Bitcoin ETFs have been making headlines recently, particularly as the price of Bitcoin approaches the prestigious $70,000 mark. Despite market fluctuations, these exchange-traded funds are experiencing significant losses, with reports showing $545 million in outflows this past Wednesday. This trend corresponds with a broader dip in the cryptocurrency market, which has witnessed a 20% decline year-to-date. Investors are keenly watching Bitcoin price movements, as the current atmosphere reflects varying crypto market trends and lingering uncertainty. As analysts conduct cryptocurrency analysis, many are surprised to see that a majority of Bitcoin investors are holding their positions rather than selling during this downturn.

Exchange-traded funds linked to Bitcoin, commonly known as Bitcoin ETFs, have emerged as a focal point in discussions about digital asset investments. With the Bitcoin price nearing a critical threshold, these investment vehicles have become increasingly scrutinized, especially in light of the recent uptick in ETF outflows. Many market observers are analyzing the trends surrounding these financial instruments, particularly their impact on overall cryptocurrency dynamics. Although the market has faced volatility, this phenomenon has not deterred a significant portion of investors from maintaining their positions. As the cryptocurrency landscape evolves, the resilience of Bitcoin-linked ETFs amidst turbulent market conditions offers a unique perspective to explore.

| Key Point | Details |

|---|---|

| Bitcoin ETF Outflows | $545 million in outflows as BTC nears $70,000. |

| Net Outflows | Total weekly net outflows reached $255 million, with a year-to-date negative of $1.8 billion after attracting $3.5 billion inflows. |

| Assets Under Management | Total assets under management stand at $93.5 billion. |

| Market Capitalization Impact | The cryptocurrency market capitalization has fallen by approximately 20%, from $3 trillion to $2.5 trillion. |

| Investor Sentiment | Despite losses, 94% of Bitcoin ETF investors maintain their positions according to analysts. |

| Comparative Performance | Cumulative net inflows for Bitcoin ETFs amount to $54.8 billion, down about 13% since last year’s peak of $62.9 billion. |

| Analyst Opinions | Experts remain cautious yet optimistic about the resilience of Bitcoin ETFs amidst volatility. |

Summary

Bitcoin ETFs have faced significant challenges recently, marked by substantial outflows and a downturn in the broader cryptocurrency market. As these instruments continue to navigate this tumultuous landscape, analysts note that most investors are holding their positions, demonstrating a degree of resilience. Despite Bitcoin ETFs’ current challenges, which include $545 million in recent outflows and a net negative of $1.8 billion, the sentiment among long-term investors remains stable. With total assets under management aggregating $93.5 billion, the future of Bitcoin ETFs will largely depend on market recovery and investor confidence.

Bitcoin ETFs: Current Market Trends and Investor Sentiment

Bitcoin ETFs have faced significant outflows amidst a challenging market climate, with $545 million withdrawn recently as the Bitcoin price teetered around the $70,000 mark. This trend speaks volumes about the current investor sentiment, which is heavily influenced by the overall movements in the crypto market. While the recent data shows that the cumulative inflows to these ETFs have been substantial this year, at $3.5 billion, this has been overshadowed by the $5.4 billion in outflows, leading to a net negative of $1.8 billion. Such fluctuations suggest that while Bitcoin continues to draw attention as a digital asset, the volatility is prompting many to reassess their investment strategies.

Analysts have noted a remarkable resilience among Bitcoin ETF investors, with only around 6% of total assets pulling out despite the drop in prices. The market dynamics can induce fear and panic, yet many investors are choosing to hold their positions rather than exiting, signifying a belief in Bitcoin’s long-term value. The current statistics indicate that Bitcoin ETFs still hold considerable assets under management, amounting to $93.5 billion, which highlights both the trust in the asset and the cautious optimism surrounding future market movements.

The ongoing challenges in the cryptocurrency markets reflect wider macroeconomic trends that investors are grappling with. The overall market capitalization has seen a marked decline, dropping around 20% this year, showing clear signals of crypto market trends that can heavily influence ETF performance. Investors closely monitoring these trends are often engaged in a complex landscape of price fluctuations and sentiment shifts.

Furthermore, ETF analysts suggest that as the Bitcoin price approaches significant thresholds like $70,000, market psychology plays a crucial role. The duality of fear and potential profit forces investors to weigh their options carefully. While Bitcoin investments often exhibit higher volatility, the decision to maintain positions amidst uncertainty can also signal strong commitment to the asset—a sentiment that could turn favorable should market conditions improve.

