Crypto banking licenses are rapidly becoming a focal point for fintech transformation as the digital finance landscape evolves. In a bid to adapt to new banking regulations, many crypto firms are entering a competitive race to secure these licenses, which enable them to operate as recognized financial institutions. With looser U.S. regulations encouraging innovation, major players like Circle and Ripple are paving the way toward institutional legitimacy. The acquisition of trust bank licenses allows these companies to not only stabilize their funding sources amidst capital market volatility but also gain seamless access to federal payment systems. This shift signifies a pivotal moment in the financial sector, moving away from traditional banking models and towards more integrated and efficient digital finance solutions.

As the financial industry evolves, the emergence of licensed cryptocurrency banks marks a transformative shift in how digital assets interact with traditional banking systems. By obtaining banking charters, these innovative firms aim to reshape the landscape of modern finance, enabling direct participation in regulatory frameworks that previously only applied to conventional banks. This evolution reflects a growing trend in the fintech space, where companies are actively pursuing authoritative licenses to enhance their operational capabilities and improve customer trust. Moving beyond mere digital wallets, these institutions are reimagining the role of technology in providing seamless financial services. The new wave of crypto banking holds the promise of greater security, transparency, and access within the burgeoning fintech ecosystem.

| Key Point | Details |

|---|---|

| Looser U.S. Regulations | The U.S. regulatory environment is becoming more favorable for crypto and fintech companies. |

| Acceleration of Banking Licenses | More crypto firms are now applying for banking licenses to operate as licensed banks. |

| Trust Bank Licenses Approved | The OCC has approved conditional applications for trust bank licenses from five prominent firms including Circle, Ripple, and Fidelity Digital Assets. |

| Hedging Against Market Volatility | Having a banking license allows these firms to better protect themselves against capital market fluctuations. |

| End of Traditional Front-end Role | Fintech firms are moving away from being just front-end channels for traditional banks, aiming for more direct banking capabilities. |

| Stable Funding Sources | Direct access to banking licenses allows crypto firms to raise deposits and connect to federal payment systems, enhancing stability and funding. |

Summary

Crypto banking licenses are becoming increasingly sought after as fintech firms transition into fully licensed banks, prompted by the looser regulatory framework in the U.S. This shift not only enhances their operational capabilities but also helps them secure stable funding and adapt to market dynamics effectively. The fast-tracking of trust bank licenses by the OCC showcases a significant transformation in the financial landscape, suggesting a competitive future between traditional banks and burgeoning crypto firms.

The Rise of Crypto Banking Licenses

With the gradual easing of regulations in the U.S., crypto firms are now seizing the opportunity to apply for banking licenses. This shift marks a significant transformation in the fintech landscape, where companies are no longer just intermediaries between traditional banks and customers. Instead, they are pursuing the status of fully-fledged banks, capable of offering a variety of financial services, including the ability to manage deposits and facilitate transactions through the federal payment system. Major players like Circle, Ripple, and Fidelity Digital Assets have begun the process of obtaining trust bank licenses, driven by the need for stability in an increasingly volatile capital market.

The implications of this shift towards acquiring crypto banking licenses are profound for both the fintech industry and traditional banking. As digital finance firms achieve legitimate banking status, the competition among fintech firms will intensify, pushing them to innovate and expand their service offerings. This trend also signals a maturation of the industry, where regulatory compliance becomes crucial not just for legitimacy but also for competitive advantage in a crowded marketplace. As more financial products and services emerge from these licensed entities, they will likely develop a unique position that could redefine customer trust and engagement in the finance sector.

Impact of Banking Regulations on Fintech Transformation

The evolving landscape of banking regulations in the U.S. has played a pivotal role in the fintech transformation narrative. The increased speed and efficiency of the approval process for trust bank licenses reflect a dynamic shift in how regulators view the relationship between traditional banking and fintech. As companies like BitGo and Paxos gain access to banking privileges, they not only enhance their operational capabilities but also solidify their positions in the financial market. This transformation is seen as a crucial step towards integrating digital finance within the established banking framework, ultimately leading to a more robust financial ecosystem.

Furthermore, as fintech firms begin to navigate the complexities of banking regulations, their ability to innovate will be put to the test. Complying with regulatory standards while maintaining operational agility is a delicate balance. Successful navigation of regulatory landscapes will empower these firms to offer tailored financial products that meet consumer needs while ensuring security and compliance, positioning them as strong competitors to traditional banks. The interplay between fintech firm growth and established banking regulations will continue to shape the future of financial services well into the coming years.

