In a significant move that has caught the attention of crypto enthusiasts, Binance delists RVV and YALA contracts, marking a critical date in the calendar for traders using Binance Futures. Set for February 10, 2026, this decision to eliminate the USDⓈ-MRVVUSDT and YALAUSDT perpetual contracts means that traders will need to act swiftly to manage their holdings. As the clock ticks down, users are urged to close their positions manually to avoid an automatic settlement, which could have unforeseen consequences. The news about the RVV contract and YALA contract delisting is crucial for anyone keeping up with the latest crypto trading news. Staying informed about these developments is essential in navigating the ever-changing landscape of cryptocurrency markets and ensuring investment strategies remain robust.

In the rapidly evolving world of cryptocurrency, recent discussions highlight the upcoming cessation of RVV and YALA trading options as Binance moves to streamline its futures offerings. The recent announcement indicates that investors in these perpetual contracts need to be proactive, as the delisting will result in the expiration of trading opportunities for the affected assets. As Binance aims to refine its services for its user base, traders must remain vigilant and adapt their strategies accordingly. The removal of these pairs from the platform is an essential aspect of maintaining a balanced trading environment amidst the fluctuations in the digital asset market. Keeping abreast of such changes is paramount for traders looking to capitalize on opportunities in the volatile crypto landscape.

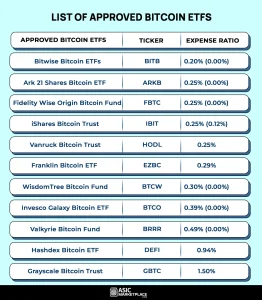

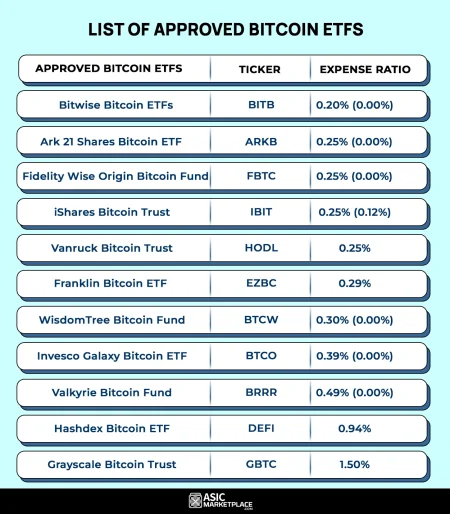

| Key Point | Details |

|---|---|

| Delisting Announcement | Binance will delist RVV and YALA perpetual contracts. |

| Effective Date | February 10, 2026, at 09:00 (UTC) |

| Order Closure | Users cannot place new orders starting at 08:00 (UTC) on February 10, 2026. |

| Manual Closure Recommendation | Users should close their positions manually to avoid automatic settlements. |

Summary

Binance delists RVV and YALA contracts as part of its ongoing evaluations of trading options. The delisting of these perpetual contracts will take effect on February 10, 2026. Users are encouraged to close their positions before this date to ensure a smooth transition, as any positions left open will be automatically settled. This decision highlights Binance’s commitment to maintaining a streamlined and efficient platform for its traders.

Binance Futures to Delist RVV and YALA Contracts: What You Need to Know

Binance has officially announced that it will be delisting the RVV and YALA perpetual contracts on February 10, 2026. This decision affects all users participating in Binance Futures, signifying a significant development in the crypto trading landscape. Starting from 08:00 (UTC) on that date, users will no longer be able to place new orders for these contracts, emphasizing the importance of understanding the implications this has for existing positions.

For traders holding RVV and YALA contracts, it is crucial to be proactive. Users are encouraged to manually close their positions ahead of the automatic settlement scheduled for 09:00 (UTC), which could otherwise lead to unintended losses. This decision is likely to generate substantial discussions in the crypto trading community, as traders respond to the latest crypto trading news surrounding Binance’s delisting.

Understanding Perpetual Contracts: The RVV and YALA Impact

Perpetual contracts are a popular trading instrument in the crypto market, allowing traders to speculate on the future price of digital assets like RVV and YALA without a fixed expiration date. However, the announcement by Binance about delisting these specific perpetual contracts raises concerns about the liquidity and future viability of trading these assets. Traders should familiarize themselves with the characteristics of perpetual contracts, as they can provide significant opportunities but also substantial risks, especially in a volatile marketplace.

The impending delisting of RVV and YALA contracts means that traders need to stay informed about alternative contract options available on Binance. Exploring other crypto pairs and derivatives can be beneficial for portfolio diversification. As the crypto landscape evolves, understanding the nuances between different perpetual contracts becomes critical for navigating price swings and regulatory changes, further emphasizing the need for staying abreast of crypto trading news.

Steps to Prepare for Binance’s RVV and YALA Contracts Delisting

As Binance prepares to delist the RVV and YALA contracts, users must take timely steps to manage their holdings effectively. The first recommendation is for traders to assess their positions in the RVV and YALA contracts, determining whether to close or hold until the last moment. By remaining proactive, they can mitigate potential losses that arise from the automatic settlement process that Binance will initiate on February 10, 2026.

Additionally, traders should consider reallocating funds to other viable perpetual contracts available on Binance Futures. This strategic move can help ensure that their exposure to cryptocurrency remains robust, even amidst the delisting news. Keeping an eye on market trends and adjustments is essential, as the market may respond dynamically to the changes in available trading products, thereby creating new opportunities in the always-changing world of crypto.

What to Expect After the Delisting of RVV and YALA Contracts

Following the delisting of RVV and YALA contracts on Binance Futures, traders may notice fluctuations in trading behavior across the platform. Such changes may lead to shifts in liquidity, especially if users decide to move their assets to other profitable digital currencies or derivatives. Traders should stay tuned to official Binance communications for updates on new product offerings or changes that may affect their trading strategy going forward.

