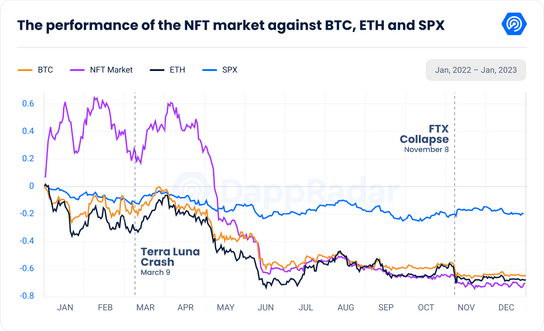

The recent decline in NFT market cap has sent shockwaves throughout the digital asset sector, dropping to approximately $1.5 billion and mirroring pre-2021 hype levels. This significant downturn is reflective of the broader cryptocurrency market trends, which have witnessed major assets like Bitcoin and Ethereum plummet in value. A noticeable decline in NFT sales, coupled with increased supply, has led to a tightening of supply and demand dynamics within the NFT ecosystem. As platform closures continue to rise, the implications for the future of non-fungible tokens become increasingly uncertain. Understanding these shifts is essential for investors and collectors alike as the NFT landscape evolves in the face of adversity.

The contraction of the non-fungible token sector indicates a pivotal moment for digital collectibles and their associated platforms. This downturn is characterized by a significant drop in market valuation, aligning with the recent fluctuations in cryptocurrency valuations. As the NFT community grapples with dwindling sales and increased inventory, the balance between what is available and what is sought after has shifted precariously. Additionally, the recent exits of prominent companies and the shutting down of various NFT marketplaces have further exacerbated the challenges facing this once-booming industry. As the digital art and asset market continues to transition, keeping an eye on these dynamics will be crucial for participants within the space.

| Key Point | Details |

|---|---|

| Current Market Cap | NFT market cap has fallen to nearly $1.5 billion, levels similar to 2021 before the hype. |

| Market Overview | This decline is part of a broader downturn in the cryptocurrency market, with major assets like Bitcoin and Ethereum experiencing significant price drops. |

| Supply and Demand Imbalance | NFT supply has increased, with circulation nearly 1.3 billion, while demand has fallen, causing average sale prices to drop below $100. |

| Corporate Exits | Prominent companies, including Nike and platforms like Nifty Gateway and Rodeo, have exited the NFT space, further pressuring the market. |

Summary

The NFT market cap decline has marked a significant shift in the industry, returning to pre-2021 levels of nearly $1.5 billion. This downturn is attributed to several factors, including a broader cryptocurrency market decline, an oversupply of NFTs accompanied by insufficient buyer demand, and notable corporate exits from the space. As the landscape evolves, the NFT sector faces challenges that may redefine its trajectory in the future.

The Impact of Declining NFT Market Cap on the Industry

The recent decline in NFT market cap back to $1.5 billion has significant implications for the entire industry. As one of the most pivotal periods in the history of digital assets, the current market levels resemble those before the 2021 hype cycle. This regression reflects a broader contraction in the cryptocurrency market, where essential currencies, such as Bitcoin (BTC) and Ethereum (ETH), have also experienced notable drops. The decline in market cap is not just a numerical setback; it fuels negative sentiment among buyers and investors, potentially stalling innovation and investment in the NFT sector.

Furthermore, the resurgence of interest in mainstream cryptocurrencies often overshadows the NFT market, leading to a decrease in buyer engagement. This scenario can trigger a vicious cycle where lower market cap deters potential creators from launching new projects or selling existing NFTs, ultimately generating less trading volume. The stagnant sales figures and depreciating asset values may also force emerging NFT platforms to rethink their strategies, as dwindling investor confidence has already led to platform closures. Without a significant rejuvenation in market interest, the future growth of the NFT market remains uncertain.

Analyzing NFT Market Trends Amidst Market Contraction

Understanding current NFT market trends is crucial for stakeholders navigating through this contraction phase. Recent data indicates that, while the NFT count is rapidly increasing, sales figures plummet simultaneously. This divergence between supply and demand is alarming; as prices drop below $100 on average, the disconnect suggests that while more NFTs are being produced, the buying enthusiasm among collectors is waning. Potential buyers often hesitate to engage when they perceive that the market is saturated and lacking in exclusivity.

