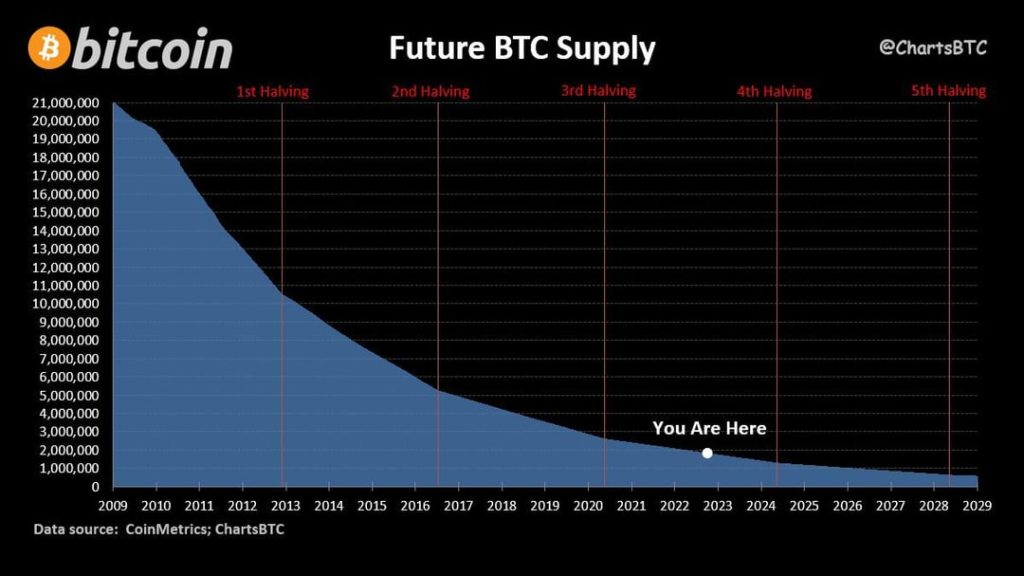

Bitcoin supply is a critical concept that influences the dynamics of the cryptocurrency market. Recent reports indicate that bitcoin whales, or large holders, are significantly impacting the overall distribution of BTC, with addresses holding between 10 and 10,000 bitcoins constituting 68.04% of the total supply, a record low in nine months. This change in BTC supply highlights the ongoing fluctuations in bitcoin ownership statistics, as these major players have sold an impressive 81,068 BTC over just eight days. In contrast, there has been a notable increase in addresses holding less than 0.01 bitcoin, now making up 0.249% of total bitcoin supply, suggesting a growing interest from smaller investors. Understanding these shifts in bitcoin supply can provide deeper insights into market trends and potential future movements in the realm of cryptocurrency and digital assets.

The availability of bitcoin and its distribution among users is paramount to the understanding of its market behavior. The recent trends illustrate the influence of large bitcoin holders, often termed as “whales,” who own substantial amounts impacting the overall BTC supply landscape. Additionally, the data reveals that smaller participants, represented by an increasing number of bitcoin addresses with minimal holdings, are beginning to carve out their place in this evolving financial ecosystem. These patterns not only reflect shifts in trading dynamics but also challenge traditional narratives around bitcoin ownership and market accessibility. Keeping a close eye on these supply variations can illuminate potential investment opportunities within the rapidly changing crypto domain.

| Key Point | Details |

|---|---|

| Whale Addresses | Whale addresses (holding 10 to 10,000 BTC) account for 68.04% of total bitcoin supply. |

| Recent Selling | In the last 8 days, these addresses have sold a total of 81,068 BTC. |

| Small Addresses | Addresses holding less than 0.01 BTC now represent 0.249% of total bitcoin supply. |

| Recent High for Small Addresses | This is the highest percentage of small addresses seen in 20 months. |

Summary

Bitcoin supply continues to be a critical aspect of the cryptocurrency landscape. Recent data indicates that whale addresses are experiencing a significant drop, holding 68.04% of the total bitcoin supply, marking a new low in nine months. Additionally, with small addresses gaining ground, representing 0.249% of the total supply, this shift marks an important trend in the market. Understanding these movements in bitcoin supply can provide deeper insights into market trends and investor behaviors.

