The Aave Protocol stands at the forefront of the decentralized finance (DeFi) ecosystem, having impressively liquidated over $450 million in crypto collateral within just a week. Founded by visionary Stani Aave, this protocol demonstrates an exceptional ability to navigate challenges in the rapidly evolving financial landscape. With the implementation of robust mechanisms for handling bad debts and a decentralized liquidation network, Aave ensures the security and efficiency of its services. As it prepares to launch Aave V4, which promises even greater flexibility and performance, the protocol continues to thrive amidst market fluctuations. This resilience not only highlights the stability of Aave but also underscores its pivotal role in facilitating seamless crypto collateral liquidation within the DeFi sector.

In the innovative world of decentralized finance, Aave Protocol has emerged as a significant player, engaging users with its unique functionalities. Known for effective management of lending and borrowing activities, the platform also features advanced liquidation strategies that protect against defaults in the crypto space. As the founder, Stani Aave has positioned this protocol to withstand market volatility, driving over $450 million in collateral liquidations recently. The upcoming Aave V4 will further enhance its capabilities, reflecting the platform’s commitment to continuous improvement and efficiency. Overall, Aave is not only a lending protocol but also a cornerstone of the evolving DeFi landscape, fostering trust and transparency in financial transactions.

| Key Point | Detail |

|---|---|

| Liquidation Amount | Aave has liquidated over $450 million in collateral in the past week. |

| Protocol Size | Aave is a significant player in the DeFi space with over $50 billion in total deposits. |

| Impact of Liquidation | Liquidations account for about 0.9% of the total deposits at the time. |

| Management of Bad Debts | Aave has built-in mechanisms to address bad debts during the lending process. |

| Liquidation Network | Its resilience stems from a broad, decentralized liquidation network. |

| Upcoming Developments | A new liquidation engine will be launched in Aave V4 for enhanced performance. |

| Philosophy | DeFi’s success lies in resilience, transparency, and cost-effective structures. |

Summary

Aave Protocol has demonstrated significant resilience in the decentralized finance ecosystem, liquidating over $450 million in collateral in just one week. This reflects not only the protocol’s size and impact but also its ability to manage financial risks effectively. The upcoming advancements, especially the new liquidation engine in Aave V4, will further bolster its capabilities, ensuring that Aave continues to thrive in the evolving financial landscape.

Understanding Aave Protocol’s Recent Collateral Liquidation

In just one week, the Aave Protocol has liquidated collateral worth over $450 million, showcasing its robust operational mechanisms amid market volatility. This liquidation is significant, especially for a lending protocol that manages over $50 billion in total deposits, with the recent liquidations constituting roughly 0.9% of its holdings. Such events highlight the critical role of collateral management within the DeFi ecosystem, where strategies must adapt fluidly to market conditions.

The liquidation process in Aave is designed to uphold the stability of the protocol and protect lenders from potential losses. By utilizing effective risk assessment and a decentralized network for liquidations, Aave ensures that problems are addressed swiftly. Such resilience not only reinforces trust in the Aave platform but also positions it as a leader in the DeFi lending space, reflecting the visionary leadership of its founder, Stani.

The Vital Role of Liquidation in the DeFi Ecosystem

Liquidation is a foundational concept that ensures the health of decentralized finance (DeFi). When a borrower defaults or their collateral’s value drops significantly, effective liquidation mechanisms are crucial for safeguarding the interests of lenders. Aave Protocol exemplifies how integrated systems can manage these risks, empowering stability across DeFi. The recent $450 million liquidation showcases how swiftly markets can respond to changing conditions, fulfilling the promise of on-chain collateral management.

In the broader context of the DeFi ecosystem, Aave’s liquidation processes reflect a commitment to transparency and decentralized governance. By employing a system that allows for communal participation in liquidations, Aave not only mitigates risks but also enhances user confidence. The innovative architecture of Aave, particularly with the upcoming Aave V4, signals a forward-thinking approach that could redefine how liquidations are perceived and implemented across decentralized platforms.

Stani Aave: Visionary Leadership in the DeFi Space

Stani Aave has been pivotal in the evolution of decentralized finance, championing the ideals of transparency and accessibility. As the founder of Aave, he has driven the development of features that bolster the protocol’s security, such as advanced liquidation mechanisms. His leadership is characterized by a proactive response to market challenges, as reflected in the recent liquidation of over $450 million in collateral. This adaptability not only protects users but also enhances the community’s trust in DeFi.

