Asset-backed security tokens are transforming the finance landscape by providing a way to tokenize real-world assets for investment and trading. As the market evolves, the China Securities Regulatory Commission (CSRC) has stepped in with strict regulations regarding the overseas issuance of these tokens tied to domestic assets. These guidelines aim to ensure security token compliance and protect investors by requiring domestic entities to file detailed reports with the CSRC before launching any offerings. The involvement of the CSRC underscores the increasing scrutiny on asset-backed security tokens, particularly regarding adherence to overseas issuance guidelines. By mandating a thorough review of the underlying asset information and issuance plans, the CSRC is paving the way for a more secure and transparent token economy.

Tokenized assets, often referred to as asset-backed security tokens or digital securities, represent physical or digital goods that can be traded on blockchain platforms. With the rise of these financial instruments, regulatory bodies like the China Securities Regulatory Commission (CSRC) are implementing measures to oversee and control their issuance, particularly concerning local investments expanded to overseas markets. This intersection of innovation and regulatory scrutiny addresses concerns about security token compliance and aims to safeguard investors against potential risks. By adhering to the new regulations, domestic entities are prompted to provide comprehensive details about their offerings, thereby enhancing transparency in the financial ecosystem. Such developments reflect a growing acceptance of securities in the digital age, where traditional asset management practices meet modern technology.

| Key Point | Details |

|---|---|

| CSRC Regulation | The CSRC has issued guidelines to regulate the issuance of asset-backed security tokens for domestic assets being offered overseas. |

| Filing Requirements | Domestic entities controlling underlying assets must file with the CSRC before proceeding with overseas offerings. |

| Submission Details | Relevant filings must include detailed information on the filing entity, underlying asset, and the issuance plan. |

| Accuracy of Information | Filing materials must be true, accurate, and complete with no misleading statements or omissions. |

Summary

Asset-backed security tokens are a significant area of regulation, particularly as the CSRC imposes strict guidelines on their overseas issuance for domestic assets. These regulations ensure that the underlying entities maintain transparency and accountability, fostering a secure investment environment. By enforcing strict filing requirements and accuracy standards, the CSRC aims to uphold the integrity of the asset-backed security token market.

Understanding CSRC Regulations on Asset-Backed Security Tokens

The China Securities Regulatory Commission (CSRC) has initiated comprehensive guidelines aimed at managing the overseas issuance of asset-backed security tokens that are associated with domestic assets. This regulatory approach underscores the importance of compliance and transparency in the burgeoning landscape of security token offerings. By mandating that domestic entities clarify their control over the underlying assets, the CSRC aims to maintain market integrity and protect investors from potential risks that could arise from misinformation or lack of disclosure.

These regulations necessitate that any business intending to issue asset-backed security tokens overseas must undergo a strict filing process. The required documents must detail various aspects, such as the identity of the filing entity, specifics about the underlying assets, and comprehensive descriptions of the token issuance. Such meticulous requirements showcase the CSRC’s commitment to ensuring that all parties involved in the issuance process adhere to regulatory standards, thereby fostering a secure investment environment.

Navigating Overseas Issuance Guidelines for Domestic Assets

Among the key aspects of the CSRC’s overseas issuance guidelines is the stringent requirement that entities establish their legitimacy and control over the domestic assets backing the security tokens. This process includes submitting a thorough filing report to the commission that encompasses all aspects related to asset ownership and the management team’s qualifications. This initiative is crucial in building investor confidence as it reinforces the notion that every asset-backed security token is grounded in a valid and verifiable underlying asset.

Moreover, the requirement for full transparency regarding the domestic entity’s structure—comprising shareholders, actual controllers, and management personnel—plays a pivotal role in diminishing fraudulent activities. By ensuring that the filing materials are not only accurate and complete but devoid of misleading statements or omissions, the CSRC aims to protect the integrity of the market. Entities must be prepared to undergo a rigorous compliance landscape to successfully navigate these overseas issuance guidelines.

The Importance of Security Token Compliance

Compliance with security token regulations set forth by the CSRC is paramount for any domestic entity looking to explore asset-backed token issuance. The emphasis on compliance ensures that the interests of investors are safeguarded and that there is a clear channel for accountability in the event of discrepancies. The CSRC’s stringent inspection of filing materials before approving overseas issuance initiatives encourages best practices among issuers, leading to enhanced market trust and credibility.

