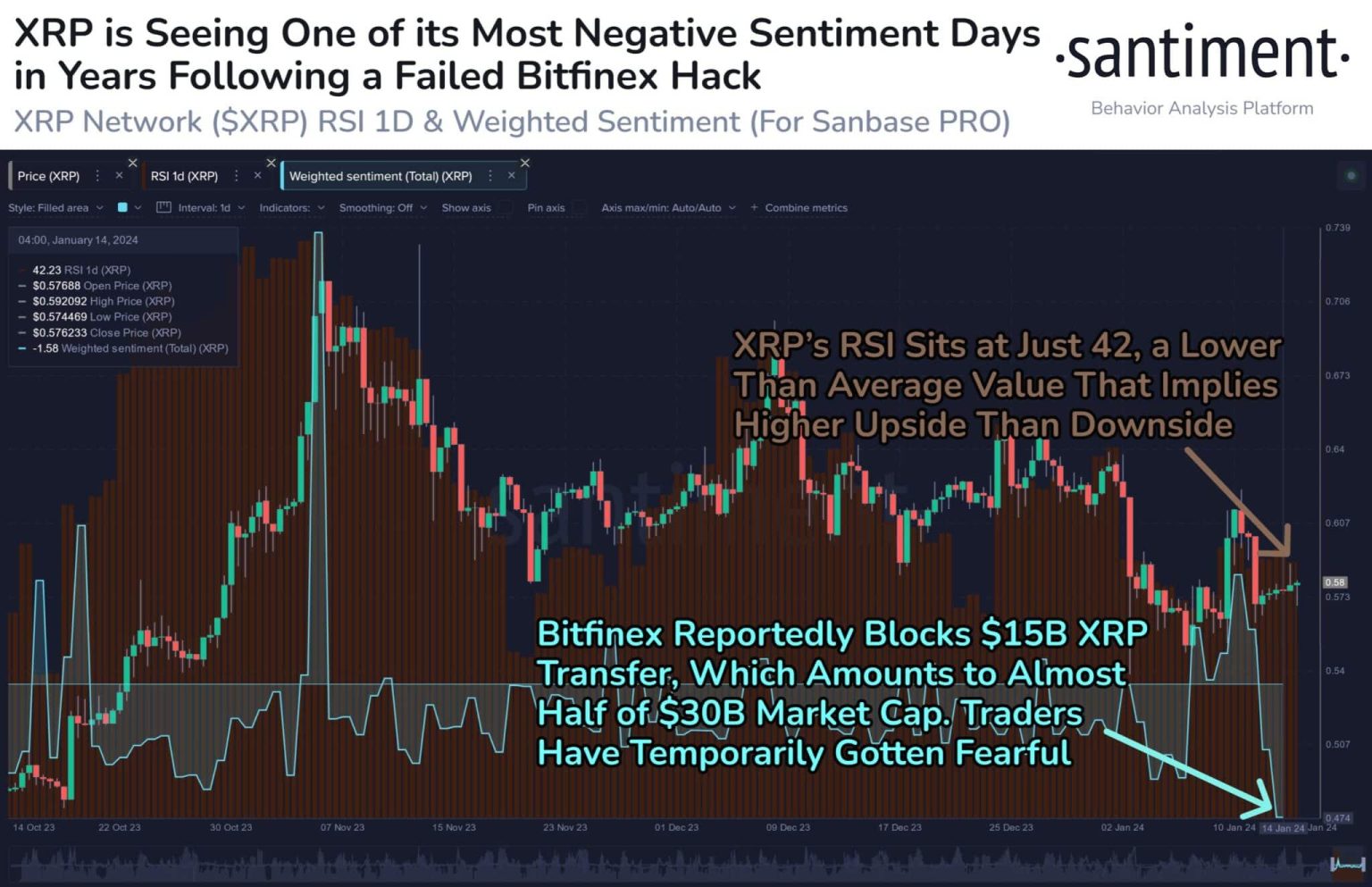

As the cryptocurrency landscape continues to unfold, XRP sentiment is showcasing a distinct contrast to the prevailing negativity seen with major players like Bitcoin and Ethereum. Recently, analytics platform Santiment highlighted that social media sentiment around XRP remains notably optimistic, despite the broader market downturn that has seen Bitcoin hovering close to $70,000. In fact, the Positive/Negative sentiment metric for XRP stands at a commendable 2.19, significantly outperforming Bitcoin and Ethereum by 103% and 173%, respectively. This growing positivity reflects traders’ confidence in XRP’s resilience amidst the current volatility in cryptocurrency trends. Understanding XRP’s market outlook is vital for traders looking to analyze the shifting crypto sentiment and make informed decisions based on XRP price movement.