Impact of Bitcoin Price on ETF Performance

The Bitcoin price has a direct correlation with the performance of Bitcoin ETFs, and recent declines have prompted significant ETF outflows, exemplifying how sensitive these investments are to market conditions. As Bitcoin edged closer to the critical $70,000 mark, investor reactions revealed deeper market anxieties. The juxtaposition of potential highs with the reality of losses is creating an environment where investors find themselves in a quandary, deciding whether to hold or sell their positions amidst the volatility.

According to reports, while Bitcoin ETFs have reported large net outflows, the resilient core of investors choosing to remain invested underlines an intriguing paradox in the market. High volatility, especially around significant price zones, often sends mixed signals to traders and can lead to a ripple effect across related asset classes. The current challenges present a unique opportunity for those who are willing to analyze the crypto landscape thoroughly in pursuit of potential gains.

Moreover, as analysts delve deeper into cryptocurrency analysis, the effects of Bitcoin price changes extend beyond mere figures; they indicate shifts in investor behavior and market strategy. ETFs are structured to attract a particular type of investor, often those looking for accessible exposure to cryptocurrencies without direct ownership. Thus, fluctuations in the Bitcoin price directly impact the ETF’s attractiveness and investor confidence. As the price fluctuates near significant landmarks, strategic decisions by traders and institutions play vital roles in shaping market outcomes.

Investors who observe the subtleties of ETF performance are also privy to secondary trends, such as those in altcoins linked to Bitcoin’s movements. Understanding how Bitcoin’s value influences broader market trends, including ETF outflows for other cryptocurrencies, is essential for grasping the full spectrum of cryptocurrency investments. Ultimately, the interdependencies illustrate a complex web of relationships among price action, investor sentiment, and market dynamics.

Understanding ETF Outflows: What it Means for Investors and the Market as a Whole?

As Bitcoin ETFs face unprecedented outflows, it becomes crucial for investors to comprehend the reasons behind such withdrawals and their implications on the overall market. The $545 million in recent outflows represents not just a significant monetary shift but also a reflection of investor confidence amid a challenging landscape. Analysts suggest that while the cumulative inflows show strength, the ongoing pressures could indicate a cautious approach among investors—leaving them wondering about the right time to act amidst uncertainty.

ETF outflows can often paint a broader picture of market sentiment. Each withdrawal can signify an investor’s lack of confidence in the sustainability of Bitcoin’s price rally or a reaction to external market pressures. As the total assets under management continue to fluctuate, understanding these movements can provide essential insights into the market’s health and its trajectory moving forward.

Market Dynamics: How Bitcoin ETFs React to the Larger Cryptocurrency Ecosystem

In the fluctuating landscape of cryptocurrencies, Bitcoin ETFs serve as a barometer for the broader market dynamics. With the cryptocurrency market capitalization shrinking from approximately $3 trillion to $2.5 trillion this year, such changes have a nuanced effect on ETF performance. The correlation between Bitcoin’s price and the overall health of the crypto market is undeniable, and as ETFs continue the trend of withdrawals, they indirectly reflect the vulnerabilities faced by other altcoins as well. Investors observing the interactions between Bitcoin ETFs, altcoin inflows, and outflows can better position themselves to navigate potential market shifts.

The interplay between Bitcoin’s price performance, ETF structures, and investor behavior contributes to a complex market environment. For instance, movements in Bitcoin prices can subsequently influence investor sentiment toward other cryptocurrencies represented in ETFs. Consequently, understanding these intricacies can empower investors to make informed decisions based on both historical market performance and future projections of crypto market trends.

Frequently Asked Questions

What are Bitcoin ETFs and how do they relate to Bitcoin price dynamics?

