In recent days, cryptocurrency market sentiment has taken a significant downturn, reflecting growing concerns among investors. The cryptocurrency fear index plummeted to an alarming 9, sealing its status in the “extreme fear” category. This stark drop signifies heightened cryptocurrency volatility, as market participants react to potential downturns with increased anxiety. Moreover, the crypto market panic is evident not only in the fear and greed index but also in the overall trading environment where hesitancy prevails. As market sentiment analysis continues to unfold, it’s crucial for traders and enthusiasts to navigate these turbulent waters with informed strategies.

The emotional dynamics within the digital currency sector have shifted dramatically, highlighting an atmosphere of trepidation among traders and stakeholders. This drastic change can be captured through various indicators that measure financial anxiety, reflecting what many refer to as the crypto fear and greed index. The rising anxiety levels suggest a collective worry over potential losses, resulting in a palpable state of market distress. Investors are turning to sentiment metrics to gauge future price movements, as the unpredictable nature of cryptocurrency has led to increased panic amidst falling values. Understanding these fluctuating emotions is vital for anyone looking to participate in this unpredictable arena.

| Date | Fear Index Score | Sentiment Level | Previous Scores |

|---|---|---|---|

| 2026-02-06 | 9 | Extreme Fear | 12 (previous day), 16 (last week), 42 (last month) |

Summary

Cryptocurrency market sentiment is currently characterized by extreme fear, with the fear index plummeting to 9, down from 12 the previous day. This drastic drop in the sentiment reflects a rapid deterioration in market conditions, highlighting increased panic among investors and traders. Over the past month, the index has shown a significant decline from a level of 42, which was indicative of fear rather than extreme panic. The fear and greed index, which considers factors like market volatility, trading volume, and social media engagement, emphatically signals that caution is warranted in the current cryptocurrency landscape.

Understanding Cryptocurrency Market Sentiment

Cryptocurrency market sentiment is a crucial barometer for investors, providing insights into the prevailing emotions and expectations among traders. Currently, the fear and greed index, a tool that measures this sentiment, has plummeted to 9, indicating an atmosphere of ‘extreme fear.’ This sudden drop from 12 the previous day and 16 from a week ago signals a heightened sense of panic among investors. Such drastic shifts not only highlight emotional responses to market volatility but also influence trading behaviors and market dynamics.

Market sentiment analysis plays a pivotal role in understanding how news, global events, and market trends affect investor behavior. As the cryptocurrency fear index approaches lower levels, it often correlates with bearish market signals, suggesting that traders might be more inclined to sell their holdings out of panic rather than making calculated investment decisions. Recognizing these patterns can empower investors to better navigate the turbulent waters of cryptocurrency trading.

The Role of the Cryptocurrency Fear Index

The cryptocurrency fear index serves as an essential tool for gauging market emotions. By incorporating multiple factors, such as volatility, market trading volume, and social media popularity, the index provides a composite score that reflects the overall market sentiment. A score of 9 indicates that panic is pervasive amongst traders, driving many to divest in hopes of minimizing potential losses. Understanding this index helps investors to navigate their portfolios strategically, especially during times of extreme fear.

Additionally, the fear and greed index aids in assessing potential market reversals. Typically, periods of extreme fear can present buying opportunities, as the market tends to rally once panic subsides. Observing fluctuations within the index can grant investors insights into when the market is oversold or overbought, enabling them to make informed decisions. As such, a thorough analysis of the cryptocurrency fear index is essential for anyone looking to capitalize on the inherent volatility in the crypto market.

Impacts of Crypto Market Panic on Trading Strategies

When panic sets in the cryptocurrency market, trading strategies must adapt to the prevailing sentiment. Traders often find themselves in a bind, torn between selling to cut losses or holding on for a potential recovery. With the fear index indicating extreme fear, as evidenced recently with a fall to 9, many traders succumb to market panic, which can lead to impulsive decisions. It’s crucial to have a well-defined trading plan that accommodates such emotional periods, focusing on long-term goals despite short-term fluctuations in market sentiment.

Additionally, crypto market panic doesn’t just affect individual traders but also impacts overall market stability. A panic-driven drop can result in increased volatility, leading to cascading sell-offs and further deterioration of market sentiment. Traders who are attuned to the psychological aspects of trading can leverage this volatility; they may position themselves to exploit price corrections when the market begins to stabilize. Thus, understanding the implications of market sentiment is integral to developing robust trading strategies.

