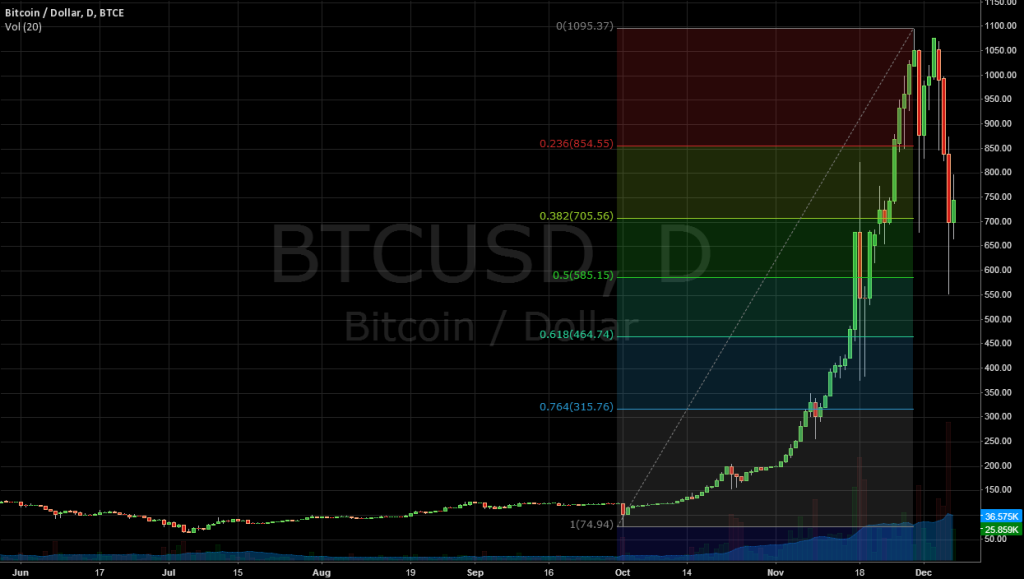

Bitcoin retracement has become a hot topic as the cryptocurrency experiences a dramatic decline of over 40% from its peak in October. This sharp downturn has left many investors in search of a robust Bitcoin investment strategy that can weather the volatile crypto market. Despite this retracement, recent crypto market analysis reveals that Bitcoin ETF resilience remains strong, with ETF outflows only at 6.6%. Such stability suggests that investors are maintaining their positions, hinting that they view these fluctuations as a potential buying opportunity rather than a reason to panic. As Bitcoin prices continue to navigate this turbulence, understanding the underlying dynamics of retracement and its impact on market sentiment is crucial for both seasoned and new investors.

The recent decline in Bitcoin value has sparked discussions around market corrections and price retracement within the increasingly complex cryptocurrency landscape. Alternative terms like Bitcoin price pullback and market retrenchment are frequently used to characterize these movements, which are not uncommon in the realm of digital currencies. Interestingly, despite the evident losses, the structured nature of Bitcoin exchange-traded funds (ETFs) has demonstrated a remarkable ability to withstand such fluctuations, leading to minimal outflows. As investors recalibrate their views, it becomes essential to explore various Bitcoin investment strategies that can capitalize on these market shifts while ensuring a degree of safety. Analyzing trends such as ETF resilience can provide valuable insights into future Bitcoin price behaviors and overall investment attitudes.

| Key Point | Details |

|---|---|

| Bitcoin Retracement | Bitcoin has seen a retracement of over 40% since its peak in October. |

| ETF Outflows | Spot Bitcoin ETFs experienced only 6.6% in net outflows during this decline. |

| Investor Behavior | ETF investors typically allocate 1%–2% of their portfolios to Bitcoin, making them more likely to hold during downturns. |

| Market Resilience | The behavior of ETF investors reflects a greater resilience compared to native crypto traders. |

| Long-Term View | Balchunas believes that ETFs may help anchor Bitcoin in traditional finance despite short-term volatility. |

Summary

Bitcoin retracement has raised concerns among investors as it exceeds 40% from its peak in October. However, the data indicates that spot Bitcoin ETFs have shown remarkable strength, with a mere 6.6% of their assets experiencing outflows. This suggests that ETF investors are more likely to maintain their holdings, reflecting a more conservative investment strategy in contrast to high-leverage crypto traders. As the market experiences volatility, the structure of these ETFs may play a crucial role in framing Bitcoin within traditional financial environments, emphasizing the importance of a long-term outlook. Overall, while Bitcoin has faced significant retracement, the response from ETF investors provides an optimistic perspective on the asset’s future stability.

