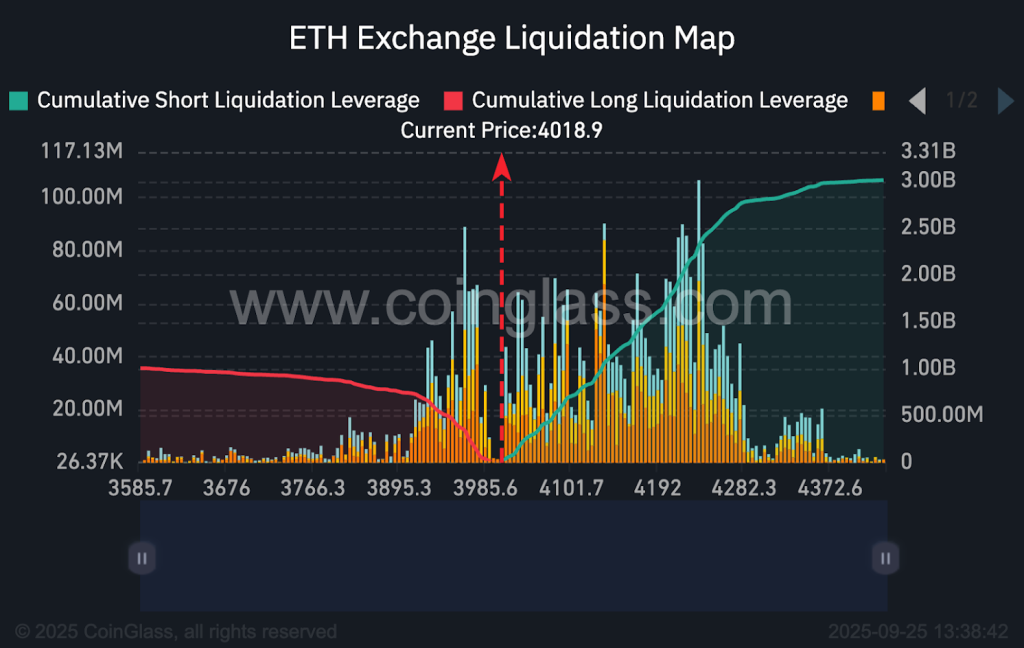

Ethereum liquidation has become a prominent concern as the cryptocurrency market faces significant volatility. As major players like Trend Research grapple with massive sell pressure, the implications of Ethereum’s price fluctuations are felt across the industry. The recent high-stakes situation surrounding Aave liquidation showcases the intricate relationship between leveraged positions and market dynamics, highlighting how quickly a position can unravel under stress. With reports indicating that Trend Research has seen a staggering $862 million in unrealized losses, the urgency to execute a deleveraging strategy has never been more acute. Investors are closely watching how these developments unfold, as they could directly influence the broader landscape of cryptocurrency liquidation and sell pressure on Ethereum.

The ongoing challenges surrounding Ethereum’s liquidation processes reveal deeper intricacies in the cryptocurrency ecosystem. Frequently described as a market ‘cascade,’ this phenomena illustrates the delicate balance between leveraged borrowing and asset value depreciation. The current situation with major liquidity providers, particularly those engaged in collateralized debts through platforms like Aave, demonstrates the risk of forced asset sales when market conditions worsen. As participants navigate the intricacies of deleveraging and protective selling, such dynamics could significantly impact Ethereum’s standing and overall market health. This evolving narrative around leveraged positions and liquidation risks highlights the importance of understanding market mechanics in today’s volatile cryptocurrency trading environment.

| Key Aspects | Details |

|---|---|

| Leveraged Position | Trend Research’s composite position reached approximately $958 million at its peak, primarily using Ethereum as collateral. |

| Recent Activity | As prices declined, Trend sold approximately 112,828 ETH to repay part of its debts, reducing its holdings from 601,000 ETH to 488,172 ETH. |

| Current Value | The remaining position is valued at around $1.05 billion based on current ETH prices. |

| Liquidation Threat | The liquidation threshold for the position increased as ETH prices fell, currently set between $1,830 to $1,880. |

| Liquidation Process | Liquidations on Aave involve selling collateral to liquidators who repay debts and may hedge by selling acquired ETH. |

| Market Impact | Large liquidations can have a cascading effect on market prices due to interconnected trading and feedback loops. |

| Watch Indicators | Monitor Aave health factors, sale patterns, and the broader market conditions to assess potential cascading impacts. |

Summary

Ethereum liquidation events can lead to significant market pressure, particularly in cases like Trend Research’s recent struggles with a $862 million liquidation risk. As the crypto landscape experiences volatility, understanding the mechanics and indicators surrounding these events becomes crucial for investors and market participants.

