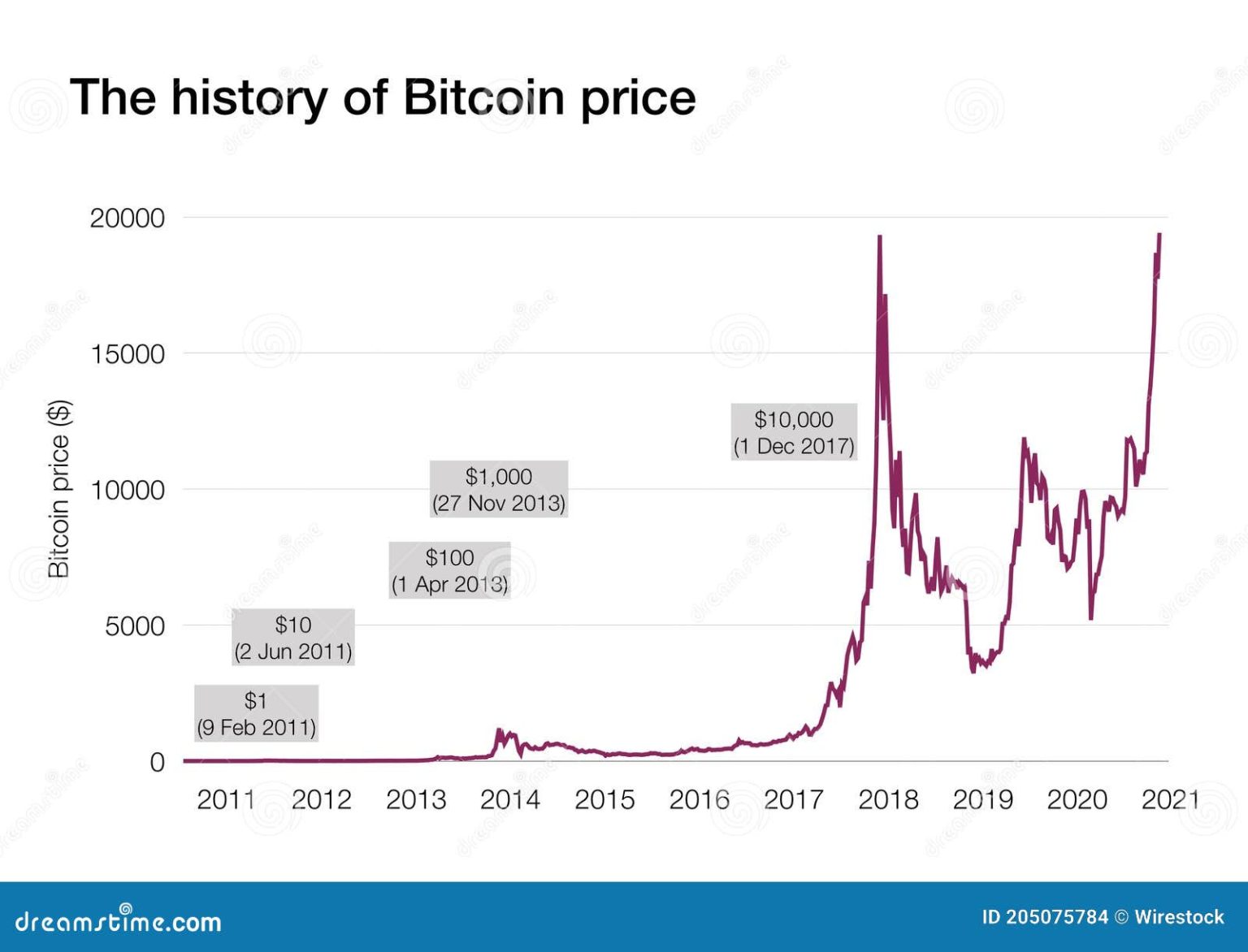

Bitcoin price analysis shows an intriguing dynamic as the cryptocurrency navigates through fluctuating market conditions. Recent trends indicate that while there has been some improvement in the macro environment, Bitcoin struggles with inadequate technical recovery. Despite growing indicators and a weakening dollar that generally support risk assets, Bitcoin’s resistance levels have become a point of contention, halting its upward momentum. A closer look reveals that earlier support zones have transformed into new resistance, complicating recovery phases. In this context, investors are keenly observing Bitcoin’s price movements, as they assess the impact of macroeconomic changes and technical signals on future trading strategies.

