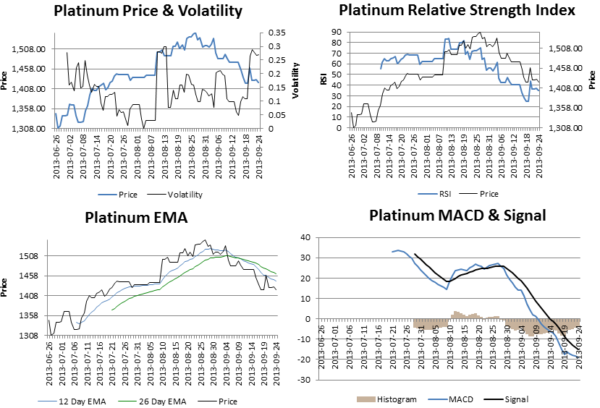

Volatility in precious metals has captured the attention of investors and analysts alike, as market shifts are largely influenced by the dollar’s performance. Recently, silver prices have experienced dramatic dips, reflecting the ongoing fluctuations within the precious metals market. As the dollar index strengthened, it led to significant market adjustments, causing the spot price of silver to plummet by 16%. With gold prices also facing pressure, experts like Fawad Razaqzada indicate that this new trend could persist if the dollar continues its upward trajectory. In this environment of heightened uncertainty, understanding the dynamics of volatility in precious metals is crucial for anyone looking to navigate these turbulent waters successfully.

The unpredictable nature of precious metal assets has become increasingly evident as market fluctuations remain a focal point for traders and investors. Terms like “price instability” and “market variability” signify the challenges faced in the gold market and silver prices alike. Analysts observe that the influence of the dollar index is pivotal, prompting frequent market adjustments that impact investment strategies. As the landscape evolves, the appreciation of currency values and shifts in risk sentiment play crucial roles in defining the trajectory of these valuable commodities. Consequently, comprehending these patterns is essential for those involved in the precious metals arena.

| Key Point | Details |

|---|---|

| Current Market Conditions | Silver prices have plummeted significantly due to a stronger dollar, dropping by 16%. |

| Dollar Impact | The dollar index rose by 0.2% to 97.79, affecting precious metals prices. |

| Analyst Insights | Fawad Razaqzada noted that if the dollar’s rebound is persistent, it may suppress gold prices. |

| Silver’s Volatility | Eva Mansi described silver as ‘gold on steroids’ due to its higher volatility compared to gold. |

| Market Expectations | Analysts predict continued volatility as investors reassess past record rises and current corrections. |

| Future Outlook | Recovery speed will depend on the dollar’s movements, interest rate expectations, and overall market sentiment. |

Summary

Volatility in precious metals is expected to persist as market conditions fluctuate. Recent trends indicate that external factors, particularly the performance of the dollar, significantly influence the price dynamics of metals like silver and gold. With silver exhibiting extreme volatility compared to gold, investors must closely monitor these developments to navigate potential market corrections and rebounds effectively.

Understanding Volatility in Precious Metals

Volatility in precious metals refers to the rapid and significant price fluctuations that can occur in markets such as gold and silver. This phenomenon is largely influenced by macroeconomic factors such as currency strength, particularly the dollar index, which can lead to drastic adjustments in market behavior. Analysts suggest that this volatility is not a recent occurrence; rather, it has become a defining characteristic of the precious metals market, particularly as it responds to global economic shifts. With unpredictable movements in investor confidence and demand, the precious metals market requires investors to remain vigilant and adaptable.

The current landscape of precious metals has underscored increased price swings, with silver prices experiencing dramatic drops, underscoring the concept of volatility. During periods of high inflation or economic uncertainty, investors often flock to gold and silver as safe-haven assets. However, this influx can sometimes lead to over-exuberance, creating an unsustainable rise in prices followed by rapid corrections. Such dynamics reinforce the necessity for market participants to analyze underlying trends and adjust strategies in real-time.

Frequently Asked Questions

How does the dollar index impact volatility in precious metals?

The dollar index significantly influences volatility in precious metals like gold and silver. A stronger dollar can lead to reduced demand for these commodities, resulting in price drops. For instance, recent spikes in the dollar index have caused marked adjustments in the precious metals market, demonstrating the correlation between currency strength and metal prices.

Why are silver prices more volatile compared to gold in the precious metals market?

Silver prices exhibit higher volatility compared to gold due to several factors. Analysts refer to silver as ‘gold on steroids’ because its smaller market size makes it more susceptible to fluctuations based on industrial demand and investment trends, contributing to greater price swings in the precious metals market.

What causes market adjustments in the precious metals market?

Market adjustments in the precious metals market typically occur due to changes in economic indicators, such as fluctuations in the dollar index, interest rate expectations, and overall market sentiment. These factors drive investor behavior, leading to significant volatility in precious metals prices.

What does the recent sell-off in the precious metals market indicate about future volatility?

The recent sell-off is seen by some analysts as a technical or cyclical correction rather than a sign of long-term structural weakness in the precious metals market. Future volatility will likely depend on the dollar’s trajectory and macroeconomic factors, suggesting that while prices may fluctuate, the fundamental demand for precious metals remains strong.

Can we expect continued volatility in silver prices amid dollar fluctuations?

Yes, continued volatility in silver prices is anticipated as long as the dollar experiences fluctuations. Analysts note that if the dollar’s rebound is sustained, it could continually suppress silver prices, leading to ongoing volatility in the precious metals market.

What role does investor sentiment play in the volatility of gold prices?

Investor sentiment is a crucial factor in the volatility of gold prices. When market conditions are uncertain, investors may flock to gold as a safe haven, driving prices up. Conversely, positive economic news can lead to reduced demand, increasing volatility in the gold market.

How do interest rate expectations affect volatility in the precious metals market?

Interest rate expectations greatly impact the volatility in the precious metals market, especially for gold and silver. Higher interest rates can diminish the appeal of holding non-yielding assets like gold, resulting in price declines, while lower rates can enhance demand and lead to rebounds, creating fluctuations in precious metals prices.