In light of the recent financial turmoil in the cryptocurrency sector, the Strategy Bitcoin loss Q4 2025 has raised eyebrows among investors and analysts alike. This staggering $12.4 billion hit was largely a result of Bitcoin’s dramatic price drop of 22%, which saw the cryptocurrency tumble from its peak of $126,000 to below $88,500 in just three months. Such a sharp decline not only affected Bitcoin Q4 2025 valuations but also triggered a 17% dip in Strategy’s stock, drawing attention to the broader implications of these losses. Amid the crypto market news and discussions on the harsh realities of investing in Bitcoin, stakeholders are keenly assessing the company’s financial report and its outlook moving forward. Strategy’s predicament underscores the volatile nature of the crypto landscape, especially as investors grapple with the challenges of a fluctuating market and shifting company strategies.

As Bitcoin faced a significant downturn in the closing months of 2025, the repercussions were felt throughout the financial ecosystem, notably in Strategy’s recent quarterly earnings. The corporate financial report unveiled a staggering loss attributed to the cryptocurrency’s infamous volatility during this period. Beyond the raw numbers, the implications of a plummeting Bitcoin price can ripple through the entire market, influencing investor confidence and future capital strategies. The financial outlook for Strategy, once seen as resilient due to its Bitcoin holdings, is now under scrutiny, prompting discussions about potential recovery strategies. This situation highlights the intricate relationship between individual companies in the crypto domain and the overarching trends within the digital currency sphere.

| Key Point | Details |

|---|---|

| Net Loss | $12.4 billion in Q4 of 2025 due to Bitcoin drop. |

| Bitcoin Performance | Bitcoin fell by 22% in Q4, going from $126,000 to under $88,500. |

| Impact on Shares | Shares of Strategy dipped by 17% alongside Bitcoin’s tumble. |

| Financial Stability | Strategy’s CFO stated that their capital structure is strong despite losses. |

| Cash Reserves | Increased cash holdings to $2.25 billion to support 30 months of dividends. |

| Debt Situation | No major debt maturing until 2027, reducing pressure to sell Bitcoin. |

| Enterprise Value | Enterprise value remains above the $45 billion Bitcoin reserve. |

| Market Resilience | CEO expressed confidence in the company’s strategy and market position. |

Summary

Strategy Bitcoin loss Q4 2025 saw the company reporting a staggering net loss of $12.4 billion due to the significant downturn in Bitcoin prices. Despite the alarming figures, Strategy’s management maintains that the company is on stable financial ground with strong cash reserves and no immediate debt obligations, allowing for resilience against market fluctuations. The ongoing strategic approach to Bitcoin investment suggests that while the losses are substantial, there remains a calculated optimism about the future.

Analysis of Strategy’s $12.4B Loss in Q4 2025

In the fourth quarter of 2025, the financial landscape for Strategy took a significant hit as the company reported a staggering loss of $12.4 billion. This downturn was primarily attributed to the drastic fall in Bitcoin’s value, which plummeted 22% within the quarter. Investors witnessed Bitcoin reaching its peak at $126,000 in October, only to decline to below $88,500 by the year’s end. The sheer volatility of the cryptocurrency market is reflected in this steep price drop, signaling to many that despite Bitcoin’s previous gains, it remains a risky investment.

Moreover, the decline pushed Strategy’s shares down by 17% on the day of the financial report release, creating concerns among stakeholders about the company’s future in a volatile crypto market. The loss not only underscores the uncertainty surrounding the Bitcoin market but also raises questions regarding the adequacy of Strategy’s investment strategies. Analysts are now scrutinizing the sustainability of the company’s hold on Bitcoin and its long-term financial outlook, especially as Bitcoin’s value continues to be unpredictable.

The Financial Resilience of Strategy Amidst Market Volatility

Despite the reported losses, Strategy’s Chief Financial Officer, Andrew Kang, emphasized that the company remains on strong financial footing. With a robust capital structure and an extensive Bitcoin reserve, Strategy is better positioned than some competitors to weather the storm of market fluctuations. The decision to hold $2.25 billion in cash suggests a proactive strategy to ensure liquidity for dividend payouts over the next two and a half years. This financial prudence indicates that Strategy is not only focused on short-term recovery but is also preparing for a potentially prolonged downturn in the crypto market.