The Competitive Edge of Licensed Crypto Firms

As the trend of obtaining banking licenses continues to rise among crypto firms, the competitive edge that comes with these licenses can redefine the landscape of digital finance. Licensed firms, such as those approved by the OCC, are poised to attract customers with innovative products that leverage both technology and regulatory security. This dual advantage allows them to offer lower-cost services while reducing risks associated with capital market fluctuations, thereby gaining trust from consumers wary of volatility in the crypto space.

Moreover, having a banking license offers these firms significant advantages in regulatory compliance and operational legitimacy. This move not only differentiates licensed crypto banks from their unlicensed counterparts but also positions them as trusted partners in the broader financial ecosystem. As they expand their offerings of digital asset management and secure payment solutions, these firms can enhance user experience through seamless integration with traditional banking processes, ultimately driving growth in the fintech market.

Trust Bank Licenses: A Key to Financial Stability

Trust bank licenses have emerged as a crucial tool for crypto firms seeking financial stability in a landscape marked by volatility. By obtaining these licenses, companies can directly engage in banking activities such as accepting deposits and making loans, which traditionally have been the domain of established financial institutions. This ability to create a stable funding source not only strengthens their financial position but also allows them to support their users more effectively during market fluctuations.

The move towards securing trust bank licenses reflects a broader recognition of the importance of regulatory frameworks in fostering business resilience. As digital finance continues to evolve, those crypto firms obtaining these licenses may be better equipped to manage risks associated with capital market dynamics, offering a sense of security to investors and customers alike. This strategic shift indicates a promising future where the lines between traditional finance and blockchain technology become increasingly blurred.

Navigating the Challenges of Regulatory Compliance in Fintech

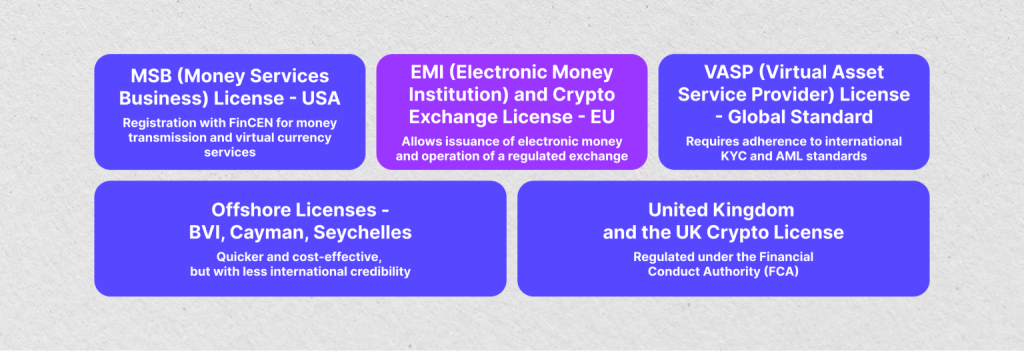

Navigating the challenges of regulatory compliance remains a critical issue for fintech companies, particularly those venturing into the world of banking licenses. As these firms seek to align with banking regulations, they face intricate legal requirements that can often seem overwhelming. Ensuring adherence to anti-money laundering (AML), know-your-customer (KYC), and other regulatory mandates requires not only robust systems but also expert knowledge about evolving legal landscapes.

Moreover, the regulations governing traditional banks can differ significantly from those applicable to fintech companies, adding another layer of complexity. Firms must adapt their operational frameworks to accommodate these differences, often resulting in delayed time-to-market for new services. However, overcoming these hurdles can lead to enhanced credibility and a stronger competitive position in the fast-evolving financial marketplace.

Future Trends in Digital Finance and Banking

Looking ahead, the future of digital finance and banking is likely to be defined by further integration between traditional banking services and revolutionary fintech models. As regulatory frameworks evolve to keep pace with technological advancements, we can expect an unprecedented level of collaboration between established banks and emerging financial technology firms. This synergy can result in enhanced customer experiences, offering seamless access to a diversified range of financial products.

Additionally, the potential for innovative solutions such as blockchain applications and decentralized finance (DeFi) could reshape how we view finance altogether. These trends will not only offer new opportunities for crypto firms to establish themselves within the banking sector but also challenge traditional banking institutions to adapt to a more digital landscape. Ultimately, the interplay of regulation, technology, and consumer demand will dictate the new narrative of finance in the years to come.

