Brother Maji ETH position has recently made waves in the crypto community following the strategic increase of his holdings by an impressive 50 ETH longs. This bold move comes amidst fluctuating market conditions, with the liquidation price for ETH currently set at $2007. According to the latest ETH long position news from Odaily Planet Daily, this adjustment reflects Brother Maji’s confidence as he navigates the volatile landscape of cryptocurrency trading. As the world keeps an eye on crypto trading updates, savvy investors are keen to track Maji’s moves, knowing his impact on market trends. With such a significant stake in Ethereum, Maji’s decisions could ripple through the market, making this an exciting time for ETH enthusiasts and long-position traders alike.

The latest developments surrounding Brother Maji’s long positions in Ethereum highlight his active engagement in the evolving world of digital assets. Known for his insightful trading strategies, Maji’s recent enhancement of his ETH position not only adds to his portfolio but also attracts attention from crypto analysts and investors alike. The report detailing his liquidation price and floating losses sheds light on the risk factors underpinning his bold trading tactics. Furthermore, Maji’s involvement with HYPE long positions amplifies the intrigue surrounding his market maneuvers. This renewed focus on long positions amidst market volatility symbolizes a broader trend in the cryptocurrency space, where investors are continuously adapting to shifting dynamics.

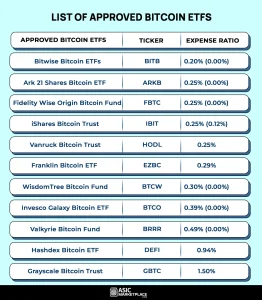

| Position Type | Leverage | Total Value (USD) | Opening Price (USD) | Current Floating Loss (USD) | Liquidation Price (USD) |

|---|---|---|---|---|---|

| ETH Long | 25x | $2.318 million | $2171 | -$70,000 | $2007 |

| HYPE Long | 10x | $1.55 million | $34.8 | -$17,000 | $31.9 |

Summary

Brother Maji ETH position has recently experienced a significant increase, as he added an additional 50 ETH longs. This strategic move highlights the confidence he has in the market despite the current floating losses. With his liquidation price for ETH set at $2007 and a robust total value of his positions, Brother Maji continues to navigate the trading landscape with keen insight and calculated risk management.

Brother Maji ETH Position: A Deeper Look

Brother Maji has made significant waves in the crypto market recently by increasing his ETH long position by an impressive 50 ETH. Currently, he holds a robust 25x ETH long position with a substantial total value of $2.318 million. However, the market has not been favorable, as his position is facing a floating loss of $70,000. This highlights the volatile nature of cryptocurrency trading, especially with the recent fluctuation of Bitcoin and Ethereum prices. Investors often monitor trends and key indicators, and Brother Maji’s moves provide crucial insights into market sentiment.

With a liquidation price set at $2007, Brother Maji’s ETH position invites speculation among traders regarding potential outcomes. Should ETH plunge beneath this price, it would trigger an automatic liquidation, a scenario that could significantly impact portfolio values. Consequently, traders are keenly observing ETH long position news, monitoring the market for any factors influencing the ETH price. The ensuing reactions from retail and institutional traders alike could create heightened volatility in the crypto markets.

Understanding Ethereum Liquidation Price

In the realm of crypto trading, understanding the concept of liquidation price is crucial. The liquidation price of ETH for Brother Maji is currently pegged at $2007, indicating the price point at which his leveraged long position could be unwound by the trading platform. For traders venturing into such leveraged positions, knowing their liquidation price is vital in order to manage risk appropriately and avoid catastrophic losses.

Liquidation events can create panic in the market, amplifying sell-offs as positions unwind. As ETH fluctuates around this critical price point, many traders will be keeping a watchful eye on developments within the market. In situations like these, the news surrounding ETH positions can significantly influence trading psychology and strategic decision-making in assessing whether to hold or liquidate amidst price changes.

Recent Crypto Trading Updates: Insights from Brother Maji

Recent crypto trading updates reveal that Brother Maji has made notable adjustments to his portfolio, including holding a 10x HYPE long position valued at $1.55 million. This savvy maneuver indicates a strategic approach to diversify his holdings amid uncertainty within the Ethereum market. HYPE, a relatively newer player in the crypto arena, offers the potential for high returns, which may intrigue traders looking to capitalize on emerging trends.

Though facing a floating loss of $17,000 with his HYPE position, the market’s volatility provides a backdrop where informed traders can make decisive moves. For followers of Brother Maji, these updates are not merely statistics but rather indicators of broader market dynamics, highlighting the interplay between various cryptocurrencies and how they can lead or lag behind ETH pricing dynamics.

The Role of HYPE Long Positions in the Current Market

HYPE long positions are increasingly gaining traction among traders looking for alternative investments alongside Ethereum. The 10x long position taken by Brother Maji for HYPE indicates a calculated risk aimed at harnessing potential market upswings in this lesser-known asset. As the cryptocurrency landscape evolves, traders are diversifying their portfolios, seeking opportunities in both established cryptocurrencies like ETH and emerging tokens like HYPE.

