The recent surge in trading activity surrounding the BlackRock Bitcoin ETF has captured the attention of investors as Bitcoin undergoes a tumultuous phase, dropping 12% in just 24 hours. This spike in interest is evidenced by the iShares Bitcoin Trust’s record-breaking daily trading volume of $10 billion, despite the underlying cryptocurrency experiencing a significant price decline. As traders navigate through these choppy waters, the ramifications of the Bitcoin market crash ripple across cryptocurrency trading volume, raising questions about future Bitcoin price trends. With analysts warning of potential crypto investment risks, this scenario underscores the volatility that has long characterized the digital asset space. As we delve deeper into these developments, the dynamics between the BlackRock Bitcoin ETF, market sentiment, and broader economic factors remain essential to understand.

In the midst of a turbulent landscape for digital currencies, the rise of the BlackRock Bitcoin exchange-traded fund (ETF) has emerged as a focal point for market participants. The iShares Bitcoin Trust has gained traction as investors seek avenues to gain exposure to cryptocurrency, particularly during volatile periods like the recent market crash. With significant fluctuations in value, the performance of this fund reflects broader trends observed within the cryptocurrency ecosystem. As investors grapple with the complexities of blockchain-based assets, terms like Bitcoin investment vehicles and digital currency funds are increasingly coming into play. Understanding these financial instruments will be crucial for those looking to navigate the potential risks and opportunities that this evolving market presents.

| Key Point | Details |

|---|---|

| Record Trading Volume | BlackRock’s iShares Bitcoin Trust ETF (IBIT) reached an all-time peak daily trading volume of $10 billion as traders reacted to Bitcoin’s price drop. |

| Market Performance | Bitcoin’s price fell by 12% in 24 hours to $64,000, reflecting a decline of approximately 50% since its all-time high in early October. |

| Net Outflows | On Wednesday, IBIT experienced net outflows of $373.4 million, facing only 10 trading days of net inflows in 2026. |

| Price Drops | IBIT dropped 13% on Thursday, marking its second-largest daily price drop since launch. |

| Analyst Remarks | Analysts note that Bitcoin’s current market turmoil shows signs of prolonged selling without strong buyer support. |

Summary

The BlackRock Bitcoin ETF has been making headlines recently, marking a significant rise in trading activity amidst a turbulent Bitcoin market. The iShares Bitcoin Trust ETF (IBIT) not only set a record for daily trading volume but also highlighted the vulnerability of Bitcoin’s investment landscape as prices fell dramatically. Investors should remain cautious and informed as market dynamics evolve, especially in light of influential factors such as the job market and trends in other sectors.

BlackRock Bitcoin ETF Trading Surge Amid Market Turmoil

The recent performance of BlackRock’s iShares Bitcoin Trust ETF (IBIT) illustrates a marked increase in trading activity despite adverse market conditions. On Thursday, as Bitcoin prices saw a dramatic 12% decrease, IBIT recorded a record trading volume of $10 billion. This surge indicates a heightened interest from traders, who may be viewing the decline in Bitcoin’s value as an opportunity for potential gains, reflecting the inherently volatile nature of cryptocurrency investments. With more traders engaging in cryptocurrency trading volume fluctuations, it becomes evident that even during a crash, there exists a spectrum of strategies focused on short-selling and profit taking.

However, the alarming drop in Bitcoin price trends raises substantial concerns regarding the sustainability of IBIT’s recent gains. The significant outflows of $373.4 million witnessed recently suggest a growing apprehension among investors who are increasingly exposed to crypto investment risks. Analysts warn that a persistent bearish trend could further dampen investor sentiment, leading to increased selling pressure. As experienced traders navigate these choppy waters, understanding the underlying mechanics of the Bitcoin market becomes crucial in managing both risk and reward.

Understanding the Impact of the Bitcoin Market Crash

The latest Bitcoin crash, where the cryptocurrency fell dramatically to $64,000 from over $126,000 mere weeks ago, has sent shockwaves throughout the digital asset space. Marco investors are keen to analyze the factors behind such price corrections—weak US job data and a fear of capital being siphoned into the booming artificial intelligence sector have also fueled investor anxiety. This market crash has highlighted the how fickle Bitcoin price trends can be, revealing that even established products like the iShares Bitcoin Trust ETF are not immune to broader market conditions.

As traders and investors witness such fluctuations, many are reminded of the volatile nature that characterizes cryptocurrency markets. The decline of Bitcoin serves as a sobering reminder of the investment risks involved. While some see potential in lower prices for acquiring more Bitcoin or shares in IBIT, others may retreat, fearing further losses. The emotional rollercoaster inherent in cryptocurrency trading continues to challenge investors’ strategies, as risk tolerance levels often dictate market movements during turbulent times.

