The BTC-USDT leverage ratio has emerged as a crucial metric in understanding current market dynamics as traders navigate the volatile waters of cryptocurrency. Recent discussions from CryptoQuant CEO Ki Young Ju indicate that this ratio is experiencing a cooling trend, suggesting a shift in trading behaviors. As the influence of institutional funds from entities like MSTR and the anticipated effects of crypto ETFs wane, we see a reduced influx of capital supporting excessive long positions. Consequently, Bitcoin liquidation risks are becoming more pronounced, urging traders to reassess their strategies. Monitoring the BTC-USDT leverage ratio is essential for anyone looking to capitalize on evolving cryptocurrency market trends.

Exploring the leverage metrics associated with Bitcoin trading against Tether (BTC-USDT) reveals significant insights into the current cryptocurrency landscape. With the recent commentary from industry leaders, it is evident that the balance of leveraged trading is undergoing a notable shift. As the influx from institutional investments and crypto exchange-traded funds (ETFs) fluctuates, the influence on long positions is diminishing. This landscape adjustment heightens the potential for Bitcoin liquidation risks, prompting traders to adjust their approaches. Understanding these leverage dynamics is vital for anyone engaged in crypto assets.

| Key Point | Details |

|---|---|

| Leverage Ratio Cooling | The leverage ratio for BTC-USDT perpetual contracts is declining, indicating a potential reduction in risk. |

| Impact of MSTR and ETFs | The previous surge in leverage was supported by funds from MSTR and ETFs, which have now plateaued. |

| Liquidation of Long Positions | With less funding inflow, excessive long positions are more likely to be liquidated. |

| Return to Pre-ETF Levels | The leverage ratio is reverting to levels observed before ETF approvals. |

Summary

The BTC-USDT leverage ratio is currently experiencing a cooling trend, reflecting a healthy adjustment in the market. As the influx of funding from entities like MSTR and ETFs stabilizes, the excessive long positions are being systematically unwound, leading to a return to more sustainable leverage levels. This change is significant as it indicates a normalization in trading behavior among investors, allowing for a healthier Bitcoin trading environment.

Understanding the BTC-USDT Leverage Ratio

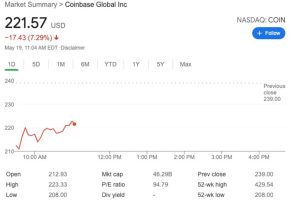

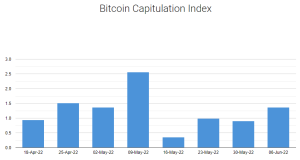

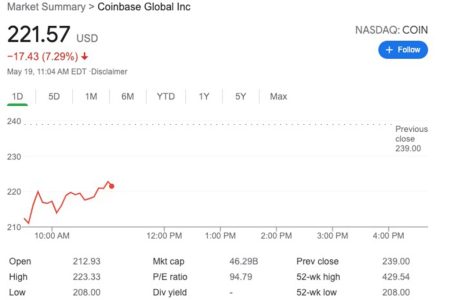

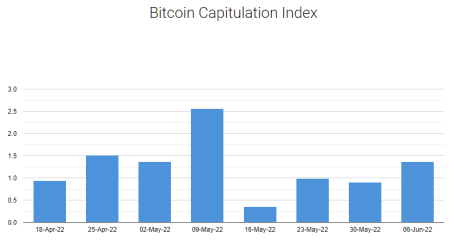

The leverage ratio for BTC-USDT perpetual contracts plays a crucial role in the trading dynamics of Bitcoin. As noted by CryptoQuant CEO Ki Young Ju, the leverage ratio has been cooling down, reflecting a stabilization in trading behavior among investors. A cooling leverage ratio indicates that traders are adopting a more cautious approach, which could help mitigate the risks associated with overleveraging in a volatile cryptocurrency market. This shift is a critical signal for traders keen on maximizing their investment returns while managing liquidation risks.

Historically, high leverage ratios can lead to massive price spikes or dips, triggering liquidations for both long and short positions. The recent trend of a decreasing BTC-USDT leverage ratio, particularly following heavy inflows of funds from MicroStrategy (MSTR) and cryptocurrency ETFs, suggests a market recalibration. As funding from these institutional players becomes less impactful in influencing market sentiment, traders may find it prudent to reduce their exposure, thereby lowering the overall risk of liquidation.

