Metaplanet is navigating uncharted waters as it restructures its approach to investment and growth, under the vigilant leadership of CEO Simon Gerovich. As he recently shared on the X platform, the company’s core strategy remains unwavering despite the recent fluctuations in stock price trends and challenges within the shareholder situation. With a keen focus on bolstering its BTC holdings, Metaplanet aims to enhance its profitability while preparing for a robust future. This steadfast commitment positions Metaplanet as a potential frontrunner in the tech industry landscape, creating new opportunities for investors and stakeholders alike. The company’s strategic framework will be essential in weathering market volatility and seizing growth in the evolving digital currency landscape.

In the face of significant market shifts, Metaplanet is focusing on refining its operational strategies to enhance investor confidence. Under the guidance of Simon Gerovich, the firm is doubling down on its cryptocurrency investments, particularly Bitcoin, to fortify its asset base amid challenging shareholder dynamics. The current focus is on understanding the correlations between stock price trends and digital asset performance, aiming to leverage these insights for future growth. By maintaining a clear vision and robust investment strategy, Metaplanet is set to navigate the complexities of the tech and financial sectors. This proactive approach reinforces their position as a pivotal player in innovation and investment within the digital marketplace.

| Key Points |

|---|

| Metaplanet’s CEO, Simon Gerovich, addressed the company’s strategy amid stock price trends. |

| The company will maintain its current strategy despite challenges faced by shareholders. |

| Metaplanet plans to increase its Bitcoin (BTC) holdings. |

| The focus will be on expanding profits in the upcoming phases. |

| The company is preparing for future growth despite market volatility. |

Summary

Metaplanet is strategically positioned to navigate market challenges as highlighted by CEO Simon Gerovich’s recent statement. By staying the course with their approach to increasing Bitcoin holdings, Metaplanet aims to not only secure profits but also ensure growth in the coming phases. This steadfastness in strategy demonstrates Metaplanet’s commitment to its shareholders’ interests and their drive towards long-term sustainability.

Metaplanet’s Unwavering Strategy Amid Volatile Stock Prices

In his recent announcement on the X platform, Metaplanet CEO Simon Gerovich highlighted the company’s commitment to its strategic direction despite the turmoil in stock price trends. The current market fluctuations have not swayed Metaplanet’s objectives. Instead, the firm remains resolute in its plans to bolster its Bitcoin (BTC) holdings. By doing so, Metaplanet aims to fortify its financial foundation, enabling it to navigate through the uncertainties and emerge stronger in the competitive landscape.

This steadfast approach is essential, particularly in today’s economic climate where shareholder confidence is paramount. The severe situation faced by shareholders requires not just reassurance but also actionable steps demonstrating that Metaplanet is in control of its destiny. By maintaining and expanding BTC holdings, Metaplanet is strategically positioning itself to capitalize on future market uptrends, regardless of present adversities.

Understanding Shareholder Dynamics and Growth Opportunities

Shareholder situations often shape a company’s strategic maneuvers, and for Metaplanet, this is no different. As the company evaluates current stock price trends, it becomes increasingly crucial for Metaplanet to communicate effectively with its shareholders. Simon Gerovich’s transparency regarding the company’s intentions serves to alleviate concerns while highlighting the dedication to enhancing shareholder value. Making informed decisions on BTC holdings not only signals stability but also reflects the potential for significant returns in the long run.

Moreover, by keeping shareholders informed about the ongoing strategy and anticipated growth phases, Metaplanet fosters a relationship of trust and collaboration. As the market evolves, adapting investment strategies will be key. Metaplanet’s proactive stance will not only help in navigating the present challenges but will also set a robust foundation for capitalizing on emerging opportunities, ultimately benefiting both the company and its investors.