Additionally, the broad downturn in cryptocurrency markets is further complicating the situation for NFT assets, which have historically leaned heavily on the performance of major cryptocurrencies like Bitcoin and Ethereum. As the NFT sector is directly influenced by the overall health of the cryptocurrency market, the declining trends in these foundational assets may hinder the upward movement of NFT transactions and values. Thus, it’s critical for NFT creators and platforms to adapt their strategies to meet changing market conditions and restore buyer confidence.

The Relationship Between NFT Supply and Demand

The current oversupply of NFTs compared to buyer demand raises critical questions about the sustainability of the marketplace. As reported, the NFT supply has surged to nearly 1.3 billion, marking a 25% increase from the previous year. This oversized supply, especially amid a sales decline of 37% year-over-year, indicates that NFTs are becoming easier to mint, leading to an environment where too many assets are chasing too few buyers. Such imbalances can create pricing pressure, pushing average sales to disappointing lows and deterring potential investors.

This oversupply scenario may detract from the uniqueness and desirability that initially attracted buyers to NFTs. To counteract this trend, established artists and platforms may need to collaborate on exclusive drops or limited series to reignite buyer interest. Furthermore, enhancing the utility of NFTs beyond mere collectibles through gaming or as tickets for exclusive events may help restore the balance between demand and supply in the long term. Innovation in utility and creativity could become the defining factors for a resilient NFT marketplace.

Corporate Exits and Their Effects on the NFT Ecosystem

The exit of major corporations from the NFT landscape signifies a concerning trend for the entire ecosystem. Recently, brands like Nike and established platforms including Nifty Gateway have publicly stepped back from their NFT initiatives, citing the harsh realities of a declining market. Nike’s quiet sell-off of RTFKT illustrates how high-profile players are reassessing their involvement amid unfavorable conditions, which can send signals of uncertainty to smaller investors and creators, causing further declines in market confidence.

Moreover, the shutdown of platforms like Nifty Gateway point to systemic issues affecting NFT market infrastructure. As these platforms wind down operations, the ever-multiplying NFT inventory is in jeopardy of becoming illiquid, further alienating current holders from potential buyers. Continuous corporate exits can instigate a loss of innovation and diverse offerings within the NFT market, thereby limiting opportunities for creators and contributing to a downward spiral where fewer players reinforce decreasing values.

The Future of NFT Sales and Market Sustainability

Looking ahead, the future of NFT sales heavily relies on how the industry addresses current market challenges. The existing sales decrease poses serious questions about the sustainability of existing pricing models and platforms. For the market to recover, there must be a concerted effort from platforms and creators to attract buyers back into the fold. Strategies could include deploying new technologies that enhance user experience or offering valuable utility linked to NFT ownership to revive interest and engagement.

Furthermore, bridging the gap between traditional art and digital assets could help bolster future NFT sales by attracting a more diverse audience. Artists and creators are now tasked with rethinking their approaches, focusing on quality over quantity to elevate the perceived value of their work. This approach, combined with community engagement and effective marketing strategies, could rejuvenate the market and foster a more sustainable ecosystem where both artists and collectors thrive.

Examining the Role of NFT Marketplaces in the Current Decline

NFT marketplaces serve as vital infrastructure within the NFT economy, and their role is even more critical in light of the current market decline. For platforms like OpenSea and Rarible, the challenge lies in adapting to shifting user demands while also navigating the turbulent waters of decreasing trading volumes. While some platforms are streamlining their services to retain loyal users, others, like Nifty Gateway, are opting to cease operations entirely due to prolonged low engagement.

As the market navigates through this rough patch, the functionality and support provided by marketplaces will significantly impact user perception and, subsequently, market recovery. The introduction of innovative features such as fractional ownership of NFTs, enhanced royalty options for creators, and improved secondary market activity may help revitalize interest in NFTs. As buyers look for improved experiences, NFT marketplaces must embrace change to remain relevant and capable of supporting a recovering market.

