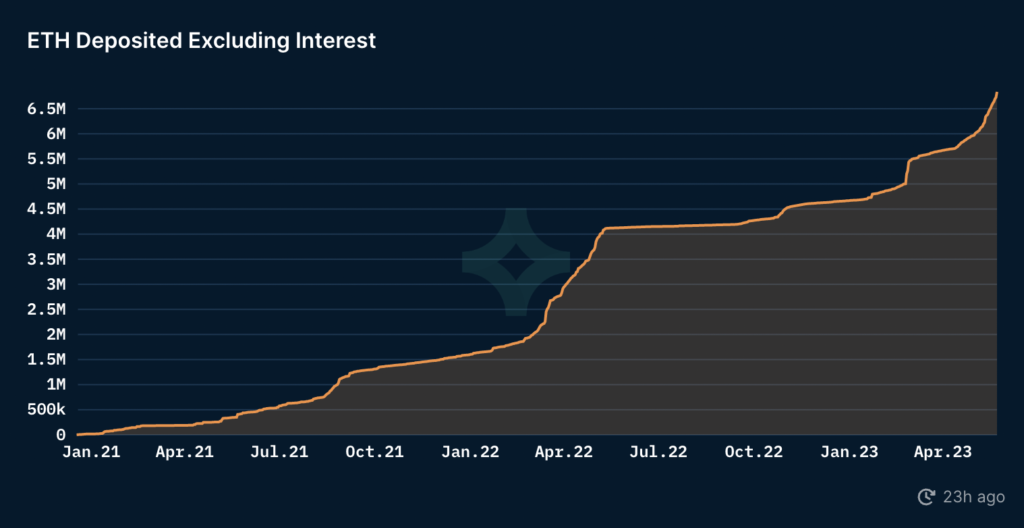

The recent ETH deposit made by Trend Research, guided by Yili Hua, has captured the attention of the crypto community. With an impressive 30,000 ETH added to Binance, valued at an astounding 58.18 million USD, this transaction highlights significant movements within the Ethereum ecosystem. As crypto investment gains momentum, understanding these changes through on-chain analysis becomes crucial for potential investors. The total amount of ETH on the blockchain has seen a decrease to 217,274 ETH, approximately 421 million USD, which raises questions about the broader implications for Ethereum news. Observing such shifts in Binance holdings can offer valuable insights into market trends and investor sentiment.

In the dynamic world of cryptocurrency, the latest activity involving Ethereum deposits has become a hot topic. The infusion of 30,000 ETH into the Binance platform, orchestrated by Trend Research under the leadership of Yili Hua, signifies a noteworthy transaction valued at 58.18 million USD. This development is not only pivotal for the holders but also serves as a crucial indicator within the landscape of digital asset investments. Monitoring such on-chain trends can provide vital information about market behaviour and potential shifts in strategy. With total Ethereum reserves now at 217,274 ETH, valued around 421 million USD, the implications for the crypto market are profound.

| Key Point | Details |

|---|---|

| Deposit Amount | 30,000 ETH (valued at 58.18 million USD) |

| Current On-Chain Holdings | 217,274 ETH (421 million USD) |

| Leverage Elimination Potential | Selling another 146,000 ETH can eliminate all leverage |

Summary

The recent ETH deposit activity highlights an important movement in the cryptocurrency market, particularly focusing on ETH deposits. Trend Research, led by Yili Hua, showcases significant investment actions with a substantial deposit of 30,000 ETH into Binance, which amplifies the current trading landscape. With the reduction of on-chain holdings to 217,274 ETH, it’s clear that strategic decisions are being made to manage leverage effectively. The potential to remove leverage completely by selling an additional 146,000 ETH indicates a cautious but proactive approach to market volatility. Overall, these developments around ETH deposits emphasize the dynamic nature of cryptocurrency investments.

Understanding the Recent ETH Deposit Movement

In a significant move that has captured the attention of the crypto investment community, Trend Research, led by Yili Hua, has deposited an additional 30,000 ETH into Binance. This transaction, valued at approximately 58.18 million USD, highlights the ongoing shifts in Ethereum holdings and the strategic maneuvers made by institutional investors. As Binance continues to be a preferred platform for Ethereum trading, this deposit indicates a growing confidence in the cryptocurrency market, despite the current fluctuations in price.