Achieving security token compliance also requires domestic entities to proactively engage with legal experts and regulatory advisors who specialize in CSRC regulations. This can help mitigate the risks associated with misunderstanding or misapplying the guidelines, which could lead to hefty fines or the revocation of issuance rights. Thus, having a robust compliance framework in place not only secures the entity’s operational capabilities but also fortifies its strategic position within the expanding market for asset-backed security tokens.

Implications of CSRC Guidelines for Investors

For investors, the implementation of CSRC guidelines regarding overseas issuance of asset-backed security tokens is a significant development. It brings forth a higher level of assurance as the regulatory framework establishes clear expectations for transparency and compliance. Investors can feel more secure knowing that any asset-backed security they are considering has undergone rigorous scrutiny, thereby reducing the likelihood of encountering fraudulent or misleading offerings.

Furthermore, these guidelines reinforce the notion of accountability among issuing entities. Should issues arise post-issuance, investors can identify responsible parties more effectively, owing to the detailed disclosures mandated by the CSRC. In essence, as these regulations evolve, they contribute to a more robust investment landscape where informed decision-making is supported by verifiable data and compliance, ultimately fostering a healthier market for all stakeholders.

Challenges Faced by Domestic Entities in Compliance

While the CSRC’s regulations aim to create a safe environment for asset-backed security tokens, they also pose challenges for domestic entities. The rigorous filing requirements and the obligation to maintain full transparency can be daunting, particularly for smaller businesses with limited resources. These entities may struggle to navigate the complex compliance landscape, which could deter their ability to issue tokens and access overseas markets.

Additionally, the costs associated with legal consultation, compliance audits, and the preparation of detailed documentation can be significant hurdles for many domestic firms. Balancing the need for compliance with the financial realities of conducting business in this regulatory framework can be a tightrope walk. Nevertheless, the long-term benefits of establishing a reputable business in line with CSRC regulations may outweigh the immediate challenges, encouraging firms to invest in compliance strategically.

Future Outlook for Asset-Backed Security Tokens

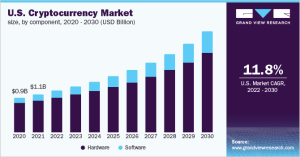

Looking forward, the landscape for asset-backed security tokens under the CSRC’s framework is poised for growth, as emerging technologies continue to change how assets are tokenized and offered to the market. With the global trend towards digital assets and decentralized finance, understanding the requirements set forth by the CSRC will be crucial for domestic entities looking to capitalize on these opportunities.

Moreover, as technological advancements simplify the processes of tokenization and asset verification, compliance with CSRC regulations may become more efficient. This evolution could lead to wider adoption of asset-backed security tokens, promoting greater liquidity and a diversified investment portfolio for individuals looking to enter the digital asset market. Thus, the future may well unveil innovative solutions that align regulatory compliance with cutting-edge technologies, helping to shape a vibrant ecosystem for asset-backed security tokens.

Impact of CSRC Regulations on the Financial Market

The introduction of the CSRC regulations on the overseas issuance of asset-backed security tokens marks a transformative moment in China’s financial market. These regulations are expected to not only enhance the safety and reliability of investment options but also attract foreign investments into China’s burgeoning digital asset sector. By establishing clear standards and protocols, the CSRC is signaling a commitment to fostering a structured environment that aligns with international best practices.

As the regulations take effect, many financial analysts predict an initial adjustment period during which domestic entities will adapt to the new compliance requirements. However, this evolution is likely to mature the market, setting a precedent for other jurisdictions considering similar frameworks. The long-term impact may lead to increased participation from both domestic and international investors, diversifying the assets available in the marketplace and reinforcing China’s position in the global financial ecosystem.

Importance of Transparency in Asset-Backed Security Tokens

Transparency is a cornerstone of the regulations instituted by the CSRC concerning asset-backed security tokens. A commitment to transparency ensures that all stakeholders, especially investors, have access to the pertinent information regarding the underlying assets. This is crucial in establishing trust, as transparent practices mitigate the risks associated with opaqueness in asset valuation and ownership.

