In a significant move that has captured cryptocurrency news headlines, Vitalik Buterin, co-founder of Ethereum, has conducted an ETH sale involving nearly 3,000 Ether, valued at approximately $6.6 million. This transaction comes shortly after Buterin announced plans to withdraw some of his Ethereum holdings to support privacy-focused technology initiatives. As the ETH price drops below $2,130, his decision raises eyebrows among enthusiasts and investors alike, especially given the context of recent fluctuations in cryptocurrency markets. The Ethereum Foundation is now navigating a phase of ‘mild austerity,’ during which it plans to allocate these funds judiciously towards impactful projects. With large holders like Buterin making such moves, the scrutiny on Ethereum’s market dynamics and strategies for sustaining its ecosystem only intensifies.

Recently, Ethereum’s co-founder has made waves in the crypto community by offloading a significant quantity of Ether. This pivotal sale aligns with an evolving narrative surrounding cryptocurrency management and the strategic allocation of funds within the Ethereum ecosystem. As the price of Ether experiences notable declines, investors and analysts are paying close attention to the implications of Buterin’s actions for the broader market and how it resonates within the Ethereum Foundation’s objectives. The latest developments underscore the foundation’s commitment to prioritizing innovative technologies while adapting its financial strategies in response to market conditions. Furthermore, as discussions around large asset holders become more prevalent, Buterin’s actions may serve as a barometer for the resilience of the Ethereum network and its future endeavors.

| Key Point | Details |

|---|---|

| Vitalik Buterin’s ETH Sale | Buterin sold nearly 3,000 ETH valued at $6.6 million. |

| Timing of Sale | The sales occurred shortly after announcing withdrawals from his holdings. |

| Purpose of Funds | Funds allocated for supporting technology developments in privacy and open-source hardware. |

| Ethereum Foundation’s Strategy | Explored alternative financing strategies including staking and DeFi due to past criticism. |

| Market Condition | ETH has dropped over 5%, increasing sell pressure from large holders. |

Summary

The recent events surrounding the Vitalik Buterin ETH sale highlight significant movements in the cryptocurrency space. Buterin, in selling nearly 3,000 ETH worth $6.6 million, demonstrates strategic positioning in response to current market conditions and a shift towards funding privacy-focused technologies. As the Ethereum Foundation aims for a sustainable development path, the scrutiny over large ETH holders and market trends ultimately shapes the foundation’s future in the blockchain ecosystem.

Vitalik Buterin ETH Sale: Key Highlights and Reactions

Ethereum co-founder Vitalik Buterin recently made headlines with his decision to sell nearly 3,000 ETH, valued at approximately $6.6 million. This sale took place shortly after he announced his plans to withdraw a portion of his Ethereum holdings. The move sparked discussions within the cryptocurrency community, especially as the market saw a drop in ETH prices, dipping over 5% in a single day. This sale highlights the potential impact of substantial transactions on market volatility, an aspect traders and investors closely monitor.

Furthermore, the circumstances surrounding Buterin’s sale prompted curiosity about the future direction of the Ethereum Foundation and its financial strategies. As Buterin reallocates his resources to support privacy-enhancing technologies and secure software development, it raises questions about how these investments will influence both the foundation and the Ethereum ecosystem at large. Observers are keenly watching to see if this shift in strategy will bolster the foundation’s reputation, especially in light of previous criticisms regarding its reliance on selling ETH for funding.

Implications of Ethereum Price Fluctuations on Holdings

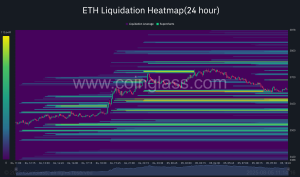

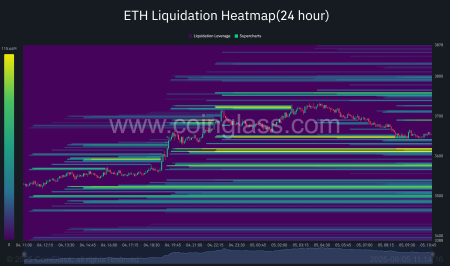

The recent drop in Ethereum prices has been significant, causing a ripple effect across the cryptocurrency market. Those holding substantial amounts of ETH, including large investors and institutions, have been compelled to react strategically, sometimes resulting in liquidating assets to settle their leveraged loans. As Buterin’s sale coincides with this market downturn, analysts are revisiting the dynamics between large-holder activities and price movements, which can often lead to increased sell pressure in a fragile market.

