Binance inflow has made headlines recently, highlighting a significant surge in the exchange’s net fund influx over the past month. According to a report by Odaily Planet Daily, CZ, the CEO of Binance, confirmed via X that the platform has recorded inflows totaling billions of dollars across various time frames, including 1 day, 7 days, and 1 month. This encouraging Binance news contradicts earlier speculation about potential outflows, fueling discussions on current cryptocurrency trends. Investors are keenly observing these dynamics as they delve into crypto market analysis. The robust inflow underscores a revived interest in digital assets, with CZ’s statements playing a pivotal role in shaping user confidence and market sentiment.

The recent surge in funds flowing into Binance is an indicator of shifting patterns in the cryptocurrency market. With Binance experiencing a notable increase in capital deposits, analysts and enthusiasts are keen to understand the broader implications for digital assets. This influx could signify a positive trend, highlighting renewed trust among investors amidst market fluctuations. The statements from CZ Binance serve as crucial insights into the current state of the exchange, which is pivotal for anyone engaging in crypto discussions. As the landscape evolves, monitoring these developments will be essential for anyone looking to navigate the intricate world of cryptocurrencies.

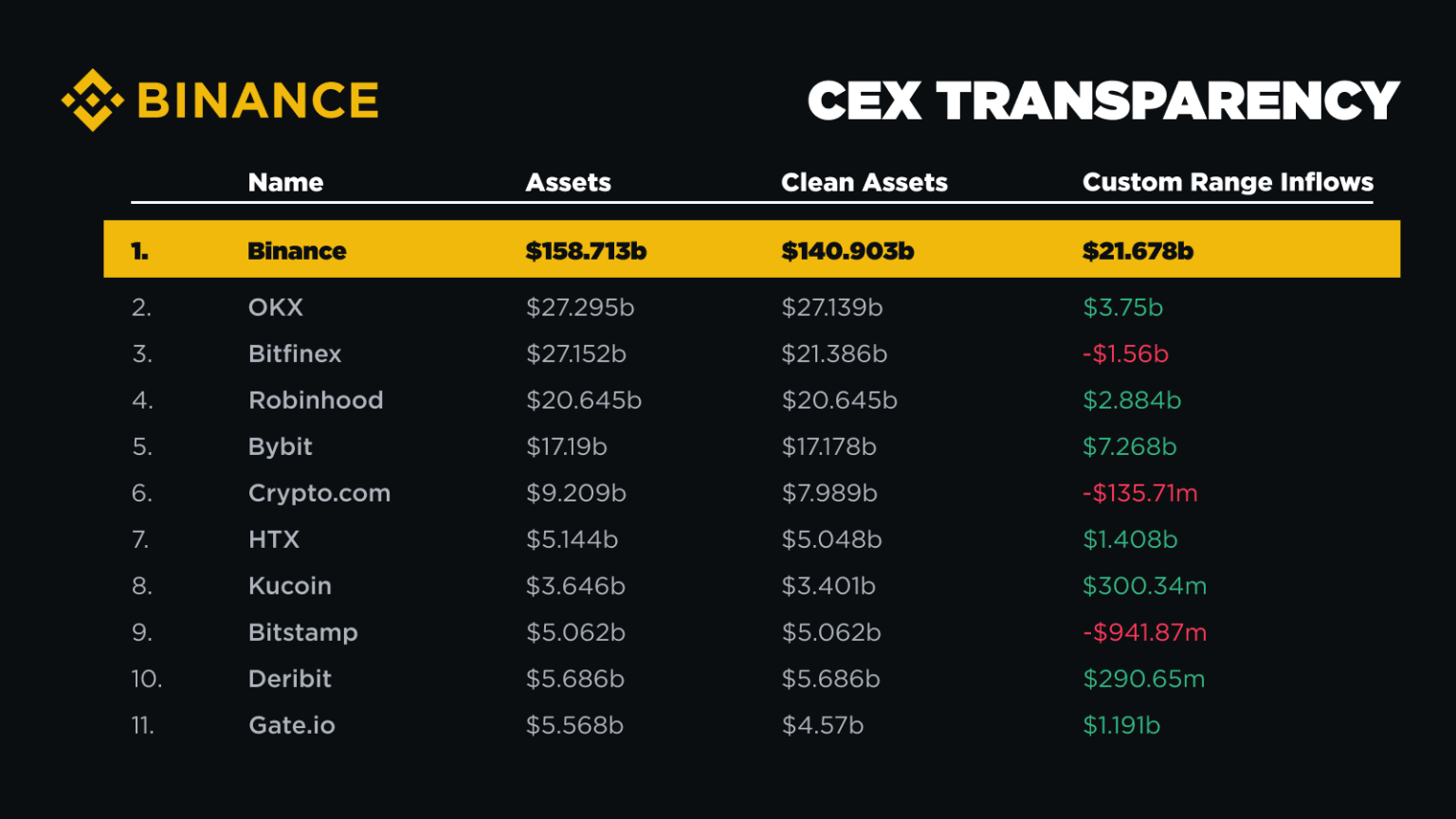

| Time Period | Net Inflow | Remarks |

|---|---|---|

| 1 Day | Billions of Dollars | Positive growth reported by CZ. |

| 7 Days | Billions of Dollars | Consistent inflow amidst market skepticism. |

| 1 Month | Billions of Dollars | Overall, a significant net inflow. |

Summary

Binance inflow has experienced remarkable growth over the past month, as reported by CZ, who states that the exchange saw billions in net inflows across various time frames. Despite some external fears and indications of outflow from certain critics, Binance’s solid performance underscores its resilience in the cryptocurrency market. This positive trend highlights the ongoing confidence investors have in Binance, suggesting that the platform remains a key player in the industry.