The nuances of on-chain analysis reveal the complexity behind such large deposits. With the total on-chain holdings of ETH now at 217,274, equivalent to 421 million USD, it’s clear that large players like Trend Research are making calculated decisions influenced by market conditions and potential profit opportunities. Understanding these dynamics can provide insights into future market trends and investor sentiment toward Ethereum and the broader crypto landscape.

Impact of Yili Hua’s Actions on Ethereum Market

Yili Hua’s decision to add 30,000 ETH to Binance is not only a reflection of his strategy but also an indicator of the broader market conditions affecting Ethereum. The increase in Binance holdings can affect liquidity and trading volumes, leading to more significant price movements. For crypto investors, recognizing the implications of such transactions is essential for making informed investment decisions in the Ethereum ecosystem.

Furthermore, as on-chain analysis continues to gain traction, the implications of these actions can be further studied to forecast future trends in Ethereum. With the possibility of eliminating leverage by selling another 146,000 ETH, the market dynamics could shift rapidly, impacting both retail and institutional investors. Consequently, understanding the influence of large deposits and withdrawals on market sentiment and price is crucial for anyone involved in Ethereum trading.

The Role of Binance in Ethereum Trading

Binance has solidified its position as a leading exchange in the cryptocurrency space, particularly concerning Ethereum. With significant deposits such as the recent 30,000 ETH by Trend Research, the platform bolsters its reputation and provides users with increased trading capabilities. This trend further enhances Binance’s standing as a go-to platform for crypto investment, particularly for Ethereum enthusiasts looking to take advantage of market trends.

The implications of Binance’s growing Ethereum holdings go beyond mere numbers; it signifies a shift in trading behavior and investor confidence in the platform’s security and reliability. As traders and analysts monitor Binance’s ETH reserves, these fluctuations can offer insights into market behavior and anticipate potential price movements, making it essential for investors to track these developments closely.

On-Chain Analysis: Decoding Ethereum’s Trends

The recent ETH deposit by Yili Hua provides a perfect case study for on-chain analysis, which examines the flow of assets on the blockchain. By analyzing these transactions, investors can identify patterns that reveal larger trends within the Ethereum network. For instance, with the on-chain holdings now totaling 217,274 ETH, it is crucial to monitor how these holdings fluctuate and what it might mean for future price movements, particularly in a volatile market.

On-chain analysis not only sheds light on individual actions, such as the deposit from Trend Research but also informs broader market strategies. Investors who utilize these analytical tools can gain critical insights that others may overlook, helping them make educated decisions based on the behavioral patterns of large holders in the Ethereum ecosystem.

Market Implications of ETH Liquidity Changes

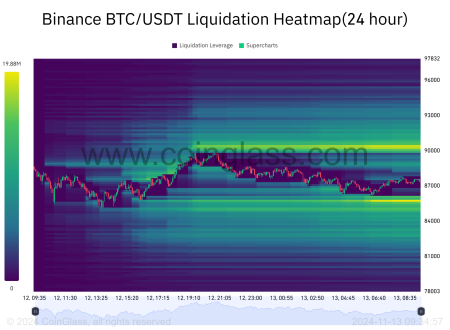

The recent changes in ETH liquidity—with the deposit of 30,000 ETH into Binance—pose several implications for the market. Increased liquidity generally enhances trading opportunities and can lead to a more stable price environment. However, with the potential liquidation of additional ETH holdings, the market may experience significant fluctuations that traders must prepare for.

It is vital for investors to stay informed about the liquidity situation in Ethereum, especially with large players deciding to move significant amounts off-chain or into exchanges like Binance. Such movements can trigger changes in price momentum and investor sentiment, influencing overall market health and individual trading strategies within the crypto landscape.

The Future of Ethereum Investments

The future of Ethereum continues to be bright, especially considering the increasing institutional interest showcased by figures like Yili Hua and Trend Research. Their strategic ETH deposit into Binance echoes the potential for Ethereum to thrive as a dominant player in the blockchain space. With ongoing updates and developments regarding Ethereum’s technology and scalability, such moves instill confidence that higher price points may follow.