The Role of Consumer Trust in Fintech Growth

Consumer trust plays an essential role in the ongoing growth of fintech firms, especially as they transition towards becoming licensed banks. As digital finance products gain traction, customers’ willingness to engage with these services largely hinges on their perceptions of security and reliability. Obtaining a banking license serves as a critical step in building this trust by signaling to customers that regulatory bodies endorse the firm, thus establishing credibility in the digital finance space.

Fintech companies that prioritize transparency and communication in their operations will likely foster stronger relationships with their customer base. By demonstrating compliance with stringent banking regulations and providing robust security measures, these firms can alleviate concerns regarding the safety of funds. As consumer trust solidifies, the potential for expansion and deeper market penetration increases, paving the way for a more integrated financial future.

Market Opportunities for Fintech and Crypto Firms

As fintech and crypto firms pursue banking licenses, a wealth of market opportunities emerges across the financial services landscape. The ability to offer banking services such as loans, deposits, and payment processing opens doors to attract diverse customer segments. These firms can capitalize on gaps in traditional banking services, particularly by targeting underserved markets that seek innovative solutions, thereby fostering financial inclusion.

Moreover, as these firms evolve, they have the potential to disrupt established banking paradigms, introducing new financial models that prioritize user experience, lower costs, and enhanced accessibility. This evolution signifies not just a competitive sweep in the financial services market, but also a shift towards collaborative environments where consumers benefit from the innovations that these fintech firms bring forth.

The Intersection of Technology and Regulation

The intersection of technology and regulation is becoming increasingly relevant as fintech firms transition into licensed entities. This relationship underscores the importance of aligning technological advancements with the necessary regulatory frameworks to ensure both innovation and compliance. Fintech companies that effectively leverage technology to meet regulatory demands can create a proactive approach to consumer needs while remaining accountable to regulatory bodies.

Additionally, as technology evolves, so too must the regulations that govern it. The dynamic landscape of digital finance requires ongoing dialogue between industry stakeholders and regulatory authorities to create adaptable frameworks that support innovation while safeguarding consumer interests. This cooperative relationship can foster a more resilient financial ecosystem, ultimately promoting the growth of both fintech and traditional banking institutions.

Frequently Asked Questions

What are crypto banking licenses and why are they important for fintech transformation?

Crypto banking licenses are regulatory approvals that allow cryptocurrency firms to operate as licensed banks. They are crucial for fintech transformation as they enable these firms to provide a wider range of banking services, including raising deposits and connecting to the federal payment system, thus enhancing customer trust and operational stability.

How has the approval process for trust bank licenses changed recently for crypto firms?

Recently, the approval process for trust bank licenses has accelerated significantly, with regulatory bodies like the OCC approving applications from several crypto firms. This speed-up reflects the growing acceptance of digital finance and the desire among crypto companies to compete within the regulated banking framework.

What impact does acquiring a banking license have on crypto firms in terms of competition?

Acquiring a banking license allows crypto firms to compete more effectively by providing them access to federal payment systems and funds management, ultimately enabling them to offer more competitive services and reducing reliance on traditional banks.

How do banking regulations affect crypto banking licenses in the U.S.?

Banking regulations in the U.S. dictate the requirements that crypto firms must meet to obtain banking licenses. As the regulatory environment loosens, more crypto firms are likely to pursue these licenses, impacting competition and broadening the scope of services offered within digital finance.

Why is obtaining a banking license considered a hedge against capital market volatility for crypto companies?

For crypto companies, obtaining a banking license acts as a hedge against capital market volatility by providing access to a stable funding source through deposits, thereby reducing risks associated with market fluctuations.

What are the advantages of crypto firms operating with a banking license?

Operating with a banking license offers crypto firms advantages such as credibility, direct access to the federal payment system, improved funding options, and the ability to serve customers more effectively by providing a wider range of financial services.

Can all crypto firms successfully obtain banking licenses, and what factors influence this?

Not all crypto firms can obtain banking licenses; factors such as compliance with regulatory standards, financial stability, and operational transparency largely influence the approval process.

What role do trust bank licenses play in the evolution of digital finance?

Trust bank licenses play a pivotal role in the evolution of digital finance by allowing crypto firms to operate under a regulated environment, which enhances consumer confidence and fosters innovation within the sector.

How do crypto banking licenses enhance customer trust and service offerings?

Crypto banking licenses enhance customer trust by ensuring that firms comply with regulatory standards, thereby offering safe and reliable services, while also allowing them to provide a more comprehensive range of banking products.