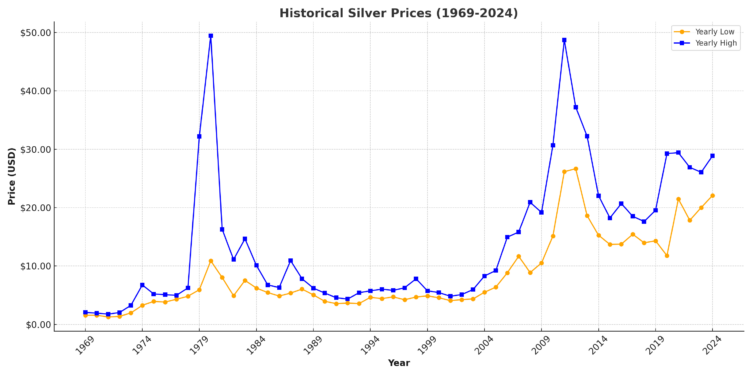

Silver prices volatility has been a focal point in the precious metals market, reflecting significant fluctuations that influence traders and investors alike. Recently, silver prices dipped below the critical $74 per ounce mark, culminating in a 4.7% drop in silver futures contracts. Analysts suggest that this volatility is a result of leveraged positions being liquidated following a period of intense speculative trading. Understandably, market participants are keenly observing current silver prices as they navigate through these tumultuous trends. For those invested in silver, keeping abreast of silver market analysis and price predictions is essential for making informed decisions within the dynamic landscape of precious metals.

The unpredictability of silver values has garnered considerable attention, particularly as it shapes investment strategies in the precious metals arena. Recently, the shifts in silver pricing have led to discussions on silver futures trends, with the market witnessing notable sell-offs and recoveries. Investors are turning their focus to potential price predictions while also seeking insights from the latest precious metals updates. Understanding these price movements is crucial for anyone involved in trading or investing in this market. As the silver landscape continues to evolve, both seasoned investors and newcomers must adapt to the inherent volatility that characterizes this asset.

| Key Points |

|---|

| Silver prices dipped below $74 per ounce, ending the week 5.7% lower due to liquidation of leveraged positions after speculative activity. |

| Analysts noted sentiment stabilized in early Asian trading, reversing some of the week’s losses. |

| Gold futures trading slightly lower at approx. $4,880, but ending the week about 3.6% higher. |

| The US dollar strengthened, aided by political factors affecting monetary policy expectations. |

| Oil prices dipped after a seven-week gain streak, impacted by changing geopolitical tensions. |

| The British Pound recovered slightly against the USD amid political tensions in the UK. |

Summary

Silver prices volatility has characterized recent market activities, particularly as prices experienced a notable dip to below $74 per ounce. This volatility has resulted from various factors including speculative trading activities and the liquidation of leveraged positions, leading to a 5.7% decline for the week. Traders are now watching sentiment shifts closely as adjustments occur following this turbulent period.

Understanding Current Silver Prices in the Volatile Market

Silver prices have recently experienced notable fluctuations, particularly as they approached the $70 mark. As of February 6, 2026, silver dipped below the $74 per ounce threshold, culminating in a significant 4.7% decrease in silver futures. This volatility in silver prices is rooted in a combination of market speculation and external economic factors, including currency fluctuations and the overall performance of precious metals such as gold. A focus on silver market analysis reveals that traders are closely monitoring changes, as these could indicate future trends and potential investment opportunities.

The dip in silver prices highlights the intense nature of market sentiment, especially following several days of heavy trading activity. Liquidation of leveraged positions contributed significantly to this downturn. However, early trading sessions in Asia saw some recovery, suggesting that traders are recalibrating their strategies in light of changing market fundamentals. Current silver prices reflect this ongoing volatility, as they are highly susceptible to both market speculation and global economic indicators.

The Impact of Silver Prices Volatility on Investment Strategies

Investors observing current silver prices must adapt their strategies to the inherent volatility present in the market. The recent selloff, described as severe, prompts a reevaluation of how investors approach silver futures trading. Acknowledging the volatility in silver prices can aid investors in forming more robust strategies that account for short-term fluctuations as opposed to solely focusing on long-term predictions. This requires agility in decision-making and a keen eye on external influences, including shifts in the broader economic landscape.

Understanding silver futures trends can also enhance investment acumen during these turbulent times. Key indicators in the market, such as changes in interest rates and movements in competitor markets (like gold), serve as critical information for investors aiming to navigate the silver market effectively. As analysts provide silver price predictions, they emphasize the necessity for investors to stay informed and proactive in managing their portfolios, particularly in a climate characterized by uncertainty and price fluctuations.

Silver Market Analysis: Key Factors Influencing Silver Prices

The silver market is influenced by a multitude of factors, ranging from geopolitical events to economic indicators. Recent declines in silver prices can be attributed to a broader selloff in precious metals, driven primarily by speculative trading and the liquidation of leveraged positions. In conjunction with insights from silver market analysis, it is evident that systemic global issues, such as inflation rates and central bank policies, can cause significant shifts in silver valuations. Traders often rely on these analyses to gauge market sentiment and make informed decisions about their investments.

A current silver price examination reveals that fluctuations in investment demand, particularly from industrial sectors and the jewelry market, also play a pivotal role in shaping price dynamics. As the current market forces evolve, the role of silver as a hedge against inflation and currency fluctuations becomes increasingly pronounced. Understanding these factors enables investors to better anticipate potential market movements and align their investment strategies accordingly.

