The current Bitcoin bear market has raised eyebrows as the cryptocurrency has fallen below the crucial 200-week moving average, signaling a potential prolonged downturn. Bitcoin price analysis reveals that this decline, exacerbated by a turbulent U.S. labor market and rising unemployment claims, has led many investors to reevaluate their strategies. Amidst these developments, the cryptocurrency market trends indicate a notable retreat in investor confidence, driven largely by a recent sell-off in tech stocks. Consequently, Bitcoin decline news has dominated headlines as both novice and seasoned investors grapple with the implications of this bearish phase. For those considering investing in Bitcoin during a bear market, it is essential to stay informed about these dynamics and the market’s shifting landscape for better decision-making.

As Bitcoin enters a tumultuous period characterized by significant price drops, it becomes increasingly critical for investors to understand the implications of a prolonged downtrend in the cryptocurrency landscape. The recent descent below the vital 200-week moving average hints at deeper challenges ahead, prompting both analysts and traders to closely monitor evolving market conditions. This situation reflects a broader sentiment in the digital currency sphere, where potential investors may be grappling with uncertainties and adjusting their portfolios accordingly. Fundamental shifts in the economy, coupled with a volatile stock market, highlight the risks associated with trading cryptocurrencies during such bearish phases. Overall, staying attuned to Bitcoin’s performance and related market trends is essential for navigating this complex financial terrain effectively.

| Key Point | Details |

|---|---|

| Bitcoin Price Movement | Bitcoin has fallen below the 200-week moving average, indicating a potential deep bear market. |

| Market Conditions | Increased risk aversion is reflected by rising unemployment claims in the U.S., affecting investor confidence. |

| Impact on Safe Haven Status | Some investors are reevaluating Bitcoin’s safe haven status compared to gold amid a significant decline in U.S. tech stocks. |

| Investor Sentiment | Short-term market sentiment has weakened, but institutional investors are monitoring the effects of macroeconomic changes. |

Summary

The Bitcoin bear market appears to be intensifying as Bitcoin has fallen below the critical 200-week moving average. This decline is occurring in a context of increased risk aversion, largely influenced by poor performance signals from the U.S. labor market and a significant sell-off in tech stocks. Investors are questioning Bitcoin’s role as a safe haven in turbulent times, especially in comparison to traditional assets like gold. While the sentiment among retail investors has weakened, institutional and long-term investors are closely watching the impact of broader economic and liquidity trends on the future of cryptocurrency.

Understanding Bitcoin’s Decline Below the 200-Week Moving Average

The recent drop of Bitcoin below the crucial 200-week moving average has sent shockwaves through the cryptocurrency market. This significant indicator is closely watched by investors, as falling below it often signals a prolonged bear market phase. Analysis of Bitcoin price patterns shows that historical trends can provide insights into potential recovery periods and future price action. As of now, Bitcoin’s dip has raised concerns over its stability, compelling investors to reassess their positions and strategies.

Experts highlight that this decline comes amid a broader economic context marked by rising unemployment and investor hesitance, particularly within tech stocks that have felt downward pressure. The interrelationship between these market dynamics and Bitcoin’s performance is critical to understanding current trends. With market sentiment dwindling, many are left pondering whether Bitcoin can reclaim its standing as a reliable investment in turbulent financial waters.

Navigating the Bitcoin Bear Market: Investment Strategies

Investing in Bitcoin during a bear market requires strategic thinking and a solid understanding of market trends. While many may be inclined to panic sell, seasoned investors recognize that market downturns can also present unique opportunities. By analyzing historical Bitcoin price movements and comparing them to current conditions, investors may find potential entry points that align with their risk tolerance. Utilizing tools like the 200-week moving average can help determine whether the current prices offer a favorable investment opportunity.

Furthermore, seasoned analysts advocate for a diversified investment strategy during these uncertain times. Holding a mix of crypto assets alongside traditional investments can mitigate some risks associated with volatility in the cryptocurrency market. As one navigates through Bitcoin’s bear phases, it’s also essential to stay updated on economic indicators and global market trends, which significantly influence the performance of Bitcoin and other cryptocurrencies.

