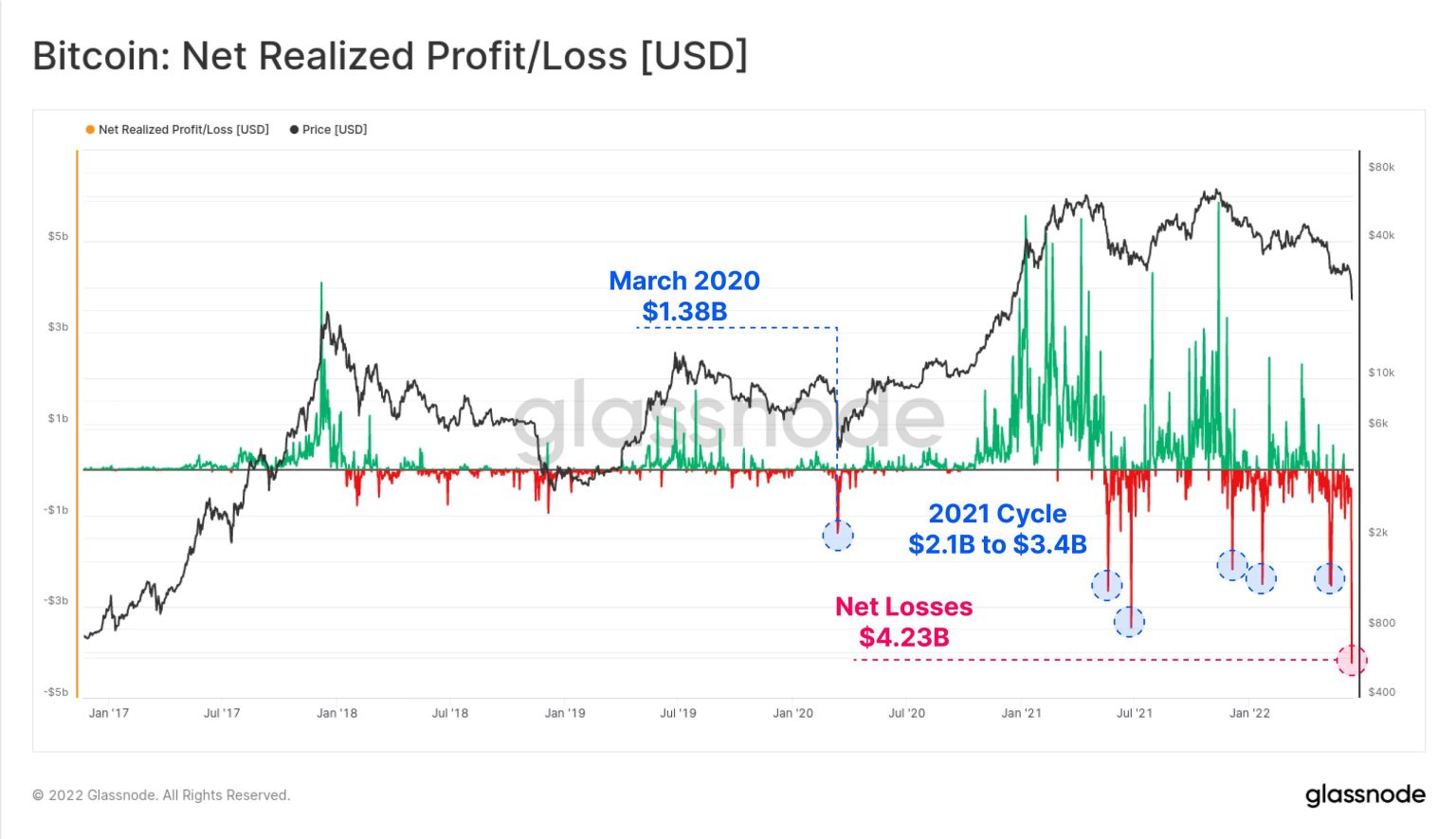

BTC realized losses have taken center stage in the ongoing analysis of the cryptocurrency market, as the recent wave of market panic has triggered substantial financial repercussions. On February 5, on-chain analyst Murphy reported that these losses, adjusted for entity-specific withdrawals, surged to a staggering $3.2 billion, marking the highest recorded in Bitcoin history. This dramatic figure not only eclipses previous tumultuous events such as the collapse of Luna and the infamous FTX failure, but it also underscores a significant shift in investor sentiment within the Bitcoin market. Such alarming statistics highlight the severity of the current crypto market analysis, painting a vivid picture of panic-induced liquidations. As we approach the trends expected in 2026, understanding these BTC losses will be crucial for investors hoping to navigate the turbulent waters of the digital currency landscape.

