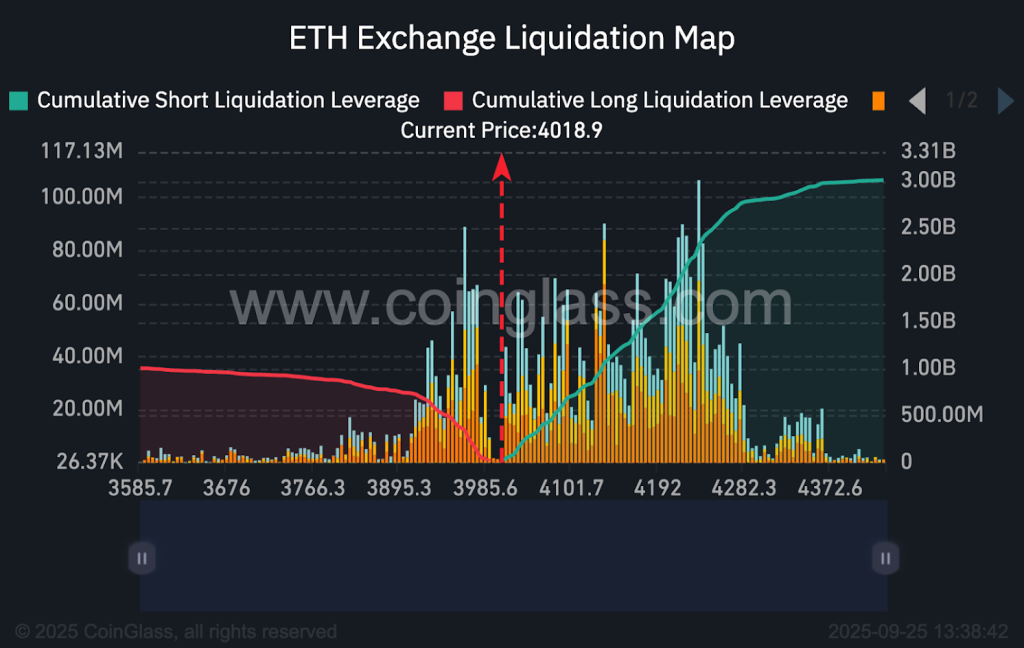

Ethereum liquidation is becoming a significant concern for many investors as the ETH price drop nears crucial liquidation levels. Recent trends show that the investment firm Trend Research has been strategically reducing its exposure to Ether, particularly as it falls below $1,700. This decrease comes amid overwhelming crypto market trends, where the value of ETH has plummeted nearly 30% in just a week. Such dramatic fluctuations highlight the volatile nature of cryptocurrencies, leading firms like Trend Research to execute asset liquidations to fulfill their loan obligations. As the situation develops, observers are closely monitoring these liquidation levels, which range between $1,698 and $1,562, ensuring they stay informed about the broader implications for the crypto landscape.

The topic of Ethereum liquidation, often described in terms of asset dispossession or forced selling, has garnered significant attention in recent weeks. In light of the recent downturn in crypto prices, especially for Ether, firms are increasingly finding themselves at a crossroads where they must make tough decisions to manage their investments. The ongoing ETH price decline raises critical questions about the sustainability of leveraged positions within the crypto market and the repercussions for larger entities like Trend Research. With many investors delving into the mechanics of borrowing against their holdings, such discussions are essential to understanding the landscape of cryptocurrency investments. As liquidations continue to shape market dynamics, the implications for both institutional and retail investors remain a key topic of analysis.

| Key Point | Details |

|---|---|

| Trend Research Reduces Ether Exposure | The firm decreased its Ether holdings as ETH approaches critical liquidation levels, which started when it dipped below $1,700. |

| Current Ether Holdings | As of Sunday, Trend Research held approximately 651,170 ETH, which dropped to about 247,080 ETH by Friday. |

| ETH Price Drop | ETH fell nearly 30% this month, reaching a low of $1,748. |

| Liquidation Levels | Trend Research faces liquidation levels ranging from $1,698 to $1,562. |

| Association | Trend Research is linked to Jack Yi, founder of Liquid Capital. |

| Recent Transfers | Trend Research transferred 411,075 ETH to Binance since the beginning of the month. |

Summary

Ethereum liquidation is becoming a pressing issue for investment firms like Trend Research, which is reducing its Ether holdings to navigate the critical liquidation thresholds as ETH prices plummet. The firm’s strategy to mitigate risks involves significant asset liquidation, driven by loan repayments and a sharply declining market. With the current ETH price hovering around challenging liquidation levels, observers are keen to see how these developments will impact the broader cryptocurrency landscape.