Analyzing Cryptocurrency Volatility Amid Panic

Cryptocurrency volatility is a hallmarked characteristic of digital assets, often exacerbated during times of market panic. The current drop in the fear and greed index reflects this volatility, where a rapid swing from previous levels of relative stability to ‘extreme fear’ has triggered tumultuous price movements. As the index gauges fear at a mere 9, traders are faced with unpredictable swings in asset prices, requiring a keen understanding of risk management to safeguard their investments.

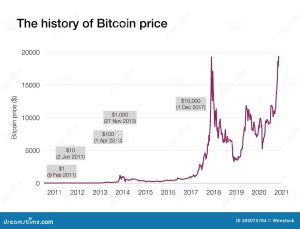

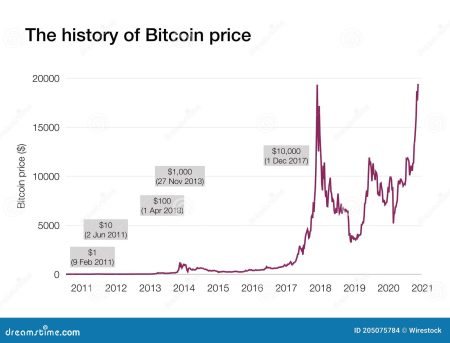

During volatile market periods, it’s critical to acknowledge that panic can influence the perceived value of cryptocurrencies. Sudden drops can lead to mispricing, opening opportunities for astute investors to enter the market at lower price points. However, traders must remain vigilant, as such environments can lead rapidly to increased risk—not only due to price changes but also due to broader market sentiment shifts. Analyzing historical data alongside current conditions, and incorporating concepts like the cryptocurrency fear index, can provide a strategic advantage.

Market Sentiment Analysis: A Crucial Trading Tool

Market sentiment analysis involves evaluating the mood of the market as quantified by various indices, including the cryptocurrency fear index. By closely monitoring shifts from fear to greed, traders can anticipate potential market movements. This proactive approach to sentiment analysis allows for more informed decision-making, enabling investors to identify trends that may indicate an impending market recovery or further decline.

Furthermore, market surveys and social media trends serve as valuable indicators of public sentiment, often reflecting deeper market realities. The increasing reliance on technology and data analytics has transformed how traders approach market sentiment analysis. By incorporating various metrics, including trading volume and Google trends, traders can create a holistic picture of the market landscape, leading to more informed investment choices in the tumultuous world of cryptocurrency.

Navigating Cryptocurrency Investments During Fearful Times

Investing in cryptocurrencies during periods of extreme fear can be intimidating but also offers significant opportunities for prudent traders. With the fear index sitting at a low of 9, it signifies that many investors are hesitant, which can sometimes lead to undervalued assets. For those willing to ride out the volatility, historical trends suggest that markets often rebound from such lows, making it imperative to analyze the potential for gains amidst the fear.

To successfully navigate these challenging times, it is essential for investors to stay well-informed about market trends and sentiment indicators. Utilizing tools like the fear and greed index not only provides insight into current emotional responses within the market but also guides investors towards making strategic decisions. Developing a robust investment strategy that capitalizes on temporary fear can set the stage for long-term gains.

The Psychology Behind Cryptocurrency Market Movement

The psychology behind cryptocurrency market movements significantly drives market volatility and sentiment. Understanding why traders react to fear—and the broader implications of panic in the market—can inform better trading strategies. For example, a sudden drop in prices tends to evoke fear and selling behavior among investors, manifesting as panic across trading platforms. Recognizing these psychological triggers enables traders to distance themselves from the emotional responses that often lead to impulsive actions.

Furthermore, by leveraging market sentiment analysis, traders can tailor their approach to capitalize on others’ fears. Many seasoned investors observe fear-driven market performance, strategically stepping in when prices are low and fear is high. This juxtaposition of psychology and trading strategies showcases the importance of a disciplined mindset in trading during tumultuous times, emphasizing the dual role of understanding both market sentiment and human behavior.

Long-term vs Short-term Cryptocurrency Strategies

When embroiled in extreme cryptocurrency market sentiment, investors must differentiate between long-term and short-term strategies. In times of fear, short-term traders may feel compelled to react swiftly to market changes, selling assets to mitigate loss. However, longer-term investors may view market downturns as an opportunity to acquire undervalued cryptocurrencies, especially when the fear index is low. Understanding one’s investment horizon and aligning strategies accordingly is paramount in navigating market volatility.