Recent developments in the cryptocurrency space have revealed noteworthy trends in the realm of Bitcoin losses, often referred to as realized losses. This phenomenon encapsulates the actual financial setbacks investors face when they exit positions, particularly during periods of extreme market anxiety. The considerable fluctuations observed in the BTC market mirror broader patterns of distress that ripple across the crypto industry, including significant events that affect market sentiment. As volatility reigns and traders assess their positions, on-chain metrics highlight the impact of these losses, providing critical insights into investor behavior. Engaging with these dynamics is essential for grasping the evolving landscape of digital assets and anticipating future shifts in trading trends.

| Date | BTC Realized Losses (in Billion $) | Impact Compared to Past Events | Notes |

|---|---|---|---|

| February 5, 2026 | $3.2 billion | Exceeds: Luna Collapse, FTX Failure, March 12 & May 19 Events | Not influenced by black swan events. |

| November 21, 2025 | Adjusted Data | Previous significant losses observed | Data later adjusted due to Coinbase wallet restructuring. |

Summary

BTC realized losses have reached alarming levels, with reports indicating a staggering $3.2 billion in losses as of February 5, 2026. This unprecedented figure highlights the impact of market panic, surpassing previous major events in cryptocurrency history. The current losses are documented without the complications of recent black swan events, illustrating a clear reaction from entities within the market.

Understanding BTC Realized Losses Amid Market Panic

The recent fluctuations in Bitcoin’s market price have ignited panic among investors, leading to significant realized losses. On-chain analysts have reported that the current losses for Bitcoin (BTC), following an unprecedented tumult, reached an alarming $3.2 billion. This figure not only reflects the immediate consequences of investor fear but also highlights broader trends in the crypto market where panic can trigger mass sell-offs. Observing these numbers helps us take a crucial look at the implications of on-chain analysis in understanding BTC’s market behavior.

Such dramatic losses have not been seen since historic moments in cryptocurrency history, such as the collapse of the Luna ecosystem or the infamous FTX scandal. Unlike these black swan events that significantly disrupt market stability, the current Bitcoin realized losses are a result of genuine market reactions. By unpacking the reasons behind these losses, investors can better equip themselves against future downturns while understanding the elements shaping the 2026 crypto trends.

Impact of Market Panic on Bitcoin’s Stability

Market panic can have significant ramifications on Bitcoin’s stability, influencing not just price movements but investor behavior as well. As seen recently, the record-setting realized losses indicate that many traders have been forced to liquidate positions in fear of further declines. Such actions contribute to a vicious cycle in the crypto market, exacerbating volatility and creating a detrimental environment for both new and seasoned investors. Through crypto market analysis, we can dissect the factors that have led to this heightened state of market anxiety.

Furthermore, on-chain analysis provides invaluable insights into market trends, allowing participants to gauge the health of the Bitcoin ecosystem. Tools and metrics used to analyze BTC loss records can predict potential market behavior, ensuring that savvy investors stay ahead of 2026 crypto trends. Understanding this cyclical nature of fear and market reaction can help quell panic and foster a more stable investing climate in the future.

Analyzing Historical Loss Trends in Bitcoin

Historically, the Bitcoin market has experienced several dramatic fluctuations that often correlate with external factors and internal market fears. Each significant decline is often accompanied by an influx of realized losses, showcasing the essential relationship between market conditions and investor psychology. A crucial period to analyze is back in November 2025, where realized losses were reflected similarly on on-chain analysis platforms, leading to substantial investor retrenching.

By conducting a deeper analysis of these historical loss trends, investors can better anticipate potential downturns and prepare for the subsequent recoveries. For example, understanding how the aftermath of events like the FTX collapse influenced market perception can provide insights into future BTC loss records. Knowledge of these patterns is vital as we delve into the evolving landscape of cryptocurrency investment leading into 2026.

The Role of On-Chain Analysis in Understanding BTC Losses

On-chain analysis has emerged as a pivotal tool for comprehending Bitcoin’s performance amidst the chaos of market panic. By examining blockchain data, investors can glean essential insights regarding realized losses and overall market sentiment. The recent surge to $3.2 billion in losses highlights the necessity of this analytical approach, especially as it adjusts for entity-specific behavior and provides a clearer picture of market conditions.

Utilizing on-chain metrics enables a comprehensive understanding of how large holders and entities react during periods of fear, reinforcing the relevance of proactive engagement in the crypto market. Analyses that incorporate both current events and historical data create a robust framework for predicting market trends and upcoming BTC performance. Striving to understand these patterns allows individuals to make informed decisions, ultimately mitigating panic responses.

Forecasting Crypto Market Trends for 2026

As the Bitcoin market evolves, predicting crypto market trends for 2026 becomes increasingly vital for investors. The volatility witnessed in early 2026 serves as a reminder of the ever-changing landscape of digital assets, where investor sentiment can pivot rapidly. With recent record-setting losses in mind, forecasters are taking a closer look at upcoming patterns that may emerge and affect Bitcoin’s long-term viability.

