XRP Permissioned Domains represent a significant evolution within the XRP Ledger (XRPL), facilitating structured access control in the realm of blockchain compliance. Activated on February 4, with a notable 91% validator approval, this innovative feature allows for the creation of controlled environments on a public blockchain, enabling permissioned trading and institutional finance on blockchain. By introducing on-ledger access control, XRP Permissioned Domains enable institutions to engage with assets while adhering to stringent regulatory requirements, fundamentally transforming the way financial activities are conducted on the XRPL. The upgrade not only enhances security and compliance but also positions the XRPL as a frontrunner in enabling trustless, yet regulated, interactions in the digital asset ecosystem. As the landscape of tokenized real-world assets grows, the strategic implementation of Permissioned Domains aligns with the need for robust XRPL access control mechanisms to foster a more inclusive financial infrastructure.

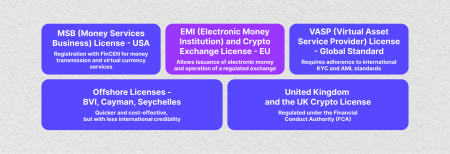

The introduction of controlled zones within the XRP Ledger (XRPL), termed as Permissioned Domains, unveils a groundbreaking mechanism for facilitating compliance and access regulation. This framework enables financial institutions to operate securely within a public blockchain environment while maintaining adherence to essential compliance standards, like KYC and AML. By leveraging ledger-based credentials, these domains empower organizations to conduct permissioned trading and enhanced institutional finance on blockchain networks effectively. This strategic move not only streamlines regulated operations but also enhances the XRPL’s potential to capture significant market share in the burgeoning landscape of tokenized assets. As the demand for compliant financial solutions surges, the development of these on-ledger access controls underscores the XRPL’s commitment to fostering a trustworthy digital finance ecosystem.

| Key Point | Details |

|---|---|

| Activation | XRP Ledger activated Permissioned Domains with 91% validator approval. |

| Purpose | Facilitate regulated financial activities on a public blockchain without private network transformation. |

| Permissioned Domains Defined | Ledger object that maintains a list of Accepted Credentials for account verification. |

| Functionality | Wallets with valid credentials gain automatic access to domains, enabling compliance. |

| Impact on Trading | Enables on-chain payments and trading, providing verified liquidity for financial institutions. |

| Market Context | Addressing the transition towards real-world asset tokenization and the need for compliance in the public blockchain. |

| Next Steps | Monitoring the adoption rates, credentials issued, and the establishment of regulated liquidity islands. |

Summary

XRP Permissioned Domains represent a significant evolution within the XRP Ledger, allowing for regulated financial activities to occur in a secure and compliant manner on a public blockchain. This upgrade not only enables institutions to conduct transactions in adherence to regulations such as KYC and AML but also streamlines the transition from experimental practices to operational standards. With the increasing demand for a compliant framework in blockchain technology, XRP Permissioned Domains pave the way for greater institutional adoption and, ultimately, a more robust digital economy.

Understanding XRP Permissioned Domains

XRP Permissioned Domains represent a significant evolution within the XRPL ecosystem, activated with a remarkable validator approval of 91%. This upgrade introduces a new on-ledger access control mechanism, allowing digital wallets with specific credentials to engage with certain services on the network. Essentially, Permissioned Domains can be likened to digital gates that ensure only authorized participants can access particular functionalities, thereby enhancing the security and compliance of transactions on the public blockchain.

While it may seem paradoxical for a public blockchain like XRPL to host “permissioned” zones, the primary objective is to enable fully regulated financial operations within a public ledger framework. This architectural innovation reduces the reliance on off-chain access controls and manual vetting processes, streamlining compliance by embedding verification directly into the blockchain. As institutions increasingly look to leverage on-chain technologies, the significance of XRP Permissioned Domains becomes clear, reflecting a shift towards more secure, compliant financial transactions.

Frequently Asked Questions

What is XRP Permissioned Domains and how does it work?

XRP Permissioned Domains represent an essential feature of the XRP Ledger (XRPL) that enables on-ledger access control. This functionality allows digital wallets with certain credentials to participate in blockchain activities. The mechanism relies on an access-control object that defines lists of accepted credentials, thereby creating a compliant environment for regulated financial operations without compromising the public nature of the ledger.

How does XRP Permissioned Domains enhance blockchain compliance for financial institutions?

XRP Permissioned Domains enhance blockchain compliance by allowing financial institutions to operate within a controlled environment on the public XRP Ledger. By utilizing credential-based access, institutions can ensure that only verified entities engage in transactions, thereby adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations while maintaining the transparency and efficiency of a public blockchain.

Can Permissioned Domains facilitate institutional finance on the XRPL?

Yes, Permissioned Domains are specifically designed to facilitate institutional finance on the XRP Ledger (XRPL). The ability to create gated environments ensures that only approved participants can access certain features, such as permissioned trading or lending protocols, thus aligning XRPL with the compliance requirements of institutional investors.

What impact will the XRP Ledger upgrade to Permissioned Domains have on financial trading?

The upgrade to XRP Permissioned Domains is set to revolutionize financial trading by allowing institutions to trade on-chain with compliance assurances. By confining trades within credentialed liquidity pools, this facilitates a secure and regulated trading environment, enabling institutions to gain access to verified liquidity sources without the risks associated with unverified entities.

How do XRP Permissioned Domains reconcile public blockchain features with private access controls?

XRP Permissioned Domains reconcile public blockchain features with private access controls by allowing the XRP Ledger to retain its open nature while adding layers of compliance through credential verification. This architecture allows identities to remain private while still enabling the enforcement of access restrictions, ensuring that financial interactions meet regulatory standards.

What are the potential benefits of using XRP Permissioned Domains for trading venues?

XRP Permissioned Domains offer several benefits for trading venues, including enhanced security, compliance with regulatory frameworks, and the ability to maintain a distinct domain for credential-gated trading. This setup allows market participants to confidently engage in transactions with verified counter-parties, thereby fostering institutional trust and participation in blockchain finance.

How might the adoption of XRP Permissioned Domains affect the future of tokenized assets?

The adoption of XRP Permissioned Domains is likely to accelerate the integration of tokenized assets into mainstream finance. By providing a compliant structure on the XRPL for asset trading and management, institutions can interact with tokenized real-world assets in a secure and regulated manner, which may lead to increased investment and innovation in this space.

What challenges could arise from the implementation of XRP Permissioned Domains?

Challenges from the implementation of XRP Permissioned Domains could include ensuring clarity in compliance regulations, managing the complexity of credentials, and preventing fragmentation within the market. If not carefully managed, the creation of gated environments may limit liquidity and accessibility, which could pose barriers for some market participants.