Trends in NFT Pricing and Valuation Decline

The ongoing decline in NFT pricing and valuation poses a challenging environment for collectors and creators alike. Average NFT sale prices have dropped below $100, indicating a significant market reset. This regression could permanently alter buyer perceptions of value and rarity, undermining the unique selling proposition of NFTs. The operational costs associated with creating and marketing NFTs remain high, leading to a squeeze where profits are increasingly difficult to achieve.

To navigate through these challenging pricing trends, NFT creators and platforms must rethink their strategies. Value may need to be redefined in cultural or entertainment contexts rather than purely financial ones, ensuring that NFTs resonate with buyers on multiple levels. By integrating elements of storytelling, brand experiences, or community engagement, creators can reinvigorate interest and justify the price points, potentially turning the declining valuation tide around.

Potential Responses to NFT Market Challenges

In response to declining market conditions, NFT creators and platforms have a unique opportunity to innovate their offerings. By exploring avenues such as utility-based NFTs or collaboration with traditional industries, they can increase the inherent value of their digital assets. Projects that merge NFT technology with gaming, events, or exclusive rights can present compelling reasons for buyers to engage, ultimately working to counterbalance current market challenges.

Moreover, fostering community involvement and feedback can lead to more responsive development paths that align closely with consumer interests. Educational efforts focused on NFTs can also enhance understanding and appreciation while encouraging participation from new buyers. By proactively demonstrating the benefits and potential of NFTs, the industry can work towards a more robust recovery and future growth.

Navigating the NFT Landscape Beyond the Current Crisis

Navigating through the current NFT landscape requires agility and resilience among all players. While the decline represents significant hurdles, it also presents an opportunity for stakeholders to recalibrate and innovate. Establishing stronger connections within communities and understanding buyer sentiment will be crucial for enabling recovery. Placing an emphasis on unique selling propositions, rather than numerical metrics alone, can forge a path toward renewed engagement and marketplace vitality.

As the NFT sector continues to evolve, ongoing education, transparency, and collaboration are essential strategies. Stakeholders must remain committed to adjusting their approaches in light of market changes, ensuring that the NFT ecosystem remains dynamic and capable of attracting diverse participation. This adaptability can ultimately position the NFT market for success as it emerges from its current downturn.

Frequently Asked Questions

What caused the NFT market cap decline to below $1.5 billion?

The NFT market cap decline to below $1.5 billion is primarily driven by a combination of factors, including a broader downturn in the cryptocurrency market, decreased NFT sales, and a growing imbalance between NFT supply and demand.

How does the cryptocurrency market affect NFT market cap declines?

The NFT market cap decline correlates with the overall cryptocurrency market downturn, where significant drops in leading cryptocurrencies like Bitcoin and Ethereum have led to decreased investor confidence, affecting NFT sales and market capitalization.

What impact has rising NFT supply had on the market cap decline?

Rising NFT supply has led to a market cap decline by creating an oversaturated market. Despite the increase in NFTs, the decrease in buyer demand has driven average sale prices down, pushing the market into a low-price environment.

Are NFT sales decreasing significantly contributing to the market cap decline?

Yes, the significant decrease in NFT sales, with a reported 37% year-over-year drop, is a key factor contributing to the NFT market cap decline, indicating a reduction in buyer engagement and overall market activity.

What role do NFT platform closures play in the market cap decline?

NFT platform closures, such as Nifty Gateway and Rodeo, contribute to the market cap decline by reducing available outlets for buyers and sellers, further diminishing trading volume and confidence in the NFT market.

Can we expect recovery in the NFT market cap after this decline?

While recovery is possible, it largely depends on a shift in consumer demand, innovations within the NFT space, and overall trends in the cryptocurrency market. A more balanced NFT supply and demand dynamic will also be crucial for a sustainable recovery.

How do NFT market trends impact the market cap and sales?

NFT market trends affect market cap and sales by influencing buyer behavior, with current trends reflecting inventory surpluses and declining prices, thereby complicating the recovery and growth of the NFT sector.

Is the NFT market cap decline temporary or indicative of a larger trend?

While the NFT market cap decline may seem temporary, it reflects larger trends in the cryptocurrency market and ongoing challenges like supply-demand imbalances, suggesting a more systemic issue that may persist without significant change.