The dichotomy of long-term versus short-term strategies highlights the importance of patience and research. Short-term strategies may yield quick returns but also harbor high risks, particularly in a fearful market. Conversely, a long-term approach requires a solid understanding of the underlying fundamentals of cryptocurrencies, fostering resilience against the noise of daily market fluctuations. Ultimately, success in the crypto market often hinges upon the ability to balance these strategies effectively.

Preparing for Future Cryptocurrency Market Trends

As the cryptocurrency market continually evolves, preparing for future trends is essential for investors. The current state of the fear and greed index is illustrative of broader market conditions that may influence future movements. Understanding that fear-driven volatility often leads to subsequent recovery phases allows traders to position themselves advantageously for the future. Keeping an eye on market indicators and adapting strategies accordingly will be invaluable in navigating the unpredictable crypto landscape.

Moreover, staying informed about regulatory changes, technological advancements, and macroeconomic factors can equip investors with the insights needed to anticipate market shifts. By leveraging tools such as market sentiment analysis and tracking the cryptocurrency fear index, traders can cultivate a more proactive investment approach. Ultimately, those who prepare effectively for future trends can emerge stronger and more resilient, ready to capitalize on the opportunities that come their way.

Frequently Asked Questions

What does a cryptocurrency fear index of 9 indicate about market sentiment?

A cryptocurrency fear index of 9 indicates ‘extreme fear’ in the market, suggesting that investors are highly cautious and anxious about potential losses. This level of fear can lead to increased volatility and market fluctuations as traders react to negative sentiment and market conditions.

How does the cryptocurrency fear and greed index affect trading strategies?

The cryptocurrency fear and greed index can significantly influence trading strategies. Traders often use this index to gauge market sentiment; a low index (like 9) may suggest a buying opportunity in a bearish market, while a high index indicates potential sell signals in euphoria-driven scenarios.

What are the main components that influence the cryptocurrency fear index?

The cryptocurrency fear index is influenced by several components, including volatility (25%), market trading volume (25%), social media popularity (15%), market surveys (15%), Bitcoin’s dominance in the market (10%), and Google trends analysis (10%). These factors combine to assess current market sentiment.

Why should investors monitor cryptocurrency market sentiment analysis?

Investors should monitor cryptocurrency market sentiment analysis to better understand market trends and investor behavior. Market sentiment can provide crucial insights into possible price movements, enabling traders to make more informed decisions and avoid costly mistakes during periods of volatility.

How does crypto market panic affect investment decisions?

Crypto market panic can lead to irrational investment decisions, often resulting in mass sell-offs and increased volatility. When the market is gripped by fear, as indicated by a low fear index, many investors may panic and exit positions, which can further exacerbate market declines.

What is the significance of cryptocurrency volatility in the fear and greed index?

Cryptocurrency volatility is significant in the fear and greed index as it directly influences investor sentiment. High volatility, particularly during periods of extreme fear, can lead to greater hesitance among traders, impacting their willingness to buy or sell in the market.

How can social media trends affect the cryptocurrency fear index?

Social media trends can greatly affect the cryptocurrency fear index as they reflect the public sentiment towards digital currencies. Increased negative postings or discussions regarding a particular cryptocurrency can contribute to a decline in market sentiment, thus lowering the fear and greed index.

What does it mean when the cryptocurrency market sentiment analysis shows a decline from 42 to 9?

When the cryptocurrency market sentiment analysis shows a decline from 42 to 9, it signifies a drastic shift from a moderate level of fear to extreme fear. This rapid deterioration suggests that investor confidence has significantly dropped, likely leading to increased selling pressure and further market instability.

How can understanding cryptocurrency market sentiment improve trading outcomes?

Understanding cryptocurrency market sentiment can improve trading outcomes by helping investors anticipate market movements based on fear and greed dynamics. By analyzing sentiment indicators, traders can better position themselves, mitigate risks, and capitalize on potential rebounds in market conditions.

What role do market surveys play in the cryptocurrency fear and greed index?

Market surveys play a crucial role in the cryptocurrency fear and greed index as they gather investor opinions and sentiments regarding current market conditions. This data helps assess the collective mood of traders, influencing the overall sentiment score and providing insights into potential future trends.