This environment of declining ETH prices emphasizes the need for strategic financial planning among Ethereum holders. Liquidation events triggered by price drops can create a domino effect, impacting the overall market sentiment and leading to further price declines. For the Ethereum Foundation, navigating this volatility is crucial as they seek alternative funding strategies, including staking and decentralized finance methods, that may insulate them from the immediate pressures exerted by ETH price fluctuations.

The Future of Ethereum Holdings: Buterin’s Strategic Moves

Vitalik Buterin’s recent strategic decisions, including his ETH sale and pivotal allocations towards privacy-preserving technologies, indicate a forward-thinking approach towards both personal and organizational holdings. By gradually deploying a notable portion of his holdings, Buterin aims to foster innovation while mitigating immediate financial risks associated with the declining ETH market. This calculated move showcases his commitment to long-term advancements in the Ethereum ecosystem, emphasizing a gradual but impactful transition.

As the Ethereum Foundation continues to adapt to its current fiscal landscape, Buterin’s emphasis on creating a secure and verifiable technology stack is particularly noteworthy. The integration of both hardware and software development is essential for establishing a more robust, privacy-focused ecosystem that aligns with contemporary technological demands. Observers are eager to see how these strategic choices will influence Ethereum’s trajectory in the coming years, particularly amid its ongoing evolution in the competitive cryptocurrency landscape.

Community Reactions to Buterin’s ETH Selling Strategy

The cryptocurrency community has been vocal about Buterin’s decision to sell a significant portion of his ETH. While some view this as a prudent financial move during a time of market instability, others have expressed concerns about the implications for Ethereum’s overall health. This dichotomy of opinions reflects the diverse perspectives within the crypto ecosystem, where decisions made by influential figures like Buterin can sway investor sentiment and market dynamics considerably.

Critics of the ETH sale have pointed out that such moves can contribute to market volatility, potentially discouraging retail investors who fear they might be at a disadvantage compared to prominent players. On the other hand, advocates argue that Buterin’s reinvestment into crucial technologies is a sign of confidence in Ethereum’s future. Balancing community concerns with responsible fiscal strategies will be critical for the Ethereum Foundation as it seeks to maintain trust amidst ongoing scrutiny.

Analyzing Buterin’s Vision for Ethereum’s Technical Roadmap

In his latest statements, Vitalik Buterin has stressed a commitment to advancing Ethereum’s technical roadmap through dedicated efforts towards open-source, secure, and verifiable technologies. This vision highlights a proactive approach to address evolving challenges in the crypto space, especially concerning security and privacy. Buterin’s determination to lead these developments personally suggests a hands-on approach that may invigorate community participation in bolstering Ethereum’s infrastructure.

As the Ethereum Foundation enters a phase of what Buterin describes as “mild austerity,” the need for innovative solutions to sustain operations becomes paramount. The foundation’s focus on privacy-preserving technologies aligns well with current trends in cryptocurrency, where user data protection is a growing concern. By championing advancements in this area, Buterin not only aims to enhance Ethereum’s offerings but also to reaffirm its position as a pioneering force in the blockchain landscape.

The Role of the Ethereum Foundation in Current Market Trends

The Ethereum Foundation plays a critical role in shaping the future of Ethereum, especially during times of market fluctuation. With recent ETH sales to support ongoing operations, the foundation has faced both scrutiny and validation from the community. While it’s essential for the foundation to ensure financial sustainability, the methods adopted for raising funds—such as selling ETH—must be balanced with long-term growth and stability.

Innovative funding strategies, like staking and leveraging decentralized finance, are now being explored as alternatives to traditional asset sales. These approaches not only align with the founder’s vision but also address community concerns about potential sell-offs that may harm the market. Maintaining transparency in these financial strategies will be vital for the Ethereum Foundation to foster trust and ensure that its initiatives resonate positively with both investors and developers.

Tracking Market Reaction to Buterin’s Ether Decisions

Market reactions to Vitalik Buterin’s decision to sell a significant amount of ETH have been swift and varied. Following the announcement, many investors closely monitored trading patterns and price performance. The immediate aftermath saw ETH struggling to maintain its value, reflecting how the actions of high-profile figures can sway market sentiment dramatically. Observers continue to analyze price trends, correlating them with news and selling activities from large holders.

The ability of the market to absorb such high-volume transactions without severe downturns can indicate underlying strength or weakness. For Ethereum traders, understanding these patterns is crucial. As the market reacts to Buterin’s sale, insights gleaned can assist investors in making informed decisions moving forward. The community’s response underscores the intricate relationship between market reactions and prominent influencers within the cryptocurrency space.