Understanding Binance’s Recent Fund Inflows

In a recent statement made by CZ, the CEO of Binance, it has come to light that the exchange experienced a remarkable net inflow of funds over the past month. According to reports, Binance’s net inflow totaled billions of dollars when analyzed across different timeframes – 1 day, 7 days, and 1 month. This significant influx contradicts some negative sentiments that were fueled by reports of potential fund outflows from the platform. It’s essential to recognize how this substantial inflow plays into the cryptocurrency trends and reflects investor confidence in Binance as a leading exchange.

The net inflow noted by CZ indicates a positive signal for Binance amidst ongoing discussions in the crypto market. As more investors flock to Binance for trading and investing in cryptocurrencies, it underlines the exchange’s ability to adapt to market changes and attract liquidity. Analysts are now closely watching Binance news to assess how these inflows might correlate with broader market movements. With Binance at the forefront of crypto market analysis, the trends observed now could greatly influence future forecasting and investment strategies.

CZ Binance’s Statements and Their Impact

CZ’s statements regarding Binance’s inflow of funds are pivotal not only for the exchange but for the entire cryptocurrency ecosystem. As analysts dissect the implications of his remarks, it becomes clear that CZ aims to mitigate fears generated by FUD (Fear, Uncertainty, Doubt) spread by skeptics claiming net outflows. His assurances about the ongoing interest and capital influx into Binance can bolster market stability as confidence plays a critical role in the crypto sphere, where emotions can drive significant price fluctuations.

Moreover, these declarations from CZ contribute to a more informed public narrative regarding Binance’s position in the market. By emphasizing the substantial net inflows, he is reshaping perceptions among investors and stakeholders alike. As cryptocurrency trends shift continually, remarks made by influential figures like CZ can lead to renewed confidence in the market, a necessary quality as regulatory environments tighten and public awareness of cryptocurrency grows exponentially.

The Role of Binance in Shaping Cryptocurrency Trends

Binance’s role in shaping current cryptocurrency trends cannot be overstated. With billions of dollars flowing into the exchange, it serves as a barometer for market health and investor sentiment. As investment patterns range from retail to institutional, platforms like Binance help create a robust environment for liquidity and trading activities. This continuous flow of capital into Binance indicates a strong belief in the convergence of technology and finance, leading to more innovative approaches within the cryptocurrency market.

Furthermore, Binance’s vast array of offerings, including spot trading, futures, and staking, attract diverse investor profiles and influence trends actively. Investors looking to capitalize on emerging cryptocurrencies or those seeking stability find favorable conditions on the platform, contributing to its sustained success. The insights derived from activities on Binance can serve as invaluable data for market analysts and traders attempting to navigate the often volatile cryptocurrency landscape.

Analyzing the Crypto Market: Implications of Recent Binance News

Recent Binance news highlighting the exchange’s significant net inflow provides vital insights for analysts evaluating the broader cryptocurrency market. The ability of Binance to attract and maintain substantial fund inflows demonstrates its resilience in the face of market fluctuations. Investors are noticing that despite the FUD around potential outflows, Binance remains a preferred destination for placing bets on digital currencies and blockchain projects.

This analysis of Binance’s inflows goes beyond mere infographics; it encapsulates the sentiment of a vibrant trading community. Furthermore, as analysts dissect this data, it reiterates the necessity of staying apprised of developments within Binance. Through a combination of comprehensive market analysis and current news from the exchange, investors can strategize more effectively, aligning their decisions with prevailing trends and potential shifts in the crypto landscape.

Understanding Investor Confidence in Binance’s Stability

Investor confidence plays a critical role in the health of any financial market, and Binance’s recent reported inflows only amplify this principle. CZ’s confidence-building statements regarding the billions in net inflow serve as a reminder of Binance’s strong position amid market volatility. For traders and investors, understanding this aspect is fundamental, as trust in an exchange may dictate trading behaviors and overall market trends.

In addition, as crypto becomes more prominent in mainstream finance, the stability associated with Binance could prove advantageous to securing institutional investments. Such confidence translates to broader acceptance of cryptocurrency among traditional investors who may have previously been hesitant. This stability fosters a community where participation can grow, reinforcing Binance’s status as a leading exchange in the cryptocurrency market.

