The Binance USDT over-the-counter price has seen significant fluctuations recently, temporarily soaring to 7.4 Yuan before settling at around 7.28 Yuan. This change reflects a USDT premium rate currently reported at 4.89%, which highlights the vibrant activity within the cryptocurrency market. Investors closely monitoring the current USDT price can take advantage of these shifts, ensuring they make informed decisions during trading. Additionally, for those interested in USDT to Yuan exchanges, these rates can offer valuable insights into market trends and potential profitability. As Binance OTC trading gains traction, keeping abreast of cryptocurrency market updates is essential for maximizing investments.

The latest movements in the Binance USDT over-the-counter market have captured the interest of traders and investors alike. With a recent uptick in the price of USDT compared to the Yuan, this premium rate provides a unique opportunity for those looking to trade digital assets. As market conditions evolve, understanding the specific dynamics of Binance’s pricing can be crucial for making strategic investments. Furthermore, exploring the broader implications of the USDT to Yuan conversion can illuminate potential shifts in trading practices within the crypto landscape. In this context, remaining informed about the overall cryptocurrency market updates will empower users to seize the best trading opportunities.

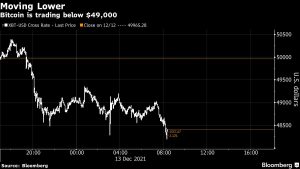

| Key Point | Details |

|---|---|

| Binance USDT OTC Price | 7.4 Yuan (temporary peak), currently 7.28 Yuan |

| Current USD/CNY Exchange Rate | 6.94 |

| USDT Premium Rate | 4.89% |

Summary

The Binance USDT over-the-counter price has recently experienced a fluctuation, peaking at 7.4 Yuan before settling at around 7.28 Yuan. This change is significant given the current exchange rate of the US dollar to the Chinese Yuan at 6.94, highlighting a notable USDT premium rate of 4.89%. Investors should monitor these rates closely as they reflect market dynamics and can impact trading strategies for USDT.

Understanding Binance USDT Over-the-Counter Price Dynamics

The Binance USDT over-the-counter (OTC) price reflects a unique market segment where larger trades are executed privately, often resulting in different pricing from public exchanges. Recently, the USDT OTC price surged to 7.4 Yuan, indicating a notable shift in demand and supply dynamics in the cryptocurrency market. This spike can mainly be attributed to increased trading activity and investor sentiments amidst market volatility.

Currently, the USDT OTC price has stabilized at around 7.28 Yuan, but its premium rate, recorded at 4.89%, showcases the premium investors are willing to pay for immediate liquidity in USDT. The variations in OTC prices can be influenced by multiple factors, including trading volume, market sentiment, and broader economic conditions. Understanding these dynamics is crucial for traders and investors looking to navigate the complexities of cryptocurrency trading effectively.

The USDT Premium Rate: Significance and Implications

The USDT premium rate provides a clear indication of how much higher the OTC price is compared to the standard market rate. With the current USDT premium rate reported at 4.89%, it suggests that traders are prepared to accept higher costs to secure USDT quickly. This can be particularly important when executing larger trades, as they give traders confidence in executing their strategies without significantly impacting market prices.

Moreover, fluctuations in the USDT premium rate are closely tied to the overall stability of the cryptocurrency market. High premium rates often highlight periods of uncertainty where investors lean towards stablecoins like USDT, anticipating potential volatility in other assets. Tracking these rates not only aids traders in making informed decisions but also reflects the broader trends influencing the cryptocurrency market, such as regulatory updates and macroeconomic conditions.

Current USDT Price: A Crucial Metric for Investors

The current USDT price serves as a critical benchmark in assessing the overall health of the cryptocurrency market. As of the latest updates, the USDT price is closely linked to the fluctuating exchange rates between the US dollar and other currencies. With an exchange rate of 6.94 Yuan to the dollar, investors should keep a keen eye on movements in this area as they directly impact the purchasing power and investment strategies involving stablecoins.

Moreover, fluctuations in the current USDT price can significantly affect traders’ strategies, especially those dealing in cross-border transactions. For instance, understanding how the USDT to Yuan exchange rate is evolving will help traders manage risks and optimize their portfolios amidst the growing complexity of cryptocurrency dynamics and global currencies.

Binance OTC Trading: A Popular Choice Among Investors

Binance OTC trading has emerged as a preferred option for both retail and institutional investors seeking to conduct significant transactions without causing disruptions in the open market. The recent surge in USDT’s OTC price is indicative of the growing demand for descrete trading mechanisms that Binance provides, allowing large trades to occur at favorable rates and reducing the impact on public market liquidity.

The appeal of Binance OTC trading lies not just in its competitive pricing but also in the service it offers to high-net-worth individuals and organizations. The dedicated support and personalized execution strategies often lead to better pricing outcomes, especially in a volatile market. This makes Binance’s OTC services an integral part of the trading landscape for those looking to maximize their investment potential while minimizing risk.

Cryptocurrency Market Updates: Impacts on USDT and Beyond

The rapidly evolving landscape of cryptocurrency market updates has profound implications for all digital assets, including USDT. Traders and investors must stay informed about market trends, regulatory news, and economic shifts, as these factors can lead to significant fluctuations in USDT’s value. Staying updated allows market participants to anticipate price movements better and make informed trading decisions.