Furthermore, the absence of significant debt maturing until 2027 alleviates immediate pressure on the company, allowing them to maintain their Bitcoin holdings without panic selling. Phong Le, the CEO, exuded confidence, suggesting that Strategy’s enterprise value still outstrips its Bitcoin reserves, establishing a cushion against market volatility. This perspective positions the company favorably in the eyes of potential investors, who may see the current financial turmoil as a temporary setback rather than a sign of systemic failure.

Understanding Bitcoin Price Fluctuations and Company Impacts

The fluctuations in Bitcoin prices have a profound impact on the financial health of companies like Strategy. The recent Bitcoin price drop to under $88,500 marked not only a dramatic decrease in value but also influenced investor sentiment across the broader crypto market. Companies heavily invested in Bitcoin are inherently at risk, as their balance sheets are closely tied to the performance of this volatile asset. For investors looking at Q4 2025, understanding this correlation is critical in evaluating the stability and risk of such investments.

As Bitcoin continues to experience high volatility, the importance of having a comprehensive financial strategy becomes paramount for firms involved in cryptocurrency. Strategy’s approach, which involves increasing its cash reserves whilst holding a significant amount of Bitcoin, reflects a balanced strategy intended to mitigate risks associated with price declines. Consequently, this unique position allows them to sustain operational resilience even while navigating the unpredictable waters of the crypto market.

Strategic Outlook for Bitcoin Holdings in 2026

Looking forward into 2026, Strategy is outlining its approach in response to the tumultuous Q4 2025 financial landscape. With significant Bitcoin holdings, the company plans to enhance its strategic positioning to take advantage of market rebounds once confidence returns to the crypto sector. Implementing a strategy focused on market analytics and Bitcoin valuation trends could bolster their chances of regaining lost ground and attracting both retail and institutional investors. Navigating through the aftermath of the Bitcoin price drop, Strategy’s leadership is tasked with crafting solutions that support the firm’s long-term growth.

In addition, Strategy’s pivot towards Digital Credit plays a vital role in its future. This shift diversifies its revenue streams beyond Bitcoin alone, potentially stabilizing the company during periods of crypto market uncertainty. Investors are keenly aware that companies which adapt to changing market conditions tend to outperform during recoveries. Thus, observing how Strategy maneuvers its Bitcoin assets alongside new financial strategies will be crucial for stakeholders as the year progresses.

Proactive Measures: Strategy’s Cash Management

Strategy’s decision to bolster its cash reserves to $2.25 billion in Q4 was not coincidental; it was a calculated move aimed at ensuring financial stability amidst adversity. This decision provides a safety net, allowing the firm to maintain its dividends and support operations despite the downturn in Bitcoin prices. Such proactive cash management strategies can instill confidence among investors, ensuring them that their interests are safeguarded even in challenging economic climates.

Additionally, maintaining a solid cash position enables Strategy to seize future investment opportunities that may arise from market corrections. The ability to act swiftly and capitalize on lower asset prices can significantly enhance the company’s profitability when the market stabilizes. Shareholders should watch closely how effectively Strategy can balance its Bitcoin exposures with a robust cash management strategy moving forward.

