Tokenized securities are rapidly emerging as a groundbreaking asset class that could revolutionize how we approach investment in traditional markets. Recently, the Hong Kong Securities and Futures Commission (SFC) expressed plans to permit licensed virtual asset trading platforms (VATPs) to facilitate the secondary trading of these innovative financial instruments, primarily aimed at retail investors. This development signals a notable shift in the regulatory landscape, showcasing the SFC’s commitment to integrating cutting-edge technology with established financial frameworks. With tokenized money market funds at the forefront, the move is expected to provide unprecedented access to investment opportunities for the general public while retaining the same operational risks and regulatory compliance as traditional securities. As discussions progress, stakeholders are closely monitoring how these advancements could impact both market dynamics and investor participation in the evolving financial ecosystem.

In the realm of financial innovation, digitized assets are gaining attention, particularly as regulators explore their potential integration into mainstream trading platforms. These asset-backed tokens, often referred to as digital securities, offer the promise of enhanced liquidity and easier access for all types of investors, especially those classified as retail participants. Recently, a notable regulatory body, the Hong Kong Securities and Futures Commission, has initiated discussions focused on enabling virtual asset trading platforms to expand their offerings to include secondary transactions involving these digitized assets. This strategic move not only underscores the alignment between technology and asset management but also highlights the ongoing evolution towards a more inclusive investment environment. As the digitization of traditional assets unfolds, both financial institutions and investors are poised to experience transformative changes in how investments are approached.

| Key Point | Details |

|---|---|

| VATPs to Offer Secondary Trading | Hong Kong Securities and Futures Commission (SFC) is considering allowing licensed virtual asset trading platforms to offer secondary trading of tokenized securities to retail investors. |

| Focus on Tokenized Money Market Funds | The initiative primarily focuses on local tokenized money market funds, aiming to facilitate their trading on licensed platforms. |

| Regulatory Considerations | The SFC is currently assessing operational risks, relevant requirements, and control measures before finalizing regulations. |

| Tokenized vs. Traditional Securities | According to Luo Haishi, tokenized securities are treated similarly to traditional securities, differing mainly in technology. |

Summary

Tokenized securities represent a significant evolution in the financial landscape, particularly with the recent plans from the Hong Kong Securities and Futures Commission. They aim to allow virtual asset trading platforms to enable retail investors to participate in secondary trading. This move could open new avenues for investment and liquidity in tokenized money market funds, indicating a growing acceptance of tokenized assets alongside traditional ones. As the regulatory framework develops, it will be crucial to monitor how these tokenized securities integrate into existing markets and impact investor participation.

Understanding Tokenized Securities in Hong Kong

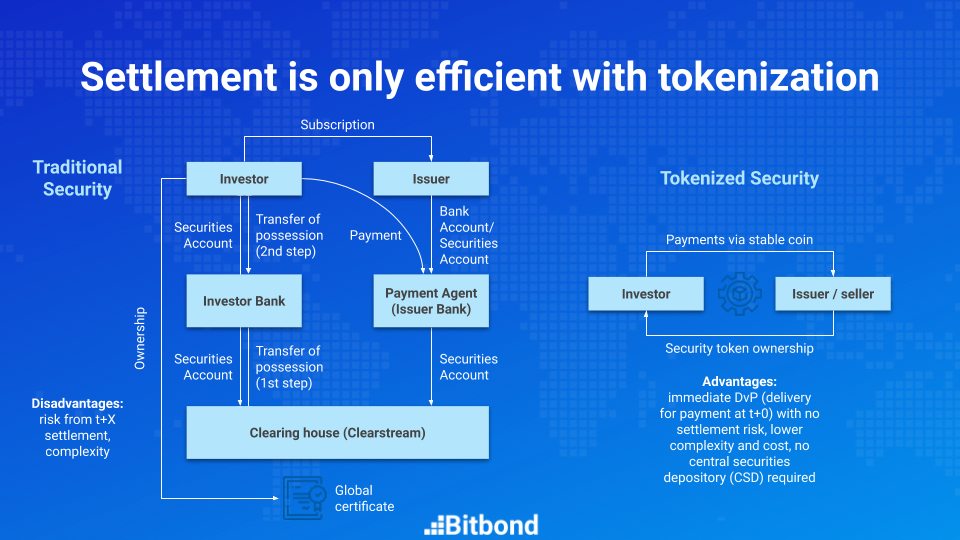

Tokenized securities represent a modern bridge between traditional finance and digital assets. According to the Hong Kong Securities and Futures Commission (SFC), they are essentially similar to their traditional counterparts, differing primarily in their technological implementation. This innovation allows securities to be issued, traded, and settled more efficiently on blockchain platforms, thus significantly reducing transaction costs and times associated with conventional trading methods.