Silver Price Prediction for Upcoming Quarters

Market analysts and economists engage in rigorous assessments to provide silver price predictions, factoring in current trends, economic conditions, and even trader behaviors. The recent dip below $74 per ounce might raise concerns, but analysts also point to recovery signals in early Asian trading. Such forecasts are crucial for investors looking to strategize for the upcoming quarters, particularly in the context of precious metals updates that reflect not only the silver market but also the broader economic environment.

As market dynamics shift, the outlook for silver pricing becomes more evident. Predictions often suggest that should economic conditions stabilize and demand for silver rise, particularly from industrial applications, we might see a rebound in prices. Additionally, shifts in monetary policy from central banks can further impact silver forecasts by influencing currency strength and investment sentiment. Consequently, keeping abreast of silver price predictions is vital for any stakeholder in the precious metals market.

Analyzing Silver Futures Trends for Strategic Investments

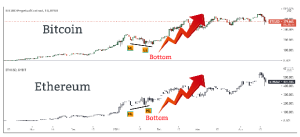

Silver futures trends provide critical insights for investors aiming to navigate this high-volatility environment. The fluctuations observed recently, including a sharp decline, reflect the collective reactions of traders to global economic factors and speculation. Understanding these trends allows investors to identify optimal entry and exit points within the market, enhancing their overall investment outcomes. Furthermore, historical price movements can serve as a guide for anticipating future shifts in silver futures.

Recent weeks have shown how quickly silver futures can respond to changes in market sentiment. The predominant selloff that led to a 4.7% decrease in silver futures signifies not just reactive measures by traders but also a profound understanding of underlying economic signals. As silver trends evolve, informed investors are encouraged to scrutinize these patterns continuously, in conjunction with broader commodity updates, to align their strategies with emerging market trends.

The Role of Economic Indicators in Silver Price Movements

Economic indicators significantly influence silver price movements and should be a focal point for investors. In particular, trends in inflation, currency stability, and interest rates are crucial to understanding the broader context in which silver prices operate. The influence of such indicators became evident recently as the dollar’s performance prompted shifts in silver trading activity. Investors must pay close attention to these economic signals to grasp potential changes in the silver market.

Furthermore, the interplay of gold and silver prices must also be considered, as they frequently move in correlation with one another due to their classification as precious metals. When gold prices rise, this often supports silver as an alternative investment. Therefore, it is essential for traders to monitor economic indicators closely, as shifts can have cascading effects on silver prices and ultimately impact investment decisions in the precious metals market.

Current Trends in the Precious Metals Market

The precious metals market is witnessing a dynamic landscape, with current trends indicating potential shifts in investment strategies. The recent dip in silver prices provides a stark reminder of the volatility that can characterize this market. In analyzing recent trends for silver and other precious metals, investors are encouraged to consider how interconnected these markets can be. For example, fluctuations in gold often precede movements in silver, making it crucial for investors to adopt a holistic approach when assessing market conditions.

Another key trend is the increasing interest in precious metals as a hedge against inflation and currency instability. As the economic landscape evolves, the demand for silver and gold as safe-haven assets is likely to increase, despite short-term price fluctuations. Therefore, a keen understanding of current trends in the precious metals market can empower investors to make more informed decisions, positioning themselves strategically within this volatile environment.

Strategic Insights for Navigating Silver Market Volatility

Navigating the volatility of the silver market requires strategic foresight and informed decision-making. As silver prices dip and rebound, investors must look beyond immediate price movements and focus on broader market conditions and potential long-term forecasts. Understanding the reasons behind silver’s recent performance—such as the impact of speculative trading and leveraged positions—will aid investors in developing more nuanced trading strategies. Tools like market analysis and robust data interpretation are vital in crafting these strategies.

Furthermore, tools like sentiment analysis can play a pivotal role in navigating uncertain market conditions. By gauging investor sentiment and understanding the psychological aspects of trading behavior, investors can make more informed decisions during turbulent times in the silver market. In conclusion, leveraging strategic insights while closely monitoring market developments will help investors not only weather volatility but also harness opportunities within the precious metals landscape.

Frequently Asked Questions

What factors contribute to silver prices volatility in the current silver market analysis?

Silver prices volatility is influenced by several factors, including speculative trading activities, leveraged positions being liquidated, and macroeconomic conditions like US monetary policy. Recent analysis indicates that intense market speculation has led to dramatic price changes, with traders reassessing silver fundamentals often contributing to these shifts.

How do silver futures trends impact current silver prices?

Silver futures trends greatly influence current silver prices as they reflect market sentiment and anticipated future movements. A selloff in silver futures, like the recent 4.7% drop, indicates traders’ reactions to broader economic signals and leads to immediate adjustments in spot prices.

What is the significance of precious metals updates on silver prices volatility?

Precious metals updates carry significant weight on silver prices volatility as they provide insights into market trends, global economic conditions, and investor sentiment. Keeping up with these updates enables traders to gauge potential price movements and adjust their strategies accordingly.

Can we expect further fluctuations in silver prices based on recent silver price predictions?

Yes, we can expect further fluctuations in silver prices based on recent silver price predictions, as analysts highlight the potential for ongoing volatility influenced by market conditions and geopolitical factors. Staying informed on expert predictions allows investors to better manage risk in the silver market.

How does the dollar’s performance impact silver prices volatility?

The dollar’s performance significantly impacts silver prices volatility, with a stronger dollar typically leading to lower silver prices as the metal is often inversely correlated with dollar strength. Recent trends show that as the dollar stabilizes, silver prices may see both downward pressures and retractions based on market sentiment.

What role do geopolitical tensions play in silver prices volatility in the current market?

Geopolitical tensions play a critical role in silver prices volatility, as uncertainty often leads investors to seek safe-haven assets like silver. Current tensions, such as those between the US and Iran, can drive up demand for silver, impacting its pricing dynamics.