Reactions to Increased Capital Flow into IBIT

The recent spike in trading volume for BlackRock’s IBIT during a disastrous period for Bitcoin has piqued the interest of market observers. Investors may be taking advantage of market inefficiencies during the drop, leading to substantial capital flow into the ETF. The dramatic rise to $10 billion in trading volume serves not only as a testament to the ETF’s liquidity but also underscores the aggressive strategies being employed by traders amidst the chaos. As traders react to the market crash, it is essential to examine how this high trading volume impacts the overall perception of Bitcoin assets.

Moreover, market analysts observe that this behavior could signify a shift in investor psychology, where rapid capital flows into IBIT may suggest opportunistic buying instead of panic selling. This perspective implies a growing confidence in the long-term resilience of Bitcoin, countering the prevailing sentiment stemming from the immediate market crash. However, navigating such rapid shifts requires precision and informed decision-making, as the trading atmosphere remains charged with uncertainty stemming from external economic indicators.

Expert Perspectives on Bitcoin’s Future Stability

According to veteran trader Peter Brandt, the current price action of Bitcoin displays ‘fingerprints of campaign selling’—a pattern characterized by concentrated selling by a smaller number of entities. This insight reflects a broader concern that Bitcoin, despite its reputation as a store of value, may be subjected to severe oscillations influenced by a handful of traders. The implications for new investors are significant, as the current downturn challenges assumptions about Bitcoin’s stability and future growth. Fears of Bitcoin encountering further resistance at previous support levels have traders on high alert.

As the market collectively holds its breath, commentators urge caution among retail investors, particularly those discouraged by the persistent downward trends. For many, these experiences underscore a vital lesson: the importance of understanding the dynamics of the cryptocurrency space. With BlackRock Bitcoin ETF poised at the center of these discussions, the feedback from both bullish and bearish sentiments becomes crucial in understanding market directions and preparing for potential rebounds.

Bitcoin’s Price Volatility and Trading Strategies

The inherent volatility of Bitcoin is a double-edged sword, offering both opportunities and threats for investors. As price fluctuations become more pronounced, sophisticated trading strategies such as dollar-cost averaging and options trading have gained traction. With bricks-and-mortar financial tools now available through ETFs like the iShares Bitcoin Trust, the retail investor landscape is changing rapidly. Educating oneself about the Bitcoin market crash consequences is imperative for developing a robust trading approach in this unpredictable environment.

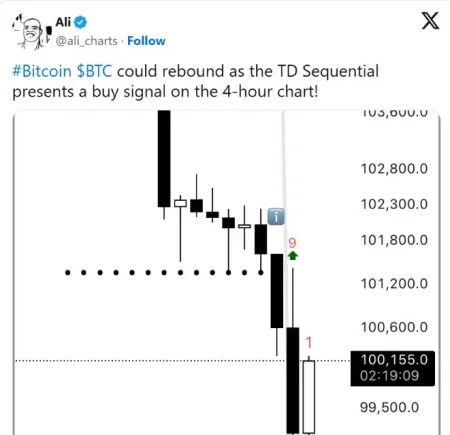

Furthermore, understanding market indicators can provide investors with a competitive edge, allowing for better timing when entering or exiting positions. As Bitcoin continues to experience significant price trends, the ability to adapt one’s strategy in response to market signals becomes increasingly essential. Engaging with expert analyses and trending trading strategies can equip investors with the tools necessary to minimize risks while maximizing potential on rebounds following downturns.

Potential Risks for Investors in the Crypto Space

Investing in the cryptocurrency market inevitably entails a certain level of risk, especially highlighted during the recent market downturn. As Bitcoin prices have plummeted, the sharp fall from a peak of $126,000 to around $64,000 has led many to reassess their investment approaches. The correlation between the performance of Bitcoin and the tracked iShares Bitcoin Trust ETF demonstrates that when Bitcoin suffers, so too do ETFs reliant on its performance, compounding potential investment risks for those looking to diversify through funds.

To navigate such uncertainties, investors are urged to perform thorough due diligence and maintain an awareness of broader market trends that influence Bitcoin’s volatility. Awareness of factors such as regulatory changes, macroeconomic indicators, and potential shifts in institutional investment strategies all play a role in shaping the crypto market landscape. Ensuring that ambitions align with realistic expectations can help investors safeguard their portfolios against the risks endemic to cryptocurrency trading.