The move towards integrating tokenized securities into the financial ecosystem is a response to the rising interest in digital asset trading platforms. As the SFC considers permitting licensed virtual asset trading platforms (VATPs) to engage in secondary trading of these tokenized products, it paves the way for retail investors to access a new array of investment opportunities. Investors can potentially benefit from enhanced liquidity and reduced entry barriers, which are often associated with traditional securities.

The Role of Virtual Asset Trading Platforms (VATPs)

Hong Kong’s finance landscape is evolving, especially with the emergence of Virtual Asset Trading Platforms (VATPs). These platforms are set to play a critical role in the secondary trading of tokenized securities, enabling retail investors to access these innovative financial instruments. The SFC’s assessment of VATPs underscores the importance of regulatory oversight in ensuring that these platforms adhere to established financial laws, thus providing a safe trading environment for all participants.

Additionally, VATPs are subject to rigorous operational risk evaluations as highlighted by the SFC’s Director, Luo Haishi. The new regulations will not only foster a secure ecosystem for trading tokenized securities but also aim to instill confidence among retail investors. This approach aligns with global trends where regulators recognize the need to adapt existing frameworks to accommodate and regulate the rapidly changing landscape of digital finance.

Regulatory Framework for Tokenized Securities

The regulatory framework surrounding tokenized securities is crucial for the growth and acceptance of these digital assets. The Hong Kong Securities and Futures Commission is drafting guidelines that will outline the compliance requirements for licensed VATPs. These regulations ensure that any trading of tokenized securities meets the same standards of safety and transparency as traditional securities. This is particularly important for protecting retail investors who may lack the sophisticated knowledge of cryptocurrency markets.

As the SFC seeks to balance innovation and investor protection, the guidelines will likely include measures related to disclosure, cybersecurity protocols, and operational risks. By establishing clear rules, the SFC aims to create a level playing field and foster confidence among retail investors, allowing them to engage actively in secondary trading of tokenized securities.

Implications for Retail Investors

For retail investors, the decision by the SFC to allow VATPs to offer secondary trading of tokenized securities holds significant implications. This move democratizes access to a broader range of investment products previously reserved for institutional investors. With this new framework, retail investors can diversify their portfolios with tokenized money market funds, potentially benefiting from the increased liquidity and efficiency that digital trading provides.

Moreover, the introduction of regulated tokenized securities trading through VATPs enables retail investors to invest with a better understanding of risks and rewards. The SFC’s commitment to upholding market standards will help mitigate fraud and enhance overall investor protection, making the prospect of engaging in digital markets more appealing to a wider audience.

Future Prospects for Tokenized Securities in Hong Kong

As the landscape of finance continues to evolve, the future prospects for tokenized securities in Hong Kong appear promising. With the SFC indicating its support for the integration of VATPs into the secondary trading space, we can expect increased innovation within the sector. The potential for tokenized securities to revolutionize investment processes bodes well for the financial ecosystem in Hong Kong, attracting both local and international attention.

Additionally, the evolving regulatory landscape will likely influence how other jurisdictions approach tokenized securities and VATPs. As Hong Kong positions itself as a leader in the digital asset space, the best practices established by the SFC may serve as a model for other nations considering similar legislative frameworks. This could facilitate further growth in the adoption of tokenized securities globally.

Key Benefits of Tokenized Securities

Tokenized securities offer multiple benefits that could transform traditional investment practices. One of the primary advantages is the enhanced liquidity they provide. With trading occurring on VATPs, investors can buy and sell tokenized securities instantly, unlike traditional securities which may require significant time to execute trades through intermediaries.

Moreover, tokenization often entails lower fees due to the reduction in administrative overheads and the need for fewer intermediaries. For retail investors, this means that the costs associated with trading can significantly decrease, making it a more feasible option for small-scale traders. Overall, the shift towards tokenized securities represents a step forward in making financial markets more efficient and accessible.