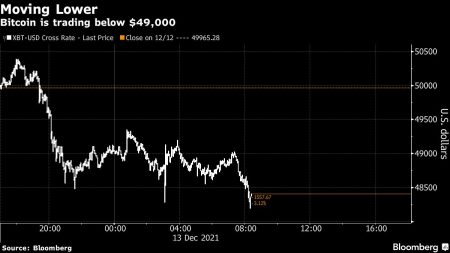

Furthermore, the interconnectedness of various cryptocurrencies means that developments in one segment can affect prices across the board. For example, if Bitcoin experiences a downward trend, it can lead to an increased demand for stablecoins like USDT as investors seek safety. Consequently, adhering to reliable sources for cryptocurrency market updates is crucial for any trader looking to navigate these waters successfully.

The Role of USDT in Cryptocurrency Investment Strategies

USDT plays a critical role in many cryptocurrency investment strategies due to its stability compared to more volatile assets. As investors often face market uncertainty, the availability of a stablecoin like USDT allows them to secure their profits without having to exit the cryptocurrency market completely. This versatility makes USDT a fundamental component of investment strategy, allowing traders to seamlessly transition between various cryptocurrencies and cash.

Moreover, utilizing USDT in trading pairs can minimize risks associated with price volatility. By converting profits into USDT during a bullish market and quickly exchanging back during dips, traders can effectively hedge against market fluctuations. Ultimately, understanding the utility and positioning of USDT in various investment strategies is essential for both novice and experienced traders alike.

How to Analyze USDT to Yuan Exchange Rates

Analyzing the USDT to Yuan exchange rate is vital for any investor looking to maximize their trading performance, especially in the volatile crypto market. As exchange rates fluctuate, staying informed about economic indicators, government policies, and market sentiment related to China and the US dollar can significantly impact the conversion rates of USDT. Using technical analysis and historical data can assist traders in identifying significant trends.

Additionally, monitoring real-time exchange rates and incorporating them into trading decisions ensures that investors are equipped with the most current information possible. By understanding the factors influencing the USDT to Yuan exchange rate, traders can make timely decisions that optimize their positions, whether investing in China or capitalizing on arbitrage opportunities.

Factors Influencing USDT Premium Rates

Several key factors influence USDT premium rates, making them an essential consideration for any trader involved in cryptocurrency. Market demand, regulatory news, and the overall health of the cryptocurrency ecosystem play substantial roles. For instance, during periods of financial uncertainty or heightened demand for stablecoins, premium rates may increase, indicating heightened trading activity.

Additionally, understanding market liquidity is crucial—if trading volumes in USDT are low, sellers may command higher premiums, affecting buyers’ costs. Keeping abreast of these factors and how they affect premium rates is vital for smart trading decisions, especially given the volatility often associated with digital assets.

The Future Outlook of USDT in Cryptocurrency Markets

As the cryptocurrency market continues to evolve, the outlook for USDT appears promising, albeit with challenges. With increasing adoption of digital currencies and a growing number of platforms integrating USDT for transactions, its role as a market stabilizer and transactional currency is likely to strengthen. The enhancements in Binance USDT OTC trading may further increase its utility, catering to larger investors seeking security amid volatility.

However, regulatory challenges and market saturation could present hurdles that impact USDT’s growth. As regulators increasingly focus on stablecoins, investor confidence could be tested. Ultimately, the future of USDT will rely on continuous innovation within the cryptocurrency landscape, reflecting the broader dynamics of market demands and regulatory environments.

Frequently Asked Questions

What is the current Binance USDT over-the-counter price?

The current Binance USDT over-the-counter price is reported at 7.28 Yuan, having previously peaked at 7.4 Yuan. This reflects the ongoing market dynamics of Binance OTC trading.

How is the USDT premium rate calculated on Binance?

The USDT premium rate on Binance is calculated by comparing the over-the-counter price against the standard exchange rate. Currently, the USDT premium rate is 4.89%, indicating that the price of USDT is higher on the OTC market than the typical market rate.

What factors influence the Binance USDT over-the-counter price?

Several factors can influence the Binance USDT over-the-counter price, including market demand, trading volume, and fluctuations in the USDT to Yuan exchange rate. Additionally, cryptocurrency market updates often play a significant role in price adjustments.

How does the current USDT price impact cryptocurrency trading?

The current USDT price directly impacts cryptocurrency trading, especially in markets where USDT is used as a stablecoin. If the USDT over-the-counter price rises, it can indicate increased demand and influence trading strategies on platforms like Binance.

What does the temporary rise to 7.4 Yuan in USDT mean for traders?

The temporary rise to 7.4 Yuan in USDT suggests heightened demand in the Binance OTC market, which may present trading opportunities for traders looking to leverage price movements or capitalize on the current USDT premium rate.

Are there any risks associated with trading Binance USDT over-the-counter?

Yes, trading Binance USDT over-the-counter carries risks, including price volatility and market liquidity. Traders should stay updated with cryptocurrency market trends and be aware of the potential impacts on the USDT to Yuan exchange.

How often do Binance USDT over-the-counter prices fluctuate?

Binance USDT over-the-counter prices can fluctuate frequently due to various market forces, including trading volume and changes in the cryptocurrency market. Regular monitoring of price trends is crucial for traders.

Can I buy USDT at the same price across different exchanges?

No, the USDT price can vary across different exchanges due to localized supply and demand factors. Traders should compare prices, including the Binance USDT over-the-counter price, before making a purchase.

What information should I follow to keep track of the USDT premium rate?

To track the USDT premium rate effectively, follow reliable cryptocurrency market updates, analyze trading volumes on Binance, and monitor changes in the USDT to Yuan exchange rate.

How does Binance OTC trading differ from regular trading?

Binance OTC trading allows for larger transactions without affecting the public order book, often resulting in different pricing, such as the current Binance USDT over-the-counter price, which may include a premium due to larger volume trades.