Understanding Bitcoin Supply Dynamics

Bitcoin supply dynamics are crucial to comprehending how the cryptocurrency market operates. Currently, whale addresses, defined as those holding between 10 to 10,000 bitcoins, constitute approximately 68.04% of the total bitcoin supply. This significant portion highlights the concentration of bitcoin ownership in the hands of a few, often referred to as ‘bitcoin whales.’ As these entities control large amounts of BTC, their trading behaviors can significantly impact market trends and sentiment.

Recently, the reported selling of 81,068 BTC by these whale addresses over a span of just eight days signals a potential shift in market dynamics. Such movements raise questions about future price stability and volatility, sparking debates among investors regarding the implications of concentrated ownership. Understanding these patterns helps investors gauge market trends, assess risks, and make data-informed decisions related to their cryptocurrency portfolios.

The Rise of Small-Bitcoin Holders

Conversely, there is a notable increase in the number of addresses holding less than 0.01 bitcoin, which now account for 0.249% of the total supply—indicative of a growing interest among retail investors. This trend reflects a shift in bitcoin ownership demographics, suggesting that more individuals are entering the cryptocurrency market, potentially contributing to a more decentralized ownership structure.

This new high in small-holdings positions smaller investors as significant players in the cryptocurrency ecosystem. It may enhance the overall volatility and liquidity of bitcoin, as these small holders could react quickly to market changes compared to larger entities. Furthermore, understanding this emerging group of small investors aids in analyzing bitcoin ownership statistics and their influence on the broader market.

Impact of Bitcoin Whales on Market Trends

Bitcoin whales are known for their ability to sway market sentiments, given the considerable amounts of BTC they wield. The recent acknowledgement that whale addresses are now selling off substantial numbers of bitcoins raises concerns among investors about potential bearish trends. When whales sell large chunks of their holdings, it can create panic selling, leading to rapid price declines. This phenomenon underscores the intertwined relationship between whale activity and market movements.

Additionally, the behavior of these whales often serves as indicators for market speculation. The inclination of whales to sell rather than hold can signify a larger trend, urging smaller investors to reassess their positions. The dynamics of whale behavior provide a lens through which to observe the fluctuations within the cryptocurrency market, influencing trading strategies and investment decisions for a broad spectrum of market participants.

Analyzing Bitcoin Address Trends

The changing landscape of bitcoin addresses offers valuable insights into the evolving cryptocurrency environment. With whale addresses dominating a significant percentage of the total BTC supply, observing the trends in both whale and smaller holder addresses can reveal significant shifts in market dynamics. Tracking the activity across various bitcoin addresses allows traders and analysts to evaluate market confidence and investor sentiment.

More importantly, as the landscape shifts, it becomes paramount to understand how these address dynamics affect overall bitcoin supply change. The rise of smaller addresses holding 0.01 BTC or less suggests a democratization of bitcoin investment, potentially fostering new demand as individual investors become increasingly interested in cryptocurrency. Consequently, keeping an eye on these address changes will be essential for forecasting future market movements and developing robust investment strategies.

Bitcoin Ownership Statistics: A Closer Look

The statistics surrounding bitcoin ownership paint a compelling picture of who holds the currency and how it is distributed among the population. Current ownership trends show that while a substantial percentage of bitcoin is concentrated in whale addresses, there’s also an increasing number of individual holders entering the market. Understanding these bitcoin ownership statistics is critical for gauging the health and future of the cryptocurrency market.

Moreover, ownership patterns are influential in determining market reactions to price fluctuations. An influx of small holders may create more liquidity and sustainability in price movements, potentially leading to decreased volatility. As trends in bitcoin ownership evolve, they reflect broader societal changes toward digital currencies, offering a glimpse into the future of how bitcoin integrates into the financial landscape.

Economic Implications of BTC Supply Changes

The economic implications of bitcoin supply changes have garnered considerable attention from both traders and economists. The staggering proportion of bitcoin held by whale addresses not only influences market liquidity but also affects pricing stability. As large holders sell their BTC, it intensifies discussions about future scarcity and market valuation, making it essential to consider these factors in investment strategies.

