XRP has emerged as a resilient player in the tumultuous landscape of cryptocurrency, especially as Bitcoin and Ethereum face significant market challenges. While the broader crypto market has seen price drops, with XRP recently trading around $1.35, its underlying fundamentals present a more optimistic scenario. This optimism is bolstered by a substantial influx of institutional investment, marking a notable shift in behavior amidst ongoing volatility. The latest Ripple news emphasizes the token’s unique position, underscoring developments and updates that cater specifically to institutional needs. Analysts are increasingly focusing on XRP market analysis and its price prediction, highlighting how these adaptations may pave the way for a brighter future, even as macroeconomic pressures weigh heavily on other assets.

The Ripple network’s digital currency, XRP, is gaining traction as investors seek opportunities in the fluctuating cryptocurrency ecosystem. Unlike leading cryptocurrencies like Bitcoin and Ethereum, which are currently struggling with significant sell-offs, XRP showcases a different trajectory driven by growing institutional interest and targeted infrastructure enhancements. This distinctive positioning allows XRP to potentially benefit from emerging trends in decentralized finance and regulated markets. Furthermore, recent developments regarding XRP blockchain updates have fostered a sense of stability and forward momentum, inviting speculative interest. As the industry continues to evolve, XRP stands out as a compelling subject for those closely monitoring financial technology advancements and investment strategies.

| Aspect | Bitcoin | Ethereum | XRP |

|---|---|---|---|

| Price Status | Below $70,000 | Over $2.4 billion outflows since November | Trading at $1.35, but gaining institutional interest |

| Institutional Flows | Loss of $1.6 billion in January 2026 | More than $2.4 billion of net outflows | Attracted $1.3 billion since ETF launch in November |

| Market Outlook | High beta asset; bearish sentiment | Similar bearish indicators and outflows | Potential catalyst for recovery amid positive sentiment |

| Institutional Integration | Reduces liquidity due to ETF outflows | Lacking substantial institutional upgrades | Recent Ripple infrastructure upgrades for institutions |

Summary

XRP remains resilient amid the broader vulnerabilities faced by Bitcoin and Ethereum, with institutional investments shifting towards it as the market seeks new structures and regulatory clarity. The positive sentiment surrounding XRP is rooted in significant inflows and the anticipation of innovative partnerships that promise to solidify its role in the evolving financial landscape. As investors focus on decentralized finance and institutional access through initiatives like Ripple’s upgrades, XRP is positioned as a leading asset poised for potential growth in the cryptocurrency market.

Understanding XRP’s Rise Amid Bitcoin’s Challenges

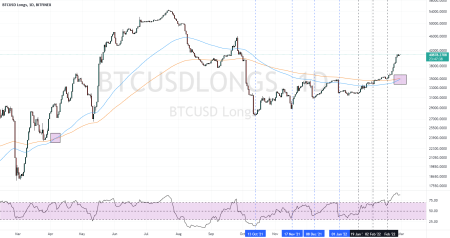

As Bitcoin and Ethereum face significant challenges with prolonged outflows from their ETFs, XRP is entering a distinct phase of growth characterized by substantial institutional interest. While Bitcoin has experienced substantial withdrawals, with over $1.6 billion leaving its investment products just in January 2026, XRP’s ETFs have seen inflows of approximately $1.3 billion since their launch. This divergence highlights a growing sentiment that XRP is being viewed as a more stable option in a turbulent market landscape. Many analysts are promoting XRP’s resilience, tapping into the narrative that it is supported by innovative structural upgrades in its ecosystem.

The rise of XRP amidst Bitcoin’s struggles can be attributed to multiple factors, including innovative developments that cater specifically to institutional needs. Ripple has focused on building an infrastructure that enhances accessibility and efficiency for traditional financial institutions looking to integrate blockchain solutions. This strategic emphasis on direct access to on-chain liquidity and institutional-grade services positions XRP favorably compared to its more volatile counterparts. As institutional investors become more discerning with their capital allocations, XRP’s advantages are increasingly apparent, driving a more optimistic market sentiment.

XRP Institutional Investment: A Game Changer

The influx of institutional capital into XRP is reshaping perceptions of the digital asset. Ripple’s innovative product offerings have wooed major financial players, prompting them to explore integration into the cryptocurrency space. The excitement surrounding XRP’s potential arises from the clear operational frameworks being established, allowing institutional investors to harness blockchain capabilities without compromising familiarity or compliance standards. This shift towards institutional investment catalyzes XRP’s market dynamics and underscores its relevance in the broader cryptocurrency landscape.