Understanding Bitcoin Price Fluctuations

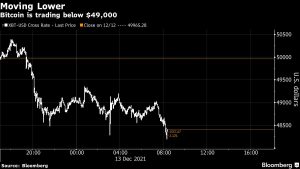

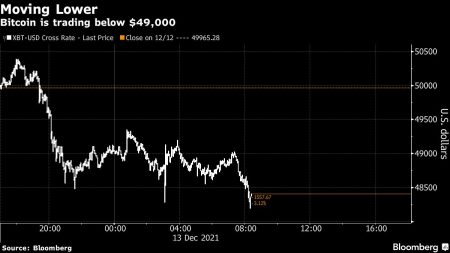

Bitcoin prices have demonstrated significant volatility, particularly witnessed in recent months where the asset has retraced more than 40% from its all-time high in October. This dramatic decline raises questions among investors, as they seek to understand the driving forces behind such fluctuations. Various factors contribute to Bitcoin’s price changes, including regulatory updates, macroeconomic conditions, and the overall sentiment within the cryptocurrency market. The high volatility of Bitcoin is often compared to traditional assets, making it essential for investors to develop robust Bitcoin investment strategies that can withstand such market turbulence.

In navigating the complexities of Bitcoin price fluctuations, it is critical to conduct thorough crypto market analysis. Investors should consider not only technical indicators but also how external factors like news sentiment and global economic shifts impact Bitcoin’s performance. For instance, the surge of interest from institutional investors through Bitcoin ETFs can influence demand, while adverse regulatory news can trigger swift sell-offs. Understanding these dynamics allows investors to make informed decisions, aligning their strategies with both market trends and their personal financial goals.

The Resilience of Bitcoin ETFs Amid Market Retracement

Despite a significant Bitcoin retracement, spot Bitcoin ETFs have demonstrated remarkable resilience, with only 6.6% of their assets experiencing net outflows during this downturn. This resilience indicates a nuanced investor behavior, distinct from traditional crypto traders who may react hastily to market downturns. ETF investors typically adopt a long-term perspective, allocating a modest portion of their portfolios—around 1% to 2%—to cryptocurrencies, thereby reducing the pressure to liquidate during dips. This behavior highlights the stabilizing role that ETFs can play in the broader crypto market.

The robust performance of Bitcoin ETFs during this period of volatility suggests that they may serve as a strategic entry point for more conservative investors. As the market navigates through periods of uncertainty, the structure of ETFs could anchor Bitcoin’s position within portfolios, providing a bridge between traditional finance and the crypto world. Investors may find that the lower concentration of capital allocated to Bitcoin through ETFs prevents panic selling, thereby allowing the market to absorb shocks more effectively, ultimately leading to a healthier investment landscape.

The Impact of ETF Outflows on Bitcoin Prices

ETF outflows play a critical role in shaping the dynamics of Bitcoin prices, especially during turbulent market periods. With only 6.6% of Bitcoin ETF assets exiting the market during a substantial retracement, this low percentage reflects not just investor confidence but also the unique characteristics of ETF structures. Unlike direct Bitcoin trading, where leveraged positions can exacerbate price swings, ETF investors often exhibit patience and a longer-term outlook. This behavior is crucial in minimizing the immediate impact on Bitcoin prices, stabilizing the market even when faced with broader economic headwinds.