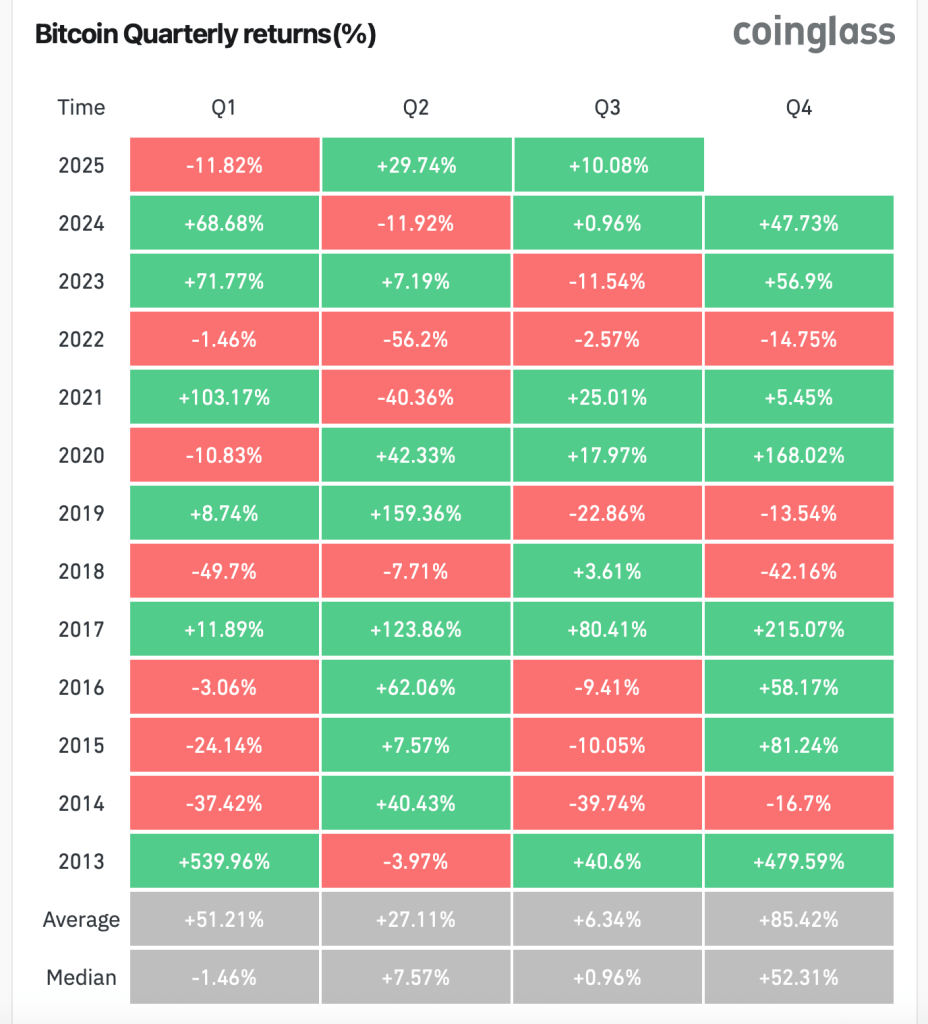

Market Trends and Predictions for Bitcoin in 2025 and Beyond

The crypto market is notoriously difficult to predict, but various analysts have offered insights into potential trends for Bitcoin well into 2025. Much of the speculation centers around how regulatory changes and market maturity will influence Bitcoin’s price trajectory. Some predict that Bitcoin could experience a resurgence as institutional adoption increases, while others warn of possible increased volatility due to economic factors. Understanding these market dynamics is essential for any investor evaluating companies like Strategy that are deeply entrenched in Bitcoin.

Furthermore, as new technologies emerge and the crypto landscape evolves, companies that remain adaptable are likely to thrive. Strategy’s focus on aligning its financial strategies with anticipated Bitcoin market trends showcases its commitment to maintaining relevance amidst change. Engaging with crypto market news will help investors stay informed about developments and potential impacts on Strategy’s holdings in Bitcoin and overall performance.

Reassessing Investment Strategies in the Crypto Market

The monumental loss reported by Strategy invites a broader reconsideration of investment strategies within the cryptocurrency sphere. Investors looking to invest or maintain investments in Bitcoin must evaluate risk management protocols and asset diversification. Digital assets remain unpredictable, and companies with a singular focus may find themselves at a disadvantage during downturns. Portfolio diversification and strategic risk assessment are now more critical than ever for crypto investors.

In the face of volatility, having a balanced investment strategy that includes a mix of stable assets alongside more speculative positions could provide a buffer against significant losses. Companies like Strategy, which are evolving their financial approaches in response to market conditions, may provide valuable lessons in resilience. Emphasizing informed decision-making and strategic adaptability will likely define the path forward for investors in the ever-changing crypto landscape.

