In a notable development in the cryptocurrency space, Trend Research ETH sales have surged recently, with the company selling a staggering 170,000 ETH in a mere 19 hours. This strategic move, driven by the need to facilitate crypto loan repayment, highlights the shifting dynamics within the ETH market trends and investor strategies. As Ethereum price analysis reveals a complex landscape of valuations, the decisions made by Trend Research emphasize the importance of liquidity in maintaining ETH holdings. Furthermore, these sales come at a time when the market is closely monitoring such activities, revealing crucial insights in Trend Research news. Overall, the company’s significant transactions may influence future ETH price forecasts and trading patterns in the broader cryptocurrency ecosystem.

In recent times, the activity around Ethereum has garnered considerable attention, especially with Trend Research’s recent transactions involving vast amounts of ETH. Over the past day, this entity has executed a noteworthy divestiture of approximately 170,000 units of Ethereum to address outstanding crypto loans, showcasing a proactive approach in managing their financial commitments. Holding onto more than $563 million in ETH reveals a robust investment strategy, with implications for overall ETH market trends. These developments present an intriguing case for analysts examining Ethereum’s price shifts and the behaviors surrounding ETH holdings. With such high stakes at play in the field of digital currencies, understanding these transactions is essential for grasping the evolving landscape of cryptocurrency financial management.

| Point | Details |

|---|---|

| Total ETH Sold | 170,033 ETH |

| Value of Sold ETH | $322.5 million |

| Current ETH Holdings | 293,121 ETH |

| Current Value of Holdings | $563 million |

| Timeframe | Past 19 hours |

| Reason for Sale | To repay loans |

Summary

Trend Research ETH sales have seen a significant volume as the company sold 170,033 ETH in just the last 19 hours to clear outstanding loans. This aggressive strategy highlights Trend Research’s approach to managing its financial liabilities while still maintaining a substantial portfolio of 293,121 ETH valued at $563 million, indicating its strong position in the market despite the sales activity.

Trend Research ETH Sales and Loan Repayment

In a significant move within the cryptocurrency sector, Trend Research has recently sold 170,000 ETH over the past 19 hours, a strategic decision primarily aimed at repaying outstanding loans. The decision to liquidate such a substantial amount of ETH underscores a critical trend in the ETH market where entities are undertaking urgent measures to manage their crypto-asset portfolios effectively. As reported, this sales event generated around $322.5 million, indicating a focused approach amidst the prevalent Ethereum price fluctuations.

Despite this sizable sale, Trend Research maintains a robust position, still holding 293,121 ETH valued at approximately $563 million. This balance not only highlights their commitment to maintaining a significant presence in the market but also reflects on the broader Ethereum market trends where timely loan repayments can lead to more stable investment strategies. Investors and analysts alike are watching closely to gauge the long-term implications of such sales on ETH holdings and the overall market dynamics.

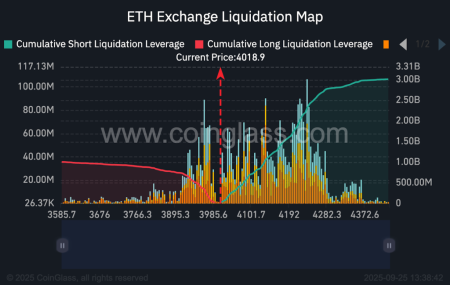

Analyzing Ethereum Price Trends Post Loan Sales

The recent activity surrounding Trend Research’s sale of ETH has raised questions about the immediate future of Ethereum prices. Following the liquidation of 170,000 ETH, analysts are keenly observing how these trends may influence market liquidity and investor confidence. Market trends indicate that significant sell-offs can create downward pressure on prices, which may prompt other holders to consider their positions in relation to Ethereum price analysis.

As the ETH market continues to evolve, tracking these price trends is essential for both current and prospective investors. The volatility often witnessed in the crypto landscape can be attributed to actions taken by major players like Trend Research. The recent loan repayment strategy showcases a proactive approach, yet it simultaneously opens the floor for speculation regarding future price stability and potential rebounds.

Impact of Loan Repayment on ETH Holdings

Trend Research’s decision to sell a large volume of ETH for loan repayment has underscored a notable trend in the crypto lending space. The company’s holdings of ETH remain robust even after such a significant sale, which indicates a calculated risk management strategy. For holders and investors, understanding how loans influence ETH holdings is crucial, as loan repayment often necessitates asset liquidation, which can inform future investment strategies.

The implications of this sale extend beyond just Trend Research; they resonate throughout the Ethereum community and impact how smaller investors approach their own ETH holdings. By navigating the balance between maintaining liquidity and minimizing risk exposure, other stakeholders in the market can evaluate their own strategies in the context of broader trends being shaped by entities like Trend Research.

The Role of ETH in Crypto Market Dynamics

As the crypto landscape fluctuates, Ethereum’s role remains pivotal to understanding market dynamics. With Trend Research’s recent sales and substantial ETH holdings, it is clear that ETH is not just a cryptocurrency but a critical asset influencing market behavior. Each significant movement, such as the sale of 170,000 ETH, reverberates through the market and prompts other holders to reassess their exposure and strategies concerning ETH and its ongoing trends.

Investor sentiment can change rapidly, especially in markets like cryptocurrency, where information regarding major sell-offs and asset management becomes public. As seen in the aftermath of Trend Research’s actions, this can greatly influence crypto loan repayment and investment decisions. Understanding such trends helps demystify the often volatile and unpredictable nature of the Ethereum market.