In light of the shifting dynamics within the crypto ecosystem, the current outlook on XRP, a prominent altcoin, is revealing important insights into trader behavior and sentiment. As broader market conditions have turned against Bitcoin and Ethereum, the sentiment surrounding XRP is notably more favorable, reflecting a unique trader perspective amidst these turbulent times. Analysts are increasingly focusing on the signs of optimism within XRP, suggesting that a potential divergence in trader sentiment may influence forthcoming price movements. This alternative sentiment analysis emphasizes the importance of considering various market reactions as investors navigate through changing cryptocurrency trends, all while maintaining an eye on XRP’s ongoing potential and the implications it holds for the altcoin market.

| Key Point | Details |

|---|---|

| Bitcoin and Ethereum Sentiment | Social media sentiment for Bitcoin and Ethereum is extremely bearish. |

| XRP Sentiment | Contrastingly, XRP sentiment remains strong, with a Positive/Negative score of 2.19. |

| Price Trends | XRP has dropped 6.82%, while Bitcoin and Ethereum fell by 4.97% and 4.92%, respectively. |

| Market Volatility | XRP holders experience less volatility and maintain a stable outlook on the asset. |

| Future Predictions | Analysts predict a short-term relief rally despite current market fears. |

| Overall Market Sentiment | The Crypto Fear & Greed Index indicates ‘Extreme Fear’ among overall investors. |

Summary

XRP sentiment shows a stark contrast to the bearish outlook surrounding Bitcoin and Ethereum, indicating a growing optimism among XRP traders. This positivity may pave the way for future resilience in the market, especially as the current environment is riddled with fear and uncertainty among other cryptocurrency assets. Investors are looking for signs of a recovery, and XRP might just be positioned to benefit from a potential rally as the sentiment landscape evolves.

Current XRP Sentiment: A Glimmer of Optimism

Recent trends in social media sentiment have revealed a noticeable divergence in trader attitudes towards various cryptocurrencies. According to Santiment, while the outlook for Bitcoin and Ethereum has turned extremely bearish, XRP sentiment remains robust, indicating a unique position for this altcoin in the prevailing market climate. The Positive/Negative sentiment score for XRP of 2.19 significantly eclipses Bitcoin’s 0.80 and Ethereum’s 1.08, highlighting that traders are fostering a relatively optimistic view despite wider market declines. This trend suggests that XRP users are still engaging positively, which can have potential implications for future price movements.

The current market sentiment towards XRP serves as a crucial indicator for investors looking to navigate the complexities of cryptocurrency trends. With Bitcoin and Ethereum experiencing a substantial downturn, the stable optimism surrounding XRP gives traders a strategic advantage. Maintaining a belief in XRP’s fundamentals may allow traders to weather volatility better and prepare for potential rebounds. As traders dissect these sentiment shifts, it becomes essential to understand how the collective mood impacts the cryptocurrency market, specifically relating to XRP’s upcoming price movement.

XRP Market Outlook Amid Crypto Sentiment Analysis

Despite the current market’s challenges, analysts believe the XRP market outlook remains hopeful. The prevailing crypto sentiment analysis points to potential recovery hints in the short term as traders show strong interest in XRP separate from the bearish trends of BTC and ETH. It appears that many XRP holders are more risk-averse and less influenced by drastic price fluctuations, which often characterize the broader market. This stable base of support may insulate XRP from the more severe downturns experienced by its larger counterparts.