Challenges Facing Tokenized Securities

Despite the advantages, tokenized securities do face certain challenges that need addressing. Regulatory concerns remain at the forefront, particularly regarding the legal status of these digital assets and the frameworks necessary to manage their trading. The SFC’s proactive approach to drafting regulations is a positive step, but the industry must remain vigilant to ensure that all potential risks are adequately covered.

Additionally, operational risks are inherent in any trading environment, and tokenized securities are no exception. Issues such as technology glitches, cybersecurity threats, and market manipulation are concerns that could undermine the integrity of trading platforms. Ensuring robust security protocols and operational guidelines will be essential for the sustainable growth of tokenized securities in Hong Kong.

The Importance of Investor Education

As the marketplace for tokenized securities expands, so too does the need for investor education. It is critical that retail investors fully understand the intricacies of tokenized trading, including the associated risks and rewards. Education initiatives led by the SFC, VATPs, and other stakeholders can help inform potential investors about how to navigate this innovative financial landscape.

Moreover, increasing awareness can empower investors to make informed decisions, helping them to understand the technological aspects that differentiate tokenized securities from traditional investments. As more retail investors engage in this space, comprehensive educational resources will be vital to fostering confidence and participation in markets that are increasingly embracing digital transformation.

Aligning with Global Financial Trends

Hong Kong’s move to allow VATPs to trade tokenized securities aligns with global financial trends where digital transformation is gaining traction. Other financial markets around the world are exploring similar initiatives, indicating a broader acceptance of blockchain technology and its application in securities trading. Being part of this trend can position Hong Kong as a leading center for international finance and innovation.

By adopting advanced technologies such as blockchain for secondary trading, Hong Kong can attract global investors looking for transparent and efficient market access. This strategic alignment not only reinforces Hong Kong’s financial market but also contributes to its reputation as a forward-thinking jurisdiction poised to adapt to future trends.

Conclusion: The Future of Trading in Hong Kong

The future of trading in Hong Kong is on the brink of transformation with the involvement of tokenized securities and VATPs. As the SFC lays down the regulatory framework, there is a clear pathway for integrating these innovative assets into the local financial landscape, presenting new opportunities for retail investors. The excitement surrounding this evolution suggests that we may soon see a marked shift in how securities are conceptualized, traded, and regulated.

In conclusion, the proactive steps being taken by the Hong Kong Securities and Futures Commission serve as a blueprint for advancing digital finance. By addressing potential risks and emphasizing investor protection alongside innovation, the future of trading in Hong Kong could not only enhance its local economy but also play a significant role in the global fintech landscape.

Frequently Asked Questions

What are tokenized securities and how are they regulated by the Hong Kong Securities and Futures Commission?

Tokenized securities represent ownership of assets using blockchain technology, and they are regulated by the Hong Kong Securities and Futures Commission (SFC) like traditional securities. The SFC has indicated that tokenized securities share the same risks and regulations as conventional financial instruments, ensuring a standardized approach to their oversight.

How will virtual asset trading platforms (VATPs) facilitate secondary trading of tokenized securities for retail investors?

The Hong Kong Securities and Futures Commission plans to allow licensed virtual asset trading platforms (VATPs) to offer secondary trading of tokenized securities. This initiative aims to enhance accessibility for retail investors, enabling them to trade tokenized securities on regulated platforms, which are currently under evaluation for regulatory compliance and operational safeguards.

What is the significance of the Hong Kong Securities and Futures Commission’s approval of VATPs for trading tokenized securities?

The approval by the Hong Kong Securities and Futures Commission for virtual asset trading platforms (VATPs) to trade tokenized securities marks a key development in integrating traditional finance with digital assets. It allows retail investors to participate in a market that was previously inaccessible, helping to legitimize and expand the tokenized securities market in Hong Kong.

Can retail investors trade tokenized money market funds on VATPs according to the new SFC guidelines?

Yes, under new guidelines from the Hong Kong Securities and Futures Commission, retail investors will soon be able to trade local tokenized money market funds on licensed virtual asset trading platforms (VATPs). This is part of the SFC’s effort to broaden investment opportunities for individual investors in the tokenized securities space.

What operational risks is the SFC evaluating regarding VATPs and tokenized securities?

The Hong Kong Securities and Futures Commission is currently assessing various operational risks related to virtual asset trading platforms (VATPs) offering tokenized securities. This includes evaluating the platforms’ technological infrastructure, compliance mechanisms, and the overall security of transactions to safeguard retail investors’ interests.