The Impact of MSTR and Crypto ETFs on BTC Trading

The influx of capital from MicroStrategy and crypto ETFs has significantly shaped the landscape for Bitcoin trading. These institutional investments have instilled a sense of legitimacy and reliability in the cryptocurrency market. However, as the CryptoQuant CEO mentioned, this influx appears to be tapering off, allowing the leverage ratios to normalize. The transition reflects ongoing cryptocurrency market trends that signal a return to more traditional trading practices, focusing on sustainable growth rather than speculative bubbles.

Furthermore, with the diminishing influence of MSTR funds and ETFs, traders are being more selective about their positioning in the market. This scenario is leading traders to recalibrate their strategies by reducing leverage, which in turn decreases their exposure to potential liquidation events. Understanding the correlation between institutional investments and leverage ratios is essential for traders who want to navigate the complexities of the crypto market effectively.

Bitcoin Liquidation Risks in Today’s Market

Bitcoin liquidation risks have been a daunting concern for traders, particularly during periods of high volatility. With fluctuating leverage ratios, there is always a potential danger of positions being liquidated, resulting in significant monetary losses. As the market stabilizes post-ETF approval, traders are advised to remain vigilant about their risk exposure, especially when leveraging their investments in Bitcoin. Lowering leverage can serve as a strategic move to ensure that they do not fall victim to sudden market downturns.

Additionally, monitoring Bitcoin liquidation risks involves analyzing various market indicators, including trading volume and investor sentiment. In the context of MSTR funding and crypto ETF impacts, it’s essential for traders to stay informed about how these dynamics influence overall market health. A recalibration in leverage ratios can often indicate a shift in trader confidence, signaling the need for adaptive strategies to mitigate risks inherent in the crypto space.

The Role of Crypto Market Trends in BTC Trading

Recent trends in the cryptocurrency market indicate a shift toward more disciplined trading practices, influenced by macroeconomic factors and institutional interests. As noted by various analysts, the cooling leverage ratio signifies a growing awareness among traders of the risks associated with aggressive positions. With ongoing volatility, being attuned to broader market trends is essential for traders who wish to make informed decisions regarding their BTC investments.

In essence, crypto market trends not only affect individual asset performance but also contribute to the overall trading environment. The interplay between market sentiment, regulatory developments, and institutional participation creates a complex framework that traders need to navigate. As leverage ratios stabilize, understanding these trends can help traders adjust their strategies to achieve more favorable outcomes amid the ever-evolving landscape of cryptocurrency.

Strategies for Managing BTC Leverage in Trading

Managing BTC leverage effectively is crucial for traders seeking to enhance their market positions while minimizing risks. As the BTC-USDT leverage ratio cools down, traders are encouraged to adopt strategies that prioritize risk management over speculative gains. This can include setting appropriate stop-loss levels, diversifying portfolios, and recalibrating leverage to avoid exposure to drastic market changes that could lead to liquidations.

Moreover, staying informed about market trends and institutional movements, such as those from MSTR and ETFs, can provide valuable insights into optimal leverage levels. Traders can benefit from historical data and analysis to forecast potential liquidity events that may arise from sudden shifts in market conditions. By developing a comprehensive trading strategy that incorporates these factors, individuals can better navigate the complexities of the cryptocurrency market.

Analyzing Bitcoin Market Sentiment

Understanding Bitcoin market sentiment is crucial for anticipating price movements and potential liquidity crises. Market sentiment is often influenced by various factors, including news on institutional investments and regulatory developments. The impact of MSTR and ETF activities can sway trader confidence, leading to either bullish or bearish movements in Bitcoin’s price. By closely monitoring these sentiments, traders can make more educated decisions regarding their leverage and position sizes.

Analyzing market sentiment tools, such as sentiment analysis platforms, can provide insights into trader behavior and potential market shifts. As the leverage ratio for BTC-USDT contracts evolves, keeping an eye on sentiment indicators can help traders adjust their strategies accordingly. A nuanced understanding of the market atmosphere prepares traders to optimize their performance while minimizing risks associated with leverage.