Under Stani’s guidance, Aave has played a critical role in segmenting itself from traditional finance, using cutting-edge technology and innovative solutions to address the unique challenges of the crypto space. The anticipated launch of Aave V4 is a testament to this ongoing commitment to improvement. With enhancements aimed at increasing performance and efficiency, it encapsulates Stani’s vision for a more resilient DeFi ecosystem where all assets can thrive safely.

Aave V4: Innovations Driving Liquidation Efficiency

Aave V4 promises to introduce a new liquidation engine designed to enhance operational flexibility and efficiency within the protocol. As the DeFi landscape continues to evolve, the need for protocols like Aave to maintain a competitive edge is paramount. By focusing on technological advancements, Aave can streamline its liquidation processes, providing a more seamless experience for both lenders and borrowers.

The new features expected in Aave V4 will not only optimize the liquidation mechanics but also likely improve risk management across the board. The introduction of better algorithms and tools for assessing collateral values can significantly reduce instances of unsuccessful liquidations, protecting users’ funds and maintaining overall protocol integrity. Aave’s innovative approach will solidify its place as a key player in the DeFi ecosystem, reinforcing the foundational role of liquidations.

The Future of Aave: More Than Just Liquidity

While liquidations are a vital function of the Aave Protocol, the future outlook for Aave encompasses much more. As the DeFi sector matures, Aave aims to diversify its offerings, incorporating new features that will enhance user experience and broaden its appeal. Innovations in collateral options, lending terms, and integration with other DeFi products are all on the horizon, positioning Aave as a comprehensive finance platform.

Furthermore, the ethos of resilience championed by Stani and his team will serve as a guiding principle in navigating potential challenges within the crypto landscape. As regulatory scrutiny increases and the market becomes more complex, Aave’s commitment to transparency, security, and user engagement will be crucial in ensuring the protocol remains at the forefront of the DeFi revolution.

Risk Mitigation: Aave’s Approach to Bad Debts

Aave Protocol has established rigorous mechanisms to mitigate the risks associated with bad debts in the lending process. With a proactive approach to monitoring collateral values and implementing liquidation strategies, Aave minimizes default rates and protects its users. The recent liquidation haul underscores the effectiveness of these systems, demonstrating that prompt action can shield lenders from deeper financial exposure.

Additionally, the decentralized nature of liquidations within Aave fosters an environment of trust, where users can rely on the protocol’s integrity. Transparency in operations not only reassures lenders but also attracts new users, forming a cycle of trust and engagement that strengthens Aave’s position in the DeFi ecosystem.

The Impact of Collateral Liquidation on Cryptocurrency Markets

The phenomenon of collateral liquidation in protocols like Aave has broad implications for cryptocurrency markets. When large sums are liquidated, it can lead not just to movements in Aave’s own ecosystem but reverberate through broader crypto markets, affecting asset prices and liquidity. Understanding this interconnectedness is crucial for investors and participants in DeFi to strategize effectively.

Moreover, these liquidations highlight the importance of maintaining sufficient collateral ratios to safeguard against sudden market shifts. As experienced recently, a drop in asset prices can trigger a cascade of liquidations, emphasizing the volatility inherent in cryptocurrency markets. Aave’s approach to managing these risks is crucial for sustaining user confidence and preventing market disruptions.

Aave and the Evolution of Financial Instruments in DeFi

The Aave Protocol is at the forefront of creating innovative financial instruments within the DeFi space. By positioning itself as more than just a lending platform, Aave is revolutionizing how digital assets can be utilized, paving the way for complex financial products like flash loans and unique collateral options. These innovations expand the possibilities for users and enhance the overall utility of cryptocurrency.

As Aave continues to evolve, the integration of new financial instruments will likely attract a broader audience, from individual retail investors to institutional players. The ability to harness diverse options for borrowing and lending allows users to optimize their strategies effectively. In this rapidly evolving landscape, Aave’s commitment to innovation will ensure its continued relevance in the future of finance.

How Aave Protocol Enhances User Experience Through Liquidation Transparency

Transparency in the liquidation process is a cornerstone of Aave’s user experience. By clearly communicating risks and the conditions under which collateral might be liquidated, Aave empowers users to make informed decisions about their investments. This level of transparency is vital in building trust within the decentralized finance community, where users are often wary of the inherent risks.