The Impact of ETH Price Drop on Liquidation Levels

The recent ETH price drop has significantly affected many market participants, particularly investment firms like Trend Research. As Ether dipped below $1,700, the urgency to manage liquidation levels became paramount for these investors. This decline of nearly 30% in just one week has raised alarm bells, especially as it approaches critical liquidation thresholds. Liquidation levels near $1,698 to $1,562 mean that if the price continues to slip, substantial assets may need to be sold off to avoid defaulting on loans. This scenario not only impacts firm liquidity but also the broader dynamics of the crypto market, leading to increased volatility.

Ethereum’s precarious position in the market serves as a reminder of how quickly conditions can shift within the crypto sector. The journey of Trend Research, for instance, shows how a strategy built on borrowing against ETH can quickly turn into a risk-laden endeavor when prices fall sharply. With the ETH price now on the brink of these liquidation levels, investors and stakeholders must keep a close watch, as future price movements could dictate the necessity for more complex rebalancing strategies to safeguard investments.

Trend Research’s Strategy Amid Crypto Market Trends

Trend Research’s recent decisions highlight a strategic recalibration in response to evolving crypto market trends. The firm reduced its Ether exposure extensively, realizing that continuing to hold into a declining market could compromise its fiscal health. The movement of over 411,000 ETH to the Binance exchange emphasizes a tactical shift, suggesting that the firm is repositioning its assets in anticipation of further market changes. This caution reflects broader sentiments in the cryptocurrency community, where many are skeptical and actively searching for safer investments in volatile conditions.

As trends in the crypto market shift unpredictably, firms like Trend Research must remain agile and responsive. By strategically liquidating Aave Ethereum assets at a critical price point, they attempt to mitigate losses and address borrowing demands. In light of recent market activity, this proactive approach not only aids immediate liquidity but also positions the firm better for potential future gains as market conditions stabilize. It’s essential for investment firms to analyze such trends continuously, as the cyclical nature of crypto can yield both risks and opportunities for those willing to adapt.

Ethereum Liquidation Risks for Investment Firms

The looming liquidation risks faced by investment firms engaged with Ethereum are particularly pronounced during sudden market downturns. Trend Research’s situation exemplifies the fragility of leveraging ETH as collateral to secure loans. With the price swing nearing critical liquidation levels, firms must navigate the delicate balance between leveraging potential returns and managing the peril of forced asset sales. When Ethereum values plummet, as seen in the recent price drop affecting Trend Research, the fallout can domino through the broader ecosystem, compelling other firms to follow suit and increasing overall market volatility.

In addition to Trend Research, other firms holding substantial Ether, such as Bitmine, are also under scrutiny. The interconnectedness of these firms means that liquidation events, such as Trend Research’s predicament, could set off a chain reaction across the sector. As investment firms grapple with the maximization of ETH exposure against these liquidation risks, it becomes imperative for them to devise robust risk mitigation strategies. This might include diversifying their asset portfolios or employing hedging techniques to buffer against swift price declines, safeguarding their investments against potential market catastrophes.

Navigating Ethereum and Aave: Investment Insights

Investing in Ethereum, particularly through mechanisms like Aave, offers opportunities for significant returns but also comes with heightened risks. The recent actions taken by Trend Research reflect both a sophisticated investment strategy and a reactive posture to prevailing market pressures. Utilizing borrowed stablecoins to acquire more ETH represents a calculated risk that relies heavily on favorable market conditions. However, the sharp price drops can trigger margin calls, putting substantial pressure on liquidity and forcing firms to liquidate holdings to maintain solvency.

What’s crucial for investors navigating these waters is a sound understanding of market dynamics and the potential implications of using DEFI platforms like Aave. As prices fluctuate, it’s essential to continuously monitor liquidation thresholds and adjust strategies accordingly. This situation presented by Trend Research highlights the importance of an adaptive investment approach in the ERC-20 asset market, ensuring that decisions are not only data-driven but also reflective of a rapidly changing crypto landscape.

The Role of Aave in Ethereum’s Ecosystem

Aave has emerged as a pivotal player within the Ethereum ecosystem, providing essential DeFi services that empower investors to leverage their ETH holdings. The platform enables users to borrow and lend cryptocurrencies seamlessly while earning interest on their deposits. This functionality has attracted a burgeoning user base, particularly amid rising ETH prices. However, as seen with Trend Research, the same mechanisms that present opportunities for profit can also bring about substantial risk during market downturns, highlighting the dual nature of such platforms.

For firms utilizing Aave, the need for prudent risk management strategies cannot be overstated. The platform’s ability to facilitate quick borrowing can be a double-edged sword, especially when Ether values enter precarious territory. The recent ETH price drop, which pushed Trend Research to liquidate parts of its holdings, serves as a critical reminder that even robust DeFi solutions like Aave require diligent oversight and a proactive investment approach to navigate potential downturns effectively.