Impact of Economic Conditions on Bitcoin’s Performance

Economic conditions profoundly influence Bitcoin’s performance in the market. Recent data reflects a concerning increase in unemployment claims, prompting fears about the U.S. economy’s resilience. These macroeconomic factors can negatively affect risk assets, including Bitcoin, as investors often shift towards safer havens during periods of uncertainty. The correlation between economic indicators and Bitcoin price trends cannot be understated; a sluggish economy typically results in lower investor confidence, leading to declines in cryptocurrency valuations.

Additionally, analysts are increasingly aware of how government actions, particularly those by the Federal Reserve regarding interest rates, play a crucial role in shaping market sentiments. The prospect of aggressive monetary policy adjustments fosters a sense of urgency among investors to reassess their asset allocations. As conversations surrounding Bitcoin’s efficacy as a safe haven arise, it remains paramount for individuals to stay informed about both economic developments and broader trends within the cryptocurrency market.

Long-term Outlook for Bitcoin Amidst Market Bearishness

Despite current bearish trends, there remains a long-term optimism about Bitcoin’s potential. Institutional investors, who typically advance the market, are still keenly observing trends, signaling that confidence may return with stabilized economic conditions. While short-term volatility often garners headlines, the strategic long-term holding of Bitcoin during these declines can prove beneficial for those willing to endure the market’s ebb and flow and maintain sight of their long-term investment goals.

Moreover, Bitcoin’s historical performance during previous bear markets shows resilience as it has often rebounded to reach unprecedented highs following substantial declines. By understanding this cyclical nature of Bitcoin and maintaining informed perspectives based on thorough market analysis, investors can better position themselves for potential profits in the future.

Identifying Valuable Insights from Bitcoin Decline News

Keeping abreast of Bitcoin decline news is vital for making informed investment decisions. Observing how other market participants react to negative news can provide insights into market sentiment and future price movements. For instance, social media discussions and expert analyses can yield various perspectives, helping investors discern whether a dip represents a buying opportunity or a sign of deeper market troubles.

Moreover, utilizing sentiment analysis tools can offer additional layers of understanding regarding how broader market players interpret Bitcoin’s declining trajectory. By leveraging these tools alongside fundamental analysis of Bitcoin price movements and impacting macroeconomic factors, investors can improve their positioning in the vibrant yet volatile cryptocurrency landscape.

The Role of Technical Analysis in Bitcoin Trading

Technical analysis plays an essential role in understanding Bitcoin’s price movements, particularly during bearish trends. Traders often rely on various indicators, such as the 200-week moving average, to help determine potential entry and exit points while navigating the market. By correlating these technical signals with market sentiment, investors might gain valuable insights that assist in decision-making despite ongoing volatility.

Additionally, many traders seek to identify chart patterns that could suggest a trend reversal. During bear markets, notable patterns such as double bottoms or bullish divergences can signal potential recoveries. Thus, those well-versed in technical analysis can better position themselves to benefit in the long run, despite the inherent difficulties posed by market periods characterized by persistent declines.

The Multifaceted Nature of Cryptocurrency Market Trends

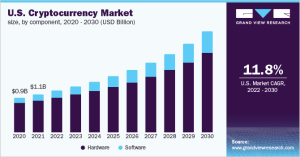

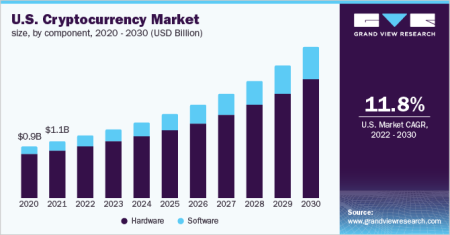

Cryptocurrency market trends are complex and influenced by several factors ranging from technological advancements to regulatory changes. Understanding the multifaceted nature of these trends is essential, particularly for Bitcoin, as it serves as a bellwether for the entire market. With shifts in international policies, institutional involvement, and emerging technologies impacting sentiment, investors must stay informed to navigate the optimistic and pessimistic scenarios inherent in this evolving landscape.