The Role of Leadership: Strategy’s Executive Insights

Leadership plays a crucial role in navigating periods of financial uncertainty, and Strategy’s executives have articulated the company’s vision amid recent challenges. CEO Phong Le’s assertive stance on their Bitcoin strategy reflects a commitment to long-term goals rather than short-term panic. His insights indicate an understanding that market cycles are inevitable, and having a firm foundation can position the company to emerge stronger from these downturns.

Moreover, the leadership’s transparency with stakeholders regarding the company’s financial position and strategies instills confidence and aligns shareholder expectations with operational realities. As Strategy continues to engage with investors and communicate its long-term plans effectively, its leadership will be a driving force in shaping both company culture and market perception. The strategies devised to cope with Bitcoin fluctuations will demonstrate how strong leadership can lead a company through turbulent financial times.

Regulatory Environment and Its Impact on Bitcoin Operations

The regulatory landscape for cryptocurrencies is in constant flux, each development holding potential ramifications for companies like Strategy that are heavily invested in Bitcoin. Strategies to navigate this changing environment must include closely monitoring regulatory updates that may affect operational decisions and market stability. A supportive regulatory framework could lend credibility to Bitcoin as an asset class, stimulating broader market adoption and potentially leading to price recovery post-Q4 2025.

Conversely, tightening regulations could challenge the operational models of Bitcoin-reliant companies. Strategy will need to adapt its business practices to not only comply with emerging restrictions but to also actively engage with regulatory authorities. A proactive approach in its legal framework will be vital to assuring investors that the company is prepared for regulatory changes and that their investments remain secure in an increasingly regulated environment.

Frequently Asked Questions

What were the main reasons for Strategy’s Bitcoin loss in Q4 2025?

Strategy’s Bitcoin loss in Q4 2025 was primarily due to a significant 22% drop in Bitcoin price, which fell from a high of $126,000 to below $88,500. This decline led to a reported net loss of $12.4 billion for the quarter.

How did the Bitcoin price drop in Q4 2025 impact Strategy’s financial report?

The Bitcoin price drop in Q4 2025 significantly affected Strategy’s financial report, resulting in a 17% dip in shares and a net loss of $12.4 billion. The volatile crypto market placed the company’s holdings under substantial pressure.

What is Strategy’s outlook after the Bitcoin price decrease in Q4 2025?

Despite the Bitcoin price decrease in Q4 2025, Strategy maintains a positive outlook, citing strong cash reserves of $2.25 billion and a resilient capital structure. The company’s management believes they are well-positioned for the long-term, with no immediate debt pressures.

How did Strategy’s CEO respond to the Bitcoin loss in Q4 2025?

Strategy’s CEO, Phong Le, expressed confidence despite the Bitcoin loss in Q4 2025. He emphasized the company’s robust financial standing and reassured investors that there are no current issues with their operations or strategies related to Bitcoin.

What is the significance of Strategy’s Bitcoin holdings after the Q4 2025 loss?

Even after the Q4 2025 loss, Strategy’s Bitcoin holdings remain significant, totaling 713,502 BTC. The CEO indicated that the enterprise value still exceeds the value of these holdings, positioning the company strongly within the crypto market.

What measures has Strategy taken to mitigate losses due to Bitcoin price fluctuations in Q4 2025?

In response to the Bitcoin price fluctuations in Q4 2025, Strategy increased its cash holdings to $2.25 billion, ensuring financial flexibility and the ability to cover 30 months of dividends, thus insulating itself from immediate market pressures.

Can Strategy recover from its $12.4 billion loss in Q4 2025?

Yes, Strategy can potentially recover from its $12.4 billion loss in Q4 2025. The company’s CFO states that its capital structure is stronger than ever, and their strategic shift towards digital assets may further bolster resilience in the long term.

What market trends contributed to the Bitcoin losses experienced by Strategy in Q4 2025?

Market trends contributing to the Bitcoin losses for Strategy in Q4 2025 included overall market volatility and a substantial drop in Bitcoin prices, which declined 30% year-to-date, impacting many institutional investors in the crypto landscape.