insufficient to cover the losses, leading to liquidation.

How do Bitcoin liquidations differ from Ethereum liquidations?

Bitcoin liquidations tend to dominate the market due to Bitcoin’s status as the leading cryptocurrency. For instance, recent data showed Bitcoin liquidations at $24.53 million, compared to Ethereum liquidations of $9.84 million. These differences can stem from varying market volatility, trading volumes, and investor sentiment towards each asset.

What impact do short positions have on crypto liquidations?

Short positions are particularly sensitive to price movements because traders bet against the market. In a volatile market, significant short positions can lead to high liquidation values. Recently, around $38.79 million of the total $45 million in liquidations affected short positions, highlighting the risks associated with short selling during market fluctuations.

What role does crypto market analysis play in understanding liquidations?

Crypto market analysis is crucial for predicting potential liquidations. By analyzing market trends, price movements, and trader behaviors, analysts can foresee impending liquidations, particularly for heavily leveraged positions. This allows traders to manage their risks better and avoid forced liquidations.

Can long positions also lead to liquidations in the crypto market?

Yes, long positions can also lead to liquidations, although they are often associated with bullish market conditions. When the market declines, long positions can become liquidated if a trader’s capital is insufficient to cover margin requirements. For example, in a recent report, long positions accounted for $6.51 million of the total liquidations.

What strategies can traders use to avoid crypto liquidations?

To avoid crypto liquidations, traders can use lower leverage, set stop-loss orders, and closely monitor their positions. Additionally, maintaining sufficient collateral and conducting thorough market analysis can help traders mitigate risks associated with price volatility and potential liquidations.