By utilizing advanced analytics and real-time data for liquidation events, Aave provides users with the insights they need to manage their positions actively. This commitment to transparency, combined with effective liquidation strategies, enhances the overall user experience and helps maintain the integrity of the protocol, ensuring that Aave remains a go-to choice in the DeFi ecosystem.

Frequently Asked Questions

What is the Aave protocol and what is its significance in the DeFi ecosystem?

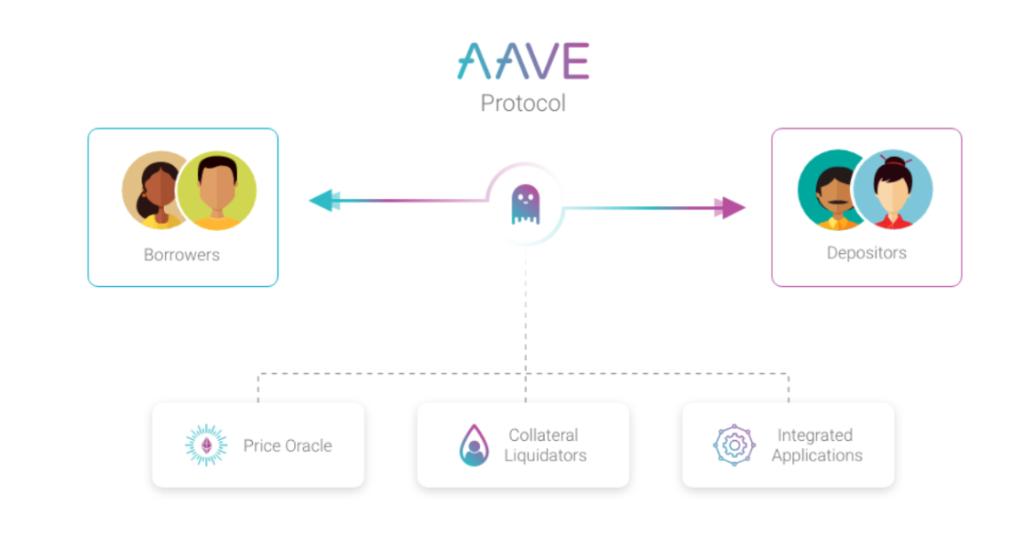

The Aave protocol is a decentralized lending platform that allows users to borrow and lend cryptocurrencies without intermediaries. It plays a crucial role in the DeFi ecosystem by providing liquidity and enabling users to earn interest on their crypto assets. Aave has developed innovative features like flash loans and collateral liquidation, which enhance its functionality and appeal in the decentralized finance space.

How does Aave liquidation work within the Aave protocol?

Aave liquidation refers to the process where under-collateralized loans are settled automatically to protect lenders from bad debts. If the value of the collateral falls below a specific threshold, the Aave protocol automatically liquidates it to repay the loan. This mechanism ensures the stability and resilience of the Aave protocol and protects the overall health of the DeFi ecosystem.

What impact did the recent $450 million Aave liquidation have on the protocol?

The recent Aave liquidation of over $450 million in collateral highlights the protocol’s robustness and its ability to manage risks effectively within the DeFi ecosystem. This event accounted for approximately 0.9% of Aave’s total deposits, emphasizing its liquidity management capabilities. Such liquidations, while concerning, demonstrate Aave’s built-in safety measures to handle potential bad debts.

Who is Stani Aave and what role does he play in the Aave protocol?

Stani Aave is the founder of the Aave protocol and a prominent figure in the DeFi community. He has been instrumental in developing the protocol’s features, promoting its transparent and resilient design, and advocating for its expansion across various blockchain networks. Stani’s vision emphasizes the importance of decentralized finance in reshaping traditional financial structures.

What improvements can we expect with the upcoming Aave V4?

Aave V4 is expected to introduce a new liquidation engine, which will enhance the protocol’s flexibility and performance. This upgrade aims to refine the Aave protocol’s collateral liquidation processes, improve efficiency, and potentially reduce costs for users. As part of Aave’s commitment to innovation, these enhancements will further solidify its position in the DeFi ecosystem.

Why is collateral liquidation essential for the Aave protocol’s success?

Collateral liquidation is vital for the Aave protocol because it prevents systemic risk and protects lenders from losses due to under-collateralized loans. By ensuring that loans are properly collateralized and automatically liquidating when necessary, Aave maintains a stable lending environment, which is crucial for fostering trust and participation in the DeFi ecosystem.