The Role of ETFs Like IBIT in Market Corrections

Exchange-Traded Funds (ETFs) like BlackRock’s IBIT provide a unique avenue for investors to engage with Bitcoin without facing the complexities of direct cryptocurrency trading. During downturns such as the current Bitcoin price crash, such products can offer a buffer, allowing investors to gain exposure while potentially limiting individual risk. As seen with the recent increase in trading volume, these ETFs attract both seasoned and novice investors looking for a safer investment vehicle amid volatility.

In addition to offering risk management benefits, IBIT allows for greater accessibility in the cryptocurrency market. Investors can trade shares seamlessly, which can be particularly appealing during rapid price fluctuations like this recent downturn. The future success of IBIT hinges not only on the performance of Bitcoin but on its ability to adapt and respond to investor sentiment—especially during critical periods like market corrections, where confidence can waver significantly.

Navigating Investor Sentiment During Market Crashes

Investor sentiment is a crucial barometer during market crashes, often dictating the overall behavior of market participants. The stark drop in Bitcoin prices has led to emotional responses, with some traders diving into the market for opportunistic buying, while others have exited in fear of further losses. Both trends are indicative of the psychological complexities inherent in trading during tumultuous periods. Understanding these human factors is essential for not only assessing market conditions but also for crafting appropriate trading strategies.

As seen in the recent spikes in trading volume for IBIT, responses to Bitcoin price dynamics can vary widely based on individual perspectives. Trading psychology and sentiment analysis become pivotal in predicting possible recovery patterns or further declines. As the market seeks a new equilibrium, staying informed about both technical indicators and the prevailing investor mood becomes paramount for anyone looking to make calculated moves in the cryptocurrency arena.

Future Outlook for Bitcoin and IBIT

Looking forward, investors are left pondering the future trajectory of Bitcoin and its associated ETFs like IBIT. With forecasts varying from optimistic rebounds to continued depressions, the uncertainty triggers active discussions among analysts and traders alike. The foundational question of whether Bitcoin can reclaim its previous highs is pivotal, shaped not only by economic conditions but also by the evolving regulatory landscape around digital assets.

Moreover, the performance of IBIT is likely to closely mirror Bitcoin’s own price movements; hence, investors should remain vigilant about both macroeconomic indicators and internal ETF dynamics. Strategic investments in IBIT could yield significant returns if conditioned on an understanding of market trends and potential responses to external economic pressures. For now, both seasoned and novice investors will need to maintain a flexible approach and prepare for continued volatility.

Frequently Asked Questions

What is the BlackRock Bitcoin ETF and how does it relate to cryptocurrency trading volume?

The BlackRock Bitcoin ETF, formally known as the iShares Bitcoin Trust, is a spot exchange-traded fund that allows investors to gain exposure to Bitcoin without directly holding the cryptocurrency. Its recent trading volumes have significantly increased, especially during market fluctuations, indicating heightened interest and trading activity in the Bitcoin market.

How did the recent Bitcoin market crash affect the BlackRock iShares Bitcoin Trust?

During the recent Bitcoin market crash, the BlackRock iShares Bitcoin Trust saw record trading activity, with a daily volume reaching $10 billion as investors reacted to the price drop of Bitcoin. However, the ETF itself experienced a notable decline of approximately 13% on that day, reflecting the volatility in the cryptocurrency market.

What are the risks associated with investing in the BlackRock Bitcoin ETF amid Bitcoin price trends?

Investing in the BlackRock Bitcoin ETF comes with risks, especially during periods of highly volatile Bitcoin price trends. Recent downturns, such as the 50% drop from Bitcoin’s all-time high, highlight potential crypto investment risks including sudden price crashes and low trading volumes that can adversely affect ETF performance.

Why is the iShares Bitcoin Trust experiencing net outflows after the Bitcoin market crash?

The iShares Bitcoin Trust is experiencing net outflows, totaling $373.4 million recently, largely due to investor uncertainty following the Bitcoin market crash. Many investors have withdrawn funds as Bitcoin’s price continues to decline, marking a challenging environment for the ETF amidst fluctuating cryptocurrency trading volumes.

What implications does the Bitcoin price drop have for investors in the BlackRock Bitcoin ETF?

The implications of the recent Bitcoin price drop for investors in the BlackRock Bitcoin ETF include potential losses, as the average dollar invested in the ETF is reportedly at a loss. This reflects the broader trend of declining Bitcoin prices and highlights the need for caution when investing in cryptocurrency-based financial products.

How are market analysts viewing the current situation of the BlackRock Bitcoin ETF in light of the Bitcoin crash?

Market analysts are closely monitoring the BlackRock Bitcoin ETF amid the latest Bitcoin crash. Concerns have been raised about weak buying support, and some analysts suggest that the market turmoil may continue, indicating possible further declines for both Bitcoin and the ETF. Investors should remain vigilant and consider market conditions carefully.