Additionally, the emphasis on providing accurate information can also foster a culture of ethical business practices within the financial sector. By adhering to guidelines that demand clear disclosures and stringent compliance measures, domestic entities contribute to a more reliable environment for security token investments. This not only protects investors but also enhances the reputation of the industry as a whole, paving the way for deeper engagement with the global financial community.

The Role of Technology in Streamlining Compliance Processes

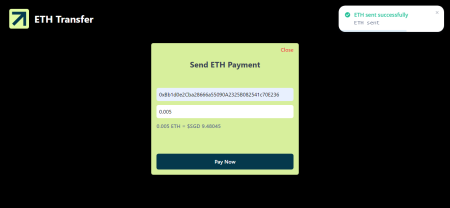

In the rapidly evolving landscape of asset-backed security tokens, technology plays a pivotal role in facilitating compliance with CSRC regulations. Automation and innovative digital solutions can help streamline the filing process, reducing the administrative burden on domestic entities. By leveraging blockchain technology, companies can enhance transparency while also simplifying the tracking and verification of asset information, which is essential for fulfilling regulatory obligations.

Furthermore, advanced analytics tools can offer insights into compliance performance, enabling firms to proactively address any potential shortcomings before they escalate into significant compliance issues. As technological solutions become more integrated into the financial landscape, they present opportunities for more agile and responsive regulatory practices, ultimately fostering a conducive environment for the growth of asset-backed security tokens.

Frequently Asked Questions

What are asset-backed security tokens and how do they relate to CSRC regulations?

Asset-backed security tokens are digital representations of assets that are backed by underlying physical or financial assets. Under the regulations set by the China Securities Regulatory Commission (CSRC), the issuance of these tokens that represent domestic assets must comply with strict guidelines. This includes registering with the CSRC and providing detailed documentation about the underlying assets and their management.

How does the CSRC regulate overseas issuance of asset-backed security tokens for domestic assets?

The CSRC regulates the overseas issuance of asset-backed security tokens for domestic assets by imposing filing requirements on domestic entities. These entities must submit a report detailing their control of the underlying assets, along with comprehensive issuance materials. This ensures compliance with CSRC’s guidelines to prevent misrepresentation or omissions.

What documents does a domestic entity need to provide to the CSRC for asset-backed security token issuance?

A domestic entity must provide a filing report and all necessary issuance materials when filing with the CSRC. This includes information about the entity controlling the underlying assets, the specifics of the assets, the security token issuance plan, and confirmations that all provided information is accurate and complete.

What are the implications of the CSRC regulations on security token compliance for domestic asset-backed security tokens?

The CSRC regulations impose rigorous standards for security token compliance, ensuring that domestic asset-backed security tokens meet legal requirements before issuance. Entities must prove the authenticity and accuracy of their filings, avoiding any false records or misleading information, which helps protect investors and maintains market integrity.

What should domestic entities do to ensure compliance with CSRC guidelines for asset-backed security tokens?

To ensure compliance with CSRC guidelines for asset-backed security tokens, domestic entities should meticulously prepare their filing materials, verify the accuracy of their information, and adhere to legal requirements regarding the underlying assets. Consulting legal experts in security token compliance can also significantly aid in the process.

Are there penalties for non-compliance with CSRC regulations on asset-backed security tokens?

Yes, failure to comply with CSRC regulations on asset-backed security tokens can result in severe penalties, including fines, suspension of issuance activities, and potential legal action against involved parties. It is crucial for entities to adhere to all guidelines to avoid repercussions.

What role does the China Securities Regulatory Commission play in overseeing asset-backed security tokens?

The China Securities Regulatory Commission (CSRC) plays a critical role in overseeing asset-backed security tokens by establishing regulatory frameworks that govern the issuance process, ensuring transparency, compliance, and protection for investors involved in the tokenization of domestic assets.

Why are CSRC regulations important for the market of asset-backed security tokens?

CSRC regulations are essential for the market of asset-backed security tokens as they establish a structured approach for issuance and compliance, enhancing investor confidence and safeguarding against fraudulent practices in the tokenization of domestic assets. This regulatory oversight promotes a more stable and trustworthy investment environment.