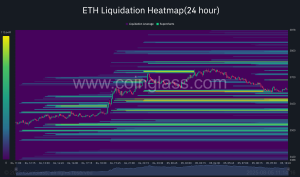

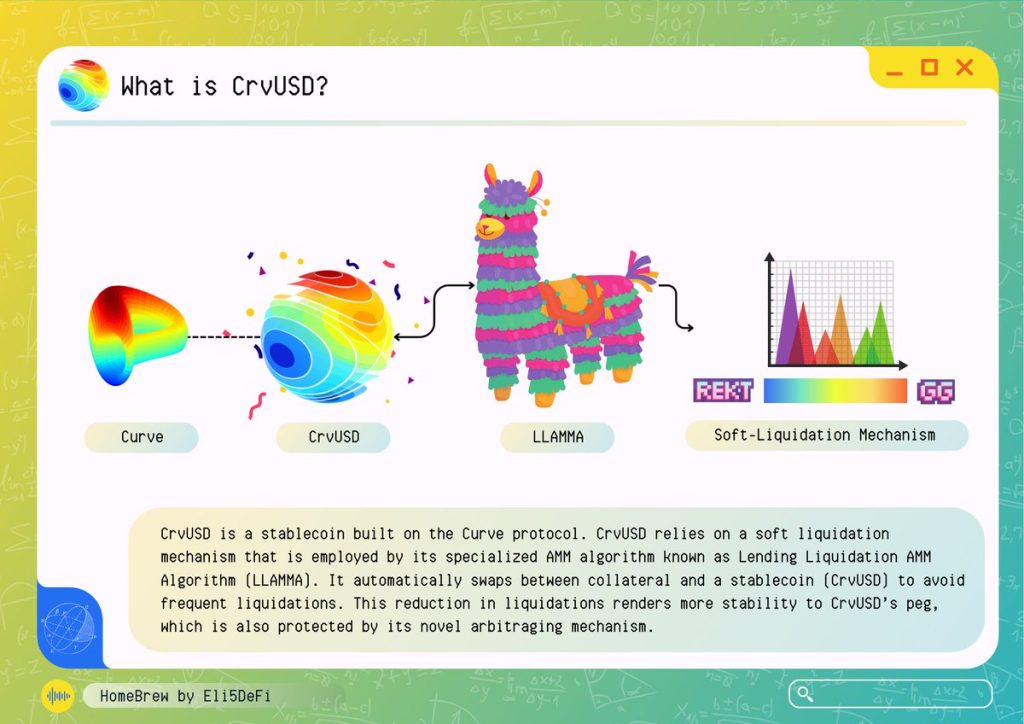

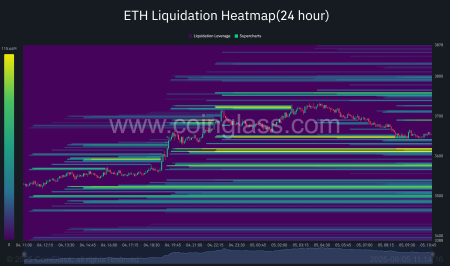

crvUSD stability is a critical component in the evolving landscape of the stablecoin market, particularly in relation to mainstream crypto assets such as Bitcoin. As highlighted by Michael Egorov, the founder of Curve, the substantial liquidity of crvUSD offers both opportunities and challenges, especially during periods of Bitcoin volatility. When BTC faces significant price swings, it inevitably exerts liquidation pressure on the crvUSD peg, making robust mechanisms for stabilization crucial. To maintain its value and adapt to trading dynamics, crvUSD must enhance its capacity while learning from the historical experiences of other stablecoins like USDT. The ongoing expansion of stablecoin adoption further emphasizes the need for crvUSD to position itself effectively in the market to meet rising demand from various yield-bearing scenarios and beyond.

