In a shocking turn of events, Bitcoin drops suddenly beneath the crucial $70,000 mark, igniting fears across the cryptocurrency landscape. This notable Bitcoin price drop has triggered a significant market selloff, erasing over $1 billion in trading positions and sending ripples through digital assets. As the world’s largest cryptocurrency falters, many investors are grappling with the risks associated with cryptocurrency liquidation, particularly as other major assets such as Ethereum and XRP also succumb to losses. The current downturn highlights growing concerns within the market, as participants reevaluate their strategies amidst increasing digital assets risk. With prices fluctuating, the current state of affairs serves as a stark reminder of the volatility inherent in cryptocurrency investments.

Recently, the digital currency market witnessed a dramatic shift, with Bitcoin experiencing a notable decline in value. This abrupt downturn, often referred to as a crypto crash, has left many traders anxious about the implications for their portfolios. Critical to this situation is the cascading effect on other cryptocurrencies, including severe price declines in XRP and Ethereum. As market dynamics evolve, the forced liquidation of assets has become more prevalent, emphasizing the precarious nature of investing in the world of cryptocurrencies. With sentiments shifting rapidly, investors are now more aware of the risks associated with their digital ventures.

| Key Points | Details |

|---|---|

| Bitcoin Drops Below $70,000 | Bitcoin fell below the $70,000 mark, leading to a significant selloff in the cryptocurrency market. |

| Total Liquidations Exceed $1 Billion | Forced liquidations in the derivatives markets reached more than $1 billion, primarily affecting long positions. |

| Asymmetry of the Selloff | Market analyst Samson Mow noted that there was a unique asymmetry causing significant pain to traders. |

| Impact on Major Cryptocurrencies | Ethereum dropped by 7%, XRP fell by over 14%, and other major tokens also faced declines. |

Summary

Bitcoin drops have created significant upheaval in the digital asset market, with a plummet below the crucial $70,000 support leading to extensive liquidations. This market movement signals a growing concern among traders as confidence wanes and capital shifts towards equities and commodities. The cascading liquidations have further exacerbated the downturn, highlighting the vulnerabilities within the crypto market. As the situation unfolds, it is crucial for investors to remain informed and exercise caution in their trading strategies.

The Significant Bitcoin Price Drop and Its Impact on Traders

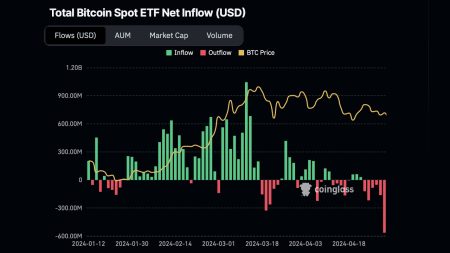

Recently, Bitcoin dropped below the crucial $70,000 support level, marking a significant downturn in the cryptocurrency market. This decline has triggered a widespread market selloff, causing losses exceeding $1 billion in liquidated trades. Traders who were heavily invested in long positions faced the brunt of this selloff, with a staggering $116 million liquidated within just one hour as prices broke technical charts. Such a stark drop in Bitcoin’s price has not only affected its traders but has also sent shockwaves throughout the broader digital assets sector, indicating just how fragile investor sentiment can be in the volatile world of cryptocurrencies.

The Bitcoin price decline has had a cascading effect on other cryptocurrencies, notably XRP, which saw a dramatic 14% drop. The fallout from Bitcoin’s downturn has put pressure on other major tokens like Ethereum, Cardano, and Solana, all of which also experienced significant losses. This intense market fluctuation showcases the interconnectedness of cryptocurrency assets, where a single asset’s significant price drop can lead to widespread negative sentiment and liquidation across the entire market. Market analysts are watching closely, as this scenario could lead to further price corrections and increased risk assessments among investors.

Understanding the Ripple Effect of Cryptocurrency Liquidation

As Bitcoin’s price dipped, an unprecedented wave of cryptocurrency liquidation ensued, where over $1 billion in trader positions were wiped out. On-chain data revealed that forced liquidations were largely driven by the excessive leveraging of long positions, reflecting a risky sentiment prevailing among traders. When Bitcoin’s value broke critical support, it triggered automatic sell orders aimed at minimizing losses, which only exacerbated the downward momentum. This phenomenon highlights the inherent risks of trading in the cryptocurrency market, particularly during times of extreme volatility.

