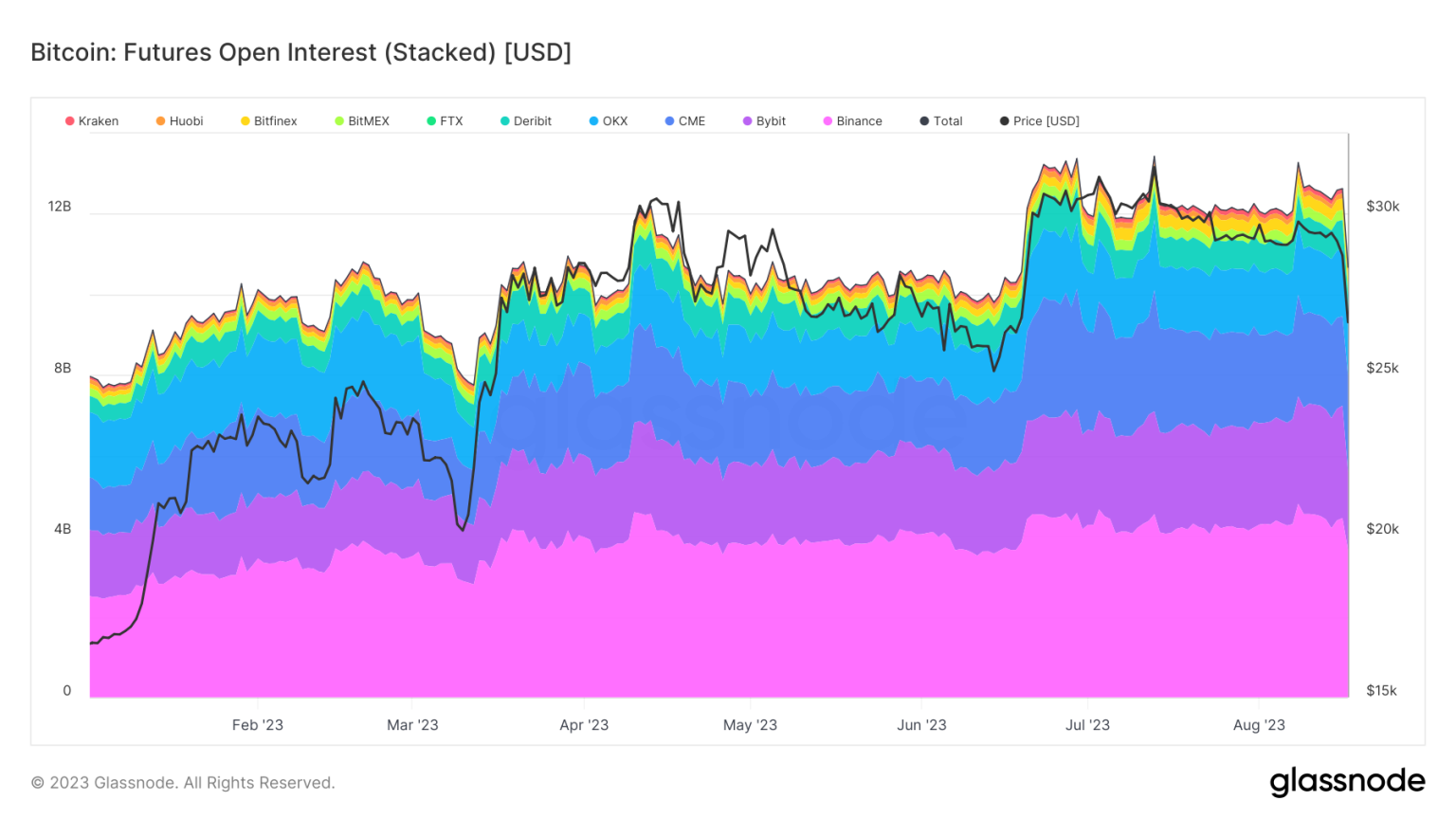

Bitcoin futures open interest has recently witnessed a significant decline, now dropping below the crucial $50 billion threshold, a level not seen since March 2025. This downturn is primarily attributed to shifting market sentiments and the ongoing volatility surrounding cryptocurrencies. As reported by Coinglass, open interest has seen a drop of 2.65% in just 24 hours, leading many traders to reevaluate the Bitcoin price impact on future trading trends. The current figure stands at approximately 699,500 BTC held, highlighting the increased caution amongst investors amid fears of BTC futures loss. This decline serves as a critical indicator not only of market health but also reflects broader trends affecting Bitcoin futures trading at large.

