In a groundbreaking move for institutional Bitcoin payments, a recent $1 million Lightning transaction highlights the immense potential of the Bitcoin Lightning Network. This swift transfer between Secure Digital Markets (SDM) and the cryptocurrency exchange Kraken on January 28 marks the largest publicly reported Lightning transaction to date, illustrating the network’s scalability for high-value payments. Previously, six-figure Lightning payments were a rarity, making this seven-figure transfer a significant milestone for the utilization of Bitcoin in institutional trading. Voltage CEO Graham Krizek referred to the transaction as an important moment, demonstrating that the Lightning Network can indeed accommodate enterprise-level financial operations. As metrics for the Lightning Network continue to improve, the ability to facilitate large-scale transfers opens new doors for Bitcoin scalability and adoption in traditional finance.

Exploring the realm of rapid Bitcoin transactions, the Lightning Network has emerged as a vital component for facilitating quick and efficient transfers in the cryptocurrency market. This innovative layer enables users to conduct transactions with minimal fees and instant confirmations, catering particularly to the financial demands of institutional clients. The historic $1 million transaction between SDM and Kraken illustrates the network’s capability to handle significant sums, pushing the boundaries of what was previously thought possible in digital currency exchanges. As financial institutions increasingly seek to leverage cryptocurrency for payments and investments, the scalability offered by such technologies as the Lightning Network becomes crucial. With its potential still largely untapped compared to Bitcoin’s overall market value, the future of Lightning transactions looks increasingly promising for both individual and corporate users.

| Key Point | Details |

|---|---|

| Transaction Amount | $1 million Lightning payment from SDM to Kraken on January 28. |

| Historical Context | Largest publicly reported Lightning transaction to date, serving as proof-of-concept for large payments. |

| Previous Transactions | The last notable payment was $140,000, highlighting the rarity of large transfers over Lightning. |

| Industry Impact | Considered an important milestone for institutional-level Bitcoin payments. |

| Current Metrics | Channel capacity on public Lightning channels reached over 5,600 BTC. |

| Usage Trends | Most usage has involved smaller payments, although larger transaction capacity is increasing. |

| Future Potential | Fidelity Digital Assets noted a 384% increase in average Lightning capacity since 2020. |

| Technological Development | Blockstream’s Core Lightning releases aim to reduce latency and support enterprise-focused implementations. |

Summary

Bitcoin Lightning transaction capabilities have significantly advanced with the recent $1 million transfer from SDM to Kraken. This landmark event demonstrates the potential for large-scale Bitcoin transactions over the Lightning Network, which has traditionally been limited to smaller payments. As institutional interest rises and network capacity increases, the Lightning Network stands poised to transform Bitcoin payment processing for enterprises, offering a promising solution for scalability and efficiency in the cryptocurrency ecosystem.

Understanding Bitcoin Lightning Transactions

Bitcoin Lightning transactions represent a groundbreaking advancement in the Bitcoin ecosystem, optimizing the scalability of cryptocurrency payments. With the recent $1 million transaction between Secure Digital Markets (SDM) and Kraken on January 28, it has become evident that the Lightning Network can facilitate high-value transactions traditionally deemed impossible within the Bitcoin protocol’s constraints. This development not only highlights the network’s potential for institutional-grade payments but also emphasizes the shift towards embracing the Lightning Network as a serious solution for transaction scalability in the cryptocurrency market.

The Lightning Network functions as an off-chain solution that allows for instant and low-cost transactions by establishing payment channels between users. This innovative mechanism provides a practical workaround for Bitcoin’s limited block size and high transaction fees, especially during peak times when network congestion often leads to delays. As institutional interest surges, clear evidence such as the $1 million Lightning transfer showcases the network’s capability to handle large-scale transactions while reducing the overall need for on-chain confirmations.

The Role of Institutional Bitcoin Payments

Institutional Bitcoin payments are becoming a crucial element in the evolving landscape of cryptocurrency exchanges. Many institutional players, like SDM, are increasingly utilizing the Lightning Network to execute significant transactions that reflect their confidence in Bitcoin’s technological evolution. The $1 million payment to Kraken stands as a testament to the operational maturity of the Lightning Network, making it clear that Bitcoin is evolving into a serious asset class for institutional investors looking to diversify their portfolios.