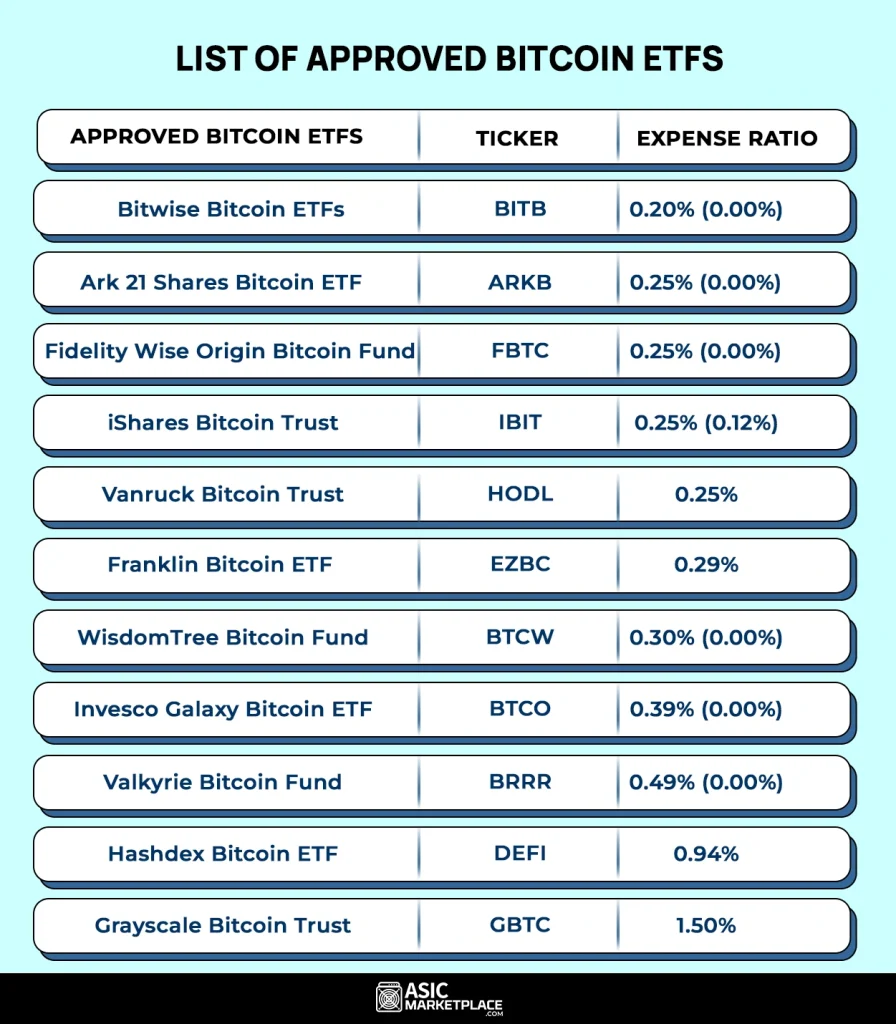

Bitcoin ETFs, or exchange-traded funds, allow investors to gain exposure to Bitcoin without owning the cryptocurrency directly. These funds track the performance of Bitcoin, making them sensitive to fluctuations in Bitcoin price. Recent trends show that as BTC approached the $70,000 mark, Bitcoin ETFs experienced significant outflows, reflecting investor sentiment and market volatility.

Why are Bitcoin ETFs experiencing outflows amid current crypto market trends?

Bitcoin ETFs have faced $545 million in outflows as of mid-week due to declining investor confidence and negative market trends across the crypto space. With the total cryptocurrency market capitalization dropping significantly this year, investors are wary, possibly leading them to liquidate positions within these ETFs.

How do ETF outflows impact Bitcoin investments overall?

ETF outflows can signal investor sentiment towards Bitcoin investments. When outflows increase, it typically indicates a lack of confidence in both Bitcoin and the overall crypto market, potentially leading to downward pressure on Bitcoin prices as investors sell off their assets.

What does cryptocurrency analysis say about the current performance of Bitcoin ETFs?

Current cryptocurrency analysis indicates that while Bitcoin ETFs are enduring their largest losses since inception, many investors are holding strong. Despite the outflows, Bitcoin ETFs accumulated $54.8 billion in net inflows over time, suggesting resilience amid market volatility.

What is the significance of the recent losses in Bitcoin ETFs compared to past performance?

The recent losses in Bitcoin ETFs, reflecting $5.4 billion in redemptions against $3.5 billion in inflows year-to-date, show a notable shift in market sentiment. However, historical performance indicates that these ETFs had previously peaked at $62.9 billion, highlighting their capacity for recovery and demand in the crypto market.

How do Bitcoin ETFs compare with altcoin funds based on recent trends?

Recent trends indicate varied performances between Bitcoin ETFs and altcoin funds. While Bitcoin ETFs suffered substantial outflows, altcoin funds like Ether and XRP displayed mixed results, with Ether experiencing outflows of $79.5 million, whereas XRP saw modest inflows. This disparity can reflect differing investor sentiments across the broader cryptocurrency landscape.

What are the future prospects for Bitcoin ETFs in light of current market conditions?

Given the current market conditions and analyst predictions, Bitcoin ETFs may continue to face challenges but could rebound as market sentiments change. Analysts suggest that despite recent outflows, the majority of investors are maintaining their positions, indicating potential resilience as Bitcoin price dynamics evolve.