The market’s reaction to Brother Maji’s decisions underscores the interest in HYPE. With the liquidation price of his investment set at $31.9, similar caution regarding risk management applies to HYPE positions as well. Understanding the risks and rewards associated with both ETH and HYPE is crucial for traders navigating the complicated waters of cryptocurrency investing, particularly in an environment characterized by rapid price fluctuations and market sentiment shifts.

The Impact of Bitcoin on Ethereum Prices

Bitcoin often sets the pace for the larger cryptocurrency market, including Ethereum. As fluctuations in Bitcoin’s price occur, they tend to create ripple effects across altcoins, affecting traders’ strategies concerning ETH long and short positions alike. For example, if Bitcoin experiences a notable drop, similarly, ETH may also observe declines, potentially impacting Brother Maji’s liquidation price.

Traders analyze these relationships closely, understanding that movements in major cryptocurrencies can dictate trends. As Bitcoin stabilizes or turns bullish, it could change the narrative surrounding ETH, possibly bringing the price back above Brother Maji’s liquidation threshold of $2007. This interdependence reflects the broader patterns in crypto trading updates, where sentiment can shift rapidly based on Bitcoin’s performance.

Risk Management Strategies in Cryptocurrencies

Effective risk management strategies are essential for anyone engaging in cryptocurrency trading, particularly for those like Brother Maji who operate with significant leveraged positions. Setting hypothetical stop-loss orders can help to mitigate potential losses in the event of unfavorable market conditions, protecting portfolios against sudden price drops that might trigger liquidation.

Moreover, diversifying assets can aid in offsetting risks associated with holding large Ethereum positions. By distributing investments across multiple cryptocurrencies such as HYPE, traders can strategically manage exposure to volatility. For Brother Maji, this balanced approach involving ETH long positions and crypto updates can ultimately contribute to a more resilient trading strategy.

Analyzing Crypto Market Sentiment

Market sentiment plays a critical role in determining the future price trajectories of cryptocurrencies. Currently, as Brother Maji navigates through his 25x ETH long position, understanding public sentiment around ETH prices is crucial. Social media platforms, news articles, and market analysis reports all contribute to the prevailing mood in the market, influencing decisions for traders contemplating long or short positions.

Furthermore, sentiments can shift rapidly based on industry news, regulatory developments, or prominent figures’ actions within the cryptocurrency space. Therefore, watching daily crypto trading updates related to Ethereum is vital. For traders like Brother Maji, successful navigation through sentiment changes can mean the difference between significant losses and sustained profitability.

Future Predictions for Ethereum

As traders and analysts look ahead, future predictions for Ethereum remain a hot topic. Factors influencing these predictions include market trends, technological advancements, and shifts in investor sentiment. For Brother Maji, the success of his increased ETH long position hinges not only on immediate price movements but also on broader predictions about Ethereum’s ecosystem.

The anticipation surrounding Ethereum upgrades and their impact on usability and scalability continues to attract significant attention. Such developments could fortify or undermine positions like those held by Brother Maji, further emphasizing the necessity of staying informed about not only current market conditions but also future technological shifts influencing Ethereum prices.

Final Thoughts on Brother Maji’s Trading Strategy

In conclusion, Brother Maji’s trading strategy illustrates the complexities involved in navigating the volatile world of cryptocurrencies. With both ETH and HYPE long positions, he exemplifies a diversified investment approach in crypto trading. His 50 ETH long position, facing challenges due to the current liquidation price, emphasizes the critical need for managing risks while seeking potential rewards.

Investors looking to replicate Maji’s strategy should focus on staying informed about market updates, understanding liquidation prices, and adapting to changing sentiments. As the crypto market evolves, learning from experienced traders can provide valuable insights into optimizing trading strategies and effectively managing risks.

Frequently Asked Questions

What is Brother Maji’s current ETH position and its liquidation price?

Brother Maji has recently increased his ETH long position by 50 ETH, bringing his total to a 25x leverage on ETH. The liquidation price for this position is currently set at $2007.

How does Brother Maji’s ETH liquidation price compare to current market prices?

Brother Maji’s liquidation price for his ETH long position is $2007, which is crucial for traders to monitor against current market fluctuations, especially given the opening price of $2171.

What updates are available regarding Brother Maji’s ETH long positions?

The latest crypto trading updates indicate that Brother Maji has heightened his exposure to ETH by adding 50 long positions, emphasizing a strategic approach to the current ETH market.

What risks does Brother Maji face with his ETH long position?

With a floating loss of $70,000 on his ETH long position, Brother Maji faces significant risks, especially with the current liquidation price set at $2007, indicating a need for careful market monitoring.

What can traders learn from Brother Maji’s ETH position and strategy?

Traders can observe Brother Maji’s increased commitment to ETH long positions and his 25x leverage strategy, which highlights both potential rewards and the risks of nearing the liquidation price of $2007.

How do Brother Maji’s actions influence the crypto trading landscape?

Brother Maji’s decision to increase his ETH long position can influence market sentiment, especially among HYPE long positions, given the interrelated dynamics within the crypto trading environment.

What is the significance of the liquidation price for Brother Maji’s ETH position?

The liquidation price of $2007 for Brother Maji’s ETH position is significant as it represents the threshold where losses start to trigger forced liquidation, making it a critical point for risk management.