Liquidation events, such as those witnessed recently, serve as a stark reminder of the digital assets risk involved in crypto trading. More than $900 million of recent liquidations were tied to long positions, illustrating how quickly bullish expectations can turn into heavy losses. The recent drop in prices not only hurt traders but also raised alarms about the structural integrity of the cryptocurrency market. Industry participants are now urged to re-evaluate their strategies, as the cyclic nature of these trends can lead to further cascading effects and increased volatility in the future.

Market Selloff: The Causes Behind Bitcoin’s Fall

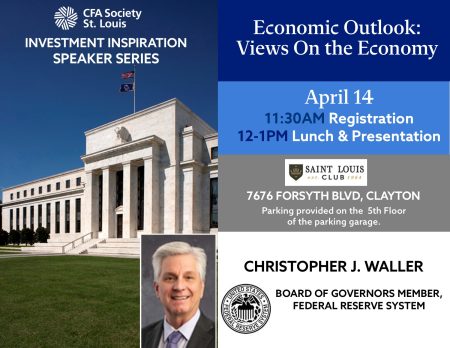

The recent market selloff has been attributed to a combination of factors, including shifts in global economic sentiment and increased risk aversion among investors. As concerns around inflation and changing interest rates grow, capital has increasingly flowed away from speculative assets like cryptocurrencies and into more stable investments. Heightened fears regarding technological valuations in the face of potential market corrections have further amplified the selloff, with traders becoming increasingly cautious about holding digital assets. Bitcoin, while still regarded as a leading cryptocurrency, remains susceptible to these broader market pressures.

Additionally, the economic climate post-2024 elections has shifted dramatically, moving from an optimistic perspective to a heightened risk-off approach. Traders are now facing uncertainty not just with Bitcoin, but across the entire cryptocurrency landscape, as evidenced by XRP’s significant dip. The unpredictability in the market has made many cautious about entering positions, resulting in a slowdown of new capital flowing into the market. Understanding these market dynamics is vital for traders looking to navigate the complexities of cryptocurrency investments during turbulent times.

The Role of XRP in Recent Market Dynamics

XRP’s price decline has drawn attention during the recent selloff as it faced the largest percentage drop among major cryptocurrencies. After its recent performance gains, the sudden plummet of more than 14% to $1.35 raises questions about market resilience and individual coin volatility. As Bitcoin faltered, XRP followed suit, reinforcing the interconnectedness of cryptocurrency assets. Given XRP’s status and its past performance, this price movement suggests that investors may view it as an indicator of broader market health.

Moreover, this XRP decline mirrors sentiments within the larger digital asset market, where confidence has been shaken due to Bitcoin’s struggles. Ripple’s challenges add another layer of complexity to the overarching narrative of cryptocurrency’s growth and acceptance. As traders assess the impact of Bitcoin drops on assets like XRP, they must also consider regulatory implications and market sentiment, both of which play crucial roles in determining future price trajectories. This interconnected landscape necessitates a holistic approach to cryptocurrency investment strategies.

Risk Assessment in the Cryptocurrency Landscape

As the cryptocurrency market grapples with volatility, assessing risk becomes paramount for traders and investors. The rapid decline of Bitcoin has amplified fears over future potential downturns, leading to a reassessment of the risks associated with holding digital assets. The drastic liquidation figures seen recently serve as a critical warning for those engaged in leveraged trading. Investors must be acutely aware that while the potential for high returns exists, the inherent risks can lead to significant losses, especially during tumultuous market conditions.

Understanding digital assets risk entails more than monitoring price movements; investors need to be cognizant of market psychology and external economic factors that influence market trends. The shift from risk-on to risk-off sentiment can happen swiftly, and traders should prepare for abrupt price corrections. Tools such as stop-loss orders and risk diversifications can help mitigate potential losses, but they can never eliminate the underlying risk associated with market trading. As the market continues to evolve, a well-rounded risk assessment strategy will be essential for navigating cryptocurrency trading in the future.

The Impact of Technical Levels on Bitcoin Trading

Technical analysis plays a crucial role in cryptocurrency trading, especially during periods of volatility such as the recent market selloff. Bitcoin’s fall through the critical $70,000 support level highlighted the importance of technical indicators in managing trading decisions. Traders rely heavily on past price levels to gauge future movements, and breaking established support often leads to increased selling pressure. Understanding these technical dynamics can provide traders with insights into potential market behavior, enabling better decision-making amid uncertainty.