Moreover, the ongoing developments surrounding XRP’s derivatives markets illustrate a strong bullish sentiment among traders. The fact that a staggering 86.87% of options open interest is focused on calls indicates a strong belief in potential price appreciation from current levels. Institutions are increasingly viewing XRP as a valuable asset not only for immediate returns but also as a strategic hedge against the inherent volatility of Bitcoin and Ethereum, further cementing its status in the market.

Ripple News: Key Updates Influencing XRP’s Sentiment

Recent Ripple news concerning the activation of ‘Permissioned Domains’ on the XRP Ledger signifies a notable advancement in its technological capabilities. This upgrade enhances the blockchain’s functionality, enabling enhanced security and compliance that appeals directly to institutional investors. Such developments are critical as they foster a reliable environment for handling sensitive financial transactions, thus elevating XRP’s appeal as a suitable blockchain for real-world applications.

In addition, Ripple’s continuous integration with traditional financial mechanisms indicates a commitment to creating bridges between conventional finance and the blockchain ecosystem. These enhancements instill confidence among investors and support positive market sentiment, which is crucial for XRP during times of broader market unrest. The narrative surrounding Ripple’s technological advancements and regulatory clarity supports XRP’s positioning as a prime contender in the institutional investment arena.

XRP Market Analysis: Navigating Current Trends

Current market analysis shows XRP displaying unique characteristics amidst a predominantly bearish cryptocurrency market. Traditional forces impacting Bitcoin and Ethereum, such as macroeconomic pressures and liquidity stresses, appear less influential on XRP due to its unique market positioning. With the asset trading on improved market structure linked to stable inflows from institutional investors, analysts are cautiously optimistic regarding XRP’s potential resilience and recovery in price.

Furthermore, as capital continues to flow into XRP while other cryptocurrencies falter, it is crucial to analyze the supporting factors for this trend. Factors such as active trading volumes, derivative market sentiment, and institutional staking provide valuable insights into XRP’s price movements. Monitoring these elements offers a clearer understanding of how XRP might navigate potential volatility, making it an attractive focus for traders and investors looking for opportunities in a fluctuating landscape.

XRP Blockchain Updates: Innovations Driving Growth

XRP’s ongoing blockchain updates are not only enhancing its functionality but also attracting a broader range of users and investors to the platform. The recent advancements, including improved scalability and security measures through the ‘Permissioned Domains,’ reflect Ripple’s commitment to industry-leading standards. These innovations facilitate smoother interactions between decentralized finance (DeFi) applications and traditional finance, sharpening XRP’s competitive edge in the market.

Moreover, Ripple’s updates demonstrate a proactive approach to regulatory challenges, establishing frameworks that ensure compliance while unlocking new functionalities. As these updates roll out, the positive implications for liquidity and transaction speeds could significantly enhance market confidence in XRP. Ultimately, these blockchain advancements position XRP as a pivotal asset in diversifying portfolios, especially for institutional players seeking credibility and stability in their crypto investments.

Macro-Economic Influences on XRP

Recent macroeconomic shifts have played a critical role in determining the trajectory of cryptocurrencies, including XRP. As liquidity conditions tighten and traditional markets fluctuate, institutional investors are re-evaluating their strategies and looking towards digital assets like XRP that offer potential security and returns. This reevaluation emerges from a need for diversification, particularly when conventional assets reveal pronounced vulnerabilities.

Additionally, XRP’s distinctive market dynamics afford it a unique resilience compared to Bitcoin and Ethereum, which are perceived as more correlated with macroeconomic cycles. By focusing on specific customer needs and regulatory compliance, XRP potentially positions itself as a refuge for investors looking for relative safety. This macro perspective reinforces the belief that XRP could thrive despite wider economic uncertainty, making it an intriguing asset for market participants.

Future Prospects for XRP: What to Expect

Looking ahead, the future prospects for XRP appear promising, particularly as analysts are modeling various scenarios that could reshape its market standing. The base case suggests that as risk assets stabilize, XRP could maintain its relative strength, buoyed by institutional support and ongoing enhancements to its ecosystem. This creates an exciting environment where investors can capitalize on XRP’s growth potential against a backdrop of uncertainty for other cryptocurrencies.