Emerging trends such as increasing institutional adoption of Bitcoin and evolving regulatory landscapes are vital in shaping the future of cryptocurrency. By analyzing these predictive elements alongside realized losses from the current downturn, investors can better position themselves for potential price surges. Keeping an eye on these developments paves the way for responsible investing in a market that remains both unpredictable and full of potential.

The Correlation Between Market Events and BTC Price Volatility

Understanding the correlation between market events and Bitcoin’s price volatility is crucial for those navigating the volatile crypto landscape. Each downturn or peak is often influenced by a series of interconnected factors, including macroeconomic shifts, regulatory announcements, and technological advancements. The recent panic-induced realized losses remind us that market sentiment can sway rapidly, turning optimism into fear in a matter of hours.

Moreover, historical examples, including the events surrounding the FTX collapse and the Luna debacle, reveal significant shifts in market dynamics that lead to extreme price fluctuations. Approaching these events with a focus on their long-term impact can foster more rational investment decisions, as identifying trends in crypto market analysis allows investors to discern the underlying causes of such volatility.

Mitigating Investment Risks During Market Downturns

In the face of market downturns characterized by realized losses, investors must develop strategies to mitigate risk effectively. Panic selling often amplifies market declines, underscoring the importance of a disciplined investment approach. Tools like dollar-cost averaging can alleviate the effects of sudden price drops, enabling investors to accumulate Bitcoin more strategically over time, rather than reacting impulsively to fleeting market conditions.

Another key element in risk management is continuous education on market trends and technological advancements within the crypto ecosystem. By staying informed through proper channels and utilizing on-chain analysis, investors can adapt their strategies to preserve capital during turbulent times. Furthermore, understanding the psychological aspects of investing can empower individuals to resist the urge to panic sell, contributing to a healthier market environment.

The Future of Cryptocurrency and Market Psychology

As we look forward to the future of cryptocurrency, understanding market psychology becomes increasingly pivotal in shaping investor behavior. Past experiences with panic-driven losses serve as a guide for the next generation of crypto investors, who must grasp the nuances of navigating turbulent market conditions. Awareness of how collective fear influences market dynamics can inform a more measured approach to investment.

The psychological impact of events like the recent $3.2 billion realized losses in BTC prompts a reevaluation of not only individual strategies but also collective market sentiment. Moving into 2026, fostering a community focused on resilience and informed decision-making can help stabilize the market. By promoting awareness about historical loss trends and embracing a mindset geared towards understanding rather than fear, the future of cryptocurrency remains bright.

Navigating the New Normal in Bitcoin Investing

The current landscape of Bitcoin investing has been reshaped significantly by the recent series of market events that led to unprecedented realized losses. As investors navigate this new normal, it becomes imperative to adopt frameworks that are responsive to ongoing volatility. Historical data, when integrated with advanced on-chain analytics, can guide investors in making rational choices rather than being driven by fear.

In this transformed investing environment, awareness of potential future trends, both positive and negative, is critical for maintaining confidence in cryptocurrency. Recognizing the cyclical nature of the market and incorporating risk management strategies can empower investors to embrace the opportunities ahead while acknowledging the inherent risks involved in Bitcoin and broader crypto investments.

Frequently Asked Questions

What are BTC realized losses and why are they significant in crypto market analysis?

BTC realized losses refer to the losses incurred when Bitcoin is sold or transferred at a price lower than its purchase price. They are significant in crypto market analysis as they reflect true market sentiment and panic, impacting the overall valuation of Bitcoin and influencing investor decisions.

How did the recent Bitcoin market panic contribute to the record BTC loss?

The recent Bitcoin market panic resulted in a staggering realized loss of $3.2 billion, as noted by on-chain analysts. This figure indicates that many investors sold their holdings at a loss, which typically signifies a high level of fear within the crypto community, influencing the broader market dynamic.

What does the BTC loss record indicate about current market trends?

The BTC loss record of $3.2 billion is a stark indicator of market distress and may suggest further bearish trends in the crypto market. Such significant losses often lead to increased volatility and can attract attention from long-term holders and analysts who study the implications of panic selling.

How can on-chain analysis BTC help investors understand realized losses?

On-chain analysis BTC provides insights into transaction histories, including realized losses, helping investors gauge market trends and sentiments. By analyzing transaction data, investors can understand when and why significant losses occur, facilitating more informed investment decisions.

What implications do BTC realized losses hold for 2026 crypto trends?

The implications of BTC realized losses might shape 2026 crypto trends by indicating to investors the potential for recovery or further decline. If losses are realized at a large scale, it may lead to increased caution among investors and affect future market strategies and innovations in the crypto space.