Exploring the current landscape of digital currencies, the analysis of Bitcoin’s value fluctuations presents a compelling narrative of market behavior. With various influencing factors such as market trends, technical evaluations, and the broader economic backdrop, the pathways for Bitcoin are becoming increasingly complex. Recently, the cryptocurrency has found itself battling critical resistance points, challenged by shifts in investor sentiment and structural changes. As we delve into its recovery cycles, it’s evident that the interplay of technical metrics and economic signals will dictate Bitcoin’s trajectory in the near future. This multifaceted examination of Bitcoin’s price dynamics is crucial for stakeholders aiming to navigate the evolving landscape of virtual currencies.

| Key Points | Details |

|---|---|

| Recent Bitcoin Retracement | Bitcoin has retraced quickly to a key downward target area, caught between improving macro conditions and inadequate technical recovery. |

| Growth Indicators | Growth indicators are rebounding, fiscal strength is increasing, and the dollar is weakening, which typically supports risk assets. |

| Technical Perspective | Key trend levels have been breached; earlier support zones have become resistance, indicating a corrective recovery rather than an actual trend change. |

| Capital Dynamics | Significant capital from higher price ranges has entered; however, this could lead to upward supply pressure if new support is not established. |

| Cyclical Position | Currently positioned towards the upper area of the cycle, with historical trends suggesting potential for price declines or weak consolidations. |

| Selling Pressure | High levels of crowded positions may prioritize cost recovery, making it difficult for new buying to overcome selling pressure. |

Summary

The Bitcoin price analysis indicates that while there are positive macroeconomic developments, Bitcoin struggles to establish a strong upward trend. The technical indicators suggest that the recent price movements are more of a correction rather than a formidable recovery phase. Factors such as the entering of capital at higher levels and the historical positioning within the cycle could hinder Bitcoin’s potential for sustained price increases. Investors should remain cautious as the balance between selling pressure and new buying continues to pose a challenge.

Understanding Bitcoin Price Analysis in Current Market Conditions

The Bitcoin price analysis is critical to understanding how the digital currency reacts to shifting market conditions. According to the latest weekly report from Matrixport, Bitcoin has retraced quickly, highlighting its volatility and sensitivity to broader economic indicators. Despite improvements in the macro environment, such as a weakening dollar and rising fiscal strength, Bitcoin has not yet confirmed a significant reversal from its recent downward trend. This indicates that investors are still cautious and waiting for clearer signals before committing further capital.

Recent price movements suggest that Bitcoin is caught in a complex market environment. The technical analysis of Bitcoin reveals that key trend levels designed to differentiate recovery phases from downturns have been crossed, losing their significance. This situation complicates investment decisions, as prior support zones now serve as overhead resistance, making it difficult for Bitcoin to break through and maintain upward momentum. Investors must closely monitor price patterns and resistance levels to gauge the potential for a breakout.

Analyzing Bitcoin Market Trends: Short-Term Volatility and Long-Term Prospects

In the context of current Bitcoin market trends, we observe notable short-term volatility that contrasts sharply with potential long-term growth. Even with the supportive macroeconomic indicators, Bitcoin is struggling to carve out a sustainable upward trajectory. Market participants need to understand that while growth indicators show promise, this is often accompanied by phases of retracement where instability can reign, impacting overall price movements. Investors should look for trends that indicate when the recovery phases may align with broader economic improvements.

The limited support observed despite favorable macro trends underscores a key aspect of market behavior. Many traders who have entered positions at higher prices tend to adopt a cautious approach during rebounds, which contributes to the wavering nature of Bitcoin’s recovery. This creates a scenario where selling pressure could outweigh new buying activity, giving rise to further fluctuations in price. To navigate these tumultuous waters, analysts need to consider both immediate price actions and historical patterns to predict future movements accurately.

Technical Analysis of Bitcoin: Is Recovery on the Horizon?

Technical analysis of Bitcoin suggests that its recent movement resembles a corrective recovery rather than a definitive shift in trend or structure. As discussed in Matrixport’s report, earlier support levels have turned into significant resistance, indicating that the path to recovery will require breaking through these hurdles. Investors must remain vigilant during this period of technical correction to ascertain potential entry points or to re-evaluate their investment strategies based on market developments.

Moreover, the behavior of market participants during recovery phases plays a crucial role in determining future Bitcoin price action. With funding structures heavily dependent on previously established positions, many investors are prioritizing a recovery of their entry costs over aggressive buying. This dynamic complicates the ability of Bitcoin to gain sustainable momentum, as sellers may dictate movements in price due to a lack of fresh buying interest in the short term.

The Influence of the Macro Environment on Bitcoin Prices

Examining the macro environment’s influence on Bitcoin prices reveals critical insights into market dynamics. The recent trends indicate a supportive macroeconomic backdrop, with factors such as fiscal strength and a weakening dollar potentially favoring risk assets like Bitcoin. However, despite these conditions, Bitcoin has not shown substantial resilience in its price levels, underscoring that macro improvement does not always equate to immediate stability in cryptocurrency prices.

Additionally, historical data suggests that during similar macro phases where conditions improve, Bitcoin often experiences weak consolidation or further declines before establishing a new baseline. This delay can be attributed to high levels of crowded positions among investors, creating a reluctance to push prices higher without the validation of sustained buying pressure. Understanding these macro influences is essential for investors seeking to build strategies aligned with Bitcoin’s price trajectory.

Identifying Bitcoin Resistance Levels: Barriers to Recovery

Identifying Bitcoin resistance levels is crucial for any trader looking to navigate recent price actions effectively. The transition of previous support zones to resistant levels poses challenges for Bitcoin’s recovery phase. Market analysis suggests that unless Bitcoin can successfully breach and hold these resistance levels, the likelihood of a sustainable upside trajectory remains uncertain.