Examining Binance Wallet Features in Relation to Fund Inflows

The features offered by Binance’s wallet, especially with recent enhancements like the Security Scan, are instrumental in maintaining the security and integrity of fund inflows. As more users deposit their funds into Binance wallets, the importance of robust security measures becomes apparent. The latest features provided by Binance reflect its commitment to user safety and bolstering confidence, which ultimately supports the continued liquidity flow into the exchange.

Moreover, as cybersecurity becomes increasingly critical in the crypto space, exploring Binance’s technological advancements cultivates a better understanding of how exchange features can influence overall market dynamics. By enhancing wallet security, Binance not only protects investor funds but also attracts new users to the platform, demonstrating a direct correlation between user-friendly features and increased net inflows.

Evaluating Institutional Interest in Binance Amidst Market Trends

Institutional interest in Binance has been a developing narrative within the cryptocurrency market. Recent net inflows signify that both retail and institutional investors are recognizing Binance’s potential as a trading platform. As reports of billions in inflows circulate, it becomes evident that Binance is positioning itself as a key player that appeals to a wide audience, including hedge funds and investment groups looking to capitalize on crypto market trends.

As institutional investors pour capital into exchanges like Binance, it fosters a deep sense of market legitimacy. This growing segment of investors can stabilize the market, making cryptocurrency more viable for everyday users. The implications of Binance’s success at attracting institutional interest resonate throughout the industry, influencing how other exchanges may strategize their offerings and protocols to align with the shifting demands of the evolving crypto landscape.

Future Projections for Binance’s Market Position

Looking forward, the implications of Binance’s recent net inflow trends hold significant weight for future market projections. Analysts remain keen on interpreting how sustained inflows could impact Binance’s competitive positioning against other exchanges. The combination of investor trust, innovative features, and positive momentum suggests that Binance may continue to solidify its role as a leader in the cryptocurrency market.

Furthermore, as more regulatory frameworks emerge globally, Binance’s proactive measures to maintain compliance and foster community trust could ensure continued success. By being at the forefront of both operational integrity and user engagement, the exchange is likely to not only weather any potential market storms but also emerge as a stronger, more secure leader in the cryptocurrency domain.

In Conclusion: The Significance of Binance’s Recent Developments

In summary, the recent developments surrounding Binance, particularly the impressive net inflow of funds, signify a remarkable chapter for the exchange and the broader cryptocurrency market. CZ’s statements serve as a beacon of confidence, reassuring investors while underscoring the importance of liquidity in shaping ongoing cryptocurrency trends. As the market oscillates between optimism and skepticism, Binance’s ability to showcase strength during challenging times reiterates its pivotal role.

Ultimately, as Binance continues to innovate and attract both retail and institutional capital, its influence on the cryptocurrency landscape is likely to expand. Keeping abreast of Binance news and developments will serve as a critical tool for investors and analysts alike, highlighting the exchange’s role in navigating the future of digital finance. The ecosystem’s growth signals a continuous reevaluation of how investors engage with cryptocurrency markets globally.

Frequently Asked Questions

What does Binance inflow mean in the cryptocurrency market?

Binance inflow refers to the amount of funds being deposited into Binance, a major cryptocurrency exchange. It is a critical indicator of market confidence and liquidity, reflecting positive user sentiment. Positive Binance fund inflow can suggest increased trading activity and willingness to invest within the crypto market.

How does CZ Binance’s statement about fund inflow impact cryptocurrency trends?

CZ Binance’s statements about net fund inflow, indicating billions over short periods, generally bolster investor confidence in cryptocurrency trends. Such announcements can lead to heightened trading activity on Binance, contributing to a bullish market sentiment.

What are the implications of Binance’s net inflow for crypto market analysis?

The net inflow reported by Binance serves as a significant metric for crypto market analysis, as it impacts liquidity and volatility. Analysts use this data to forecast trends and assess market health, with substantial inflows usually indicating a positive outlook for crypto investors.

Why is Binance fund inflow a key factor to monitor?

Binance fund inflow is crucial as it indicates the trust and engagement of users in the platform and the wider crypto ecosystem. Monitoring these inflows helps investors gauge market strength and potential price movements, as significant inflows often signal bullish behavior.

How can tracking Binance news regarding fund inflow affect trading decisions?

Keeping up with Binance news related to fund inflow can significantly affect trading decisions. Positive inflows may encourage traders to enter positions, while negative trends could lead to caution or selling. Staying informed allows investors to make strategic moves based on market sentiment driven by inflow data.

What should we make of potential FUD regarding Binance’s net inflow?

Potential FUD (Fear, Uncertainty, Doubt) surrounding Binance’s net inflow should be approached with caution. While claims of outflows could create panic, CZ’s reassurance about significant inflow can alleviate concerns. It’s essential to analyze the context and overall market trends before reacting.

How does the 1-day, 7-day, and 1-month fund inflow data from Binance reflect on its market position?

The 1-day, 7-day, and 1-month fund inflow data from Binance reflects the exchange’s strong market position. Billions in inflow over these periods demonstrate Binance’s ability to attract users and capital, solidifying its status as a leading exchange in a competitive marketplace.