Understanding Ethereum Liquidation Risks

Ethereum liquidation refers to a process where assets tied to a borrowed amount are sold off to cover debts when the value of collateral falls below a specified threshold. In the context of leveraged positions like those held by Trend Research, falling Ethereum prices can trigger these liquidations, leading to significant market impacts. As seen with Trend’s holdings, the liquidation risk is not static; it fluctuates based on market conditions and the performance of Ethereum, greatly influencing investor strategies and behavior within the cryptocurrency landscape.

When a massive position like Trend’s comes under threat of liquidation, it creates a ripple effect. Liquidators may sell off large amounts of ETH, amplifying downward pressure on Ethereum’s price. This, in turn, can lead to further liquidations of other investors caught in similar leveraged positions. Spot market reactions can be swift; thus, understanding both the mechanics of liquidation and the overall sentiment in the Ethereum market is crucial for investors aiming to navigate these risks effectively.

The Role of Aave in Deleveraging Strategies

Aave provides a platform for leveraging assets, but it also plays a key role in the deleveraging strategies of traders like Trend Research. By leveraging Ethereum as collateral to borrow against, traders can heighten their potential returns; however, they also substantially increase risk. When Ethereum prices drop, borrowers must react quickly to avoid forced liquidation of their positions. Trend’s approach to actively manage its health factor through strategic sales on platforms like Binance is a story of risk management in action, reflecting the delicate balance traders must maintain.

The selling strategy observed from Trend Research showcases how traders utilize liquidations to their advantage, mitigating potential losses by voluntarily closing portions of their positions before reaching critical liquidation thresholds. This proactive approach is not just about reducing debt; it’s about maintaining market confidence and leveraging time to recover from downward price pressures. In essence, by understanding Aave’s liquidation mechanics, traders can craft tailored strategies to avoid the tumultuous consequences of forced sell-offs, illustrating the dynamic interplay between borrowing, selling pressure, and Ethereum’s price action.

Analyzing Ethereum Price Trends and Volatility

The price of Ethereum is deeply influential in shaping the overall mood within the cryptocurrency market. Movement in Ethereum’s value often dictates the fortunes of other altcoins and can create a broader narrative affecting market sentiment. Factors influencing Ethereum’s price include technological advancements, regulatory news, and broader economic conditions that could affect investment flows into cryptocurrency. In the current state, as the Ethereum price faces severe fluctuations, traders are adapting their strategies to preserve capital and leverage market opportunities.

Market volatility can be both a challenge and an opportunity for investors managing their Ethereum holdings. For instance, periods marked by sharp declines can drive serious sell pressure as positions approach liquidation points. Conversely, sharp recoveries can spark a renewed interest in accumulation or reinvestment strategies. Observing price trends allows traders to position themselves better, either by utilizing stop-loss orders or by implementing strategies designed to mitigate losses. Therefore, grappling with Ethereum price fluctuations is an essential component of successful trading in this digital economy.

Implications of Cryptocurrency Liquidation

Cryptocurrency liquidation, particularly related to Ethereum, carries significant implications for market stability. When large positions are liquidated, they not only affect the individual investors involved but can also reverberate through the entire market, creating waves of sell pressure. As observed with Trend Research’s liquidation situation, the collapse of substantial collateral can lead to panic among other traders, prompting them to sell off their assets to avoid potential losses. This phenomenon can create a feedback loop that exacerbates price declines.

Furthermore, the implications of liquidation extend beyond just price drops. They can also affect trading volumes and liquidity. Increased liquidations typically lead to higher trading volume as liquidators execute their sales, but this can also drain the market’s liquidity, making it harder for remaining investors to execute their trades without further affecting the price of Ethereum. Thus, understanding the broader implications of cryptocurrency liquidation is essential for traders and investors who want to navigate the risks and potential rewards of investing in volatile assets like Ethereum.