Strategic Growth: BTC Holdings and Future Prospects

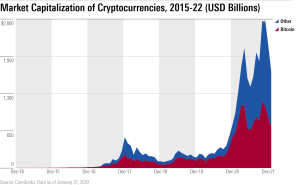

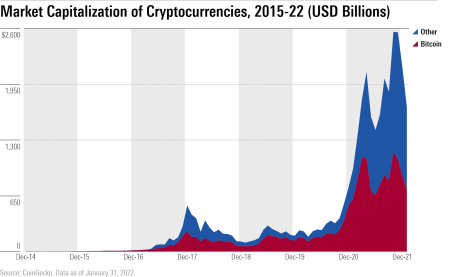

Metaplanet’s strategic growth plan places significant emphasis on increasing its BTC holdings, reflecting a forward-thinking approach to investment in digital currencies. As traditional financial markets face volatility, Bitcoin presents an opportunity to diversify assets and mitigate risk. Simon Gerovich emphasized that as Metaplanet advances to the next phase of growth, Bitcoin will play a critical role in securing profits and navigating through unpredictable market conditions.

Furthermore, leveraging BTC holdings as part of their investment strategy could lead to higher returns compared to conventional investments, particularly if Bitcoin continues its bullish trend. This approach not only enhances Metaplanet’s financial strength but also demonstrates to shareholders a robust commitment to future growth possibilities. By aligning its growth strategy with market trends in cryptocurrency, Metaplanet is poised to redefine its offerings and create lasting value for its investors.

Market Resilience and Adaptation to Shareholder Needs

In the face of continuous market evolution, Metaplanet’s resilience and adaptability become defining characteristics under Simon Gerovich’s leadership. As the company navigates recent stock price trends, it remains vigilant in addressing the needs and concerns of its shareholders. The acknowledgment of a challenging shareholder situation reflects a cognizance of market realities, proving Metaplanet’s commitment to fostering a supportive investor environment.

This focus on shareholder needs is complemented by a strategic framework that emphasizes flexibility. Market resilience is crucial, and Metaplanet aims to adapt its business model and investment strategies continuously to stay ahead of economic shifts. By aligning its BTC holdings and overall strategy with shareholder interests, Metaplanet not only secures its operational objectives but also earns the trust and loyalty of its investor base.

Future of Cryptocurrency Investments: A Metaplanet Perspective

As cryptocurrency continues to reshape the financial landscape, Metaplanet’s approach, led by Simon Gerovich, positions the company at the forefront of innovation in this sector. The decision to prioritize BTC holdings is indicative of a broader trend towards digital assets as viable investment vehicles. By taking a proactive stance, Metaplanet aims to not only secure profits but also take advantage of the dynamic shifts within the cryptocurrency market.

The advancements in digital currency adoption suggest that companies like Metaplanet will need to remain agile, adapting their strategies based on the evolving trends and market responses. By fostering a culture of continuous learning and embracing new technologies, Metaplanet is preparing itself for long-term success, ensuring that it remains relevant in an ever-changing economic landscape that increasingly favors cryptocurrency as a legitimate asset class.

Navigating Investor Sentiment During Financial Challenges

Investor sentiment can often fluctuate significantly during financial challenges, leading to questions about a company’s reliability and future direction. Metaplanet’s leadership understands this dynamic intimately, and Simon Gerovich’s public address was crafted to address these very concerns. By reaffirming the commitment to increasing BTC holdings and focusing on long-term growth, Metaplanet aims to reassure its shareholders, thereby mitigating negative perceptions.

The strategy to maintain transparency with investors also underscores the importance of communication in building confidence. During uncertain times, providing regular updates on market conditions and company strategies enables investors to feel more informed and secure in their decisions. Metaplanet’s emphasis on a supportive approach highlights its dedication not merely to survive the challenges but to thrive and evolve alongside its investor base.

The Interplay Between BTC Holdings and Stock Price Trends

The relationship between Bitcoin holdings and stock price trends is a focal point of Metaplanet’s overall strategy. As a growing number of traditional investors incorporate cryptocurrency into their portfolios, the influence of BTC on stock performance becomes increasingly pronounced. Simon Gerovich recognizes this interplay, noting that by strategically increasing BTC holdings, Metaplanet not only diversifies its assets but also positions itself to benefit from the positive price movements in the digital currency space.