As financial institutions recognize the growing relevance of cryptocurrency in global finance, the use of Lightning transactions allows for faster, more efficient trades that can better meet their operational needs. This level of participation from larger entities indicates a broader market acceptance of Bitcoin and the potential it has for mainstream financial applications. With the successful execution of higher value Lightning transactions, we might see more interest from traditional finance sectors in adopting Bitcoin as a legitimate asset class.

Emergence of Higher Value Lightning Transactions

The move from six-figure to seven-figure Lightning transactions marks a significant milestone in Bitcoin’s scalability narrative. Historically, Lightning payments have primarily been used for smaller transactions, but robust infrastructure improvements and increased liquidity are paving the way for higher value transfers. This transition not only bolsters the operational capacity of the Lightning Network but also reflects an increasing trust among users regarding its reliability and security for larger transactions.

With the announcement of the largest Lightning transaction to date, industry experts believe that this event could trigger further developments in the infrastructure supporting large payments. Companies focusing on enhancing Lightning channels and their integration into financial systems are now more motivated than ever to provide services that cater to institutional needs. The future of Bitcoin scalability seems more promising as Lightning technology evolves and adapts to manage larger volumes without compromising efficiency.

The Impact of Lightning Capacity Metrics

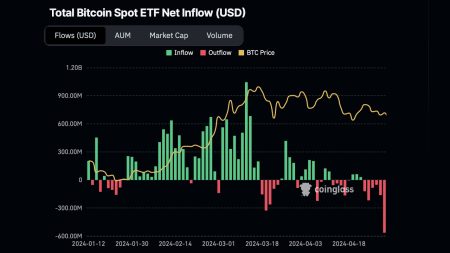

Despite the recent high-profile transaction, overall metrics for the Lightning Network indicate that much work still needs to be done in expanding its capacity. By reaching an all-time high of over 5,600 BTC in Lightning channels, the potential for increased usage is evident; however, this still represents a small fraction of Bitcoin’s overall market value. The reality is that while the Lightning Network is growing, average transaction volumes remain modest as most activities are still confined to smaller payments.

Nevertheless, significant growth in Lightning capacity—reported to have surged by 384% since 2020—suggests that initiatives aimed at expanding this infrastructure are yielding results. As more exchanges and financial institutions adopt Lightning Network capabilities, we could see a reconfiguration of the types of transactions it accommodates. Large-scale transactions could soon become the norm as these metrics improve, leading to broader advancements in cryptocurrency scalability.

Institutional Interest in Lightning Network Advancements

Growing institutional interest in the Lightning Network reflects a broader trend of adoption among financial services and companies looking to leverage the benefits of Bitcoin technology. Reports from firms such as Fidelity Digital Assets reveal that the network offers transformative opportunities for both new and existing financial institutions, indicating that there is a clear market for innovative payment solutions that utilize this technology. The testing of transactions like SDM’s $1 million payment is a major step toward validating Lightning as a serious alternative to traditional Bitcoin transactions that can often be slow and costly.

Moreover, the enhancements being made in the Lightning Network, such as those by Blockstream aimed at reducing latency and maximizing performance, are particularly appealing to institutional players. These advancements are designed to facilitate a more seamless integration of Lightning technology into existing financial frameworks, thereby fueling the ongoing trend of institutional Bitcoin acceptance. As infrastructure improves, the potential for high-volume institutional transactions will likely continue to increase, solidifying the Lightning Network’s role in the future of Bitcoin payments.

Potential of Lightning for Cryptocurrency Exchanges

For cryptocurrency exchanges like Kraken, adopting the Lightning Network can significantly improve operational efficiency and customer satisfaction. With the ability to process transactions almost instantly and at a fraction of the cost, exchanges can position themselves as leaders in the fast-paced digital asset market. The successful $1 million transaction serves as a case study in how the Lightning Network can facilitate larger trades without the traditional delays and fees associated with Bitcoin transactions, attracting more institutional clients looking for reliability.