ETH Market Trends and Future Prospects

The current ETH market trends highlight a critical phase for investors as they seek to understand the implications of recent sell-offs by significant players such as Trend Research. The sale of 170,000 ETH might signal an adaptive response to market conditions, suggesting a more vigilant approach to portfolio management. This aligns with broader observations in the cryptocurrency landscape where market actors are increasingly focusing on strategic asset allocations.

Looking ahead, understanding these market trends is essential for predicting future movements within the ETH landscape. With ongoing analyses of Ethereum price and trends, stakeholders can better position themselves amidst the market’s ever-changing dynamics. As ETH continues to be a focal point for investment strategies, awareness of these trends will be vital for navigating potential future opportunities.

Ethereum Price Analysis Amidst Market Changes

Ethereum price analysis remains a central focus as significant entities like Trend Research alter their holdings. The recent sale has implications not only for Trend Research’s portfolio but also for the overall perception of ETH’s value in the market. Investors tend to react to high-profile sell-offs, and this could reflect in short-term price changes, prompting discussions about the stability of Ethereum amidst economic pressures.

Continuous monitoring of Ethereum prices post-sale will provide insights into market resilience and the potential for recovery. Analysts often utilize trends observed from high-volume transactions to forecast movements, making ETH price analysis a pivotal aspect for traders looking to capitalize on fluctuations. Thus, maintaining a comprehensive understanding of these dynamics becomes crucial for any investor aiming for success in the cryptocurrency world.

Trends in Crypto Loan Repayment Strategies

The recent actions by Trend Research also shine a light on the growing trend of strategies related to crypto loan repayments. As the crypto world matures, many investors are adopting various techniques to manage their loan obligations, especially in volatile markets. Trend Research’s example emphasizes the necessity of liquidity and proactive measures in an environment where prices can shift rapidly.

Efficient loan repayment strategies can determine the longevity of investments, especially in an asset class as tumultuous as cryptocurrencies. Observing how organizations like Trend Research navigate their loan repayments can provide valuable lessons for other investors in the market. Understanding these strategies not only aids in short-term financial planning but also in forming a cohesive long-term investment hypothesis.

The Future of ETH Holdings: Insights and Predictions

With Trend Research still maintaining a substantial amount of ETH following their recent sales, discussions surrounding the future of ETH holdings become increasingly relevant. The balance of $563 million held by such significant players showcases a calculated investment strategy, providing insights into future expectations for Ethereum as an asset. Market analysts predict that with Ethereum’s evolving ecosystem, holders will continue to navigate the complexities of managing their holdings effectively.

Furthermore, the stabilization of ETH holdings is seen as an essential pillar for fostering confidence in the market. As stakeholders adapt to changes, predictions about ETH’s performance and the overall reflection of economic dynamics will shape future investment sentiment. Watching how major players adjust their strategies will likely influence emerging trends in ETH markets, making it a captivating area for investors.

Crypto Market Insights from Trend Research Activity

The activities of Trend Research provide significant insights into the current state of the crypto market. Their recent ETH sales reflect broader trends indicating a shift in investor behavior as they prioritize loan repayments amidst fluctuating Ethereum prices. Such actions signal the importance of liquidity and strategic asset management in a market characterized by rapid changes and uncertainty.

Analyzing the underlying motivations and outcomes of Trend Research’s sales can illuminate the strategic thinking harnessed by top players in the ETH space. As these trends unfold, they serve as key indicators for other investors, providing vital data points for understanding potential market shifts and opportunities for engagement in cryptocurrency.

Frequently Asked Questions

What recent sales activities have been reported about Trend Research ETH sales?

Trend Research has recently accelerated its ETH sales, having sold 170,033 ETH in just 10 hours to repay loans. This brings their total ETH holdings down to 293,121 ETH, valued at approximately $563 million.

How does the recent Trend Research ETH sales impact the Ethereum price analysis?

The recent Trend Research ETH sales could potentially influence Ethereum price analysis by increasing supply in the market, which may lead to price fluctuations. Observing such significant sales activities is essential for traders analyzing Ethereum market trends.

What are the implications of Trend Research’s ETH holdings on ETH market trends?

With Trend Research still holding 293,121 ETH worth $563 million after their recent sales, their positions could significantly impact ETH market trends, as any further sales or changes in their holdings might lead to increased volatility in the Ethereum market.

What motivated Trend Research to sell 170,000 ETH in a short period?

Trend Research’s decision to sell a large amount of ETH in a short period appears motivated by the need to repay crypto loans, reflecting a strategic move to manage their financial obligations while still maintaining a substantial amount of ETH holdings.

How does Trend Research’s ETH sale strategy reflect on overall crypto loan repayment trends?

Trend Research’s approach to ETH sales highlights a broader trend in the crypto market, where many entities may resort to liquidating assets to manage loan repayments, thereby affecting both individual holdings and overall market dynamics in the Ethereum ecosystem.

Where can I find more information about current Trend Research news related to ETH sales?

For the latest updates on Trend Research news regarding ETH sales and related topics, resources like cryptocurrency news platforms and financial analysis websites often provide timely information and comprehensive market reports.

What should investors consider regarding Trend Research’s ETH sales when making investment decisions?

Investors should consider the implications of Trend Research’s ETH sales on market dynamics and overall Ethereum price trends. Analyzing their asset management strategies and loan repayment actions can provide insights into potential investment risks and opportunities.