With the increasing acknowledgment of Bitcoin’s potential to act as a hedge against inflation, Metaplanet is poised to harness these benefits to enhance shareholder value. By keeping a close eye on market developments, the company can adapt its strategies in real time. This depth of understanding creates a nuanced approach to investment, enabling Metaplanet to capitalize on favorable trends while managing exposure to volatility.

Building a Stronger Financial Future Through Strategic Bitcoin Investments

In light of the current financial landscape, Metaplanet’s strategy to bolster its BTC holdings represents a significant shift towards digital assets. This move not only aligns with the company’s goal for profit expansion but is also a strategic measure to build a more stable financial future. As Simon Gerovich advocates for this investment path, the correlation between Bitcoin’s growth and increased profitability cannot be overlooked.

Moreover, this strategic investment decision reflects a broader trend within the investment community as companies recognize the value of incorporating cryptocurrency into their financial strategies. By committing to BTC, Metaplanet is not just preparing for the next phase of growth; it is also leading by example in the transition towards a more digitized economy. This foresight positions Metaplanet as a pioneer in adopting an innovative approach to asset management.

Simon Gerovich’s Vision: A Transformative Era for Metaplanet

Under CEO Simon Gerovich’s leadership, Metaplanet is entering a transformative era characterized by strategic foresight and resilience. His recent communications emphasize the necessity of adapting to current market situations while remaining unwavering in the company’s core mission. Gerovich’s vision encompasses not only addressing shareholders’ concerns but also harnessing growth potential through increased BTC holdings, illustrating a balanced approach to risk and opportunity.

In this transformative phase, Metaplanet aims to redefine its identity within the broader market. By continually reassessing its strategies in light of ongoing stock price trends and shareholder dynamics, the company not only strengthens its market position but also contributes to the overarching narrative of sustainability and profitability. This strategic clarity fosters a sense of confidence among investors, ensuring that Metaplanet remains competitive and innovative in an ever-evolving landscape.

Frequently Asked Questions

What is Metaplanet’s strategy for increasing BTC holdings?

Metaplanet’s strategy involves a commitment to progressively increase its BTC holdings, as emphasized by CEO Simon Gerovich. This approach aims to bolster revenues and adapt to changing market conditions.

How are stock price trends affecting Metaplanet’s operations?

Recent stock price trends have highlighted significant challenges for shareholders; however, Metaplanet’s operations remain unaffected. The company is dedicated to its strategy of enhancing BTC holdings and expanding profitability despite external market fluctuations.

Who is Simon Gerovich and what is his role in Metaplanet’s strategy?

Simon Gerovich is the CEO of Metaplanet, and he plays a crucial role in shaping the company’s strategy. Under his leadership, Metaplanet focuses on reinforcing its BTC holdings and addressing shareholder concerns amidst stock price trends.

What is Metaplanet doing to address the shareholder situation?

Metaplanet is actively addressing the shareholder situation by maintaining its strategic focus on increasing BTC holdings and enhancing profitability. CEO Simon Gerovich has communicated that the company’s growth plans remain in place despite current challenges.

Why is increasing BTC holdings important to Metaplanet’s growth strategy?

Increasing BTC holdings is vital to Metaplanet’s growth strategy as it enhances the company’s asset base, provides financial stability, and positions it for future opportunities in the evolving cryptocurrency market. This strategic move is underlined by Simon Gerovich’s commitment to shareholder interests.

What insights can we gain from Simon Gerovich’s recent statements about Metaplanet?

Simon Gerovich’s recent statements highlight Metaplanet’s unwavering strategy amid stock price trends and shareholder concerns. He reassures stakeholders that the company will focus on growing BTC holdings and exploring new avenues for profit in the upcoming growth phase.

How does Metaplanet plan to expand its profits in light of current market conditions?

Metaplanet plans to expand its profits by strategically increasing its BTC holdings and optimizing operational efficiencies. The company is committed to this path as a response to the challenging market conditions and fluctuating stock price trends.