As exchanges begin to leverage the benefits of Lightning transactions, we might see a shift in user behavior, with traders opting for Lightning-enabled platforms to execute large trades swiftly. This, in turn, could lead those exchanges to increase their capacity and services focusing on institutional clients. Understanding the dynamics of Lightning within exchanges will be critical for stakeholders aiming to remain competitive in the burgeoning cryptocurrency landscape, as more institutions seek efficient, scalable solutions.

Enhancing Trust in Lightning Network Transactions

Trust is a pivotal element when it comes to cryptocurrency, particularly for institutions handling large sums of money. The recent $1 million Lightning transfer has provided a substantial proof of concept, enhancing confidence in the network’s capability to provide secure and efficient transactions. This success underscores the network’s potential to serve as a reliable platform for high-value payments and could lead to widespread adoption across various financial institutions seeking secure payment methods.

The importance of trust in the Lightning Network cannot be overstated, especially as institutional players become more involved in Bitcoin payments. Security enhancements, alongside performance gains, contribute to this growing confidence, allowing institutions to feel secure about executing transactions that were previously hindered by concerns over speed and cost. Continuous improvements and successful high-value transactions are likely to foster an environment where Lightning is the go-to option for reliable Bitcoin payments.

Future Prospects of Lightning Network and Scalability

The future of the Lightning Network appears bright, especially with the ongoing push for greater scalability within Bitcoin’s infrastructure. Recent developments, including the announcement of the $1 million transaction, have sparked interest and optimism regarding the network’s scalability potential. With many improvements on the horizon, the network is likely to evolve into a robust solution that can support a significant uptick in transaction volumes as institutional engagement increases.

As more participants begin to explore the capabilities of the Lightning Network, there is an opportunity for significant transformations in how Bitcoin is perceived and utilized across financial platforms. The proactive approach taken by developers to enhance infrastructure and usability will be crucial in accommodating future growth. The alignment of Lightning technology with institutional demands could redefine Bitcoin transactions, setting a new standard for speed, cost, and scalability that will have long-lasting impacts on the cryptocurrency market.

Frequently Asked Questions

What is a Bitcoin Lightning transaction and how does it work?

A Bitcoin Lightning transaction is a type of off-chain payment that occurs on the Lightning Network, designed to increase Bitcoin scalability. This technology allows for faster and lower-cost transactions by enabling users to create payment channels for instant transactions without needing to record every detail on the main Bitcoin blockchain.

How does the Bitcoin Lightning Network facilitate institutional Bitcoin payments?

The Bitcoin Lightning Network facilitates institutional Bitcoin payments by providing a scalable solution that allows for high-value transactions, such as the recent $1 million payment from Secure Digital Markets (SDM) to Kraken. This network reduces congestion on the blockchain by enabling direct, quick transfers between parties.

What was the significance of the $1 million Lightning transfer between SDM and Kraken?

The $1 million Lightning transfer between SDM and Kraken is significant as it represents the largest publicly reported Lightning transaction to date, proving the feasibility of seven-figure transactions on the Lightning Network. This transaction exemplifies the potential for institutional Bitcoin payments to be executed seamlessly.

What are the benefits of using Bitcoin Lightning for cryptocurrency exchanges?

Using Bitcoin Lightning for cryptocurrency exchanges like Kraken can lead to faster transactions, lower fees, and enhanced scalability, making it suitable for larger transactions. This capability is essential for institutions looking to optimize their Bitcoin transactions and improve the overall user experience.

How does Lightning Network capacity affect Bitcoin scalability?

The capacity of the Lightning Network is crucial for Bitcoin scalability as it determines how much capital can be processed off-chain. With recent metrics showing record capacity levels, the potential for widespread adoption and larger payments, such as institutional transactions, increases, addressing Bitcoin’s limitations on the main blockchain.

What trends are emerging in institutional Bitcoin payments using the Lightning Network?

Emerging trends in institutional Bitcoin payments using the Lightning Network include increased transaction sizes, such as the recent $1 million transfer, and growing institutional interest in utilizing the technology for efficient payment solutions. This trend indicates a shift towards recognizing the Lightning Network’s potential in transforming how institutions handle cryptocurrency transactions.