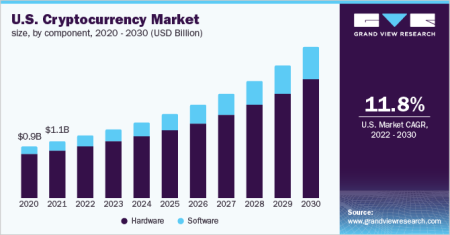

Understanding Crypto Market Trends: A Long-Term Perspective

As investors look beyond immediate market conditions, understanding the broader crypto market trends becomes essential for sustainable investment strategies. Long-term perspectives on Ethereum and its liquidity dynamics can provide insights into potential future developments, enabling firms like Trend Research to anticipate price movements and adjust accordingly. Given the market’s cyclical nature, being informed about historical trends and potential market rebounds is crucial for strategic planning.

Additionally, staying updated with external factors influencing the crypto market, such as regulatory changes and technological advancements, can aid investors in making more informed decisions. By adopting a long-term perspective, investors can better navigate periods of volatility and capitalize on recovery phases. Overall, a comprehensive understanding of crypto market trends not only prepares firms to handle adverse conditions but also positions them to seize opportunities emerging from market shifts.

Liquidation Events and Their Impact on ETH Holders

Liquidation events exert a significant influence on Ethereum holders, particularly during periods of market downturns. When the price of ETH approaches critical liquidation levels, it prompts many investors to assess their positions and make tough decisions regarding their assets. For firms like Trend Research, these moments can be particularly harrowing, as the forced sale of a large number of assets can negatively impact overall market sentiment and lead to additional sell-offs from other investors concerned about their holdings.

Moreover, such liquidation events can trigger a cascade of events that exacerbate market volatility. As more assets are liquidated, the supply flood can drive prices lower, impacting liquidity across the board. Conversely, these events can present opportunities for savvy investors looking to acquire ETH at lower prices during market capitulation. Overall, understanding the implications of liquidation events for ETH holders is essential for navigating the complex landscape of cryptocurrency investment.

The Future of Trend Research in a Fluctuating Market

As Trend Research confronts current challenges posed by the fluctuating Ethereum market, the pathway ahead will require resilience and strategic foresight. The firm’s recent actions, including liquidating significant ETH exposures, reflect attempts to stabilize its operations amid rapid price changes. Looking forward, addressing market volatility can involve diversifying investment strategies and enhancing risk management protocols to mitigate potential future setbacks.

The future of Trend Research will also depend on how effectively it adapts to technological advancements and regulatory developments within the cryptocurrency realm. By embracing a comprehensive approach that includes market analysis, stakeholder engagement, and proactive adjustment to trading strategies, Trend Research can not only navigate present challenges but emerge stronger, leveraging market trends to its advantage as it repositions itself within the evolving landscape of Ethereum investment.

Liquidation Risks: A Lesson for Crypto Investors

The current situation faced by Trend Research serves as a critical lesson for crypto investors regarding liquidation risks. Understanding the ramifications of collateralized loans, especially in the volatile atmosphere of cryptocurrency trading, is essential for all participants. Investing heavily into leveraged positions without preparation for price fluctuations can lead to detrimental outcomes, as evidenced by the forced liquidations seen in recent days for this firm.

Educating oneself on the dynamics of market trends, liquidation levels, and effective risk management strategies cannot be overstated in this context. Investors should always be prepared for the worst-case scenarios, keeping a close eye on key levels that could trigger liquidity events. This proactive mindset and preparation could spell the difference between safeguarding investments and incurring significant losses in a swiftly evolving market.

Frequently Asked Questions

What is Ethereum liquidation and how does it relate to ETH price drops?

Ethereum liquidation refers to the process where assets are sold off, typically due to a drop in the ETH price, to meet margin requirements or pay back loans. For instance, when Ethereum prices dip, like the recent drop below $1,700, firms like Trend Research may liquidate their Ether holdings to prevent further losses and fulfill debt obligations.

How do liquidation levels impact Ether holders amid falling ETH prices?

Liquidation levels are critical price points at which Ethereum holders must liquidate their assets to meet collateral requirements. For example, with Trend Research facing liquidation levels ranging between $1,698 and $1,562, a continued decline in ETH price can force the liquidation of their assets, affecting overall market stability.

What was Trend Research’s strategy in response to the recent crypto market trends?

In light of recent crypto market trends and the significant ETH price drop, Trend Research opted to reduce its Ether exposure. This was evidenced by the transfer of over 400,000 ETH to exchanges like Binance to mitigate risks associated with approaching liquidation levels.

Why is Aave Ethereum significant in the context of Ether liquidation?

Aave Ethereum plays a crucial role in Ethereum liquidation situations, as it allows users to leverage their Ether holdings as collateral to borrow stablecoins. This strategy can amplify gains but also increases the risk of liquidation if ETH prices fall sharply, as seen with Trend Research’s recent asset adjustments.

What lessons can be learned from the recent trend of Ethereum liquidation among investment firms?

Recent trends in Ethereum liquidation highlight the importance of robust risk management strategies in volatile markets. Firms like Trend Research exemplify how significant ETH price drops can trigger liquidation events, stressing the need for investors to monitor liquidation levels and market conditions closely.