Forecasting Future BTC Price Movements

Forecasting future BTC price movements involves analyzing historical data, current market conditions, and upcoming financial events. With the current cooling of the BTC-USDT leverage ratio, traders are presented with an opportunity to evaluate long-term price predictions based on more stable market conditions. This is particularly relevant for those looking to capitalize on possible price appreciation without falling into liquidation traps.

Special attention should be given to factors such as macroeconomic conditions, social trends regarding cryptocurrency adoption, and institutional investment behaviors. These components often set the stage for Bitcoin’s price trajectory, especially during critical moments of market transition. By integrating these elements into trading analysis, traders can place themselves in a favorable position to anticipate movements and leverage their investments wisely.

The Future of Cryptocurrency ETFs

The future of cryptocurrency ETFs is a pivotal aspect for traders and investors alike. As more regulatory clarity emerges, the potential for new ETF products can continue to shape market dynamics. Currently, the impact of existing cryptocurrency ETFs is apparent, influencing leverage ratios and overall market sentiment. The trend suggests an evolving landscape where Bitcoin could become more accessible to mainstream investors, subsequently affecting its pricing and associated risks.

Moreover, the performance of BTC relative to ETF inflows signals a new phase in Bitcoin trading. As institutional liquidity stabilizes, the ripple effect on leverage levels can enhance investor confidence, thereby changing the risk-reward equation for traders. Keeping an eye on developments in the ETF space will be essential for those navigating future Bitcoin trades and leverage considerations.

Mitigating Risks in Cryptocurrency Trading

Mitigating risks is an indispensable aspect of successful cryptocurrency trading. With the high volatility associated with digital currencies, particularly Bitcoin, traders must employ various strategies to protect their investments. By understanding the significance of cooling leverage ratios, traders can gauge the climate of the market effectively. A reduction in leverage ratios often implies the need for traders to adopt more cautious trading strategies.

The risks of liquidation become increasingly pertinent as leverage is heightened. Traders should consistently assess their positions and be prepared to adjust their leverage based on market signals. By prioritizing risk management and ensuring robust trading plans, investors can navigate the unpredictable nature of the crypto markets with greater assurance.

Frequently Asked Questions

What does the BTC-USDT leverage ratio indicate in cryptocurrency trading?

The BTC-USDT leverage ratio is a key metric that indicates the degree of leverage used in trading Bitcoin against the USDT (Tether). A high leverage ratio means traders are taking on more risk with larger positions, which can lead to significant liquidation risks if the market turns against them.

How does the BTC-USDT leverage ratio affect Bitcoin liquidation risks?

The BTC-USDT leverage ratio directly influences Bitcoin liquidation risks. When the leverage ratio is high, it suggests that many traders are using significant leverage for their long positions. If the market moves unfavorably, this can trigger mass liquidations, causing prices to drop sharply.

Why is the cooling BTC-USDT leverage ratio significant for cryptocurrency market trends?

A cooling BTC-USDT leverage ratio signifies that traders are becoming more cautious, reducing their exposure to risk. This change can stabilize cryptocurrency market trends as it reduces the likelihood of abrupt price swings associated with excessive leverage.

What impact do MSTR funds have on the BTC-USDT leverage ratio?

MSTR funds, which refer to investments by MicroStrategy in Bitcoin, have affected the BTC-USDT leverage ratio by injecting significant capital into the market. As these funds stabilize and the entry of ETFs slows, the leverage ratio is returning to healthier levels, reducing the likelihood of excessive long position liquidations.

How have recent ETF approvals influenced the BTC-USDT leverage ratio?

Recent ETF approvals initially contributed to a high BTC-USDT leverage ratio as liquidity surged and speculative trading increased. As the market adjusts, the leverage ratio is normalizing, moving back to levels seen prior to these approvals, indicating a more balanced trading environment.

What role does leverage trading play in the volatility of the BTC-USDT market?

Leverage trading amplifies both gains and losses in the BTC-USDT market, significantly contributing to its volatility. High leverage can lead to sharp price movements due to rapid liquidations; thus, monitoring the leverage ratio is crucial for understanding market dynamics.

Can changes in the BTC-USDT leverage ratio signal future trends in Bitcoin prices?

Yes, changes in the BTC-USDT leverage ratio can signal potential future trends in Bitcoin prices. A declining leverage ratio generally signals a stabilization in the market, while an increasing ratio may indicate growing speculation that could lead to price volatility.