Bitcoin ETFs are currently at the forefront of financial discussions, especially as they face substantial outflows—totaling nearly $1 billion in just two days. This surge in withdrawals has raised concerns among investors about the impact of ETFs on Bitcoin’s volatility and its price trends, particularly as the price of Bitcoin recently dipped following high inflows earlier in the week. Market analysts are closely examining the recent trends surrounding Bitcoin ETF outflows, specifically how they’re mirroring the instability observed in the broader crypto market. Additionally, debates around the influence of these exchange-traded funds on the Bitcoin ecosystem have intensified as criticisms arise about their potential to dilute Bitcoin’s scarcity—one of its core attributes. As such, understanding the implications of Bitcoin ETFs is crucial for investors navigating these turbulent market conditions.

In the realm of cryptocurrency investments, exchange-traded funds (ETFs) have emerged as a significant focal point, particularly concerning their role in shaping Bitcoin’s financial landscape. The discussion around crypto funds has sparked attention, especially as recent patterns of Bitcoin ETF withdrawals unfold amidst a fluctuating market environment. Investors are keenly observing the relationship between these funds and Bitcoin market trends, especially as the price fluctuates dramatically. Many are questioning whether these trading mechanisms are beneficial or if they may lead to adverse effects on Bitcoin’s overall value. As Bitcoin continues to mature as an asset class, analyzing the effects of these financial instruments becomes vital for anyone interested in the evolving dynamics of digital currency investments.

| Key Point | Details |

|---|---|

| Outflows from Bitcoin ETFs | Bitcoin ETFs saw nearly $1 billion in outflows over two days. |

| Recent Net Outflows | $434 million in outflows on Thursday, following $545 million on Wednesday. |

| Impact on Bitcoin Price | Bitcoin’s price briefly reached $60,000 before experiencing a downturn. |

| Criticism of Bitcoin ETFs | Concerns that ETFs may undermine Bitcoin’s scarcity and support fractional reserve trading. |

| Total Assets in Bitcoin ETFs | Approximately $81 billion in total assets within spot Bitcoin ETFs. |

| Flows in Altcoin ETFs | Ether ETFs saw $80.8 million outflows, while XRP and Solana ETFs had minor inflows. |

Summary

Bitcoin ETFs have been under significant scrutiny due to ongoing outflows nearing $1 billion over just two days. The tumultuous market conditions and criticism regarding their impact on Bitcoin’s perceived scarcity raise serious questions about their role in the crypto finance ecosystem. As the debate continues, understanding the implications of Bitcoin ETFs on both institutional investment and the retail market is crucial for potential investors.

The Impact of Bitcoin ETFs on Market Dynamics

Bitcoin exchange-traded funds (ETFs) have been a topic of heated discussion among investors and analysts as they witness a significant change in market dynamics. Recently, these funds have experienced substantial outflows, resulting in nearly $1 billion lost over a short span. This scenario raises questions about the resilience of Bitcoin in the face of such withdrawals. As the crypto market continues to adapt to the presence of ETFs, the correlation between ETF movements and Bitcoin price fluctuations is becoming increasingly relevant. Many investors are scrutinizing the potential consequences of these structures on Bitcoin’s scarcity and market integrity.

The ongoing debate regarding the impact of ETFs on Bitcoin is fueled by concerns that they may be diluting the asset’s traditional qualities. Critics argue that the ETF market is allowing for more speculative activity, which can lead to price manipulations. With Bitcoin reaching highs of $60,000 before a sudden price drop, observers are questioning whether the introduction of Bitcoin ETFs contributes to increased volatility, or if they provide a necessary mechanism for institutional investment. As the landscape evolves, understanding how these investment products influence Bitcoin market trends is crucial for both investors and analysts.

Frequently Asked Questions

What are Bitcoin ETF outflows and how do they impact the market?

Bitcoin ETF outflows refer to the withdrawals of capital from Bitcoin exchange-traded funds. These outflows can signify a bearish sentiment in the market, potentially leading to a drop in Bitcoin prices, as seen recently with nearly $1 billion in withdrawals over just two days. Bitcoin ETF outflows can influence market trends by affecting liquidity and pricing dynamics.

What is the significance of Bitcoin market trends in relation to Bitcoin ETFs?

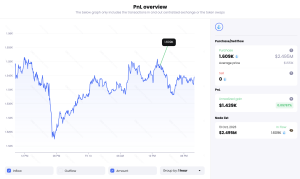

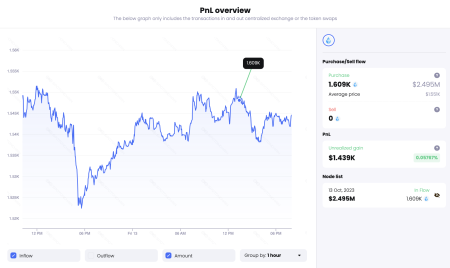

Bitcoin market trends are crucial for understanding how Bitcoin ETFs perform. Recent trends show that despite inflows at times, the overall market has faced significant withdrawals, highlighting a volatile relationship. Analysts observe that Bitcoin ETFs can affect price stability, especially when they experience major outflows or inflows.

How do Bitcoin ETFs impact the price of Bitcoin?

The impact of ETFs on Bitcoin’s price can be significant. Large inflows often drive prices up due to increased demand, while substantial outflows, as seen recently, can lead to price drops. Critics argue that Bitcoin ETFs might contribute to price volatility rather than stability, suggesting they allow for fractional reserve-like trading, which complicates the asset’s perceived scarcity.

What does crypto ETF analysis reveal about Bitcoin and market behavior?

Crypto ETF analysis reveals the interplay between Bitcoin prices and ETF fund flows. The recent analysis indicates that Bitcoin ETFs played a role in the significant price drop observed in Bitcoin, raising concerns among analysts about their potential to create an oversaturated market that may dilute Bitcoin’s real value.

What are the potential downsides of Bitcoin ETFs?

The potential downsides of Bitcoin ETFs include the risks of creating unbacked Bitcoin, which could lead to devaluation of actual holdings. Critics argue that Bitcoin ETFs may contribute to market inefficiencies by allowing financial institutions to trade against the asset in ways that could undermine its scarcity and true market value.