In analyzing the XRP landscape, insights from market experts indicate that XRP could benefit from a refocus on its fundamentals. As the industry suffers from what many have termed a ‘crypto winter’, the steady interest and unwavering faith of XRP traders suggest that a potential market reversal could be on the horizon. By understanding sentiment through an analytical lens, traders can better position themselves to capitalize on opportunities arising from the market’s cyclical nature.

XRP Price Movement: Navigating the Current Volatility

The volatility experienced in the cryptocurrency market has led to significant price movement across various assets, including XRP. Recent figures show that XRP has declined by 6.82% in the last week, mirroring the downturns seen in BTC and ETH. However, unlike other cryptocurrencies, XRP’s price dynamics seem less influenced by panic selling, primarily due to its stronger social media sentiment. Parsing through this data allows investors to understand how technical factors impact XRP price movement relative to broader market trends.

Furthermore, experts like Pav Hundal have noted that XRP holders have a unique approach to price volatility, often exhibiting an enduring belief in the asset’s long-term potential. This attitude can lead to a more stable outlook for XRP prices. As the cryptocurrency market experiences fluctuations, it’s crucial for traders to adopt a strategic framework, leveraging sentiment indicators to make informed predictions about XRP’s future price trajectory amidst overarching market conditions.

The Impact of Macro Trends on Trader Sentiment

The sentiment in the cryptocurrency market is often influenced by macroeconomic trends and investor behavior. Currently, with an ‘Extreme Fear’ score of 12 on the Crypto Fear & Greed Index, caution among investors has become the norm, influencing trader sentiment across the board. This climate has fostered an environment where traders may be less likely to venture into altcoins and more inclined to stick with established assets like BTC and ETH, often sidelining XRP despite its positive sentiment indicators.

Understanding the interrelation between macro trends and trader sentiment plays a pivotal role in predicting market movements. The prevailing fear can cause traders to exercise restraint, adversely affecting demand for altcoins such as XRP. However, the resilience seen with XRP traders may provide a counter-narrative, suggesting that amidst global economic challenges, there remains a community willing to support its longevity. This phenomenon illustrates how supplementary factors can influence market dynamics surrounding cryptocurrencies.

The Role of Fear and Optimism in Market Predictions

Market predictions in the cryptocurrency space are often fueled by a mix of fear and optimism. Currently, with the cryptocurrency landscape marked by extreme fear indicative of a prolonged bear market, analysts are questioning if this sentiment may set the stage for recovery. XRP is particularly notable in this context, as its traders exhibit a more bullish outlook despite the bearish environment surrounding major coins like Bitcoin and Ethereum. This dichotomy between broad market losses and XRP’s relative stability is a crucial factor in forecasting future trends.

Additionally, such fear-driven market conditions can sometimes catalyze a shift in trader behavior, spurring a more calculated approach to investment decisions. As small traders express disbelief in the overall cryptocurrency market, it could create openings for larger players to invest in undervalued assets such as XRP. The interplay of fear and optimism will undoubtedly continue to shape the narratives within crypto sentiment analysis, making it vital for investors to stay attuned to how these emotions can affect market predictions.

Understanding the Disconnect Between XRP and Major Cryptocurrencies

There appears to be a disconnect between XRP’s social media sentiment and the broader market trends affecting major cryptocurrencies like Bitcoin and Ethereum. As these larger cryptocurrencies are witnessing a significant downturn, XRP continues to maintain a strong positive outlook among its community. This resilience is particularly interesting given that XRP’s price has also declined, albeit at a rate that traders seem willing to accept temporarily, suggesting a more stable confidence in its long-term value.

Understanding this disconnect is crucial for traders employing cryptocurrency trends in their investment strategies. While major assets are facing extreme bearish sentiment, XRP’s stable community sentiment may provide a hint that its price correction could be less painful or swift than those of its counterparts. Investing in lesser-traded cryptocurrencies like XRP during periods of market hesitation may provide investors with leverage to capitalize on potential recoveries, blending strategic insights with sentiment-driven analysis.