Moreover, understanding ETF outflows can provide insights into investor sentiment and market trends. A significant increase in outflows can indicate a loss of confidence or a bearish outlook within the crypto market, often leading to sharper declines in Bitcoin prices. Conversely, minimal outflows, as observed in the current scenario, may suggest that the majority of ETF investors are remaining committed to their positions, even amid volatility. This distinction can help investors in formulating their strategies, prioritizing not only market timing but also sentiment analysis in their Bitcoin investment decisions.

Analyzing the Psychology of Bitcoin Investors

The psychological aspect of Bitcoin investment cannot be overlooked, particularly during periods of high volatility such as the current market retracement. Investors often grapple with fear and uncertainty, which can lead to impulsive decisions. However, ETF investors appear to exhibit a more disciplined approach, likely driven by their understanding of the underlying structure of ETFs. This structure inherently mitigates some of the emotional responses experienced by direct crypto traders, allowing ETF investors to adhere more closely to their predefined strategies and asset allocation plans despite market fluctuations.

This behavioral difference highlights an essential facet of the Bitcoin investment strategy: the need for education and emotional discipline. As the crypto market evolves, more investors are seeking a balanced approach that incorporates both the speculative nature of Bitcoin and the stability offered by investment vehicles like ETFs. By learning to manage emotions and focusing on long-term objectives, investors can better navigate the complexities of the crypto market, ensuring that they remain positioned to capitalize on future upward trends without succumbing to the fears that often accompany rapid price declines.

Long-Term Outlook: Bitcoin and Institutional Adoption

As Bitcoin continues to experience significant price retracements, the long-term outlook remains strongly tied to institutional adoption and the evolving regulatory landscape. The presence of Bitcoin ETFs signifies a growing acceptance of digital assets within traditional financial frameworks, prompting more investors to enter the market with confidence. This institutional interest not only supports Bitcoin prices but also provides a sense of legitimacy, enabling retail investors to consider Bitcoin as a viable long-term investment rather than a speculative asset.

Furthermore, the commitment from institutions indicates a shift in market dynamics, where Bitcoin could play a pivotal role in diversified investment portfolios. As more funds allocate a percentage of their assets to Bitcoin through ETFs, this could lead to increased price stability and potential upward momentum even amid retracements. By fostering a culture of long-term investment, institutions can reassure both new and seasoned investors about Bitcoin’s future as part of a balanced investment strategy.

Navigating Market Volatility with Bitcoin Investment Strategies

Developing a sound Bitcoin investment strategy is crucial when navigating the inherent volatility of the cryptocurrency market. Given the current environment in which Bitcoin has retraced over 40% from its peak, it’s essential for investors to reassess their strategies and objectives. Allocating funds wisely, considering risk tolerance, and employing dollar-cost averaging are strategies that can help mitigate losses while positioning investors to benefit from eventual market recoveries. Such approaches not only reduce the psychological burden of investing during downturns but also help in capturing value during potential rebounds.

Additionally, diversification remains key to any successful Bitcoin investment strategy. By spreading investments across various crypto assets or combining Bitcoin holdings with traditional investments, investors can buffer against the high volatility associated with any single asset class. As market analysis and trends evolve, having a diversified portfolio enables investors to withstand individual asset fluctuations while still positioning themselves for broader market gains over time.

The Future of Bitcoin ETFs in a Changing Market

As the cryptocurrency market continues to mature, the future of Bitcoin ETFs looks promising. These funds offer a structured approach to investing in Bitcoin, aligning well with traditional investment philosophies that many institutional investors embrace. Given the demonstrated resilience during market retracements, Bitcoin ETFs have the potential to draw in more conservative investors who may have previously hesitated to invest in such a volatile asset class. This increased participation could further enhance Bitcoin’s market stability and acceptance.

Moreover, as regulatory frameworks surrounding cryptocurrencies become clearer, the potential for new Bitcoin ETF products may emerge, offering different strategies that cater to varying investor needs. Future developments in Bitcoin ETFs could encompass funds focused on income generation, leverage, or even thematic strategies that target specific sectors of the Bitcoin ecosystem. Such innovations would not only drive interest but also reinforce Bitcoin’s role as a foundational asset in the investment landscape.