The recent downturn in Bitcoin derivatives signifies an important shift in market dynamics, with open positions in BTC futures decreasing markedly. This drop in engagement could influence future speculative movements, as traders become more wary of the potential for losses amid fluctuating digital asset values. Understanding the implications of this decreasing open interest offers insights into trader confidence and the anticipated trends in virtual currency markets. The sharp decline in participation may herald a period of consolidation or serve as a precursor to upcoming price movements. As traders assess their strategies, keeping an eye on Bitcoin futures could reveal critical patterns influencing the overall cryptocurrency landscape.

| Key Point | Details |

|---|---|

| Current Open Interest | $49.963 billion |

| Decrease Percentage (Last 24 Hours) | 2.65% |

| Total BTC Held | Approximately 699,500 BTC |

| Historic Low | Lowest since March 2025 |

Summary

Bitcoin futures open interest has recently seen a significant decline, dropping below the $50 billion threshold. This decrease reflects a broader trend in the futures market and signals a potential shift in investor sentiment. With open interest currently at approximately $49.963 billion and a total of 699,500 BTC held, the 2.65% reduction observed over the last 24 hours marks the lowest level since March 2025. Investors should closely monitor these changes, as they could indicate future market fluctuations.

Understanding Bitcoin Futures Open Interest

Bitcoin futures open interest is a key indicator that reflects the total value of contracts that are currently outstanding. This metric can offer insights into market sentiment and potential price movements. A declining open interest often signals decreased liquidity and may indicate that traders are exiting their positions, which can lead to volatility in Bitcoin pricing. As recent data shows, the open interest has fallen to a staggering $49.963 billion, marking its lowest point since March 2025.

The decrease in Bitcoin futures open interest is notable as it suggests a shrinking demand for these financial instruments. With approximately 699,500 BTC held, the drop in open interest by 2.65% within just 24 hours highlights the current uncertainty among traders. Such trends can be reflective of broader market sentiments, with investors reassessing risks associated with future price fluctuations. The implications of this trend are vital for understanding potential shifts in Bitcoin’s market dynamics.

Impact of Bitcoin Futures Drop on Pricing Trends

The recent drop in Bitcoin futures has significant implications for the broader cryptocurrency market. As open interest declines, it may suggest that traders are expecting a downturn in Bitcoin’s price, leading them to close positions. This situation can create a feedback loop where falling prices encourage further exits, amplifying market losses. The drop in open interest below the $50 billion mark could thus be a harbinger of increased volatility and challenges for Bitcoin’s pricing stability.

Furthermore, the impact of the futures loss on the overall market cannot be ignored. Traders watching these indicators closely may react in anticipation of price corrections or further downturns. If the trend continues, it may force price action to adjust accordingly, causing the BTC price to reflect a bearish sentiment among futures traders. This correlation between futures open interest and spot prices underscores the importance of monitoring futures markets to gauge potential changes in Bitcoin’s trajectory.

Future Trading Trends in the Bitcoin Market

Current trends in the futures trading sector reveal a cautious approach among investors in the Bitcoin market. The decline in open interest is telling of a broader trend where market participants are reassessing their strategies in response to recent price volatility. The futures market, which often serves as a barometer for anticipated Bitcoin price movements, has seen traders pull back, indicating a possible shift in trading behavior. As we analyze these trends, it’s crucial to consider how they may shape future market dynamics.

Moreover, if this cautious behavior continues, it could set the stage for a new phase in Bitcoin trading, where more conservative strategies take precedence. Traders may focus on using a hedging approach rather than speculative moves, especially with the uncertainty surrounding future price impacts. Consequently, the future trading trends in the Bitcoin market hinge heavily on the balance between risk tolerance and potential gains, making it essential to keep an eye on both the futures market and open interest levels.

Analyzing the Market Sentiment Behind Bitcoin Futures

Market sentiment plays a crucial role in influencing Bitcoin futures and their corresponding open interest. Traders’ perceptions regarding Bitcoin’s future performance can lead to significant buying or selling actions, causing fluctuations in open interest levels. A sentiment shift toward bearishness, especially following the recent drop in open interest, may discourage participation from new investors, leading to reduced liquidity and increased price volatility.

As traders digest the implications of the recent open interest decline below $50 billion, the overall market sentiment appears to lean towards caution. With many investors reassessing their strategies in light of recent price movements, understanding the psychological elements at play becomes imperative. This analysis not only helps in interpreting immediate market behaviors but also forecast future trading trends, as sentiment inevitably sways the decision-making processes of buyers and sellers alike.

The Role of Open Interest in Bitcoin Futures Trading

Open interest is a valuable tool for traders looking to navigate the complex waters of Bitcoin futures trading. It provides insights into the strength of market trends and potential price movements. A high level of open interest may indicate a robust market with active participants, while a decline could suggest that traders are losing confidence in continued upward momentum. Recent reports revealing a drop below the $50 billion threshold reinforce the necessity of examining open interest closely.

Understanding open interest also involves discerning its relationship with price. When open interest increases alongside rising prices, it often signals a strong bullish trend, whereas falling open interest amid declining prices can indicate weakening momentum. As Bitcoin’s open interest currently hovers around $49.963 billion and shows signs of further decline, it becomes increasingly important for traders to analyze these patterns to anticipate potential shifts in Bitcoin prices.