Investors can leverage this growing confidence in Ethereum by employing sound research methods and strategies. As market dynamics evolve, staying attuned to both on-chain analysis and significant player activities can empower investors to navigate through the complexities of crypto investments successfully.

How Institutional Investors Shape Ethereum’s Market

Institutional investors have a significant impact on the Ethereum market, and the recent actions of Trend Research under Yili Hua are a testament to this influence. As these large entities continue to participate actively in Ethereum trading, their movements can set the tone for retail investors, leading to either increased volatility or stability within the market. Understanding this dynamic is crucial for all investors, regardless of experience level.

Moreover, as more entities follow in the footsteps of Trend Research, the investor landscape will change, leading to a redefined relationship between institutional and retail investors. This shift not only affects trading patterns but also emphasizes the importance of aligning investment strategies with these larger players in the Ethereum market.

Analyzing Trends with Ethereum News Updates

Staying updated with Ethereum news is paramount for investors keen on capitalizing on market opportunities. The recent news regarding Yili Hua’s ETH deposit into Binance has ripple effects on market sentiment and price speculation. Following such updates allows investors to contextualize their strategies concerning larger trends within the Ethereum ecosystem.

Additionally, consistent engagement with Ethereum news enables investors to stay ahead of potential market shifts triggered by institutional actions or significant events within the blockchain space. It also provides valuable insights into how the broader crypto landscape may be affected.

Navigating Cryptocurrency Investments Amidst Market Changes

As cryptocurrency markets, particularly Ethereum, face unprecedented changes, adapting investment approaches is crucial. The deposit of 30,000 ETH into Binance by Trend Research reflects a larger movement that investors need to analyze carefully. Establishing a robust investment strategy that accommodates for rapid changes in the market is paramount for success in this fluid environment.

Traders must remain vigilant and flexible in their approach, especially in times of volatility. Harnessing insights from on-chain analysis and developments from influential figures like Yili Hua can empower investors to make informed choices, mitigate risks, and capitalize on opportunities within the evolving crypto investment landscape.

Frequently Asked Questions

What is the significance of the recent ETH deposit by Trend Research under Yili Hua?

The recent ETH deposit of 30,000 into Binance by Trend Research, led by Yili Hua, highlights the growing interest in crypto investments, as it totaled 58.18 million USD. This action indicates a strategic move to enhance Binance holdings and invest in Ethereum’s potential.

How does the ETH deposit impact on-chain analysis for Ethereum?

The 30,000 ETH deposit into Binance provides valuable data for on-chain analysis. It suggests potential market movements and reflects current Ethereum holdings, which have decreased to 217,274 ETH, valued at 421 million USD. Such data helps investors gauge the market’s health and dynamics.

Why do crypto investors watch ETH deposits to exchanges like Binance?

Crypto investors closely monitor ETH deposits to exchanges because they can signal market sentiment. The recent deposit of 30,000 ETH by Trend Research indicates an influx of capital into Binance, which may influence the trading volume and pricing of Ethereum in the broader market.

How can the ETH deposit data inform future crypto investments?

The deposit of 30,000 ETH provides insights into the liquidity and activity of Ethereum. Investors can analyze such movements to identify market trends, potential buy-sell opportunities, and overall investment strategies related to Ethereum, making informed decisions in their crypto investments.

What does the decrease in on-chain ETH holdings suggest about the market?

The decline in on-chain ETH holdings to 217,274 ETH suggests a liquidity shift in the Ethereum market. It may indicate a trend where entities like Trend Research opt to deposit funds in exchanges, potentially for trading or liquidation purposes, impacting overall market stability and investor confidence.

How does Yili Hua’s ETH deposit strategy influence broader Ethereum news?

Yili Hua’s strategy, including the recent deposit of 30,000 ETH, plays a significant role in shaping Ethereum news. Such large-scale movements highlight trading strategies and institutional interest in Ethereum, affecting market perception and encouraging more significant investor engagement.

What are the implications of eliminating leverage by selling ETH?

Eliminating leverage by selling 146,000 ETH could stabilize the market and reduce volatility for Ethereum. This strategy would not only influence Binance holdings but also ensure a more secure investment environment for crypto investors, thus impacting overall ETH market dynamics.