Moreover, the delisting could influence the price movements of the underlying assets tied to these contracts. The crypto trading community will be closely monitoring the aftermath of this decision, analyzing whether this is a strategic move by Binance or a response to broader market conditions. Engaging with trading forums and updates will be crucial for traders looking to navigate the sentiments surrounding these cryptocurrency movements.

Binance Futures: Navigating Recent Changes in Perpetual Contracts

The recent announcement regarding the delisting of RVV and YALA contracts marks a turning point in how Binance Futures is streamlining its offerings. Traders are encouraged to familiarize themselves with the updated contract list and the rationale behind such changes. This trend towards delisting certain perpetual contracts could signal Binance’s strategy to focus on more promising and actively traded assets, thus enhancing overall platform liquidity and user experience.

Staying informed about changes in the perpetual contracts landscape is vital. This requires traders to not only follow Binance’s updates but also to explore educational resources that can deepen their understanding of how these contractual changes can affect their trading outcomes. Capitalizing on current market conditions while adapting to these changes is key for success in the dynamic world of cryptocurrency trading.

Crypto Trading News: Significance of Delisting in Market Trends

The delisting of RVV and YALA contracts is a major piece of crypto trading news that every trader should pay attention to. News like this transcends just the removal of contracts; it reflects broader market trends and the shifting landscape of digital asset trading. Analysts and traders alike often watch such developments to gauge the direction of cryptocurrency exchanges and overall market health.

Furthermore, how Binance approaches the delisting can influence strategies employed by other exchanges. This becomes a learning opportunity for traders to adapt to similar scenarios in other markets, ensuring they remain flexible and capable of responding to news that could affect their trading portfolio. Keeping track of market news such as this helps traders stay ahead in a fast-paced environment.

Risk Management After Binance Delists Contracts

Effective risk management is pivotal for traders, especially following the announcement that Binance will delist RVV and YALA contracts. The possibility of sudden price spikes or drops surrounding such news mandates that traders enforce their risk management protocols. It’s crucial to analyze existing portfolios, ensuring diversification to minimize impacts while exploring new trading opportunities as they arise.

Additionally, utilizing tools such as stop-loss orders can safeguard investments, allowing traders to maintain positions that can benefit from market rebounds. With the upcoming changes at Binance Futures, having a robust risk management strategy becomes even more relevant, as it ensures that traders are prepared for fluctuations following the delisting of specific perpetual contracts.

Future Developments in Perpetual Contracts Post-Delisting

The future of perpetual contracts post-delisting of RVV and YALA rests on the innovations and adaptations within the cryptocurrency trading arena. Binance’s decision to remove these contracts may lead to the launch of new and more lucrative perpetual contracts that offer better options for trading. Staying abreast of developments will be essential for users looking to capitalize on fresh opportunities that arise.

Moreover, as Binance and other exchanges respond to market demands, there may be shifts toward more user-friendly or financially beneficial contracts. This dynamic can enhance the trading experience significantly, making it crucial for traders to remain engaged and informed about what’s new on the exchange. Emphasizing the importance of adaptability in trading strategies will prove beneficial as the crypto landscape continues to evolve.

Conclusion: Navigating the New Normal in Binance Futures

In conclusion, the upcoming delisting of RVV and YALA contracts by Binance signifies a notable change that traders need to navigate with care. Adapting to such changes while maintaining informed trading practices is essential in sustaining profitability in the current crypto environment. Recognizing that these developments can influence the market allows traders to capitalize on potential opportunities.

As Binance continues to refine its offerings within the realm of perpetual contracts, each trader must assess their strategies accordingly. The most successful traders will be those who remain vigilant, informed, and flexible in their approach to an ever-changing market. Keeping a heart on trading news and market trends is imperative for continued success in the complex world of crypto trading.

Frequently Asked Questions

Why is Binance delisting the RVV and YALA contracts?

Binance is delisting the RVV and YALA perpetual contracts as part of its regular review process for futures products, ensuring that the offerings align with market demands and regulatory requirements. This decision leads to the automatic closure and settlement of the affected contracts.

What happens to my positions in RVV and YALA contracts after Binance delists them?

After Binance delists the RVV and YALA contracts on February 10, 2026, the positions will automatically close and settle at 09:00 (UTC). Users are strongly advised to manually close their positions before this time to avoid automatic settlement.

When will the RVV and YALA perpetual contracts be removed from Binance?

The RVV and YALA perpetual contracts will be officially delisted from Binance on February 10, 2026, with new orders being barred from 08:00 (UTC) on the same day.

How can I manage my RVV and YALA positions before the delisting date?

To manage your RVV and YALA positions effectively, ensure that you manually close them before the delisting on February 10, 2026, to prevent any automatic settlement. You can do this by placing a market or limit order as per your trading strategy.

What is the impact of the Binance delisting of RVV and YALA contracts on crypto trading?

The delisting of RVV and YALA contracts from Binance Futures may affect market liquidity and trading strategies for those assets. Traders should stay informed about alternative trading options and consider adjusting their portfolios accordingly.

Are there any other contracts being affected by the Binance Futures delisting?

As of now, the official announcement specifically mentions only the RVV and YALA perpetual contracts being delisted. Traders should monitor Binance’s updates for any changes related to other contracts.

Where can I find more information about Binance delisting RVV and YALA contracts?

For more information regarding the delisting of RVV and YALA contracts, users can refer to Binance’s official announcements, updates on their platform, or relevant crypto trading news sources for comprehensive insights.