In the bullish scenario, XRP’s adoption as a primary regulated on-chain instrument positions it favorably as institutions increasingly seek compliant blockchain solutions. Such a development would likely initiate a re-rating of XRP’s market value, as demand for tokenized assets and cross-border settlement solutions grows. Conversely, the bear case hinges on persistent macroeconomic struggles; investors must be watchful of how liquidity flows impact XRP as competing assets face challenges. Overall, the outlook for XRP is shaped by its unique position in the evolving cryptocurrency landscape.

Regulatory Clarity Contributing to XRP’s Growth

Regulatory clarity surrounding XRP has fundamentally altered market perceptions and significantly influenced investor sentiment. After facing past litigation challenges, Ripple has successfully navigated complexities with regulatory entities, which has opened the door for broader institutional adoption. This newfound clarity is essential for reassuring investors about compliance, thus positively impacting XRP’s price prediction in the long term.

As regulatory frameworks continue to evolve, the potential integration of XRP into mainstream financial systems becomes increasingly plausible. Ripple’s collaborations with traditional financial institutions and their engagement with regulatory bodies signal a commitment to independent growth and structural stability. This confidence instills reassurance among prospective investors and institutions, especially as they explore the advantages of integrating XRP into their asset portfolios.

Strategic Investment Insights for XRP

Investing in XRP offers unique insights into navigating the changing cryptocurrency ecosystem. Recent data indicates that strategic investments in XRP have become increasingly attractive, particularly for those looking to leverage its institutional appeal. With the emergence of various analytical models suggesting a shift in XRP’s market valuation based on permissioned infrastructure and regulatory compliance, investors are encouraged to assess how these dynamics might influence their investment decisions.

Furthermore, as institutional investment grows, potential stakeholders can gain insight into market trends and make informed decisions by observing XRP’s performance against macroeconomic pressures. Staying abreast of real-time market updates and understanding derivative market sentiment will assist investors in maximizing their potential returns while effectively managing risks associated with cryptocurrencies. While volatility persists, XRP represents an asset class with tangible prospects for both institutional and retail investors.

Frequently Asked Questions

What is the current XRP price prediction amid institutional investment trends?

As of February 2026, XRP is trading around $1.35, reflecting a low due to broader market downturns. However, the ongoing institutional investments into XRP ETFs are driving a more optimistic outlook, with predictions suggesting potential price rallies if current structures hold.

How is Ripple news influencing XRP market analysis?

Recent Ripple news surrounding the launch of XRP ETFs and infrastructure upgrades is showing a positive impact on market analysis, indicating that while Bitcoin and Ethereum face outflows, XRP’s unique institutional appeal could lead to future gains.

What factors support XRP’s institutional investment attraction?

XRP’s recent attraction for institutional investment is supported by its innovative market structure updates, including a prime-broker-style interface that allows institutions to access on-chain derivatives, thus fostering greater engagement from traditional finance.

What are the latest XRP blockchain updates affecting its market position?

The latest XRP blockchain updates, such as the activation of ‘Permissioned Domains’ on the XRP Ledger, are enhancing the platform’s capabilities and security, making it more attractive to institutional participants, thereby strengthening its market position.

How do XRP’s derivatives markets signal a shift in trader sentiment?

XRP derivatives markets are showing a cleaner structure with a significant skew towards call options, indicating bullish sentiment among traders who anticipate a rebound, contrasting with the negative sentiments affecting Bitcoin and Ethereum.

What regulatory factors are currently impacting XRP and its institutional appeal?

Recent regulatory clarity around XRP has shifted perceptions, reducing its previous risk discount and paving the way for increased institutional interest, especially with XRP products now accessible on platforms like CME Group.

How does XRP’s market behavior differ from Bitcoin and Ethereum?

Unlike Bitcoin and Ethereum, which are experiencing significant outflows and bearish sentiment, XRP is seeing institutional inflows and maintaining a relatively optimistic market structure, indicating a unique resilience amid overall market struggles.

What could the future hold for XRP in the evolving crypto landscape?

The future for XRP appears positive if current institutional investment trends and blockchain advancements continue. Analysts predict that XRP may gain a premium in valuation compared to other cryptocurrencies if it successfully integrates with traditional financial systems.