Trading strategies should be informed by these resistance markers, as they can signal potential reversals and help manage risk effectively. Observers note that the recent cap on price movement indicates a crucial battle between buyers aiming to propel Bitcoin forward and sellers looking to capitalize on elevated prices. Thus, understanding the complexities surrounding Bitcoin’s resistance levels will be necessary for participants in this evolving market.

Navigating Bitcoin Recovery Phases: Strategies for Investors

Navigating Bitcoin recovery phases requires a strategic approach in light of current market signals. With the ongoing volatility and mixed indicators from the macro environment, investors are urged to develop flexible strategies that can adapt to rapid fluctuations. Investing during recovery phases can be particularly rewarding, but it is essential to understand the associated risks and the possibility of further corrections.

Moreover, as Bitcoin attempts to build momentum following its latest retracement, capital inflows and investor sentiments will play decisive roles in shaping its trajectory. A strategic mindset should include the readiness to reassess positions frequently, taking into account changes within the macroeconomic landscape and the behavior of Bitcoin’s resistance levels. This careful navigation will be vital for capitalizing on Bitcoin’s potential recoveries amidst uncertainty.

The Role of Technical Indicators in Bitcoin Trading Decisions

The role of technical indicators in Bitcoin trading decisions cannot be overstated, especially in a market characterized by high volatility and uncertainty. Traders often rely on various technical analysis tools to gauge the strength of price movements and predict potential reversals. As reported by Matrixport, breaches in key trend levels signal an urgent need for traders to reconsider their strategies and monitor how these conditions may evolve.

To enhance decision-making, traders should employ a combination of technical indicators to assess market conditions more holistically. Indicators that illustrate momentum, volume changes, and relative strength can provide insights into when to enter or exit positions, particularly during recovery phases. As investors adapt to the changing landscape, leveraging technical indicators will be key to navigating the complexities of Bitcoin trading effectively.

Cyclical Perspectives on Bitcoin Pricing: Lessons from History

Taking a cyclical perspective on Bitcoin pricing sheds light on how historical trends inform present behavior in the market. Historical analysis indicates that even in favorable macro conditions, Bitcoin prices often go through cycles of retracement and consolidation. Investors should be cognizant of these patterns, which suggest caution when navigating through bullish sentiment.

Moreover, learning from past cycles can help investors anticipate future price behavior. As seen in previous phases, overzealous positions can lead to retreats, making it essential for current market participants to strike a balance between optimism regarding macro trends and realism about Bitcoin’s potential price trajectory. Such an approach can mitigate risks associated with Bitcoin’s inherent volatility.

Impact of Market Sentiment on Bitcoin Price Movements

Market sentiment plays a significant role in shaping Bitcoin price movements, acting as both a catalyst and a barrier to growth. Positive sentiment regarding the macro environment can lead to increased interest in Bitcoin as a risk asset; however, without corresponding buying pressure, shifts in sentiment can also lead to sudden price declines. The recent report by Matrixport illustrates how Bitcoin remains at the mercy of prevailing perceptions, making sentiment analysis a critical component of market strategy.

To effectively harness market sentiment, traders should incorporate psychological factors into their trading approaches. Monitoring sentiment indicators can provide valuable insights into when to increase or decrease exposure to Bitcoin. As the market continues to evolve, understanding the nuances of how sentiment interacts with technical and macro factors will be essential for making informed investment decisions.

Frequently Asked Questions

What are the current Bitcoin market trends based on recent price analysis?

Current Bitcoin market trends indicate that, despite a recent downward retracement and recovery phases, Bitcoin is struggling to establish a robust upward trend due to inadequate technical recovery. The analysis shows vulnerabilities around prior support levels that have flipped to resistance, impacting its ability to maintain price stability.

How does technical analysis of Bitcoin indicate potential price movements?

Technical analysis of Bitcoin reveals that critical resistance levels have been breached, suggesting that recent price rebounds are corrective in nature rather than indicative of a trend reversal. Analysts focus on these metrics to determine whether the market may shift from its current phase of instability.

What role does the macro environment play in Bitcoin price analysis?

The macro environment has a significant influence on Bitcoin price analysis. Recent reports indicate that improving macro conditions, such as increasing fiscal strength and a weakening dollar, could have a positive effect on risk assets like Bitcoin. However, translating these improvements into sustained upward price momentum has proven challenging.

What are Bitcoin resistance levels and why are they important for price analysis?

Bitcoin resistance levels are specific price points where selling pressure tends to overcome buying pressure, making it difficult for the asset to rise above those levels. Identifying these levels is crucial in price analysis, as they can provide insight into potential reversals or continuation patterns in Bitcoin’s price action.

How do Bitcoin recovery phases affect price prediction?

Bitcoin recovery phases indicate periods where the asset attempts to regain lost value after a price decline. However, current analysis suggests that recent recoveries may not lead to significant price increases due to prior losses of key trend levels, making it essential to monitor upcoming price behaviors for effective forecasting.