The dynamics of BTC supply change also underscore the relationship between supply and demand in the cryptocurrency market. With significant shifts occurring among whale and small-holding addresses, the potential for market corrections and upheavals becomes more pronounced. Investors need to remain vigilant in responding to these economic indicators to maximize their profit potential and minimize financial risk.

Predicting Future Trends in Bitcoin Supply

Forecasting future trends in bitcoin supply requires a nuanced understanding of both market and behavioral economics. The current data showing high concentration among whale addresses coupled with growing small-holder population suggests a period of transition in the bitcoin landscape. The pivotal question remains: how will these shifts impact the broader cryptocurrency ecosystem?

As supply dynamics evolve, analysts must develop predictive models that consider the interplay between large and small holders, market demand, and external economic forces. Innovations in blockchain technology and changes in regulatory landscapes will also play a critical role in shaping future trends. Continuous monitoring of bitcoin supply indicators will be key for making informed predictions and investment decisions.

The Role of Market Sentiment in Bitcoin Ownership

Market sentiment plays a crucial role in determining bitcoin ownership dynamics. The observed changes in address metrics reflect broader investor psychology, where heightened fear or optimism often drives buying and selling behaviors. With whale addresses recently offloading large chunks of BTC, reactions among smaller investors could amplify negative sentiment, fostering a climate of caution in cryptocurrency trading.

Conversely, as more small holders enter the market, their growing presence can alter overall market sentiment positively, leading to bullish trends. Understanding how market sentiment intertwines with ownership statistics provides valuable insights for traders aiming to navigate the complex landscape of bitcoin and other cryptocurrencies effectively. Engaging with these sentiments will equip investors to better mitigate risks associated with ownership volatility.

Strategies for Investors Amid Changing Bitcoin Supply

In light of the evolving dynamics in bitcoin supply and ownership, investors must adapt their strategies to navigate potential challenges and seize opportunities. With a significant number of bitcoins controlled by whale addresses, discerning when these entities shift their holdings can provide critical insights for making informed investment decisions. Identifying entry and exit points based on whale activity may enhance overall trading performance.

Moreover, investors should also focus on diversifying their portfolios by engaging with the expanding base of smaller bitcoin holders. By understanding how this demographic influences market trends, investors can position themselves to capitalize on future growth. Staying abreast of bitcoin ownership statistics and market sentiment is essential for constructing robust investment strategies that anticipate the natural ebb and flow of the cryptocurrency market.

Frequently Asked Questions

What is the current status of bitcoin supply held by whales?

As of recent reports, bitcoin whales, which are defined as addresses holding between 10 and 10,000 BTC, account for 68.04% of the total bitcoin supply. This percentage marks a new low in whale ownership within the past 9 months.

How much bitcoin supply has been sold by whale addresses recently?

In the past 8 days, bitcoin whale addresses have sold a total of 81,068 BTC. This significant movement in the cryptocurrency market indicates a shift in bitcoin ownership statistics among large holders.

What percentage of bitcoin supply is represented by small addresses?

Addresses that hold less than 0.01 bitcoin now represent 0.249% of the total bitcoin supply, which is the highest figure recorded in the last 20 months, highlighting changing dynamics in bitcoin ownership.

How does bitcoin supply distribution affect the cryptocurrency market?

The distribution of bitcoin supply, especially among whales and small holders, plays a crucial role in the volatility and price dynamics of the cryptocurrency market. A concentration of BTC supply among fewer addresses can lead to large price swings if those holders decide to sell.

What impact do whale addresses have on bitcoin ownership statistics?

Whale addresses significantly influence bitcoin ownership statistics, as their large holdings encompass a substantial percentage of total bitcoin supply. Their buying or selling actions can affect market sentiment and overall supply dynamics.

What does the change in bitcoin supply from whale addresses signify?

The recent decrease in the bitcoin supply held by whale addresses may suggest a change in market sentiment or strategy among large holders. This could have wider implications for the stability and pricing of Bitcoin in the cryptocurrency market.