The viability and reliability of crvUSD as a stable cryptocurrency hinge on its ability to maintain price consistency amid market fluctuations. In a sector driven by the performance of top digital currencies like Bitcoin, ensuring that crvUSD maintains its intended dollar value becomes paramount. The fluctuations in cryptocurrency values, particularly Bitcoin’s notorious volatility, often bring heightened liquidation pressure that can affect the stability of various collateralized stablecoins. As the demand for stable assets grows within trading communities, it is essential for crvUSD to adapt and expand in accordance with the increasing acceptance of stable digital currencies. Therefore, addressing the mechanics behind its stabilization will influence its integration into broader financial practices.

| Key Point | Details |

|---|---|

| Liquidity Scale | The current liquidity scale of crvUSD is significant compared to mainstream crypto assets like Bitcoin. |

| Volatility Impact | Increased pressure on crvUSD’s peg when Bitcoin experiences volatility. |

| System Capacity Expansion | There is a need to expand the system’s capacity to manage the high liquidity effectively. |

| Historical Context | Reminiscent of USDT’s early days when temporary de-pegging occurred due to processing limits. |

| Operational Model | crvUSD operates under a Collateralized Debt Position (CDP) model, necessitating specific mechanisms to address pressures. |

| Current Demand | Most of crvUSD’s demand currently comes from yield-bearing scenarios. |

| Future Adjustments | Future adjustments will likely focus on yield-bearing scenarios to maintain stability. |

| Inevitability of Adoption | As trading uses of stablecoins grow, the adoption scale of stablecoins will also need to expand. |

Summary

crvUSD stability remains a critical topic as the stablecoin faces unique challenges due to its substantial liquidity in relation to Bitcoin’s volatility. Michael Egorov highlights the need for careful consideration of the system’s capacity and mechanisms in light of these pressures. Historical comparisons to USDT’s earlier phases provide context, while the growing demand from yield-bearing scenarios suggests a focus for future adjustments. Ultimately, the ongoing rise in trading scenarios for stablecoins underscores the necessity for broader adoption and adaptation in the market.

Understanding crvUSD Stability in the Crypto Environment

The stability of crvUSD in the current cryptocurrency landscape is influenced by several factors, particularly its liquidity in relation to major crypto assets like Bitcoin. As noted by Michael Egorov, a notable challenge arises when Bitcoin volatility spikes. Such fluctuations do not just affect Bitcoin; they can create substantial liquidation pressure on crvUSD, potentially harming its peg. To maintain stability, it’s crucial for crvUSD’s system to adapt to the dynamic nature of the stablecoin market, ensuring it remains robust even during significant market movements.

Moreover, while crvUSD operates under a Collateralized Debt Position (CDP) model, similar to established stablecoins like USDT, it faces unique challenges. The emphasis on liquidity and system capacity must be a priority to mitigate risks associated with market volatility. As the crypto sector evolves and the demand for stablecoins increases, strategies to enhance crvUSD’s stability will be essential, especially in scenarios where traditional banking systems become overwhelmed during redemption periods.

Frequently Asked Questions

What factors influence crvUSD stability in the stablecoin market?

crvUSD stability in the stablecoin market is significantly influenced by its liquidity scale, particularly in relation to Bitcoin volatility. As Bitcoin experiences price fluctuations, the pressure on crvUSD’s peg can increase, particularly due to liquidation pressures on collateralized debt positions.

How does Bitcoin volatility affect crvUSD stability?

Bitcoin volatility impacts crvUSD stability by creating a ripple effect in the crypto market. When Bitcoin prices swing dramatically, it can exert greater liquidation pressure on crvUSD, challenging its peg and requiring robust liquidity management to ensure stability.

What is the importance of crvUSD liquidity for maintaining stability?

crvUSD liquidity is crucial for maintaining its stability, as it provides the necessary funds to meet demand and redeem requests. High liquidity ensures that crvUSD can withstand market fluctuations and decreases the risk of de-pegging during times of market stress.

What measures can enhance crvUSD stability in the context of stablecoin adoption?

Enhancing crvUSD stability in light of stablecoin adoption requires expanding its liquidity pools and improving its infrastructural capacity to handle increased trading demands. Engaging more users through yield-bearing scenarios can also help stabilize crvUSD by creating more usage incentives.

Why is crvUSD’s stablecoin model different from other stablecoins?

crvUSD operates under a Collateralized Debt Position (CDP) model, differing from other stablecoins like USDT. This model necessitates specific controls to manage liquidity and mitigate pressures from market volatility, making it essential to address potential risks associated with liquidation pressures.

What lessons from the early days of USDT can be applied to crvUSD stability?

The early days of USDT highlight that temporary de-pegging due to limited bank redemption capacities was not a structural issue. For crvUSD stability, maintaining robust liquidity strategies and expanding adoption are lessons to ensure it can manage fluctuations similarly effectively.