Ethereum’s Shift Towards Decentralized Solutions and Staking

As Ethereum navigates through uncertain market conditions, the foundation is actively exploring decentralized solutions and staking mechanisms as sustainable alternatives to traditional financing methods. Vitalik Buterin’s acknowledgment of the shift towards these innovative strategies signifies an essential step in fortifying Ethereum’s ecosystem against market volatility. Prioritizing decentralized finance allows the foundation to tap into contemporary trends while adhering to the core principles of blockchain.

By transitioning to staking and decentralized solutions, the Ethereum Foundation can accomplish its technical goals without solely relying on extensive ETH sales. This move not only aligns with the increasing emphasis on reducing friction in transactions but also reflects an understanding of where the market is heading. Stakeholders are keen to see how these approaches will materialize in the coming months and whether they can effectively stabilize and enhance the Ethereum network.

Conclusion: The Future of Ethereum Post-ETH Sale

As the dust settles from Vitalik Buterin’s significant ETH sale, the future of Ethereum remains in a state of cautious optimism. The foundation’s commitment to funding critical innovations while managing current assets illustrates a dynamic balancing act. Stakeholders continue to be watchful as the effects of these adjustments unfold in the marketplace, ideally leading to a stronger, more resilient Ethereum ecosystem.

Ultimately, the strategic decisions made by Buterin and the Ethereum Foundation will shape public perception and investor confidence in the upcoming phases of development. Only time will reveal whether these moves will solidify Ethereum’s standing in the crypto space or if they will spur further volatility. Engaging with community feedback and maintaining transparency will be essential for fostering trust and ensuring that Ethereum can navigate the complexities of the cryptocurrency market successfully.

Frequently Asked Questions

What prompted Vitalik Buterin to sell ETH recently?

Vitalik Buterin sold nearly 3,000 ETH valued at $6.6 million shortly after announcing a withdrawal from his Ethereum holdings. The sale aligns with his intention to finance privacy-preserving technologies and ensure the Ethereum Foundation can sustain its operations during a phase of ‘mild austerity.’

How much ETH did Vitalik Buterin sell and for what amount?

Vitalik Buterin sold approximately 2,961 Ether for around $6.6 million over three days. This sale happened when Ethereum’s price was around $2,130, following a notable price drop in the cryptocurrency market.

What are the future plans for the funds from Vitalik Buterin’s ETH sale?

The funds raised from Vitalik Buterin’s ETH sale will support privacy-preserving projects, open hardware, and secure software development. Buterin plans to gradually deploy these funds over the coming years to enhance the Ethereum Foundation’s technical roadmap.

How has the Ethereum community reacted to Vitalik Buterin’s ETH sale?

While there has been criticism in the past regarding the Ethereum Foundation’s decision to sell ETH, Vitalik Buterin’s recent sale appears to be part of a broader strategy to allocate resources responsibly. This move highlights the necessity for financial sustainability as ETH prices decline.

What impact did Vitalik Buterin’s ETH sale have on ETH prices?

Vitalik Buterin’s sale of nearly 3,000 ETH coincided with a drop in ETH prices, which fell by over 5% in a day. The activity among large holders, including Buterin, has contributed to market volatility and sell pressure among leveraged Ether traders.

Is Vitalik Buterin’s ETH sale a sign of bearish sentiment in cryptocurrency?

The sale of substantial amounts of ETH by key figures like Vitalik Buterin can signal bearish sentiment, particularly when it coincides with a falling price trend in the cryptocurrency market. Such actions often lead to increased scrutiny on large holders and market dynamics.

What is the significance of the Ethereum Foundation’s financial strategy following Buterin’s ETH sale?

In light of Vitalik Buterin’s recent ETH sale, the Ethereum Foundation is exploring alternative financing strategies, including staking and DeFi methods, to ensure long-term sustainability while transitioning from traditional sales to newer concepts of funding.

Will Vitalik Buterin’s ETH holdings continue to change in the future?

Vitalik Buterin has indicated that while he may sell portions of his Ether holdings for different initiatives, his overall focus remains on enhancing Ethereum’s technological framework. Future sales may mirror those associated with funding innovative projects.

How does Vitalik Buterin’s decision to sell ETH relate to his role in the Ethereum Foundation?

Vitalik Buterin’s decision to sell ETH is part of his effort to balance personal holdings while reinforcing the Ethereum Foundation’s financial health. This strategic approach aims to support innovation within the ecosystem while adhering to principles of financial responsibility.

What should investors watch for after the Vitalik Buterin ETH sale?

Investors should monitor the trends surrounding Ethereum prices and any further announcements from Vitalik Buterin or the Ethereum Foundation related to their funding strategies and project developments. Additionally, reactions from the broader cryptocurrency community may influence market sentiment going forward.