Monitoring Deleveraging Strategies in the Market

Deleveraging strategies among crypto investors, particularly those using platforms like Aave, are critical to observe as they indicate broader market health. When traders initiate sales to cover debts, it can signal either a defensive maneuver in response to falling prices or a more strategic decision aimed at maintaining long-term positions. Investors should closely monitor trading patterns as they can provide insights into market sentiment, revealing whether traders are succumbing to panic or taking a calculated approach to reduce their risk exposure.

Moreover, the monitoring of deleveraging across various positions can shed light on available liquidity and market resilience. For example, if many traders are minimizing their leverage and securing profits in light of declining prices, it could be a sign of a healthy market correction. Conversely, if a wave of deleveraging leads to forced liquidations, it may indicate deeper structural issues within the market. In both scenarios, staying ahead of market signals can inform trading decisions and risk management strategies.

Strategies to Mitigate Ethereum Sell Pressure

Mitigating sell pressure on Ethereum requires a comprehensive understanding of market dynamics and active management of investment strategies. Traders can deploy various risk management tactics to professionalize their approach to handling sell-offs. One strategy includes diversifying asset holdings across multiple cryptocurrencies and stablecoins, which can buffer the effects of Ethereum liquidations. Additionally, setting stop-loss orders at sensible thresholds can minimize undue losses and instead facilitate controlled selling if a steep decline occurs.

Another vital strategy is the use of derivatives and hedging techniques. By entering into futures contracts or utilizing options, traders can protect their positions from adverse price movements without the need to liquidate their ETH holdings. This pivot from outright liquidation towards more sophisticated hedging can not only stabilize individual accounts but can also contribute to less volatile fluctuations in the Ethereum market overall. Hence, equipping oneself with the necessary tools and strategies for managing sell pressure is about sustaining positions during turmoil rather than capitulating to panic.

The Cascade Effect of Large Liquidations

The cascade effect that large liquidations can induce in the Ethereum market is a critical element to consider for both investors and analysts. When a significant investor like Trend faces liquidation, the immediate reaction can lead to a chain of additional liquidations as market prices adjust rapidly. The interconnected nature of these positions means that a single liquidation event can trigger further sales, creating a snowball effect that can dramatically shift the market landscape within a short timeframe.

Understanding this cascade effect underscores the importance of having robust risk management strategies in place. Investors should anticipate potential rapid declines in market value and develop contingency plans, such as securing lower-risk positions or utilizing stop-loss measures. By preparing for these potential spillover effects, traders can better protect their portfolios against the unintended consequences of forced liquidations and navigate the complexities of the cryptocurrency market more successfully.

Indicators to Watch in the DeFi Space

Monitoring key indicators in the DeFi space is essential for anticipating the impact of Ethereum liquidation risks. First and foremost, tracking Aave’s health factor across various positions can provide real-time insights into whether collateral levels are stable or under duress. Changes in overall health factors can be a precursor to impending liquidations, allowing traders to make informed decisions to mitigate potential losses in the face of declining Ethereum values.

Additionally, transaction patterns can reveal emerging market trends, highlighting whether liquidators are entering the market in response to broad panic selling or if there’s a methodical strategy in place. Observing metrics like trading volume, price volatility, and the number of unique wallets participating in liquidation events can provide valuable context in assessing overall market health. These indicators can guide tactical trades and risk assessments, ultimately aiding traders in navigating through challenging market conditions successfully.