Moreover, the recent liquidations triggered by Bitcoin’s price dip demonstrate how significantly market participants react to technical levels. The quick breakdown below significant price points can result in cascading sell orders, compounding losses for highly leveraged positions. A robust grasp of technical analysis, alongside market fundamentals, enables cryptocurrencies like Bitcoin to navigate downtrends effectively. As new data emerges, traders must continuously adapt their strategies to align with evolving market conditions and price behaviors.

Investor Sentiment Following Bitcoin’s Price Drop

Investor sentiment is a critical driver in the cryptocurrency market, and the recent Bitcoin drop has seemingly shifted the mood from bullish enthusiasm to cautious pessimism. The volatility triggered by Bitcoin’s decline has led many investors to reconsider their strategies, with a shift towards more risk-averse positions. As a result, market participants are likely to pull back from aggressive investments until confidence is restored, impacting the entire liquidity of the crypto market. Investors are acutely aware of the precarious balance between potential profits and the risks associated with continued downward movements.

Additionally, the current climate may compel even seasoned investors to adopt a more defensive posture. With many digital assets now seen as fragile, the focus has shifted to safeguarding existing portfolios rather than exploring new opportunities. This sentiment can create a self-reinforcing cycle where diminished risk appetite leads to further price corrections, highlighting the intricate relationship between market perceptions and asset performance. Long-term, however, this could also set the stage for a potential rebound as confidence in the market returns.

Future Outlook for Bitcoin and the Cryptocurrency Market

Looking ahead, the future of Bitcoin and the broader cryptocurrency market is a topic of significant speculation among investors and analysts alike. While the recent price drop has raised concerns about sustainability and investor sentiment, it also presents opportunities for those willing to navigate the complexities of market cycles. Historical patterns suggest that after significant downturns, markets often recover, presenting potential entry points for investors. However, the timing and nature of such recoveries remain uncertain and dependent on multiple factors, including regulatory developments and macroeconomic indicators.

Furthermore, the evolution of Bitcoin’s role within the digital assets landscape will be closely observed by market participants. As the cryptocurrency market matures, the integration of more traditional financial mechanisms, such as institutional investments and regulations, could potentially create a more stable trading environment. For now, understanding the implications of recent price drops, such as the Bitcoin decline below $70,000, will be essential for predicting the future pathways of both Bitcoin and other cryptocurrencies in the ever-changing market dynamics.

Frequently Asked Questions

What causes Bitcoin price drops and their impact on the market?

Bitcoin price drops can result from various factors such as market sentiment shifts, regulatory news, or economic reports. When Bitcoin experiences a drop, it often triggers a market selloff, causing a domino effect on other cryptocurrencies like Ethereum and XRP. The resulting decline can lead to significant trading liquidations, destroying leveraged positions and creating further downward pressure.

How do Bitcoin price drops affect cryptocurrency liquidation?

When Bitcoin sees a price drop, especially below key support levels, it can lead to widespread cryptocurrency liquidation. This occurs as traders who had taken leveraged positions may be forced to sell their holdings, exacerbating the price decline. In the recent market selloff, for instance, a stark increase in forced liquidations was noted, prompting over $1 billion to vanish in various digital asset markets.

What is the relationship between Bitcoin drops and XRP price declines?

Bitcoin drops often have a correlated impact on XRP price performance. When Bitcoin’s value declines significantly, as seen recently, it can lead to similar adverse effects on XRP and other altcoins. This creates a ripple effect where XRP price declines can be attributed, in part, to the fluctuations and lack of confidence surrounding Bitcoin’s market performance.

Why do Bitcoin price drops lead to a broader market selloff?

Bitcoin is seen as a bellwether for the cryptocurrency market. When it drops sharply, it can trigger fear and uncertainty among investors, prompting them to sell other digital assets. This behavior reinforces a risk-off sentiment in the market, leading to a broader market selloff that impacts numerous cryptocurrencies simultaneously, including Ethereum, Cardano, and Solana.

What are the risks associated with holding Bitcoin during price drops?

Holding Bitcoin during price drops entails significant risks, including increased volatility and potential liquidation of leveraged positions. A sharp Bitcoin price decline raises red flags for traders, who may rush to exit their positions to avoid losses. This risk is compounded during market selloffs, where confidence in digital assets can erode quickly, leading to abrupt financial impacts.

How can traders protect themselves from Bitcoin drops and market selloffs?

To safeguard against Bitcoin drops and potential market selloffs, traders should consider employing risk management strategies, such as setting stop-loss orders and diversifying their portfolios. Staying updated with market trends and macroeconomic indicators can also help traders anticipate price movements and adjust their trading strategies proactively.