Moreover, observing correlations among different cryptocurrencies can yield valuable insights. For example, if alt-coins exhibit patterns moving in tandem with Bitcoin, it may indicate broader market dynamics at play. By diversifying one’s portfolio while keeping an eye on these interconnected trends, investors can enhance their ability to react adeptly to sudden shifts in sentiment, particularly during uncertain periods in the market.

Bitcoin and Its Comparison to Traditional Safe Havens

To understand Bitcoin’s role in the current economic climate, analyzing its position against traditional safe havens like gold becomes paramount. As investors grapple with Bitcoin’s recent performance and contemplate its effectiveness as a hedge against market volatility, comparisons to gold become increasingly relevant. This analysis also touches upon historical instances when Bitcoin acted as a store of value, positioning it in direct competition with gold during times of financial turmoil.

However, reactions to Bitcoin decline news can diverge from traditional perceptions of safe havens. Some analysts suggest that Bitcoin’s inherent volatility differentiates it significantly from gold, leaving some investors skeptical about its utility as a consistent hedge. As this discourse continues, critical reflections on Bitcoin’s advantages and disadvantages in times of economic uncertainty will shape long-term investor sentiment.

Societal Perspectives on Bitcoin During Economic Downturns

Societal perspectives on investing in Bitcoin amid economic downturns exhibit both optimism and skepticism, reflecting diverse viewpoints among investors. For many proponents of cryptocurrency, periods of decline can serve as introductions to the potential longevity and resilience of digital assets like Bitcoin. Community discussions in forums and social media highlight how Bitcoin investment can empower individuals to potentially achieve financial independence, particularly when conventional economic models become increasingly unstable.

Conversely, skeptics maintain reservations regarding Bitcoin’s ability to offer security during economic downturns, emphasizing its volatility. This dichotomy often results in fractious debates surrounding Bitcoin, with strict lines drawn between optimists and pessimists. As the cryptocurrency landscape evolves, navigating these societal perspectives will prove vital for informed decision-making among both seasoned and novice investors.

Frequently Asked Questions

What are the implications of the Bitcoin bear market below the 200-week moving average?

The Bitcoin bear market entering below the 200-week moving average indicates potential ongoing price declines and a shift in market sentiment. As Bitcoin is currently experiencing a significant downturn, this breach suggests that investor confidence is faltering, placing the cryptocurrency at risk of further losses. Analysts typically view the 200-week moving average as a critical support level, and its breach often reflects a longer-term bearish trend.

How does the current Bitcoin price analysis reflect trends in the cryptocurrency market?

Current Bitcoin price analysis shows a stark decline, which is representative of broader cryptocurrency market trends amidst rising risk aversion. Recent data, including a plunge of over 20% in Bitcoin’s price, underscores the correlation between Bitcoin and volatile assets like tech stocks, suggesting that investors are re-evaluating their positions in the face of economic uncertainty.

What strategies can investors use during the Bitcoin bear market?

Investing in Bitcoin during a bear market can be challenging but offers opportunities for seasoned investors. Strategies include dollar-cost averaging to reduce the impact of volatility, focusing on long-term holding rather than selling during panic, and researching market sentiment and macroeconomic indicators that might signal future rebounds. Staying informed on Bitcoin decline news also helps investors make educated decisions.

Is the Bitcoin bear market affecting institutional investment strategies?

Yes, the Bitcoin bear market is causing institutional investors to reassess their strategies. As Bitcoin and other cryptocurrencies face significant pressure, institutions are closely monitoring macroeconomic indicators and liquidity conditions to gauge long-term impacts on crypto assets. While short-term sentiment is bearish, many institutions remain committed to exploring Bitcoin’s future potential.

How do Bitcoin decline news and labor market signals influence investor decisions?

Bitcoin decline news, coupled with weak signals from the labor market—such as rising unemployment claims—contributes to a cautious investor mentality. Such economic indicators create uncertainty, leading to increased risk aversion among investors, which in turn amplifies declines in Bitcoin’s price as they seek safer investment alternatives.