Long-term Outlook for Ethereum and Liquidation Risks

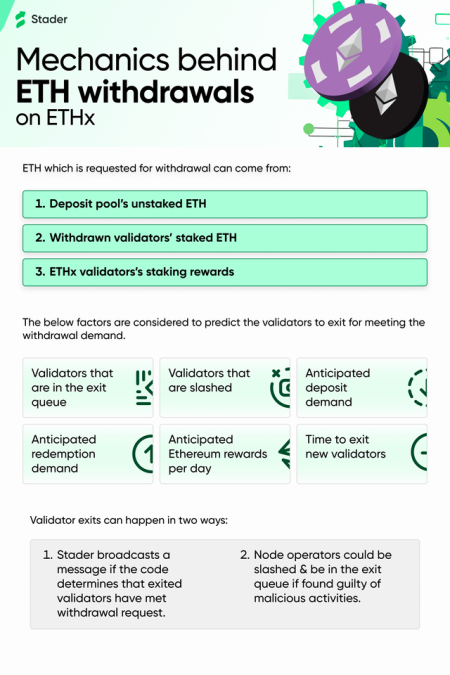

The long-term outlook for Ethereum amidst ongoing liquidation risks suggests a complex interplay between market fundamentals and investor behaviors. While short-term volatility can provoke significant anxiety among traders, the underlying technological advancements and adoption of Ethereum’s network services often hint at recovery potential. As Ethereum evolves through enhancements like ETH staking and Layer 2 solutions, gradual improvements in network efficiency and user satisfaction could fortify its price resilience.

However, for investors, the fundamental aspect of managing liquidation risks remains paramount. Awareness of how broader market conditions influence Ethereum’s price trajectory can prepare investors for fluctuations while still allowing them to embrace the potential benefits of future growth. Executing informed strategies that consider both immediate market responses and long-term fundamentals can create a balanced approach, helping traders navigate through liquidation scenarios while being ready to capitalize on upward price movements.

Frequently Asked Questions

What is Ethereum liquidation and how does it affect cryptocurrency investments?

Ethereum liquidation refers to the process where positions using Ethereum as collateral can be forcibly sold when their value drops, typically due to falling Ethereum prices. For investors, this means that if the price of Ethereum weakens significantly, it can trigger a liquidation event, leading to forced sales that create sell pressure in the market, potentially impacting the value of their overall cryptocurrency investments.

How do Aave liquidations work and what risks are involved with Ethereum collateral?

Aave liquidations occur when a borrower’s health factor drops below a critical threshold, typically due to declining Ethereum collateral values. Liquidators then repay part of the borrower’s debts and seize Ethereum collateral. The primary risk involved is that if Ethereum’s price falls dramatically, it could lead to substantial liquidation events, increasing sell pressure on the overall cryptocurrency market.

What factors contribute to the sell pressure faced by Ethereum during liquidation events?

Sell pressure during Ethereum liquidation events can be attributed to several factors: the immediate selling by liquidators trying to recover value, feedback loops created by oracle price updates that trigger further liquidations, and the potential defensive selling from large holders seeking to mitigate losses. All of these factors combined can cause a cascading effect that further depresses Ethereum’s price.

What is the relationship between Ethereum price and forced liquidation in DeFi systems like Aave?

The relationship between Ethereum price and forced liquidation in DeFi systems such as Aave is critical. As Ethereum’s price drops, the value of collateral backing borrowed funds also decreases, which can trigger forced liquidations if the health factor reaches below 1. This scenario creates an atmosphere of elevated risk where further drops in Ethereum’s price can lead to increased liquidation activities, exacerbating sell pressure in the market.

Can management strategies mitigate the impact of Ethereum liquidation on market prices?

Yes, management strategies such as proactive deleveraging can mitigate the impact of Ethereum liquidation on market prices. Borrowers can reduce their exposure by selling portions of their collateral before reaching a liquidation threshold, which helps manage their health factors and limit forced liquidations. Such strategies can reduce the amount of Ethereum that enters the market suddenly, thereby easing potential sell pressures.

What indicators should investors watch to understand Ethereum liquidation risks?

Investors should monitor several indicators to understand Ethereum liquidation risks: the health factor of large leveraged positions on platforms like Aave, the patterns of Ethereum sell transactions during market stress, and broader market conditions that might increase liquidation risks. Keeping an eye on these factors can provide insights into potential sell pressures related to Ethereum liquidation.

How does the market react to significant Aave liquidation of Ethereum positions?

The market typically reacts to significant Aave liquidation of Ethereum positions through immediate price drops due to sudden selling by liquidators. This creates a feedback loop where falling prices can trigger more liquidations, leading to greater sell pressure. Additionally, the overall sentiment changes as traders react to the volatility, potentially causing further declines in Ethereum’s price.

What is a deleveraging strategy and its impact on Ethereum liquidation risk?

A deleveraging strategy involves reducing debt through asset sales to improve a borrower’s health factor and evade forced liquidation. For Ethereum positions, such strategies can lessen the risk of liquidation by keeping collateral values above required thresholds. Successful deleveraging allows investors to maintain exposure without triggering significant sell pressure in the market.