Short-Term Recovery Potential for XRP: Insights from Analysts

Despite the downward pressure in the cryptocurrency market, analysts suggest there is potential for short-term recovery for XRP. Santiment indicated that prevailing fearful sentiment and an extreme fear environment could create interesting dynamics for the asset. As traders remain optimistic about XRP and are less impacted by the extreme bearish trends affecting Bitcoin and Ethereum, there is an argument to be made for a prospective relief rally restoring confidence in XRP prices.

Traders who closely monitor sentiment indicators alongside price movements in the cryptocurrency space may uncover potential for XRP’s short-term recovery. As indicated by analysts, understanding how emotional sentiments among small traders can pave the way for price rallies is crucial for capitalizing on emerging opportunities. By keeping an eye on analytics and market reactions, traders can make informed decisions about participating in XRP during pivotal moments of potential recovery.

Investor Behavior: The Key to XRP’s Resilience

In the crypto market, investor behavior plays a significant role in the resilience of assets like XRP amidst broader volatility. Traders who own XRP exhibit a steadfast commitment, often weathering market storms with an unwavering faith in the asset’s fundamentals. This behavior is reflected in sentiment data showing XRP performing comparatively better on social media wrong despite adverse conditions affecting Bitcoin and Ethereum, thereby showcasing the unique psychology among XRP holders.

Understanding this resilience provides traders and investors with insights into how XRP may perform in relation to ongoing market fluctuations. The core belief system among XRP investors might insulate it from emotional-driven sell-offs frequently seen in more prominent cryptocurrencies. As the cryptocurrency market continues to adapt to external pressures, these behavioral tendencies will remain crucial in shaping XRP’s journey, particularly as traders navigate the complexities of crypto sentiment.

Frequently Asked Questions

What is the current XRP sentiment compared to Bitcoin and Ethereum?

Currently, XRP sentiment is much more optimistic compared to Bitcoin (BTC) and Ethereum (ETH). According to Santiment, XRP’s Positive/Negative sentiment score is 2.19, indicating a stronger positive outlook among traders, while BTC and ETH sit at 0.80 and 1.08 respectively.

How does XRP sentiment influence its price movement?

XRP sentiment plays a significant role in its price movement. Despite a downturn in the cryptocurrency market, XRP’s positive trader sentiment can lead to a more stable price outlook, as traders maintain confidence in XRP’s fundamentals, potentially paving the way for future price recovery.

What factors are affecting XRP market outlook today?

The current XRP market outlook is being positively influenced by strong social media sentiment, even as BTC and ETH face bearish trends. Analysts suggest that the optimistic sentiment around XRP may help it resist severe volatility, underlying its potential resilience amid broader market challenges.

What does crypto sentiment analysis reveal about XRP?

Crypto sentiment analysis shows that XRP is experiencing significantly higher positive sentiment as per Santiment’s metrics, outperforming BTC and ETH. This suggests that traders may hold a more favorable view of XRP despite the negative trends prevailing in the broader cryptocurrency market.

Are XRP traders feeling optimistic amid the crypto market downturn?

Yes, XRP traders are displaying a sense of optimism despite the ongoing crypto market downturn. The Positive/Negative sentiment indicator shows a robust confidence among XRP holders, contrasting sharply with the extreme bearish sentiment seen in Bitcoin and Ethereum.

How does traders sentiment towards XRP compare in terms of volatility?

Traders sentiment towards XRP indicates that holders experience volatility differently than those holding BTC or ETH. Analysts like Pav Hundal note that XRP does not typically undergo drastic price swings, which contributes to a steadier outlook for XRP traders even during turbulent market conditions.

What is the significance of XRP’s Positive/Negative sentiment ratio?

XRP’s Positive/Negative sentiment ratio of 2.19 is significant as it reflects an overwhelmingly positive perception among traders, which is key to understanding XRP’s potential resilience and future price movements in contrast to the bearish sentiment surrounding Bitcoin and Ethereum.

How does the current crypto sentiment impact altcoins like XRP?

The current ‘Extreme Fear’ sentiment in the broader cryptocurrency market can have complex impacts on altcoins like XRP. While it may suggest caution among investors, the underlying positive sentiment towards XRP could provide it with unique opportunities for a potential short-term rally as traders remain hopeful for recovery.