Impact of Global Economic Conditions on Bitcoin Prices

Global economic conditions significantly influence Bitcoin prices, creating a complex interplay that investors must consider. Economic indicators such as inflation rates, interest rates, and geopolitical events can cause ripples in the cryptocurrency market, affecting investor sentiment and trading behavior. When inflation rises, for instance, many see Bitcoin as a hedge against currency devaluation, possibly driving demand and pushing prices higher. Conversely, economic uncertainty can lead to sharp declines in Bitcoin as investors flock to safer assets.

The recent 40% retracement in Bitcoin’s price illustrates how interconnected the cryptocurrency market is with broader economic trends. As investors monitor global economic shifts, those involved with Bitcoin ETFs may find themselves less influenced by short-term volatility than direct traders. The ETF structure can act as a buffer, allowing investors to maintain exposure to Bitcoin without the immediate pressure to react to every market dip caused by external economic factors. This understanding can help guide investment strategies in an increasingly complex financial environment.

The Role of Market Sentiment in Bitcoin Price Movements

Market sentiment plays a crucial role in Bitcoin price movements, especially in the wake of significant retracements. Investor optimism or pessimism can greatly influence trading decisions, often leading to herd behavior that drives prices up or down. During a correction where Bitcoin retraces over 40%, negative sentiment can lead to panic selling, while positive news and developments can create FOMO (fear of missing out). Understanding the psychology behind market sentiment is imperative for investors who aim to navigate these fluctuations effectively.

Moreover, Bitcoin ETFs have the potential to temper sentiment-induced price swings by providing a more stable investment route for those uncertain about direct crypto trading. As ETF investors are typically more patient and aligned with long-term strategies, their involvement can create a dampening effect on the wild swings associated with retail-driven trading. This dynamic underscores the importance of considering not just price movements but also the underlying sentiment that drives those movements, helping investors make more nuanced decisions aligned with their investment goals.

Frequently Asked Questions

What causes Bitcoin retracement and how does it impact Bitcoin prices?

Bitcoin retracement occurs when there is a temporary price decline after a significant upward trend. Such corrections can be triggered by various factors, including market sentiment, regulatory news, or broader economic shifts. Understanding Bitcoin retracement is crucial for investors, as it can influence Bitcoin prices and timing for strategic investments.

How do ETF outflows relate to Bitcoin retracement trends in the crypto market?

During Bitcoin retracement periods, ETF outflows can reflect investor confidence. In this case, despite a significant retracement exceeding 40%, only 6.6% of ETF assets faced outflows, indicating that investors are holding onto their Bitcoin investments, showcasing the resilience of Bitcoin ETFs amid volatility in the crypto market.

What is the significance of ETF structures during Bitcoin retracement?

The unique structure of Bitcoin ETFs plays a vital role during retracement phases. Unlike high-risk crypto traders, ETF investors typically only allocate 1%–2% of their portfolios to Bitcoin, which encourages a long-term holding strategy. This can provide stability and help mitigate the impacts of Bitcoin retracement, creating an anchor effect within the traditional financial assets framework.

What strategies should I consider during a Bitcoin retracement for my Bitcoin investment strategy?

During a Bitcoin retracement, it’s wise to reassess your Bitcoin investment strategy. Consider employing a dollar-cost averaging approach to mitigate impact from volatility, diversifying your portfolio to reduce risk, and analyzing market trends to make informed decisions about entry points, especially as Bitcoin has shown resilience despite retracement.

How might Bitcoin ETF resilience affect the long-term outlook despite retracement?

The resilience of Bitcoin ETFs indicates strong investor confidence, even during significant retracement periods. As ETF outflows remain low, it suggests that many investors view Bitcoin as a long-term asset, which may contribute to a more stable long-term outlook for Bitcoin, reinforcing its adoption as part of traditional investment strategies.