Future Uncertainties: Is Bitcoin Price Set to Decline?

Given the recent developments in Bitcoin futures, one pressing question is whether the Bitcoin price is set for further declines. With open interest falling significantly, traders remain cautious, leading to a sentiment ripe for potential price corrections. This uncertainty is amplified by the continuous observation of futures trends, which often serve as early indicators for market actions. If the current trend continues, we may see negative price impacts reflected in Bitcoin’s market behavior.

Market analysts and traders alike are now closely monitoring open interest levels, as they can serve as a predictor of forthcoming fluctuations in Bitcoin’s price. A sustained decrease in trade activity within the futures market could mean that investors are bracing for a downward adjustment of Bitcoin prices, potentially paving the way for a challenging trading environment. The consequences of this trend are profound, underscoring the importance of staying informed about fluctuations in open interest and market sentiment.

Caution in Bitcoin Futures Trading Strategies

In light of the recent declines in Bitcoin futures open interest, traders are advised to exercise caution. This drop signals a shifting landscape, where maintaining a defensive posture in trading strategies could be beneficial. Investors should consider employing risk management techniques to mitigate exposure amidst uncertain market conditions. This could include diversifying their portfolios or utilizing options to hedge against potential losses due to further declines in Bitcoin prices.

Moreover, it’s crucial for traders to keep informed about broader market trends influencing Bitcoin futures. As trading volumes and open interest fluctuate, the need for real-time data and analysis becomes even more critical. By staying attuned to these changes, traders can position themselves more effectively, allowing for proactive adjustments to their strategies in response to market sentiment and price movements.

Technological Advances and Their Impact on Bitcoin Futures

The cryptocurrency landscape is evolving rapidly, and technological advancements are playing a significant role in the futures trading market. Innovations in trading platforms and increased access to data analytics tools are enabling traders to make more informed decisions. This technological shift is particularly relevant now, as the open interest in Bitcoin futures has exhibited notable changes, suggesting a need for enhanced strategies that leverage current market conditions.

As Bitcoin futures continue to adapt to these technological advancements, traders must be prepared to integrate new tools and insights into their trading practices. Understanding how these innovations influence market behavior can potentially provide an edge in predicting future price movements. Adaptability to technological trends in trading can help investors navigate the current uncertainties associated with falling open interest and its implications for Bitcoin pricing.

Potential Recovery for Bitcoin Futures Open Interest?

Despite the current downturn, many traders remain hopeful for a recovery in Bitcoin futures open interest. Historical patterns suggest that markets can rebound, particularly when driven by renewed interest from institutional investors or positive regulatory news. A resurgence in open interest could signal bullish sentiment returning to the market, which would be crucial for stabilizing Bitcoin prices as they react to expectations of future gains.

In the interim, monitoring shifts within the Bitcoin futures market will be instrumental for traders exploring opportunities. Signs of a reversal in the decline of open interest may suggest that the market is regaining confidence, paving the way for heightened trading activity. Should this transpire, it could have a positive ripple effect on Bitcoin pricing, restoring some of the lost momentum and contributing to a more stable trading environment moving forward.

Frequently Asked Questions

What does the decrease in Bitcoin futures open interest indicate?

The recent decrease in Bitcoin futures open interest, which has fallen below the $50 billion mark, indicates a potential reduction in market activity and interest among traders. This decline often suggests waning investor confidence or a current bearish sentiment in the market, impacting future trading trends.

How does open interest decrease affect Bitcoin price?

A decrease in Bitcoin futures open interest can lead to lower trading volumes, which may adversely affect the Bitcoin price. As open interest drops, combined with other market factors, it can signal a lack of new capital entering the market, potentially resulting in downward price pressure for BTC.

What are the implications of falling Bitcoin futures for traders?

Falling Bitcoin futures open interest, now at approximately $49.963 billion, may imply a change in trading strategies for traders. They might reconsider their positions or adopt more cautious approaches due to increased market uncertainty and the potential for BTC futures loss.

Why is Bitcoin futures open interest significant for future trading trends?

Bitcoin futures open interest is significant because it reflects the overall liquidity and interest in the futures market. A declining open interest, such as the current drop to 699,500 BTC, can indicate reduced speculative trading and potential volatility in future trading trends.

What might cause Bitcoin futures open interest to drop?

Several factors can cause Bitcoin futures open interest to drop, including market sentiment shifts, regulatory news, macroeconomic changes, or increased volatility in the underlying Bitcoin price. The current decrease of 2.65% in open interest points to possible trader caution or repositioning in response to market conditions.

How can changes in Bitcoin futures open interest influence investor strategies?

Changes in Bitcoin futures open interest can significantly influence investor strategies. A falling open interest might prompt investors to reevaluate their long or short positions, leading to strategic adjustments in their trading plans, especially when observing the impact on Bitcoin price movements.